|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

13-3139732

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

200 Powell Place, Brentwood, Tennessee

|

|

37027

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

|

|

|

|

Registrant's Telephone Number, Including Area Code:

|

|

(615) 440-4000

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock, $.008 par value

|

NASDAQ Global Select Market

|

|

|

|

Large accelerated filer

|

þ

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

(Do not check if a smaller reporting company)

|

Smaller reporting company

|

o

|

|

Class

|

|

Outstanding at January 25, 2014

|

|

Common Stock, $.008 par value

|

|

139,559,289

|

|

Item no.

|

Form 10-K Report Page

|

|

|

Item 1.

|

Business

|

|

•

|

a management training program which covers all aspects of our store operations;

|

|

•

|

structured training on customer service and selling skills;

|

|

•

|

product knowledge and in-store training programs produced in conjunction with key vendors;

|

|

•

|

frequent management skills training classes;

|

|

•

|

semi-annual store manager meetings with vendor product presentations; and

|

|

•

|

ongoing product information updates from our management headquarters, the Store Support Center.

|

|

•

|

Equine, livestock, pet and small animal products, including items necessary for their health, care, growth and containment;

|

|

•

|

Hardware, truck, towing and tool products;

|

|

•

|

Seasonal products, including lawn and garden items, power equipment, gifts and toys;

|

|

•

|

Work/recreational clothing and footwear; and

|

|

•

|

Maintenance products for agricultural and rural use.

|

|

|

Percent of Sales

|

|||||||

|

Product Category:

|

2013

|

2012

|

2011

|

|||||

|

Livestock and Pet

|

43

|

%

|

42

|

%

|

40

|

%

|

||

|

Hardware, Tools, Truck and Towing

|

23

|

|

23

|

|

23

|

|

||

|

Seasonal, Gift and Toy Products

|

20

|

|

20

|

|

21

|

|

||

|

Clothing and Footwear

|

9

|

|

9

|

|

10

|

|

||

|

Agriculture

|

5

|

|

6

|

|

6

|

|

||

|

Total

|

100

|

%

|

100

|

%

|

100

|

%

|

||

|

•

|

C.E. Schmidt

®

,

Bit & Bridle

®

and

Blue Mountain

®

(apparel and footwear)

|

|

•

|

Countyline

®

(livestock, farm and ranch equipment)

|

|

•

|

Groundwork

®

(lawn and garden supplies)

|

|

•

|

Huskee

®

(outdoor power equipment)

|

|

•

|

JobSmart

®

(tools)

|

|

•

|

Producers Pride

®

and

Dumor

®

(livestock and horse feed and supplies)

|

|

•

|

Red Shed

®

(gifts and collectibles)

|

|

•

|

Redstone

®

(heating products)

|

|

•

|

Retriever

®

,

4health

®

and

Paws 'n Claws

®

(pet foods and supplies)

|

|

•

|

Royal Wing

®

(bird feed and supplies)

|

|

•

|

Tractor Supply Co

®

(trailers, truck tool boxes and animal bedding)

|

|

•

|

Traveller

®

(truck and automotive products)

|

|

Name

|

Position

|

Age

|

|

Gregory A. Sandfort

|

President and Chief Executive Officer

|

58

|

|

Anthony F. Crudele

|

Executive Vice President – Chief Financial Officer and Treasurer

|

57

|

|

Steve K. Barbarick

|

Executive Vice President – Merchandising and Marketing

|

46

|

|

Lee J. Downing

|

Senior Vice President – Operations

|

42

|

|

Benjamin F. Parrish, Jr.

|

Senior Vice President – General Counsel and Corporate Secretary

|

57

|

|

Alexander L. Stanton

|

Senior Vice President – Supply Chain

|

48

|

|

Kimberly D. Vella

(a)

|

Senior Vice President – Chief People Officer

|

47

|

|

Item 1A

.

|

Risk Factors

|

|

State

|

Number

of Stores

|

State

|

Number

of Stores

|

|||

|

Texas

|

138

|

Illinois

|

16

|

|||

|

Ohio

|

81

|

Wisconsin

|

15

|

|||

|

Michigan

|

72

|

Kansas

|

14

|

|||

|

New York

|

71

|

Massachusetts

|

14

|

|||

|

Pennsylvania

|

68

|

New Mexico

|

14

|

|||

|

Tennessee

|

66

|

Maryland

|

13

|

|||

|

North Carolina

|

61

|

Nebraska

|

12

|

|||

|

Georgia

|

51

|

New Jersey

|

11

|

|||

|

Florida

|

49

|

Connecticut

|

10

|

|||

|

Kentucky

|

47

|

Minnesota

|

10

|

|||

|

Virginia

|

46

|

Arizona

|

8

|

|||

|

Indiana

|

45

|

Colorado

|

8

|

|||

|

Alabama

|

43

|

Iowa

|

7

|

|||

|

Oklahoma

|

31

|

North Dakota

|

7

|

|||

|

South Carolina

|

29

|

Vermont

|

7

|

|||

|

California

|

25

|

South Dakota

|

6

|

|||

|

Louisiana

|

25

|

Delaware

|

4

|

|||

|

Mississippi

|

25

|

Montana

|

3

|

|||

|

West Virginia

|

24

|

Hawaii

|

2

|

|||

|

Arkansas

|

20

|

Oregon

|

2

|

|||

|

Maine

|

19

|

Idaho

|

1

|

|||

|

Missouri

|

18

|

Rhode Island

|

1

|

|||

|

Washington

|

18

|

Nevada

|

1

|

|||

|

New Hampshire

|

17

|

Wyoming

|

1

|

|||

|

|

1,276

|

|||||

|

Distribution Center Location

|

Approximate Square Footage

|

Owned/Leased Facility

|

||

|

Franklin, Kentucky

|

833,000

|

Owned

|

||

|

Pendleton, Indiana

|

764,000

|

Owned

|

||

|

Macon, Georgia

|

684,000

|

Owned

|

||

|

Waco, Texas

|

666,000

|

Owned

|

||

|

Hagerstown, Maryland

|

482,000

|

Owned

|

||

|

Waverly, Nebraska

|

422,000

|

Owned

|

||

|

Lakewood, Washington

|

64,000

|

Leased

|

||

|

Item 5

.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

|

Price Range (split adjusted)

|

||||||

|

|

2013

|

2012

|

|||||

|

|

High

|

Low

|

High

|

Low

|

|||

|

First Quarter

|

$52.69

|

$43.13

|

$46.37

|

$34.25

|

|||

|

Second Quarter

|

$59.12

|

$50.17

|

$50.60

|

$40.30

|

|||

|

Third Quarter

|

$67.13

|

$57.00

|

$50.64

|

$37.73

|

|||

|

Fourth Quarter

|

$77.00

|

$64.17

|

$51.87

|

$41.20

|

|||

|

Date Declared

|

Dividend Amount

Per Share

(a)

|

Stockholders of Record Date

|

Date Paid

|

|||

|

October 30, 2013

|

$0.13

|

November 18, 2013

|

December 3, 2013

|

|||

|

July 31, 2013

|

$0.13

|

August 19, 2013

|

September 4, 2013

|

|||

|

May 1, 2013

|

$0.13

|

May 20, 2013

|

June 4, 2013

|

|||

|

February 6, 2013

|

$0.10

|

February 25, 2013

|

March 12, 2013

|

|||

|

October 31, 2012

|

$0.10

|

November 19, 2012

|

December 4, 2012

|

|||

|

August 1, 2012

|

$0.10

|

August 20, 2012

|

September 5, 2012

|

|||

|

May 2, 2012

|

$0.10

|

May 21, 2012

|

June 5, 2012

|

|||

|

February 8, 2012

|

$0.06

|

February 27, 2012

|

March 13, 2012

|

|||

|

Period

|

Total Number

of Shares

Purchased

(a)

|

Average

Price Paid

Per Share

(a)

|

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs

|

Maximum Dollar Value of Shares That May Yet Be

Purchased

Under the Plans or Programs

|

||||||||||

|

First Quarter

(b)

|

1,121,246

|

|

$

|

47.99

|

|

1,045,000

|

|

$

|

241,306,997

|

|

||||

|

Second Quarter

|

353,650

|

|

54.97

|

|

353,650

|

|

221,870,716

|

|

||||||

|

Third Quarter

|

352,886

|

|

60.35

|

|

352,886

|

|

200,578,283

|

|

||||||

|

Fourth Quarter:

|

|

|

|

|

|

|

|

|

||||||

|

9/29/13 – 10/26/13

|

—

|

|

—

|

|

—

|

|

200,578,283

|

|

||||||

|

10/27/13 – 11/23/13

(c)

|

281,221

|

|

71.86

|

|

278,524

|

|

180,572,136

|

|

||||||

|

11/24/13 – 12/28/13

|

256,700

|

|

73.26

|

|

256,700

|

|

161,769,217

|

|

||||||

|

|

537,921

|

|

72.53

|

|

535,224

|

|

161,769,217

|

|

||||||

|

As of December 28, 2013

|

2,365,703

|

|

$

|

56.46

|

|

2,286,760

|

|

$

|

161,769,217

|

|

||||

|

|

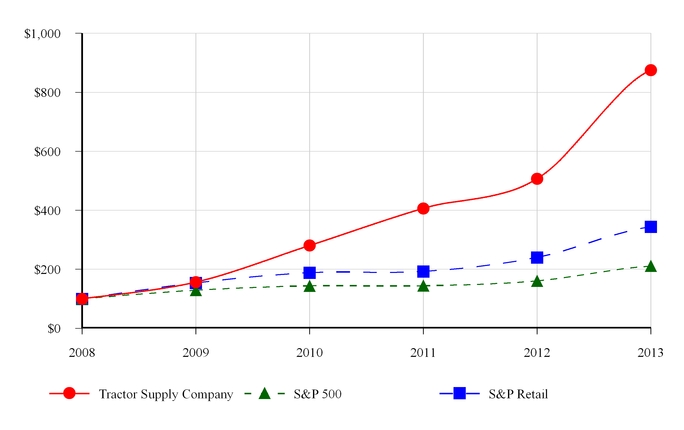

12/27/2008

|

12/26/2009

|

12/25/2010

|

12/31/2011

|

12/29/2012

|

12/28/2013

|

||||||||||||||||||

|

Tractor Supply Company

|

$

|

100.00

|

|

$

|

156.52

|

|

$

|

280.42

|

|

$

|

406.43

|

|

$

|

506.78

|

|

$

|

875.32

|

|

||||||

|

S&P 500

|

$

|

100.00

|

|

$

|

129.07

|

|

$

|

143.99

|

|

$

|

144.09

|

|

$

|

160.68

|

|

$

|

210.98

|

|

||||||

|

S&P Retail Index

|

$

|

100.00

|

|

$

|

153.87

|

|

$

|

188.62

|

|

$

|

192.81

|

|

$

|

240.33

|

|

$

|

344.26

|

|

||||||

|

Item 6

.

|

Selected Financial Data

|

|

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||

|

(52 weeks)

|

(52 weeks)

|

(53 weeks)

|

(52 weeks)

|

(52 weeks)

|

|||||||||||||||

|

Operating Results:

|

|

|

|

|

|

||||||||||||||

|

Net sales

|

$

|

5,164,784

|

|

$

|

4,664,120

|

|

$

|

4,232,743

|

|

$

|

3,638,336

|

|

$

|

3,206,937

|

|

||||

|

Gross profit

|

1,753,609

|

|

1,566,054

|

|

1,406,872

|

|

1,203,665

|

|

1,041,889

|

|

|||||||||

|

Selling, general and administrative expenses

|

1,138,934

|

|

1,040,287

|

|

973,822

|

|

867,644

|

|

784,066

|

|

|||||||||

|

Depreciation and amortization

|

100,025

|

|

88,975

|

|

80,347

|

|

69,797

|

|

66,258

|

|

|||||||||

|

Operating income

|

514,650

|

|

436,792

|

|

352,703

|

|

266,224

|

|

191,565

|

|

|||||||||

|

Interest expense, net

|

557

|

|

1,055

|

|

2,087

|

|

1,284

|

|

1,644

|

|

|||||||||

|

Income before income taxes

|

514,093

|

|

435,737

|

|

350,616

|

|

264,940

|

|

189,921

|

|

|||||||||

|

Income tax expense

|

185,859

|

|

159,280

|

|

127,876

|

|

96,968

|

|

70,176

|

|

|||||||||

|

Net income

|

$

|

328,234

|

|

$

|

276,457

|

|

$

|

222,740

|

|

$

|

167,972

|

|

$

|

119,745

|

|

||||

|

Net income per share – basic

(b) (c)

|

$

|

2.35

|

|

$

|

1.94

|

|

$

|

1.55

|

|

$

|

1.16

|

|

$

|

0.83

|

|

||||

|

Net income per share – diluted

(b) (c)

|

$

|

2.32

|

|

$

|

1.90

|

|

$

|

1.51

|

|

$

|

1.12

|

|

$

|

0.82

|

|

||||

|

Weighted average shares – diluted

(b) (c)

|

141,723

|

|

145,514

|

|

147,842

|

|

149,372

|

|

146,594

|

|

|||||||||

|

Dividends declared per common share outstanding

(c)

|

$

|

0.49

|

|

$

|

0.36

|

|

$

|

0.22

|

|

$

|

0.14

|

|

$

|

0.00

|

|

||||

|

Operating Data (percent of net sales):

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Gross margin

|

34.0

|

%

|

33.6

|

%

|

33.2

|

%

|

33.1

|

%

|

32.5

|

%

|

|||||||||

|

Selling, general and administrative expenses

|

22.1

|

%

|

22.3

|

%

|

23.0

|

%

|

23.9

|

%

|

24.4

|

%

|

|||||||||

|

Operating income

|

10.0

|

%

|

9.4

|

%

|

8.3

|

%

|

7.3

|

%

|

6.0

|

%

|

|||||||||

|

Net income

|

6.4

|

%

|

6.0

|

%

|

5.3

|

%

|

4.6

|

%

|

3.7

|

%

|

|||||||||

|

Store, Sales and Other Data:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Stores open at end of year

|

1,276

|

|

1,176

|

|

1,085

|

|

1,001

|

|

930

|

|

|||||||||

|

Comparable store sales increase (decrease)

(d)

|

4.8

|

%

|

5.3

|

%

|

8.2

|

%

|

7.0

|

%

|

(1.1

|

)%

|

|||||||||

|

New store sales (as a % of net sales)

(d)

|

5.4

|

%

|

5.9

|

%

|

5.6

|

%

|

5.6

|

%

|

7.2

|

%

|

|||||||||

|

Average transaction value

|

$

|

44.48

|

|

$

|

44.40

|

|

$

|

43.33

|

|

$

|

42.07

|

|

$

|

42.06

|

|

||||

|

Comparable store average transaction value increase (decrease)

(d)

|

0.0

|

%

|

2.0

|

%

|

3.1

|

%

|

(0.3

|

)%

|

(6.0

|

)%

|

|||||||||

|

Comparable store average transaction count increase

(d)

|

4.7

|

%

|

3.0

|

%

|

5.0

|

%

|

7.4

|

%

|

5.3

|

%

|

|||||||||

|

Total selling square footage (000's)

|

20,470

|

|

18,893

|

|

17,506

|

|

16,107

|

|

15,023

|

|

|||||||||

|

Total team members

|

19,200

|

|

17,300

|

|

16,400

|

|

14,700

|

|

13,300

|

|

|||||||||

|

Capital expenditures (000’s)

|

$

|

218,200

|

|

$

|

152,924

|

|

$

|

166,156

|

|

$

|

96,511

|

|

$

|

73,974

|

|

||||

|

Balance Sheet Data (at end of period):

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Average inventory per store

(e)

|

$

|

723.5

|

|

$

|

727.4

|

|

$

|

723.4

|

|

$

|

708.7

|

|

$

|

706.5

|

|

||||

|

Inventory turns

|

3.29

|

|

3.28

|

|

3.23

|

|

3.09

|

|

2.88

|

|

|||||||||

|

Working capital

|

$

|

677,107

|

|

$

|

569,547

|

|

$

|

629,624

|

|

$

|

617,153

|

|

$

|

475,847

|

|

||||

|

Total assets

|

$

|

1,903,391

|

|

$

|

1,706,808

|

|

$

|

1,594,832

|

|

$

|

1,463,474

|

|

$

|

1,276,580

|

|

||||

|

Long-term debt, less current portion

(f)

|

$

|

1,200

|

|

$

|

1,242

|

|

$

|

1,284

|

|

$

|

1,316

|

|

$

|

1,407

|

|

||||

|

Stockholders’ equity

|

$

|

1,246,894

|

|

$

|

1,024,974

|

|

$

|

1,008,290

|

|

$

|

933,242

|

|

$

|

779,151

|

|

||||

|

Item 7

.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

•

|

Equine, livestock, pet and small animal products, including items necessary for their health, care, growth and containment;

|

|

•

|

Hardware, truck, towing and tool products;

|

|

•

|

Seasonal products, including lawn and garden items, power equipment, gifts and toys;

|

|

•

|

Work/recreational clothing and footwear; and

|

|

•

|

Maintenance products for agricultural and rural use.

|

|

Description

|

Judgments and Uncertainties

|

Effect if Actual Results Differ From Assumptions

|

||

|

|

|

|

||

|

Inventory Valuation:

|

|

|

||

|

Inventory Impairment

|

|

|

||

|

We identify potentially excess and slow-moving inventory by evaluating turn rates, historical and expected future sales trends, age of merchandise, overall inventory levels, current cost of inventory and other benchmarks. The estimated inventory valuation reserve to recognize any impairment in value (i.e., an inability to realize the full carrying value) is based on our aggregate assessment of these valuation indicators under prevailing market conditions and current merchandising strategies.

|

We do not believe our merchandise inventories are subject to significant risk of obsolescence in the near term. However, changes in market conditions or consumer purchasing patterns could result in the need for additional reserves.

Our impairment reserve contains uncertainties because the calculation requires management to make assumptions and to apply judgment regarding forecasted customer demand and the promotional environment.

|

We have not made any material changes in the accounting methodology used to recognize inventory impairment reserves in the financial periods presented.

We do not believe there is a reasonable likelihood that there will be a material change in the future estimates or assumptions we use to calculate impairment. However, if assumptions regarding consumer demand or clearance potential for certain products are inaccurate, we may be exposed to losses or gains that could be material.

A 10% change in our impairment reserve at December 28, 2013, would have affected net income by approximately $0.4 million in fiscal 2013.

|

||

|

Description

|

Judgments and Uncertainties

|

Effect if Actual Results Differ From Assumptions

|

||

|

Shrinkage

|

|

|

||

|

We perform physical inventories at each store at least once a year, and we have established reserves for estimating inventory shrinkage between physical inventory counts. The reserve is established by assessing the chain-wide average shrinkage experience rate, applied to the related periods' sales volumes. Such assessments are updated on a regular basis for the most recent individual store experiences.

|

The estimated store inventory shrink rate is based on historical experience. We believe historical rates are a reasonably accurate reflection of future trends.

Our shrinkage reserve contains uncertainties because the calculation requires management to make assumptions and to apply judgment regarding future shrinkage trends, the effect of loss prevention measures and new merchandising strategies.

|

We have not made any material changes in the accounting methodology used to recognize shrinkage in the financial periods presented.

We do not believe there is a reasonable likelihood that there will be a material change in the future estimates or assumptions we use to calculate our shrinkage reserve. However, if our estimates regarding inventory losses are inaccurate, we may be exposed to losses or gains that could be material.

A 10% change in our shrinkage reserve at December 28, 2013, would have affected net income by approximately $1.0 million in fiscal 2013.

|

||

|

Vendor Funding

|

||||

|

We receive funding from substantially all of our significant merchandise vendors, in support of our business initiatives, through a variety of programs and arrangements, including guaranteed vendor support funds ("vendor support") and volume-based rebate funds ("volume rebates"). The amounts received are subject to terms of vendor agreements, most of which are "evergreen", reflecting the on-going relationship with our significant merchandise vendors. Certain of our agreements, primarily volume rebates, are renegotiated annually, based on expected annual purchases of the vendor’s product.

Vendor funding is initially deferred as a reduction of the purchase price of inventory and then recognized as a reduction of cost of merchandise as the related inventory is sold.

During interim periods, the amount of vendor support is known and is debited to vendors systematically; however, volume rebates are estimated during interim periods based upon initial commitments and anticipated purchase levels with applicable vendors.

|

The estimated purchase volume (and related vendor funding through volume rebates) is based on our current knowledge of inventory levels, sales trends and expected customer demand, as well as planned new store openings and relocations. Although we believe we can reasonably estimate purchase volume and related volume rebates at interim periods, it is possible that actual year-end results could differ from previously estimated amounts.

Our allocation methodology contains uncertainties because the calculation requires management to make assumptions and to apply judgment regarding customer demand, purchasing activity, target thresholds, vendor attrition and collectibility.

|

We have not made any material changes in the accounting methodology used to establish our vendor support reserves in the financial periods presented.

At the end of each fiscal year, a significant portion of the actual purchase activity is known. Thus, we do not believe there is a reasonable likelihood that there will be a material change in the amounts recorded as vendor support.

We do not believe there is a significant collectibility risk related to vendor support amounts due us at the end of fiscal 2013.

If a 10% reserve had been applied against our outstanding vendor support due as of December 28, 2013, net income would have been affected by approximately $1.1 million in fiscal 2013.

Although it is unlikely that there will be any significant reduction in historical levels of vendor support, if such a reduction were to occur in future periods, the Company could experience a higher inventory balance and higher cost of sales.

|

||

|

Freight

|

|

|

||

|

We incur various types of transportation and delivery costs in connection with inventory purchases and distribution. Such costs are included as a component of the overall cost of inventories (on an aggregate basis) and recognized as a component of cost of merchandise sold as the related inventory is sold.

|

We allocate freight as a component of total cost of sales without regard to inventory mix or unique freight burden of certain categories. This assumption has been consistently applied for all years presented.

|

We have not made any material changes in the accounting methodology used to establish our capitalized freight balance or freight allocation in the financial periods presented.

If a 10% increase or decrease had been applied against our current inventory capitalized freight balance as of December 28, 2013, net income would have been affected by approximately $4.9 million in fiscal 2013.

|

||

|

Description

|

Judgments and Uncertainties

|

Effect if Actual Results Differ From Assumptions

|

||

|

Self-Insurance Reserves:

|

|

|

||

|

We self-insure a significant portion of our employee medical insurance, workers' compensation and general liability insurance plans. We have stop-loss insurance policies to protect from individual losses over specified dollar values.

When estimating our self-insured liabilities, we consider a number of factors, including historical claims experience, demographic factors and severity factors.

|

The full extent of certain claims, especially workers' compensation and general liability claims, may not become fully determined for several years.

Our self-insured liabilities contain uncertainties because management is required to make assumptions and to apply judgment to estimate the ultimate cost to settle reported claims and claims incurred but not reported as of the balance sheet date based upon historical data and experience, including actuarial calculations.

|

We have not made any material changes in the accounting methodology used to establish our self-insurance reserves in the financial periods presented.

We do not believe there is a reasonable likelihood that there will be a material change in the assumptions we use to calculate insurance reserves. However, if we experience a significant increase in the number of claims or the cost associated with these claims, we may be exposed to losses that could be material.

A 10% change in our self-insurance reserves at December 28, 2013, would have affected net income by approximately $2.6 million in fiscal 2013.

|

||

|

Sales Tax Audit Reserve:

|

|

|

||

|

A portion of our sales are to tax-exempt customers, predominantly agricultural-based. We obtain exemption information as a necessary part of each tax-exempt transaction. Many of the states in which we conduct business will perform audits to verify our compliance with applicable sales tax laws. The business activities of our customers and the intended use of the unique products sold by us create a challenging and complex compliance environment. These circumstances also create some risk that we could be challenged as to the accuracy of our sales tax compliance.

While we believe we appropriately enforce sales tax compliance with our customers and endeavor to fully comply with all applicable sales tax regulations, there can be no assurance that we, upon final completion of such audits, would not have a significant liability for disallowed exemptions.

|

We review our past audit experience and assessments with applicable states to continually determine if we have potential exposure for non-compliance. Any estimated liability is based on an initial assessment of compliance risk and our historical experience with each state. We continually reassess the exposure based on historical audit results, changes in policies, preliminary and final assessments made by state sales tax auditors, and additional documentation that may be provided to reduce the assessment.

Our sales tax audit reserve contains uncertainties because management is required to make assumptions and to apply judgment regarding the complexity of agricultural-based exemptions, the ambiguity in state tax regulations, the number of ongoing audits and the length of time required to settle with the state taxing authorities.

|

We have not made any material changes to our sales tax audit assessment methodology in the financial periods presented.

We do not believe there is a reasonable likelihood that there will be a material change in the future estimates or assumptions we use to calculate the sales tax liability reserve. However, if our estimates regarding the ultimate sales tax liability are inaccurate, we may be exposed to losses or gains that could be material.

A 10% change in our sales tax audit reserve at December 28, 2013, would have affected net income by approximately $0.6 million in fiscal 2013.

|

||

|

Description

|

Judgments and Uncertainties

|

Effect if Actual Results Differ From Assumptions

|

||

|

Tax Contingencies:

|

|

|

||

|

Our income tax returns are periodically audited by U.S. federal and state tax authorities. These audits include questions regarding our tax filing positions, including the timing and amount of deductions and the allocation of income among various tax jurisdictions. At any time, multiple tax years are subject to audit by the various tax authorities. In evaluating the exposures associated with our various tax filing positions, we record a liability for uncertain tax positions taken or expected to be taken in a tax return. A number of years may elapse before a particular matter, for which we have established a reserve, is audited and fully resolved or clarified. We recognize the effect of income tax positions only if those positions are more likely than not of being sustained. Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being realized. Changes in recognition or measurement are reflected in the period in which the change in judgment occurs. We adjust our tax contingencies reserve and income tax provision in the period in which actual results of a settlement with tax authorities differs from our established reserve, the statute of limitations expires for the relevant tax authority to examine the tax position or when more information becomes available.

|

Our tax contingencies reserve contains uncertainties because management is required to make assumptions and to apply judgment to estimate the exposures associated with our various filing positions and whether or not the minimum requirements for recognition of tax benefits have been met.

|

We have not made any material changes in the accounting methodology used to establish our tax contingencies in the financial periods presented.

We do not believe there is a reasonable likelihood that there will be a material change in the reserves established for tax benefits not recognized.

Although management believes that the judgments and estimates discussed herein are reasonable, actual results could differ, and we may be exposed to losses or gains that could be material.

To the extent we prevail in matters for which reserves have been established, or are required to pay amounts in excess of our reserves, our effective income tax rate in a given financial statement period could be materially affected. An unfavorable tax settlement would require use of our cash and would result in an increase in our effective income tax rate in the period of resolution. A favorable tax settlement would be recognized as a reduction in our effective income tax rate in the period of resolution.

A 10% change in our uncertain tax position reserve at December 28, 2013 would have affected net income by approximately $0.2 million in fiscal 2013.

|

||

|

Description

|

Judgments and Uncertainties

|

Effect if Actual Results Differ From Assumptions

|

||

|

Impairment of Long-Lived Assets:

|

|

|

||

|

Long-lived assets other than goodwill and indefinite-lived intangible assets, which are separately tested for impairment, are evaluated for impairment whenever events or changes in circumstances indicate that the carrying value may not be recoverable.

When evaluating long-lived assets for potential impairment, we first compare the carrying value of the asset to the asset’s estimated future cash flows (undiscounted and without interest charges). The evaluation for long-lived assets is performed at the lowest level of identifiable cash flows, which is generally the individual store level. The significant assumptions used to determine estimated undiscounted cash flows include cash inflows and outflows directly resulting from the use of those assets in operations, including margin on net sales, payroll and related items, occupancy costs, insurance allocations and other costs to operate a store.

If the estimated future cash flows are less than the carrying value of the asset, we calculate an impairment loss. The impairment loss calculation compares the carrying value of the asset to the asset’s estimated fair value, which may be based on an estimated future cash flow model. We recognize an impairment loss if the amount of the asset’s carrying value exceeds the asset’s estimated fair value. If we recognize an impairment loss, the adjusted carrying amount of the asset becomes its new cost basis. For a depreciable long-lived asset, the new cost basis will be depreciated (amortized) over the remaining estimated useful life of that asset.

|

Our impairment loss calculations contain uncertainties because they require management to make assumptions and to apply judgment to estimate future cash flows and asset fair values, including forecasting useful lives of the assets and selecting the discount rate that reflects the risk inherent in future cash flows.

|

We have not made any material changes in our impairment loss assessment methodology in the financial periods presented.

We do not believe there is a reasonable likelihood that there will be a material change in the estimates or assumptions we use to calculate long-lived asset impairment losses. None of these estimates and assumptions are significantly sensitive, and a 10% change in any of these estimates would not have a material impact on our analysis. However, if actual results are not consistent with our estimates and assumptions used in estimating future cash flows and asset fair values, we may be exposed to losses that could be material.

|

||

|

2013

|

First

Quarter |

Second

Quarter |

Third

Quarter |

Fourth

Quarter |

Total

|

|||||||||||||||

|

Net sales

|

$

|

1,085,838

|

|

$

|

1,455,767

|

|

$

|

1,208,090

|

|

$

|

1,415,089

|

|

$

|

5,164,784

|

|

|||||

|

Gross margin

|

352,091

|

|

506,140

|

|

415,666

|

|

479,712

|

|

1,753,609

|

|

||||||||||

|

Operating income

|

67,923

|

|

197,979

|

|

101,670

|

|

147,078

|

|

514,650

|

|

||||||||||

|

Net income

|

44,006

|

|

123,580

|

|

64,767

|

|

95,881

|

|

328,234

|

|

||||||||||

|

Net income per share:

(a)

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Basic

|

$

|

0.32

|

|

$

|

0.89

|

|

$

|

0.46

|

|

$

|

0.69

|

|

$

|

2.35

|

|

|||||

|

Diluted

|

$

|

0.31

|

|

$

|

0.87

|

|

$

|

0.46

|

|

$

|

0.68

|

|

$

|

2.32

|

|

|||||

|

Comparable store sales increase

|

0.5

|

%

|

7.2

|

%

|

7.5

|

%

|

3.5

|

%

|

4.8

|

%

|

||||||||||

|

2012

|

First

Quarter |

Second

Quarter |

Third

Quarter |

Fourth

Quarter |

Total

|

|||||||||||||||

|

Net sales

|

$

|

1,020,417

|

|

$

|

1,291,899

|

|

$

|

1,065,638

|

|

$

|

1,286,166

|

|

$

|

4,664,120

|

|

|||||

|

Gross margin

|

332,800

|

|

451,461

|

|

357,171

|

|

424,622

|

|

1,566,054

|

|

||||||||||

|

Operating income

|

64,393

|

|

169,844

|

|

77,779

|

|

124,776

|

|

436,792

|

|

||||||||||

|

Net income

|

40,328

|

|

106,621

|

|

50,021

|

|

79,487

|

|

276,457

|

|

||||||||||

|

Net income per share:

(a)

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Basic

|

$

|

0.28

|

|

$

|

0.74

|

|

$

|

0.35

|

|

$

|

0.57

|

|

$

|

1.94

|

|

|||||

|

Diluted

|

$

|

0.27

|

|

$

|

0.73

|

|

$

|

0.35

|

|

$

|

0.55

|

|

$

|

1.90

|

|

|||||

|

Comparable store sales increase

|

11.5

|

%

|

3.2

|

%

|

2.9

|

%

|

4.7

|

%

|

5.3

|

%

|

||||||||||

|

|

2013

|

2012

|

2011

|

|||||

|

Net sales

|

100.0

|

%

|

100.0

|

%

|

100.0

|

%

|

||

|

Cost of merchandise sold

(a)

|

66.0

|

|

66.4

|

|

66.8

|

|

||

|

Gross margin

(a)

|

34.0

|

|

33.6

|

|

33.2

|

|

||

|

Selling, general and administrative expenses

(a)

|

22.1

|

|

22.3

|

|

23.0

|

|

||

|

Depreciation and amortization

|

1.9

|

|

1.9

|

|

1.9

|

|

||

|

Income before income taxes

|

10.0

|

|

9.4

|

|

8.3

|

|

||

|

Income tax provision

|

3.6

|

|

3.4

|

|

3.0

|

|

||

|

Net income

|

6.4

|

%

|

6.0

|

%

|

5.3

|

%

|

||

|

2013

|

2012

|

||||

|

Store Count, Beginning of Period

|

1,176

|

|

1,085

|

|

|

|

New Stores Opened

|

102

|

|

93

|

|

|

|

Stores Closed

|

(2

|

)

|

(2

|

)

|

|

|

Store Count, End of Period

|

1,276

|

|

1,176

|

|

|

|

Stores Relocated

|

3

|

|

1

|

|

|

|

|

Percent of Sales

|

||||

|

Product Category:

|

2013

|

2012

|

|||

|

Livestock and Pet

|

43

|

%

|

42

|

%

|

|

|

Hardware, Tools,Truck and Towing

|

23

|

|

23

|

|

|

|

Seasonal, Gift and Toy Products

|

20

|

|

20

|

|

|

|

Clothing and Footwear

|

9

|

|

9

|

|

|

|

Agriculture

|

5

|

|

6

|

|

|

|

Total

|

100

|

%

|

100

|

%

|

|

|

2012

|

2011

|

||||

|

Store Count, Beginning of Period

|

1,085

|

|

1,001

|

|

|

|

New Stores Opened

|

93

|

|

85

|

|

|

|

Stores Closed

|

(2

|

)

|

(1

|

)

|

|

|

Store Count, End of Period

|

1,176

|

|

1,085

|

|

|

|

Stores Relocated

|

1

|

|

3

|

|

|

|

|

Percent of Sales

|

||||

|

Product Category:

|

2012

|

2011

|

|||

|

Livestock and Pet

|

42

|

%

|

40

|

%

|

|

|

Hardware, Tools, Truck and Towing

|

23

|

|

23

|

|

|

|

Seasonal, Gift and Toy Products

|

20

|

|

21

|

|

|

|

Clothing and Footwear

|

9

|

|

10

|

|

|

|

Agriculture

|

6

|

|

6

|

|

|

|

Total

|

100

|

%

|

100

|

%

|

|

|

|

2013

|

2012

|

Variance

|

||||||||

|

Current assets:

|

|

|

|

||||||||

|

Cash and cash equivalents

|

$

|

142.7

|

|

$

|

138.6

|

|

$

|

4.1

|

|

||

|

Restricted cash

|

—

|

|

8.4

|

|

(8.4

|

)

|

|||||

|

Inventories

|

979.3

|

|

908.1

|

|

71.2

|

|

|||||

|

Prepaid expenses and other current assets

|

57.4

|

|

51.8

|

|

5.6

|

|

|||||

|

Deferred income taxes

|

29.8

|

|

23.1

|

|

6.7

|

|

|||||

|

Total current assets

|

1,209.2

|

|

1,130.0

|

|

79.2

|

|

|||||

|

Current liabilities:

|

|

|

|

|

|

|

|||||

|

Accounts payable

|

316.5

|

|

320.4

|

|

(3.9

|

)

|

|||||

|

Accrued employee compensation

|

50.6

|

|

48.4

|

|

2.2

|

|

|||||

|

Other accrued expenses

|

155.6

|

|

148.3

|

|

7.3

|

|

|||||

|

Income taxes payable

|

9.4

|

|

43.4

|

|

(34.0

|

)

|

|||||

|

Total current liabilities

|

532.1

|

|

560.5

|

|

(28.4

|

)

|

|||||

|

Working capital

|

$

|

677.1

|

|

$

|

569.5

|

|

$

|

107.6

|

|

||

|

•

|

We actively manage our inventory balances and in-stock levels at our stores. The

increase

in inventory was primarily due to new store growth. Average inventory per store

decreased

0.5%

compared to the prior year.

|

|

•

|

The timing of receipt of seasonal goods was much earlier in the fourth quarter in the current year and imports made up a larger percentage of fourth quarter receipts, requiring payment on trade credit prior to year end. These factors drove the decline in accounts payable.

|

|

•

|

Income taxes payable decreased due to timing of estimated tax payments, as a result of changes in allowable deductions for depreciation expense.

|

|

|

2013

|

2012

|

2011

|

||||||||

|

Net cash provided by operating activities

|

$

|

333.7

|

|

$

|

378.3

|

|

$

|

254.1

|

|

||

|

Net cash used in investing activities

|

(209.3

|

)

|

(139.1

|

)

|

(171.3

|

)

|

|||||

|

Net cash used in financing activities

|

(120.3

|

)

|

(277.5

|

)

|

(163.2

|

)

|

|||||

|

Net increase (decrease) in cash and cash equivalents

|

$

|

4.1

|

|

$

|

(38.3

|

)

|

$

|

(80.4

|

)

|

||

|

|

2013

|

2012

|

Variance

|

||||||||

|

Net income

|

$

|

328.2

|

|

$

|

276.5

|

|

$

|

51.7

|

|

||

|

Depreciation and amortization

|

100.0

|

|

89.0

|

|

11.0

|

|

|||||

|

Stock compensation expense

|

13.9

|

|

17.6

|

|

(3.7

|

)

|

|||||

|

Excess tax benefit of stock options exercised

|

(43.5

|

)

|

(25.8

|

)

|

(17.7

|

)

|

|||||

|

Deferred income taxes

|

(8.3

|

)

|

(26.6

|

)

|

18.3

|

|

|||||

|

Inventories and accounts payable

|

(75.1

|

)

|

(23.3

|

)

|

(51.8

|

)

|

|||||

|

Prepaid expenses and other current assets

|

(5.5

|

)

|

(0.1

|

)

|

(5.4

|

)

|

|||||

|

Accrued expenses

|

12.1

|

|

9.0

|

|

3.1

|

|

|||||

|

Income taxes payable

|

9.6

|

|

57.3

|

|

(47.7

|

)

|

|||||

|

Other, net

|

2.3

|

|

4.7

|

|

(2.4

|

)

|

|||||

|

Net cash provided by operations

|

$

|

333.7

|

|

|

$

|

378.3

|

|

$

|

(44.6

|

)

|

|

|

|

2012

|

2011

|

Variance

|

||||||||

|

Net income

|

$

|

276.5

|

|

$

|

222.7

|

|

$

|

53.8

|

|

||

|

Depreciation and amortization

|

89.0

|

|

80.3

|

|

8.7

|

|

|||||

|

Stock compensation expense

|

17.6

|

|

15.1

|

|

2.5

|

|

|||||

|

Excess tax benefit of stock options exercised

|

(25.8

|

)

|

(17.4

|

)

|

(8.4

|

)

|

|||||

|

Deferred income taxes

|

(26.6

|

)

|

1.9

|

|

(28.5

|

)

|

|||||

|

Inventories and accounts payable

|

(23.3

|

)

|

(75.3

|

)

|

52.0

|

|

|||||

|

Prepaid expenses and other current assets

|

(0.1

|

)

|

(17.8

|

)

|

17.7

|

|

|||||

|

Accrued expenses

|

9.0

|

|

20.0

|

|

(11.0

|

)

|

|||||

|

Income taxes payable

|

57.3

|

|

21.0

|

|

36.3

|

|

|||||

|

Other, net

|

4.7

|

|

3.6

|

|

1.1

|

|

|||||

|

Net cash provided by operations

|

$

|

378.3

|

|

$

|

254.1

|

|

$

|

124.2

|

|

||

|

|

2013

|

2012

|

2011

|

||||||||

|

New and relocated stores and stores not yet opened

|

$

|

69.1

|

|

$

|

60.4

|

|

$

|

44.9

|

|

||

|

Distribution center capacity and improvements

|

44.9

|

|

16.4

|

|

56.3

|

|

|||||

|

Corporate and other

|

40.7

|

|

13.8

|

|

1.8

|

|

|||||

|

Information technology

|

29.8

|

|

28.2

|

|

12.3

|

|

|||||

|

Existing stores

|

22.3

|

|

22.2

|

|

18.7

|

|

|||||

|

Purchase of previously leased stores

|

11.4

|

|

11.9

|

|

32.2

|

|

|||||

|

Total capital expenditures

|

$

|

218.2

|

|

$

|

152.9

|

|

$

|

166.2

|

|

||

|

•

|

We plan to open between

102

to

106

stores in fiscal

2014

.

|

|

•

|

We plan to invest in our distribution center network in fiscal

2014

, principally for development of a new Southwest distribution center and the ongoing rollout of a new warehouse management system in our distribution centers.

|

|

•

|

We plan to finish construction of our new store support center, which we expect to be completed by end of third quarter

2014

.

|

|

•

|

We also plan to invest in information technology upgrades at our stores and store support center which will include additional multi-channel capabilities, improved inventory allocation and price optimization and continued improvements in data security.

|

|

|

Payment Due by Period

|

|||||||||||||||||||

|

|

Total

|

2014

|

2015-2016

|

2017-2018

|

Thereafter

|

|||||||||||||||

|

Operating leases

|

$

|

1,855,318

|

|

$

|

220,389

|

|

$

|

414,548

|

|

$

|

369,303

|

|

$

|

851,078

|

|

|||||

|

Capital leases

(a)

|

2,218

|

|

146

|

|

292

|

|

292

|

|

1,488

|

|

||||||||||

|

Construction commitments

(b)

|

27,893

|

|

27,893

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

|

$

|

1,885,429

|

|

$

|

248,428

|

|

$

|

414,840

|

|

$

|

369,595

|

|

$

|

852,566

|

|

|||||

|

Item 8

.

|

Financial Statements and Supplementary Data

|

|

|

Page

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to

Consolidated Financial Statements

|

|

|

/s/ Gregory A. Sandfort

|

|

|

/s/ Anthony F. Crudele

|

|

|

Gregory A. Sandfort

President and Chief Executive Officer

|

|

|

Anthony F. Crudele

Executive Vice President -

Chief Financial Officer and Treasurer

|

|

|

February 19, 2014

|

|

|

February 19, 2014

|

|

|

|

Fiscal Year

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

(52 weeks)

|

(52 weeks)

|

(53 weeks)

|

|||||||||

|

Net sales

|

$

|

5,164,784

|

|

$

|

4,664,120

|

|

$

|

4,232,743

|

|

||

|

Cost of merchandise sold

|

3,411,175

|

|

3,098,066

|

|

2,825,871

|

|

|||||

|

Gross profit

|

1,753,609

|

|

1,566,054

|

|

1,406,872

|

|

|||||

|

Selling, general and administrative expenses

|

1,138,934

|

|

1,040,287

|

|

973,822

|

|

|||||

|

Depreciation and amortization

|

100,025

|

|

88,975

|

|

80,347

|

|

|||||

|

Operating income

|

514,650

|

|

436,792

|

|

352,703

|

|

|||||

|

Interest expense, net

|

557

|

|

1,055

|

|

2,087

|

|

|||||

|

Income before income taxes

|

514,093

|

|

435,737

|

|

350,616

|

|

|||||

|

Income tax expense

|

185,859

|

|

159,280

|

|

127,876

|

|

|||||

|

Net income

|

$

|

328,234

|

|

$

|

276,457

|

|

$

|

222,740

|

|

||

|

Net income per share – basic

(a)

|

$

|

2.35

|

|

$

|

1.94

|

|

$

|

1.55

|

|

||

|

Net income per share – diluted

(a)

|

$

|

2.32

|

|

$

|

1.90

|

|

$

|

1.51

|

|

||

|

Weighted average shares outstanding

(a)

|

|

|

|

|

|

|

|||||

|

Basic

|

139,415

|

|

142,184

|

|

143,554

|

|

|||||

|

Diluted

|

141,723

|

|

145,514

|

|

147,842

|

|

|||||

|

Dividends declared per common share outstanding

(a)

|

$

|

0.49

|

|

$

|

0.36

|

|

$

|

0.22

|

|

||

|

|

December 28, 2013

|

December 29, 2012

|

|||||

|

ASSETS

|

|

|

|||||

|

Current assets:

|

|

|

|||||

|

Cash and cash equivalents

|

$

|

142,743

|

|

$

|

138,630

|

|

|

|

Restricted cash

|

—

|

|

8,400

|

|

|||

|

Inventories

|

979,308

|

|

908,116

|

|

|||

|

Prepaid expenses and other current assets

|

57,359

|

|

51,808

|

|

|||

|

Deferred income taxes

|

29,838

|

|

23,098

|

|

|||

|

Total current assets

|

1,209,248

|

|

1,130,052

|

|

|||

|

Property and Equipment:

|

|

|

|

|

|||

|

Land

|

73,350

|

|

61,522

|

|

|||

|

Buildings and improvements

|

581,938

|

|

511,188

|

|

|||

|

Furniture, fixtures and equipment

|

408,021

|

|

350,224

|

|

|||

|

Computer software and hardware

|

140,222

|

|

109,121

|

|

|||

|

Construction in progress

|

65,312

|

|

37,122

|

|

|||

|

|

1,268,843

|

|

1,069,177

|

|

|||

|

Accumulated depreciation and amortization

|

(603,911

|

)

|

(519,179

|

)

|

|||

|

Property and equipment, net

|

664,932

|

|

549,998

|

|

|||

|

Goodwill

|

10,258

|

|

10,258

|

|

|||

|

Deferred income taxes

|

92

|

|

—

|

|

|||

|

Other assets

|

18,861

|

|

16,500

|

|

|||

|

Total assets

|

$

|

1,903,391

|

|

$

|

1,706,808

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|||

|

Current liabilities:

|

|

|

|

|

|||

|

Accounts payable

|

$

|

316,487

|

|

$

|

320,392

|

|

|

|

Accrued employee compensation

|

50,573

|

|

48,400

|

|

|||

|

Other accrued expenses

|

155,615

|

|

148,316

|

|

|||

|

Current portion of capital lease obligations

|

42

|

|

38

|

|

|||

|

Income taxes payable

|

9,424

|

|

43,359

|

|

|||

|

Total current liabilities

|

532,141

|

|

560,505

|

|

|||

|

Capital lease obligations, less current maturities

|

1,200

|

|

1,242

|

|

|||

|

Deferred income taxes

|

—

|

|

1,477

|

|

|||

|

Deferred rent

|

76,930

|

|

76,236

|

|

|||

|

Other long-term liabilities

|

46,226

|

|

42,374

|

|

|||

|

Total liabilities

|

656,497

|

|

681,834

|

|

|||

|

Stockholders’ equity:

|

|

|

|

|

|||

|

Preferred Stock, $1.00 par value; 40 shares authorized; no shares issued

|

—

|

|

—

|

|

|||

|

Common Stock, $0.008 par value; 200,000 shares authorized at December 28, 2013 and December 29, 2012; 166,324 shares issued and 139,654 shares outstanding at December 28, 2013 and 163,390 shares issued and 139,007 shares outstanding at December 29, 2012

(a)

|

1,331

|

|

1,307

|

|

|||

|

Additional paid-in capital

(a)

|

452,668

|

|

361,106

|

|

|||

|

Treasury stock, at cost, 26,670 shares at December 28, 2013 and 24,383 shares at December 29, 2012

(a)

|

(838,588

|

)

|

(709,172

|

)

|

|||

|

Retained earnings

|

1,631,483

|

|

1,371,733

|

|

|||

|

Total stockholders’ equity

|

1,246,894

|

|

1,024,974

|

|

|||

|

Total liabilities and stockholders’ equity

|

$

|

1,903,391

|

|

$

|

1,706,808

|

|

|

|

|

Common

Stock

(a)

|

Additional

Paid-in

Capital

(a)

|

Treasury

Stock

|

Retained

Earnings

|

Total

Stockholders’

Equity

|

||||||||||||||

|

Stockholders' equity at December 25, 2010

|

$

|

1,261

|

|

$

|

234,653

|

|

$

|

(257,376

|

)

|

$

|

954,704

|

|

$

|

933,242

|

|

||||

|

Issuance of common stock under employee stock purchase plan (107 shares)

(a)

|

1

|

|

2,336

|

|

|

|

2,337

|

|

|||||||||||

|

Exercise of stock options (2,888 shares)

(a)

and restricted stock units (136 shares)

(a)

|

24

|

|

29,099

|

|

|

|

|

|

29,123

|

|

|||||||||

|

Stock compensation

|

|

|

15,041

|

|

|

|

|

|

15,041

|

|

|||||||||

|

Tax benefit of stock options exercised

|

|

|

17,769

|

|

|

|

|

|

17,769

|

|

|||||||||

|

Repurchase of shares to satisfy tax obligations

|

|

|

(1,115

|

)

|

|

|

|

|

(1,115

|

)

|

|||||||||

|

Repurchase of common stock (6,151 shares)

(a)

|

|

|

|

|

(179,997

|

)

|

|

|

(179,997

|

)

|

|||||||||

|

Dividends paid

|

|

|

|

|

|

|

(30,850

|

)

|

(30,850

|

)

|

|||||||||

|

Net income

|

|

|

|

|

|

|

222,740

|

|

222,740

|

|

|||||||||

|

Stockholders' equity at December 31, 2011

|

1,286

|

|

297,783

|

|

(437,373

|

)

|

1,146,594

|

|

1,008,290

|

|

|||||||||

|

Issuance of common stock under employee stock purchase plan (96 shares)

(a)

|

1

|

|

3,024

|

|

|

|

|

|

3,025

|

|

|||||||||

|

Exercise of stock options (2,133 shares)

(a)

and restricted stock units (360 shares)

(a)

|

20

|

|

23,532

|

|

|

|

|

|

23,552

|

|

|||||||||

|

Stock compensation

|

|

|

17,641

|

|

|

|

|

|

17,641

|

|

|||||||||

|

Tax benefit of stock options exercised

|

|

|

25,947

|

|

|

|

|

|

25,947

|

|

|||||||||

|

Repurchase of shares to satisfy tax obligations

|

|

|

(6,821

|

)

|

|

|

|

|

(6,821

|

)

|

|||||||||

|

Repurchase of common stock (6,112 shares)

(a)

|

|

|

|

|

(271,799

|

)

|

|

|

(271,799

|

)

|

|||||||||

|

Dividends paid

|

|

|

|

|

|

|

(51,318

|

)

|

(51,318

|

)

|

|||||||||

|

Net income

|

|

|

|

|

|

|

276,457

|

|

276,457

|

|

|||||||||

|

Stockholders' equity at December 29, 2012

|

1,307

|

|

361,106

|

|

(709,172

|

)

|

1,371,733

|

|

1,024,974

|

|

|||||||||

|

Issuance of common stock under employee stock purchase plan (87 shares)

(a)

|

1

|

|

3,595

|

|

3,596

|

|

|||||||||||||

|

Exercise of stock options (2,681 shares)

(a)

and restricted stock units (166 shares)

(a)

|

23

|

|

34,699

|

|

34,722

|

|

|||||||||||||

|

Stock compensation

|

13,893

|

|

13,893

|

|

|||||||||||||||

|

Tax benefit of stock options exercised

|

43,517

|

|

43,517

|

|

|||||||||||||||

|

Repurchase of shares to satisfy tax obligations

|

(4,142

|

)

|

(4,142

|

)

|

|||||||||||||||

|

Repurchase of common stock (2,287 shares)

(a)

|

(129,416

|

)

|

(129,416

|

)

|

|||||||||||||||

|

Dividends paid

|

(68,484

|

)

|

(68,484

|

)

|

|||||||||||||||

|

Net income

|

328,234

|

|

328,234

|

|

|||||||||||||||

|

Stockholders' equity at December 28, 2013

|

$

|

1,331

|

|

$

|

452,668

|

|

$

|

(838,588

|

)

|

$

|

1,631,483

|

|

$

|

1,246,894

|

|

||||

|

|

Fiscal Year

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

(52 weeks)

|

(52 weeks)

|

(53 weeks)

|

|||||||||

|

Cash flows from operating activities:

|

|

|

|

||||||||

|

Net income

|

$