|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

27-0312904

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

590 Madison Avenue, 36th Floor

New York, New York

|

|

10022

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

Title of Each Class:

|

Name of Exchange on Which Registered:

|

|

|

Common Stock, par value $0.01 per share

|

New York Stock Exchange

|

|

|

Large accelerated filer

x

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

o

|

|

Page

|

||

|

PART I

|

||

|

PART II

|

||

|

PART III

|

||

|

PART IV

|

||

|

•

|

Agency RMBS, meaning RMBS whose principal and interest payments are guaranteed by the Government National Mortgage Association (Ginnie Mae), the Federal National Mortgage Association (Fannie Mae), or the Federal Home Loan Mortgage Corporation (Freddie Mac);

|

|

•

|

Non-Agency RMBS, meaning RMBS that are not issued or guaranteed by Ginnie Mae, Fannie Mae or Freddie Mac;

|

|

•

|

MSR;

|

|

•

|

Prime nonconforming residential mortgage loans and credit sensitive residential mortgage loans, or CSL; and

|

|

•

|

Other financial assets comprising approximately 5% to 10% of the portfolio.

|

|

•

|

changes in interest rates and the market value of our target assets;

|

|

•

|

changes in prepayment rates of mortgages underlying our target assets;

|

|

•

|

the timing of credit losses within our portfolio;

|

|

•

|

our exposure to adjustable-rate and negative amortization mortgage loans underlying our target assets;

|

|

•

|

the state of the credit markets and other general economic conditions, particularly as they affect the price of earning assets and the credit status of borrowers;

|

|

•

|

the concentration of the credit risks we are exposed to;

|

|

•

|

legislative and regulatory actions affecting the mortgage and derivative industries or our business;

|

|

•

|

the availability of target assets for purchase at attractive prices;

|

|

•

|

the availability of financing for our target assets, including the availability of repurchase agreement financing, lines of credit and financing through the Federal Home Loan Bank of Des Moines, or the FHLB;

|

|

•

|

declines in home prices;

|

|

•

|

increases in payment delinquencies and defaults on the mortgages comprising and underlying our target assets;

|

|

•

|

changes in liquidity in the market for real estate securities, the re-pricing of credit risk in the capital markets, inaccurate ratings of securities by rating agencies, rating agency downgrades of securities, and increases in the supply of real estate securities available-for-sale;

|

|

•

|

changes in the values of securities we own and the impact of adjustments reflecting those changes on our income statement and balance sheet, including our stockholders’ equity;

|

|

•

|

our ability to generate the amount of cash flow we expect from our target assets;

|

|

•

|

changes in our investment, financing, and hedging strategies and the new risks that those changes may expose us to;

|

|

•

|

changes in the competitive landscape within our industry, including changes that may affect our ability to attract and retain personnel;

|

|

•

|

our ability to build successful relationships with loan originators;

|

|

•

|

our ability to acquire mortgage loans in connection with our securitization plans;

|

|

•

|

our ability to securitize the mortgage loans that we acquire;

|

|

•

|

our exposure to claims and litigation, including litigation arising from our involvement in securitization transactions;

|

|

•

|

our ability to acquire MSR and successfully operate our seller-servicer subsidiary;

|

|

•

|

our ability to successfully diversify our business into new asset classes and manage the new risks they may expose us to;

|

|

•

|

our ability to manage various operational and regulatory risks associated with our business;

|

|

•

|

our ability to maintain appropriate internal controls over financial reporting;

|

|

•

|

our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio;

|

|

•

|

our ability to maintain our REIT qualification for U.S. federal income tax purposes; and

|

|

•

|

limitations imposed on our business due to our REIT status and our status as exempt from registration under the 1940 Act.

|

|

•

|

Rates Strategy -

Includes Agency RMBS, MSR and related hedging transactions. The performance of this strategy is most effected by changes in interest rates, prepayments and mortgage spreads. These assets have minimal exposure to the underlying credit of the investments.

|

|

Agency RMBS

|

Agency RMBS collateralized by fixed rate mortgage loans, adjustable rate mortgage loans or hybrid mortgage loans, or derivatives thereof, including:

|

|

|

Ÿ

|

mortgage pass-through certificates;

|

|

|

Ÿ

|

collateralized mortgage obligations;

|

|

|

Ÿ

|

Freddie Mac gold certificates;

|

|

|

Ÿ

|

Fannie Mae certificates;

|

|

|

Ÿ

|

Ginnie Mae certificates;

|

|

|

Ÿ

|

“to-be-announced” forward contracts, or TBAs, which are pools of mortgages with specific investment terms to be issued by government sponsored entities, or GSEs, at a future date; and

|

|

|

Ÿ

|

interest-only and inverse interest-only securities.

|

|

|

MSR

|

The right to control the servicing of mortgage loans and receive the servicing income therefrom; the actual servicing functions are outsourced to fully-licensed third-party subservicers.

|

|

|

•

|

Credit Strategy -

Includes non-Agency RMBS, residential mortgage loans and related hedging transactions. The performance of this strategy is most effected by changes in credit performance of the underlying mortgage loan collateral. These assets have interest rate and mortgage spread exposure, but the exposure is not viewed to be the main driver of performance.

|

|

Non-Agency RMBS

|

Non-Agency RMBS collateralized by prime mortgage loans, Alt-A mortgage loans, pay-option ARM mortgage loans and subprime mortgage loans, which may have fixed rate, adjustable rate or hybrid rate terms.

|

|

|

Non-Agency RMBS includes both senior and mezzanine RMBS. Senior RMBS refers to non-Agency RMBS that represent the senior-most tranches — that is, the tranches which have the highest priority claim to cash flows from the related collateral pool, within the RMBS structure. Mezzanine RMBS refers to subordinated tranches within the collateral pool. The non-Agency RMBS we purchase may include investment-grade and non-investment grade classes, including non-rated securities.

|

||

|

Hybrid mortgage loans have terms with interest rates that are fixed for a specified period of time and, thereafter, generally adjust annually to an increment over a specified interest rate index. ARMs refer to hybrid and adjustable-rate mortgage loans which typically have interest rates that adjust annually to an increment over a specified interest rate index.

|

||

|

Residential mortgage loans

|

Prime nonconforming and credit sensitive residential mortgage loans.

|

|

|

•

|

no investment shall be made that would cause us to fail to qualify as a REIT for U.S. federal income tax purposes;

|

|

•

|

no investment shall be made that would cause us to be regulated as an investment company under the 1940 Act;

|

|

•

|

we will primarily invest within our target assets, consisting primarily of Agency RMBS, non-Agency RMBS, residential mortgage loans and MSR; approximately 5% to 10% of our portfolio may include other financial assets; and

|

|

•

|

until appropriate investments can be identified, we will invest available cash in interest-bearing and short-term investments that are consistent with (i) our intention to qualify as a REIT, and (ii) our exemption from investment company status under the 1940 Act.

|

|

•

|

build an investment portfolio consisting of Agency RMBS, non-Agency RMBS, residential mortgage loans, MSR and other mortgage-related assets that will generate attractive returns while having a moderate risk profile;

|

|

•

|

manage financing, interest, prepayment rate, credit and similar risks;

|

|

•

|

capitalize on discrepancies in the relative valuations in the mortgage and housing markets; and

|

|

•

|

provide regular quarterly distributions to stockholders.

|

|

•

|

fundamental market and sector review;

|

|

•

|

cash flow analysis;

|

|

•

|

disciplined security selection;

|

|

•

|

controlled risk exposure; and

|

|

•

|

prudent balance sheet management.

|

|

•

|

Our board of directors is composed of a majority of independent directors. Our Audit, Compensation, Nominating and Corporate Governance and Risk Oversight Committees are composed exclusively of independent directors.

|

|

•

|

In order to foster the highest standards of ethics and conduct in all of our business relationships, we have adopted a Code of Business Conduct and Ethics and Corporate Governance Guidelines, which cover a wide range of business practices and procedures that apply to all of our directors, officers and employees. In addition, we have implemented Whistle Blowing Procedures for Accounting and Auditing Matters that set forth procedures by which any officer or employee may raise, on a confidential basis, concerns regarding any questionable or unethical accounting, internal accounting controls or auditing matters with our Audit Committee.

|

|

•

|

We have an insider trading policy that prohibits any of our directors, officers and personnel from buying or selling our securities on the basis of material nonpublic information and prohibits communicating material nonpublic information about us to others. In addition, we have policies that prohibit our directors, officers and personnel from buying or selling the securities of other issuers on the basis of material nonpublic information that we may possess from time to time.

|

|

•

|

We have a formal internal audit function, through the current use of an outsourced firm, to further the effective functioning of our internal controls and procedures. Our internal audit plan, which is approved annually by our Audit Committee, is based on a formal risk assessment and is intended to provide management and our Audit Committee with an effective tool to identify and address areas of financial or operational concerns and to ensure that appropriate controls and procedures are in place. We have implemented Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the SOX Act, which requires an evaluation of internal control over financial reporting in association with our financial statements as of

December 31, 2013

. (See Item 9A, “Controls and Procedures” included in this Annual Report on Form 10-K.)

|

|

•

|

hedging can be expensive, particularly during periods of volatile or rapidly changing interest rates;

|

|

•

|

available hedges may not correspond directly with the risks for which protection is sought;

|

|

•

|

the duration of the hedge may not match the duration of the related liability;

|

|

•

|

the amount of income that a REIT may earn from certain hedging transactions (other than through our TRSs) is limited by U.S. federal income tax provisions governing REITs;

|

|

•

|

the credit quality of a hedging counterparty may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction; and

|

|

•

|

the hedging counterparty may default on its obligation to pay.

|

|

•

|

conditions in the securities markets, generally;

|

|

•

|

conditions in the asset-backed securities markets, specifically;

|

|

◦

|

yields of our portfolio of mortgage loans;

|

|

◦

|

the credit quality of our portfolio of mortgage loans; and

|

|

◦

|

our ability to obtain any necessary credit enhancement.

|

|

•

|

We have limited experience acquiring MSR and operating a company with such approvals. While ownership of MSR and operation of such a subsidiary company includes many of the same risks as our other target assets, including risks related to prepayments, borrower credit, defaults, interest rates, hedging, and regulatory changes, there can be no assurance that we will be able to continue to successfully operate the subsidiary and integrate it into our business operations.

|

|

•

|

Our subsidiary’s continued approval by the government-related entities is subject to compliance with each of their respective selling and servicing guidelines, minimum capital requirements and other conditions they may impose from time to time at their discretion. Failure to meet such guidelines and conditions could result in the unilateral termination of our subsidiary’s approved status by one or more government-related entities.

|

|

•

|

We are dependent on third-party mortgage originators to originate mortgage loans that comply with applicable law and the guidelines and requirements of the government-related entities and on third-party mortgage servicers to perform the actual day-to-day servicing obligations on the mortgage loans underlying the MSR. The value of our MSR could be materially and adversely affected if the loan was not originated in accordance with applicable requirements or the third-party servicer is unable to adequately service the underlying mortgage loans in accordance with applicable laws, regulations, government-related entity requirements and generally accepted servicing practices.

|

|

•

|

The mortgage servicing business is heavily regulated, including by the CFPB. Our failure or alleged failure, or the failure or alleged failure of the third-party mortgage servicers with whom we contract, to comply with applicable regulations could subject us to substantial monetary penalties and costs related to responding to regulatory inquiries and investigations, court proceedings and litigation.

|

|

•

|

Changes in minimum servicing fee amounts for loans purchased or guaranteed by government-related entities could occur at any time and could negatively impact the value of the income derived from MSR on new origination that we may acquire in the future under our flow agreements or through bulk transactions.

|

|

•

|

Investments in MSR are highly illiquid and subject to numerous restrictions on transfer and, as a result, there is risk that we would be unable to locate a willing buyer to purchase the MSR on favorable terms or get approval from the owner of the mortgage loans to sell MSR in the future.

|

|

•

|

We may purchase RMBS that have a higher interest rate than the market interest rate at the time. In exchange for this higher interest rate, we may pay a premium over the par value to acquire the security. In accordance with GAAP, we may amortize this premium over the estimated term of the RMBS. If the RMBS is prepaid in whole or in part prior to its maturity date, however, we may be required to expense the premium that was prepaid at the time of the prepayment.

|

|

•

|

A substantial portion of our adjustable-rate RMBS may bear interest rates that are lower than their fully indexed rates, which are equivalent to the applicable index rate plus a margin. If an adjustable-rate RMBS is prepaid prior to or soon after the time of adjustment to a fully-indexed rate, we will have held that RMBS while it was least profitable and lost the opportunity to receive interest at the fully indexed rate over the remainder of its expected life.

|

|

•

|

If we are unable to acquire new RMBS similar to the prepaid RMBS, our financial condition, results of operations and cash flows would suffer.

|

|

•

|

actual receipt of an improper benefit or profit in money, property or services; or

|

|

•

|

a final judgment based upon a finding of active and deliberate dishonesty by the director or officer that was material to the cause of action adjudicated.

|

|

•

|

changes in financial estimates by analysts;

|

|

•

|

fluctuations in our quarterly financial results or the quarterly financial results of companies perceived to be similar to us;

|

|

•

|

general economic conditions;

|

|

•

|

changes in market valuations of similar companies;

|

|

•

|

regulatory developments in the United States; and

|

|

•

|

additions or departures of key personnel at Pine River.

|

|

Quarter Ended

|

Common Stock

|

Warrants

|

|||||||||||||||

|

2013

|

High

|

Low

|

High

|

Low

|

|||||||||||||

|

December 31

|

$

|

9.89

|

|

$

|

8.94

|

|

$

|

0.44

|

|

(1)

|

$

|

0.01

|

|

(1)

|

|||

|

September 30

|

$

|

10.45

|

|

$

|

8.95

|

|

$

|

1.07

|

|

$

|

0.25

|

|

|||||

|

June 30

|

$

|

12.64

|

|

$

|

10.10

|

|

$

|

2.90

|

|

$

|

0.84

|

|

|||||

|

March 31

|

$

|

13.03

|

|

$

|

10.46

|

|

$

|

3.00

|

|

$

|

0.67

|

|

|||||

|

2012

|

|||||||||||||||||

|

December 31

|

$

|

12.20

|

|

$

|

9.85

|

|

$

|

1.35

|

|

$

|

0.28

|

|

|||||

|

September 30

|

$

|

12.08

|

|

$

|

10.40

|

|

$

|

1.05

|

|

$

|

0.22

|

|

|||||

|

June 30

|

$

|

10.76

|

|

$

|

9.94

|

|

$

|

0.25

|

|

$

|

0.10

|

|

|||||

|

March 31

|

$

|

10.63

|

|

$

|

9.03

|

|

$

|

0.25

|

|

$

|

0.09

|

|

|||||

|

(1)

|

High and low sales prices for our warrants as reported on the NYSE MKT through expiration on November 7, 2013.

|

|

Declaration Date

|

Record Date

|

Payment Date

|

Cash Dividend Per Share

(1)

|

|||||

|

December 17, 2013

|

December 27, 2013

|

December 31, 2013

|

$

|

0.26

|

|

|||

|

September 11, 2013

|

September 26, 2013

|

October 23, 2013

|

$

|

0.28

|

|

|||

|

June 18, 2013

|

June 28, 2013

|

July 23, 2013

|

$

|

0.31

|

|

|||

|

March 18, 2013

|

April 2, 2013

|

April 24, 2013

|

$

|

0.32

|

|

|||

|

December 17, 2012

|

December 31, 2012

|

January 18, 2013

|

$

|

0.55

|

|

|||

|

September 12, 2012

|

September 24, 2012

|

October 22, 2012

|

$

|

0.36

|

|

|||

|

June 12, 2012

|

June 22, 2012

|

July 20, 2012

|

$

|

0.40

|

|

|||

|

March 14, 2012

|

March 26, 2012

|

April 20, 2012

|

$

|

0.40

|

|

|||

|

(1)

|

Per share amounts represent cash dividends only and exclude the distribution of Silver Bay common stock declared on March 18, 2013 and distributed on or about April 24, 2013 to our common stockholders of record as of April 2, 2013 amounting to $1.01 per share, as measured in accordance with GAAP.

|

|

December 31, 2013

|

||||||||||

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column of this table)

|

|||||||

|

Equity compensation plans approved by stockholders

|

—

|

|

$

|

—

|

|

1,828,606

|

|

|||

|

Equity compensation plans not approved by stockholders

|

—

|

|

—

|

|

—

|

|

||||

|

Total

|

—

|

|

$

|

—

|

|

1,828,606

|

|

|||

|

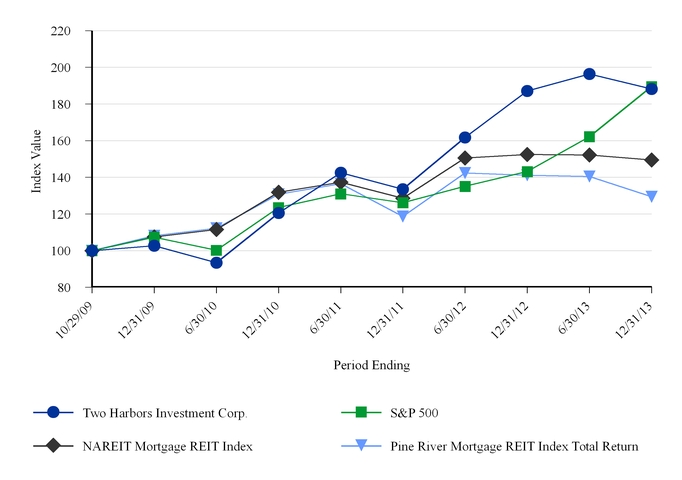

Period Ending

|

||||||||||||||||||||||||

|

Index

|

10/28/09

|

12/31/09

|

12/31/10

|

12/31/11

|

12/31/12

|

12/31/13

|

||||||||||||||||||

|

Two Harbors Investment Corp.

|

$

|

100.00

|

|

$

|

102.71

|

|

$

|

120.52

|

|

$

|

133.57

|

|

$

|

187.11

|

|

$

|

188.21

|

|

||||||

|

S&P 500

|

$

|

100.00

|

|

$

|

107.39

|

|

$

|

123.56

|

|

$

|

126.17

|

|

$

|

143.13

|

|

$

|

189.49

|

|

||||||

|

NAREIT Mortgage REIT Index

|

$

|

100.00

|

|

$

|

107.52

|

|

$

|

131.81

|

|

$

|

128.63

|

|

$

|

152.48

|

|

$

|

149.49

|

|

||||||

|

Pine River Mortgage REIT Index Total Return

|

$

|

100.00

|

|

$

|

108.11

|

|

$

|

130.79

|

|

$

|

118.64

|

|

$

|

141.20

|

|

$

|

129.44

|

|

||||||

|

(in thousands)

|

For the Years Ended December 31,

|

||||||||||||||||||

|

2013

|

2012

|

2011

|

2010

|

2009

(1)

|

|||||||||||||||

|

Interest income:

|

|||||||||||||||||||

|

Available-for-sale securities

|

$

|

507,180

|

|

$

|

448,620

|

|

$

|

197,126

|

|

$

|

39,844

|

|

$

|

2,796

|

|

||||

|

Trading securities

|

5,963

|

|

4,873

|

|

4,159

|

|

170

|

|

—

|

|

|||||||||

|

Mortgage loans held-for-sale

|

22,185

|

|

609

|

|

2

|

|

—

|

|

—

|

|

|||||||||

|

Mortgage loans held-for-investment in securitization trusts

|

19,220

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Cash and cash equivalents

|

1,043

|

|

944

|

|

347

|

|

107

|

|

70

|

|

|||||||||

|

Total interest income

|

555,591

|

|

455,046

|

|

201,634

|

|

40,121

|

|

2,866

|

|

|||||||||

|

Interest expense:

|

|||||||||||||||||||

|

Repurchase agreements

|

89,470

|

|

72,106

|

|

22,709

|

|

4,421

|

|

131

|

|

|||||||||

|

Collateralized borrowings in securitization trusts

|

10,937

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total interest expense

|

100,407

|

|

72,106

|

|

22,709

|

|

4,421

|

|

131

|

|

|||||||||

|

Net interest income

|

455,184

|

|

382,940

|

|

178,925

|

|

35,700

|

|

2,735

|

|

|||||||||

|

Other-than-temporary impairment losses

|

(1,662

|

)

|

(10,952

|

)

|

(5,102

|

)

|

—

|

|

—

|

|

|||||||||

|

Other income:

|

|||||||||||||||||||

|

(Loss) gain on investment securities

|

(54,430

|

)

|

122,466

|

|

36,520

|

|

6,127

|

|

336

|

|

|||||||||

|

Gain (loss) on interest rate swap and swaption agreements

|

245,229

|

|

(159,775

|

)

|

(86,769

|

)

|

(6,344

|

)

|

364

|

|

|||||||||

|

Gain (loss) on other derivative instruments

|

95,345

|

|

(40,906

|

)

|

26,755

|

|

7,156

|

|

—

|

|

|||||||||

|

(Loss) gain on mortgage loans held-for-sale

|

(33,846

|

)

|

2,270

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Servicing income

|

12,011

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Servicing asset valuation

|

13,881

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Other income

|

14,619

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Total other income (loss)

|

292,809

|

|

(75,945

|

)

|

(23,494

|

)

|

6,939

|

|

700

|

|

|||||||||

|

Expenses:

|

|||||||||||||||||||

|

Management fees

|

41,707

|

|

33,168

|

|

14,241

|

|

2,989

|

|

326

|

|

|||||||||

|

Securitization deal costs

|

4,153

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Servicing expenses

|

3,761

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Other operating expenses

|

37,259

|

|

17,678

|

|

9,673

|

|

4,578

|

|

12,171

|

|

|||||||||

|

Total expenses

|

86,880

|

|

50,846

|

|

23,914

|

|

7,567

|

|

12,497

|

|

|||||||||

|

Income (loss) from continuing operations before income taxes

|

659,451

|

|

245,197

|

|

126,415

|

|

35,072

|

|

(9,062

|

)

|

|||||||||

|

Provision for (benefit from) income taxes

|

84,411

|

|

(42,219

|

)

|

(1,106

|

)

|

(683

|

)

|

(318

|

)

|

|||||||||

|

Net income (loss) from continuing operations

|

575,040

|

|

287,416

|

|

127,521

|

|

35,755

|

|

(8,744

|

)

|

|||||||||

|

Income (loss) from discontinued operations

|

3,999

|

|

4,490

|

|

(89

|

)

|

—

|

|

—

|

|

|||||||||

|

Net income (loss)

|

579,039

|

|

291,906

|

|

127,432

|

|

35,755

|

|

(8,744

|

)

|

|||||||||

|

Accretion of Trust Account income relating to common stock subject to possible conversion

|

—

|

|

—

|

|

—

|

|

—

|

|

(93

|

)

|

|||||||||

|

Net income (loss) attributable to common stockholders

|

$

|

579,039

|

|

$

|

291,906

|

|

$

|

127,432

|

|

$

|

35,755

|

|

$

|

(8,837

|

)

|

||||

|

(in thousands, except share data)

|

For the Years Ended December 31,

|

||||||||||||||||||

|

2013

|

2012

|

2011

|

2010

|

2009

(1)

|

|||||||||||||||

|

Basic earnings (loss) per weighted average share:

|

|||||||||||||||||||

|

Continuing operations

|

$

|

1.64

|

|

$

|

1.19

|

|

$

|

1.29

|

|

$

|

1.60

|

|

$

|

(0.39

|

)

|

||||

|

Discontinued operations

|

0.01

|

|

0.02

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Net income (loss)

|

$

|

1.65

|

|

$

|

1.21

|

|

$

|

1.29

|

|

$

|

1.60

|

|

$

|

(0.39

|

)

|

||||

|

Diluted earnings (loss) per weighted average share:

|

|||||||||||||||||||

|

Continuing operations

|

$

|

1.64

|

|

$

|

1.18

|

|

$

|

1.29

|

|

$

|

1.60

|

|

$

|

(0.39

|

)

|

||||

|

Discontinued operations

|

0.01

|

|

0.02

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Net income (loss)

|

$

|

1.65

|

|

$

|

1.20

|

|

$

|

1.29

|

|

$

|

1.60

|

|

$

|

(0.39

|

)

|

||||

|

Dividends declared per common share

|

$

|

1.17

|

|

$

|

1.71

|

|

$

|

1.60

|

|

$

|

1.48

|

|

$

|

0.26

|

|

||||

|

Weighted average number of shares of common stock:

|

|||||||||||||||||||

|

Basic

|

350,361,827

|

|

242,014,751

|

|

98,826,868

|

|

22,381,683

|

|

22,941,728

|

|

|||||||||

|

Diluted

|

350,992,387

|

|

242,432,156

|

|

98,826,868

|

|

22,381,683

|

|

22,941,728

|

|

|||||||||

|

Comprehensive income (loss):

|

|||||||||||||||||||

|

Net income (loss)

|

$

|

579,039

|

|

$

|

291,906

|

|

$

|

127,432

|

|

$

|

35,755

|

|

$

|

(8,744

|

)

|

||||

|

Other comprehensive (loss) income:

|

|||||||||||||||||||

|

Unrealized (loss) gain on available-for-sale securities, net

|

(251,723

|

)

|

755,174

|

|

(81,335

|

)

|

23,569

|

|

(950

|

)

|

|||||||||

|

Other comprehensive (loss) income

|

(251,723

|

)

|

755,174

|

|

(81,335

|

)

|

23,569

|

|

(950

|

)

|

|||||||||

|

Comprehensive income (loss)

|

$

|

327,316

|

|

$

|

1,047,080

|

|

$

|

46,097

|

|

$

|

59,324

|

|

$

|

(9,694

|

)

|

||||

|

(in thousands)

|

At December 31,

|

||||||||||||||||||

|

2013

|

2012

|

2011

|

2010

|

2009

(1)

|

|||||||||||||||

|

Available-for-sale securities

|

$

|

12,256,727

|

|

$

|

13,666,954

|

|

$

|

6,249,252

|

|

$

|

1,354,405

|

|

$

|

494,465

|

|

||||

|

Total assets

|

$

|

17,173,862

|

|

$

|

16,813,944

|

|

$

|

8,100,384

|

|

$

|

1,797,432

|

|

$

|

538,366

|

|

||||

|

Repurchase agreements

|

$

|

12,250,450

|

|

$

|

12,624,510

|

|

$

|

6,660,148

|

|

$

|

1,169,803

|

|

$

|

411,893

|

|

||||

|

Total stockholders’ equity

|

$

|

3,854,995

|

|

$

|

3,450,577

|

|

$

|

1,270,086

|

|

$

|

382,448

|

|

$

|

121,721

|

|

||||

|

•

|

Agency RMBS (which includes inverse interest-only Agency securities classified as Agency Derivatives for purposes of U.S. GAAP), meaning RMBS whose principal and interest payments are guaranteed by Ginnie Mae, Fannie Mae or Freddie Mac;

|

|

•

|

Non-Agency RMBS, meaning RMBS that are not issued or guaranteed by Ginnie Mae, Fannie Mae or Freddie Mac;

|

|

•

|

MSR;

|

|

•

|

Prime nonconforming residential mortgage loans and CSL; and

|

|

•

|

Other financial assets comprising approximately 5% to 10% of the portfolio.

|

|

As of

|

||||||||||||||

|

December 31,

2013 |

September 30,

2013 |

June 30,

2013 |

March 31,

2013 |

December 31,

2012 |

||||||||||

|

Agency RMBS

|

77.9

|

%

|

77.1

|

%

|

80.5

|

%

|

80.2

|

%

|

81.0

|

%

|

||||

|

Non-Agency RMBS

|

22.1

|

%

|

22.9

|

%

|

19.5

|

%

|

19.8

|

%

|

19.0

|

%

|

||||

|

Three Months Ended

|

|||||||||

|

December 31,

2013 |

September 30,

2013 |

June 30,

2013 |

March 31,

2013 |

December 31,

2012 |

|||||

|

Average annualized yields

(1)

|

|||||||||

|

Agency RMBS

|

3.1%

|

2.8%

|

2.7%

|

2.9%

|

2.9%

|

||||

|

Non-Agency RMBS

|

8.9%

|

9.0%

|

9.1%

|

9.2%

|

9.5%

|

||||

|

Aggregate RMBS

|

4.2%

|

4.0%

|

3.7%

|

4.0%

|

4.0%

|

||||

|

Cost of financing

(2)

|

1.1%

|

1.2%

|

1.2%

|

1.1%

|

1.1%

|

||||

|

Net interest spread

|

3.1%

|

2.8%

|

2.5%

|

2.9%

|

2.9%

|

||||

|

(1)

|

Average annualized yield incorporates future prepayment, credit loss and other assumptions, all of which are estimates and subject to change.

|

|

(2)

|

Cost of financing includes swap interest rate spread.

|

|

As of

|

|||||||||

|

December 31,

2013 |

September 30,

2013 |

June 30,

2013 |

March 31,

2013 |

December 31,

2012 |

|||||

|

Average annualized yields

(1)

|

|||||||||

|

Agency RMBS

|

3.0%

|

2.9%

|

2.8%

|

2.9%

|

2.9%

|

||||

|

Non-Agency RMBS

|

9.0%

|

9.0%

|

9.1%

|

9.2%

|

9.4%

|

||||

|

Aggregate RMBS

|

4.1%

|

4.1%

|

3.8%

|

3.8%

|

4.0%

|

||||

|

Cost of financing

(2)

|

1.1%

|

1.2%

|

1.2%

|

1.1%

|

1.2%

|

||||

|

Net interest spread

|

3.0%

|

2.9%

|

2.6%

|

2.7%

|

2.8%

|

||||

|

(1)

|

Average annualized yield incorporates future prepayment, credit loss and other assumptions, all of which are estimates and subject to change.

|

|

(2)

|

Cost of financing includes swap interest rate spread.

|

|

•

|

Managing a portfolio of RMBS to generate attractive returns with balanced risks

. We operate a hybrid REIT model, diversifying our portfolio across Agency and non-Agency RMBS in combination with derivative hedging instruments. We manage to an overall low level of interest rate exposure and leverage. We believe carrying a balance of risks within our portfolio is critical to providing an attractive return to our stockholders and our ability to adjust our allocations and deploy capital across sectors allow us to optimize portfolio results over time.

|

|

•

|

Executing business diversification opportunities across residential mortgage loans, MSR and other real estate assets.

We pursued a variety of opportunities that leverage our core competencies of credit and prepayment risk management. In late 2011, we began acquiring prime nonconforming residential mortgage loans from select mortgage loan originators and secondary market institutions in order to establish a nonconforming loan securitization program. As of

December 31, 2013

, we have participated in two securitizations, one sponsored by a third party and one sponsored by a subsidiary of Two Harbors. In early 2013, we began acquiring CSL and have purchased

$424.7 million

in CSL as of

December 31, 2013

. In addition, on April 30, 2013, one of our wholly owned subsidiaries acquired a company that has approvals from Fannie Mae, Freddie Mac and Ginnie Mae to hold and manage MSR. As of

December 31, 2013

, we held

$514.4 million

in MSR acquired in conjunction with the acquisition of this entity as well as MSR subsequently purchased. We are taking a measured approach as we diversify, keeping true to our strategic long-term plans and our core strengths.

|

|

•

|

Maintaining “best in class” investment, corporate governance, investor relations and disclosure practices.

We attribute our growth to our portfolio alpha generation, innovation and best practice in corporate governance and disclosure.

|

|

Level 1

|

Inputs are quoted prices in active markets for identical assets or liabilities as of the measurement date under current market conditions. Additionally, the entity must have the ability to access the active market and the quoted prices cannot be adjusted by the entity.

|

|

Level 2

|

Inputs include quoted prices in active markets for similar assets or liabilities; quoted prices in inactive markets for identical or similar assets or liabilities; or inputs that are observable or can be corroborated by observable market data by correlation or other means for substantially the full-term of the assets or liabilities.

|

|

Level 3

|

Unobservable inputs are supported by little or no market activity. The unobservable inputs represent the assumptions that market participants would use to price the assets and liabilities, including risk. Generally, Level 3 assets and liabilities are valued using pricing models, discounted cash flow methodologies, or similar techniques that require significant judgment or estimation.

|

|

•

|

The Federal Reserve continued actions to lower long-term interest rates. During 2012, the Federal Reserve launched QE3, a policy that involves large-scale purchases of Agency RMBS by the Federal Reserve. The intent of QE3 is to continue downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative. In June 2013, based on the strength of economic data in the second quarter, the Federal Reserve suggested a potential tapering of RMBS purchases which impacted the market. However, the Federal Reserve later announced that monthly purchases of RMBS would remain at $85 billion for the near future, which brought interest rates down toward the end of the third quarter, yet still materially above the lows seen in the early part of 2013. In December 2013, the Federal Reserve announced plans to modestly reduce the pace of its asset purchases, first by lowering monthly purchases in January 2014 to $75 billion, which was later reduced to $65 billion and only slightly impacted the market. The Federal Reserve has indicated that it will likely keep short-term interest rates at “exceptionally low levels” well past the time unemployment falls below 6.5 percent, especially if inflation stays below its 2 percent target as expected.

|

|

•

|

In January 2014, Mel Watt was sworn in as Director of the FHFA and in February 2014, Janet Yellen was sworn in as Federal Reserve Chair. It is generally perceived that Ms. Yellen will follow retiring Chairman Ben Bernanke’s policies closely at least during the initial stages of her tenure. Conversely, Mr. Watt has announced that he intends to delay the implementation of the higher guarantee fees until further review of the policy can be completed, and it has been widely speculated that he may overhaul HARP.

|

|

•

|

In April 2013, the FHFA’s HARP 2.0 program was extended through December 31, 2015 in an effort to attract more eligible borrowers who can benefit from refinancing their home mortgage. Key provisions of the program include eliminating certain risk-based fees for borrowers, removing the 125 percent loan-to-value ceiling, waiving certain representations and warranties, and eliminating the need for new property appraisals where there is a reliable automated valuation model. The program’s objective to provide an opportunity for responsible homeowners to refinance and encourage borrowers to continue paying on their loans will impact the prepayment speed on certain RMBS. We believe that our portfolio prepayment protection characteristics will be largely isolated from this program.

|

|

•

|

Senators Boxer and Menendez reintroduced their refinance legislation, the Responsible Homeowner Refinancing Act, or HARP 3.0, in 2013. The bill seeks to expand eligibility under HARP by removing barriers to competition, guaranteeing equal access to streamlined refinancing for all GSE borrowers, eliminating up-front fees on refinances and appraisal costs for all borrowers, and further streamlining the application process.

|

|

•

|

Government programs to provide homeowners with assistance in avoiding residential mortgage loan foreclosures continue to be in effect, including HAMP and other programs. These homeowner assistance programs may involve the modification of mortgage loans to reduce the principal amount of the loans (through forbearance and/or forgiveness) or the rate of interest payable on the loans, or may extend the payment terms of the loans. They may also allow for streamlined financing, thus increasing prepayments, or for a delay in foreclosures, thus potentially altering the timing and amount of cash flows to certain securities. In general, these homeowner assistance programs, as well as future legislative or regulatory actions, may affect the value of, and the returns on, our RMBS portfolio. To the extent that these programs are successful and fewer borrowers default on their mortgage obligations, the actual default rates realized on our non-Agency RMBS may be less than the default assumptions made by us at the purchase of such non-Agency RMBS. This could cause the realized yields on our non-Agency RMBS portfolio to be higher than expected at time of purchase. Conversely, if these programs lead to forced reductions in principal, certain RMBS could be affected and decrease in value.

|

|

Three Months Ended

|

||||||||||||

|

Agency RMBS

|

December 31,

2013 |

September 30,

2013 |

June 30,

2013 |

March 31,

2013 |

||||||||

|

Weighted Average CPR

|

7.9

|

%

|

8.7

|

%

|

8.7

|

%

|

7.0

|

%

|

||||

|

(dollars in thousands)

|

December 31,

2013 |

December 31,

2012 |

|||||||||||

|

Agency

|

|||||||||||||

|

Fixed Rate

|

$

|

8,490,788

|

|

68.0

|

%

|

$

|

10,823,674

|

|

77.5

|

%

|

|||

|

Hybrid ARMs

|

1,006,621

|

|

8.1

|

%

|

188,429

|

|

1.3

|

%

|

|||||

|

Total Agency

|

9,497,409

|

|

76.1

|

%

|

11,012,103

|

|

78.8

|

%

|

|||||

|

Agency Derivatives

|

218,509

|

|

1.8

|

%

|

301,264

|

|

2.2

|

%

|

|||||

|

Non-Agency

|

|||||||||||||

|

Senior

|

2,282,132

|

|

18.3

|

%

|

2,132,272

|

|

15.3

|

%

|

|||||

|

Mezzanine

|

468,667

|

|

3.8

|

%

|

518,466

|

|

3.7

|

%

|

|||||

|

Interest-only securities

|

8,519

|

|

—

|

%

|

4,113

|

|

—

|

%

|

|||||

|

Total Non-Agency

|

2,759,318

|

|

22.1

|

%

|

2,654,851

|

|

19.0

|

%

|

|||||

|

Total

|

$

|

12,475,236

|

|

$

|

13,968,218

|

|

|||||||

|

As of December 31, 2013

|

||||||||||||||||||

|

Agency RMBS AFS

|

Agency Derivatives

|

Total Agency RMBS

|

||||||||||||||||

|

(dollars in thousands)

|

Fixed Rate

|

Hybrid ARMs

|

||||||||||||||||

|

Other low loan balances

|

$

|

505,565

|

|

$

|

—

|

|

$

|

—

|

|

$

|

505,565

|

|

5

|

%

|

||||

|

High LTV (predominantly MHA)

|

2,319,464

|

|

—

|

|

—

|

|

2,319,464

|

|

24

|

%

|

||||||||

|

Home equity conversion mortgages

|

1,792,937

|

|

—

|

|

—

|

|

1,792,937

|

|

19

|

%

|

||||||||

|

$85K Max Pools

|

1,313,097

|

|

—

|

|

—

|

|

1,313,097

|

|

14

|

%

|

||||||||

|

Low FICO

|

679,336

|

|

—

|

|

—

|

|

679,336

|

|

7

|

%

|

||||||||

|

Seasoned (2005 and prior vintages)

|

270,549

|

|

110,324

|

|

148,221

|

|

529,094

|

|

5

|

%

|

||||||||

|

Pre-pay lock-out or penalty-based

|

495,796

|

|

6,551

|

|

—

|

|

502,347

|

|

5

|

%

|

||||||||

|

2006 and subsequent vintages

|

872,334

|

|

519,047

|

|

—

|

|

1,391,381

|

|

14

|

%

|

||||||||

|

2006 and subsequent vintages - discount

|

241,710

|

|

370,699

|

|

70,288

|

|

682,697

|

|

7

|

%

|

||||||||

|

Total

|

$

|

8,490,788

|

|

$

|

1,006,621

|

|

$

|

218,509

|

|

$

|

9,715,918

|

|

100

|

%

|

||||

|

As of December 31, 2012

|

||||||||||||||||||

|

Agency RMBS AFS

|

Agency Derivatives

|

Total Agency RMBS

|

||||||||||||||||

|

(dollars in thousands)

|

Fixed Rate

|

Hybrid ARMs

|

||||||||||||||||

|

Other low loan balances

|

$

|

1,720,319

|

|

$

|

—

|

|

$

|

—

|

|

$

|

1,720,319

|

|

16

|

%

|

||||

|

High LTV (predominantly MHA)

|

2,904,683

|

|

—

|

|

—

|

|

2,904,683

|

|

27

|

%

|

||||||||

|

Home equity conversion mortgages

|

1,906,957

|

|

—

|

|

—

|

|

1,906,957

|

|

17

|

%

|

||||||||

|

$85K Max Pools

|

2,262,443

|

|

—

|

|

—

|

|

2,262,443

|

|

20

|

%

|

||||||||

|

Low FICO

|

781,855

|

|

—

|

|

—

|

|

781,855

|

|

7

|

%

|

||||||||

|

Seasoned (2005 and prior vintages)

|

345,412

|

|

129,940

|

|

207,869

|

|

683,221

|

|

5

|

%

|

||||||||

|

Pre-pay lock-out or penalty-based

|

541,495

|

|

13,502

|

|

—

|

|

554,997

|

|

4

|

%

|

||||||||

|

2006 and subsequent vintages

|

200,390

|

|

44,987

|

|

—

|

|

245,377

|

|

2

|

%

|

||||||||

|

2006 and subsequent vintages - discount

|

160,120

|

|

—

|

|

93,395

|

|

253,515

|

|

2

|

%

|

||||||||

|

Total

|

$

|

10,823,674

|

|

$

|

188,429

|

|

$

|

301,264

|

|

$

|

11,313,367

|

|

100

|

%

|

||||

|

As of December 31, 2013

|

|||||||||||||||

|

(in thousands)

|

Principal and Interest Securities

|

Interest-Only Securities

|

Total

|

||||||||||||

|

Senior

|

Mezzanine

|

||||||||||||||

|

Face Value

|

$

|

3,496,359

|

|

$

|

644,636

|

|

$

|

333,358

|

|

$

|

4,474,353

|

|

|||

|

Unamortized discount

|

|||||||||||||||

|

Designated credit reserve

|

(1,124,838

|

)

|

(109,611

|

)

|

—

|

|

(1,234,449

|

)

|

|||||||

|

Unamortized net discount

|

(594,726

|

)

|

(151,187

|

)

|

(325,646

|

)

|

(1,071,559

|

)

|

|||||||

|

Amortized Cost

|

$

|

1,776,795

|

|

$

|

383,838

|

|

$

|

7,712

|

|

$

|

2,168,345

|

|

|||

|

As of December 31, 2012

|

|||||||||||||||

|

(in thousands)

|

Principal and Interest Securities

|

Interest-Only Securities

|

Total

|

||||||||||||

|

Senior

|

Mezzanine

|

||||||||||||||

|

Face Value

|

$

|

3,685,422

|

|

$

|

753,084

|

|

$

|

65,493

|

|

$

|

4,503,999

|

|

|||

|

Unamortized discount

|

|||||||||||||||

|

Designated credit reserve

|

(1,179,811

|

)

|

(111,135

|

)

|

—

|

|

(1,290,946

|

)

|

|||||||

|

Unamortized net discount

|

(718,101

|

)

|

(216,459

|

)

|

(61,930

|

)

|

(996,490

|

)

|

|||||||

|

Amortized Cost

|

$

|

1,787,510

|

|

$

|

425,490

|

|

$

|

3,563

|

|

$

|

2,216,563

|

|

|||

|

(in thousands)

|

Three Months Ended

|

Year Ended

|

|||||||||||||||||

|

December 31,

|

December 31,

|

||||||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

2011

|

|||||||||||||||

|

Interest income:

|

|||||||||||||||||||

|

Available-for-sale securities

|

$

|

120,934

|

|

$

|

135,466

|

|

$

|

507,180

|

|

$

|

448,620

|

|

$

|

197,126

|

|

||||

|

Trading securities

|

1,928

|

|

1,295

|

|

5,963

|

|

4,873

|

|

4,159

|

|

|||||||||

|

Mortgage loans held-for-sale

|

6,776

|

|

247

|

|

22,185

|

|

609

|

|

2

|

|

|||||||||

|

Mortgage loans held-for-investment in securitization trusts

|

7,548

|

|

—

|

|

19,220

|

|

—

|

|

—

|

|

|||||||||

|

Cash and cash equivalents

|

271

|

|

324

|

|

1,043

|

|

944

|

|

347

|

|

|||||||||

|

Total interest income

|

137,457

|

|

137,332

|

|

555,591

|

|

455,046

|

|

201,634

|

|

|||||||||

|

Interest expense:

|

|||||||||||||||||||

|

Repurchase agreements

|

22,097

|

|

24,369

|

|

89,470

|

|

72,106

|

|

22,709

|

|

|||||||||

|

Collateralized borrowings in securitization trusts

|

4,825

|

|

—

|

|

10,937

|

|

—

|

|

—

|

|

|||||||||

|

Interest expense

|

26,922

|

|

24,369

|

|

100,407

|

|

72,106

|

|

22,709

|

|

|||||||||

|

Net interest income

|

110,535

|

|

112,963

|

|

455,184

|

|

382,940

|

|

178,925

|

|

|||||||||

|

Other-than temporary impairment losses

|

—

|

|

(1,642

|

)

|

(1,662

|

)

|

(10,952

|

)

|

(5,102

|

)

|

|||||||||

|

Other income:

|

|||||||||||||||||||

|

Gain (loss) on investment securities

|

97,850

|

|

108,219

|

|

(54,430

|

)

|

122,466

|

|

36,520

|

|

|||||||||

|

Gain (loss) on interest rate swap and swaption agreements

|

21,841

|

|

(6,096

|

)

|

245,229

|

|

(159,775

|

)

|

(86,769

|

)

|

|||||||||

|

Gain (loss) on other derivative instruments

|

29,290

|

|

(27,276

|

)

|

95,345

|

|

(40,906

|

)

|

26,755

|

|

|||||||||

|

(Loss) gain on mortgage loans

|

(8,584

|

)

|

1,679

|

|

(33,846

|

)

|

2,270

|

|

—

|

|

|||||||||

|

Servicing income

|

10,560

|

|

—

|

|

12,011

|

|

—

|

|

—

|

|

|||||||||

|

Servicing asset valuation

|

13,065

|

|

—

|

|

13,881

|

|

—

|

|

—

|

|

|||||||||

|

Other (loss) income

|

(2,001

|

)

|

—

|

|

14,619

|

|

—

|

|

—

|

|

|||||||||

|

Total other income (loss)

|

162,021

|

|

76,526

|

|

292,809

|

|

(75,945

|

)

|

(23,494

|

)

|

|||||||||

|

Expenses:

|

|||||||||||||||||||

|

Management fees

|

12,319

|

|

9,886

|

|

41,707

|

|

33,168

|

|

14,241

|

|

|||||||||

|

Securitization deal costs

|

—

|

|

—

|

|

4,153

|

|

—

|

|

—

|

|

|||||||||

|

Servicing expenses

|

2,561

|

|

—

|

|

3,761

|

|

—

|

|

—

|

|

|||||||||

|

Other operating expenses

|

12,395

|

|

6,255

|

|

37,259

|

|

17,678

|

|

9,673

|

|

|||||||||

|

Total expenses

|

27,275

|

|

16,141

|

|

86,880

|

|

50,846

|

|

23,914

|

|

|||||||||

|

Income from continuing operations before income taxes

|

245,281

|

|

171,706

|

|

659,451

|

|

245,197

|

|

126,415

|

|

|||||||||

|

Provision for (benefit from) income taxes

|

6,602

|

|

(10,203

|

)

|

84,411

|

|

(42,219

|

)

|

(1,106

|

)

|

|||||||||

|

Net income from continuing operations

|

238,679

|

|

181,909

|

|

575,040

|

|

287,416

|

|

127,521

|

|

|||||||||

|

Income (loss) from discontinued operations

|

735

|

|

7,391

|

|

3,999

|

|

4,490

|

|

(89

|

)

|

|||||||||

|

Net income attributable to common stockholders

|

$

|

239,414

|

|

$

|

189,300

|

|

$

|

579,039

|

|

$

|

291,906

|

|

$

|

127,432

|

|

||||

|

(in thousands, except share data)

|

Three Months Ended

|

Year Ended

|

|||||||||||||||||

|

December 31,

|

December 31,

|

||||||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

2011

|

|||||||||||||||

|

Basic earnings per weighted average common share:

|

|||||||||||||||||||

|

Continuing operations

|

$

|

0.66

|

|

$

|

0.62

|

|

$

|

1.64

|

|

$

|

1.19

|

|

$

|

1.29

|

|

||||

|

Discontinued operations

|

—

|

|

0.03

|

|

0.01

|

|

0.02

|

|

—

|

|

|||||||||

|

Net income

|

$

|

0.66

|

|

$

|

0.65

|

|

$

|

1.65

|

|

$

|

1.21

|

|

$

|

1.29

|

|

||||

|

Diluted earnings per weighted average common share:

|

|||||||||||||||||||

|

Continuing operations

|

$

|

0.66

|

|

$

|

0.61

|

|

$

|

1.64

|

|

$

|

1.18

|

|

$

|

1.29

|

|

||||

|

Discontinued operations

|

—

|

|

0.02

|

|

0.01

|

|

0.02

|

|

—

|

|

|||||||||

|

Net income

|

$

|

0.66

|

|

$

|

0.63

|

|

$

|

1.65

|

|

$

|

1.20

|

|

$

|

1.29

|

|

||||

|

Dividends declared per common share

|

$

|

0.26

|

|

$

|

0.55

|

|

$

|

1.17

|

|

$

|

1.71

|

|

$

|

1.60

|

|

||||

|

Weighted average number of shares of common stock:

|

|||||||||||||||||||

|

Basic

|

364,700,903

|

|

295,492,372

|

|

350,361,827

|

|

242,014,751

|

|

98,826,868

|

|

|||||||||

|

Diluted

|

364,700,903

|

|

296,229,245

|

|

350,992,387

|

|

242,432,156

|

|

98,826,868

|

|

|||||||||

|

Comprehensive income:

|

|||||||||||||||||||

|

Net income

|

$

|

239,414

|

|

$

|

189,300

|

|

$

|

579,039

|

|

$

|

291,906

|

|

$

|

127,432

|

|

||||

|

Other comprehensive (loss) income:

|

|||||||||||||||||||

|

Unrealized (loss) gain on available-for-sale securities, net

|

(68,039

|

)

|

(3,938

|

)

|

(251,723

|

)

|

755,174

|

|

(81,335

|

)

|

|||||||||

|

Other comprehensive (loss) income

|

(68,039

|

)

|

(3,938

|

)

|

(251,723

|

)

|

755,174

|

|

(81,335

|

)

|

|||||||||

|

Comprehensive income

|

$

|

171,375

|

|

$

|

185,362

|

|

$

|

327,316

|

|

$

|

1,047,080

|

|

$

|

46,097

|

|

||||

|

Three Months Ended December 31, 2013

|

Year Ended December 31, 2013

|

||||||||||||||||

|

Agency

|

Non-Agency

|

Consolidated

|

Agency

|

Non-Agency

|

Consolidated

|

||||||||||||

|

Gross Yield/Stated Coupon

|

4.4

|

%

|

2.9

|

%

|

4.1

|

%

|

4.3

|

%

|

2.8

|

%

|

4.1

|

%

|

|||||

|

Net (Premium Amortization)/Discount Accretion

|

(1.4

|

)%

|

6.0

|

%

|

—

|

%

|

(1.5

|

)%

|

6.2

|

%

|

(0.2

|

)%

|

|||||

|

Net Yield

(1)

|

3.0

|

%

|

8.9

|

%

|

4.1

|

%

|

2.8

|

%

|

9.0

|

%

|

3.9

|

%

|

|||||

|

Three Months Ended December 31, 2012

|

Year Ended December 31, 2012

|

||||||||||||||||

|

Agency

|

Non-Agency

|

Consolidated

|

Agency

|

Non-Agency

|

Consolidated

|

||||||||||||

|

Gross Yield/Stated Coupon

|

4.4

|

%

|

2.7

|

%

|

4.1

|

%

|

4.5

|

%

|

|

2.7

|

%

|

|

4.2

|

%

|

|||

|

Net (Premium Amortization)/Discount Accretion

|

(1.5

|

)%

|

6.8

|

%

|

(0.2

|

)%

|

(1.6

|

)%

|

|

6.9

|

%

|

|

—

|

%

|

|||

|

Net Yield

(1)

|

2.9

|

%

|

9.5

|

%

|

3.9

|

%

|

2.9

|

%

|

|

9.6

|

%

|

|

4.2

|

%

|

|||

|

(1)

|

These yields have not been adjusted for cost of delay and cost to carry purchase premiums.

|

|

Three Months Ended December 31, 2013

|

Year Ended December 31, 2013

|

||||||||||||||||||||||

|

(dollars in thousands)

|

Agency

|

Non-Agency

|

Total

|

Agency

|

Non-Agency

|

Total

|

|||||||||||||||||

|

Average amortized cost

|

$

|

9,622,675

|

|

$

|

2,248,949

|

|

$

|

11,871,624

|

|

$

|

10,615,981

|

|

$

|

2,323,307

|

|

$

|

12,939,288

|

|

|||||

|

Coupon interest

|

105,994

|

|

16,435

|

|

122,429

|

|

460,881

|

|

65,321

|

|

526,202

|

|

|||||||||||

|

Net (premium amortization)/discount accretion

|

(34,987

|

)

|

33,492

|

|

(1,495

|

)

|

(162,229

|

)

|

143,207

|

|

(19,022

|

)

|

|||||||||||

|

Interest income

|

$

|

71,007

|

|

$

|

49,927

|

|

$

|

120,934

|

|

$

|

298,652

|

|

$

|

208,528

|

|

$

|

507,180

|

|

|||||

|

Net asset yield

|

3.0

|

%

|

8.9

|

%

|

4.1

|

%

|

2.8

|

%

|

9.0

|

%

|

3.9

|

%

|

|||||||||||

|

Three Months Ended December 31, 2012

|

Year Ended December 31, 2012

|

||||||||||||||||||||||

|

(dollars in thousands)

|

Agency

|

Non-Agency

|

Total

|

Agency

|

Non-Agency

|

Total

|

|||||||||||||||||

|

Average amortized cost

|

$

|

11,601,486

|

|

$

|

2,192,618

|

|

$