|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

OR

SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ____________

Commission File Number

(Exact name of registrant as specified in its charter)

|

|

|

| ||

(State or other jurisdiction of |

| (I.R.S. Employer |

incorporation or organization) |

| Identification No.) |

(Address of principal executive offices)

(Zip Code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each Class | Trading Symbol | Name of each exchange on which registered |

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

¨ Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

| þ |

| Accelerated Filer | ¨ | Non-Accelerated Filer | ¨ | |

| Smaller Reporting Company |

| Emerging Growth Company |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes

As of June 28, 2019, the aggregate market value of the registrant’s Common Stock held by non-affiliates (using the New York Stock Exchange closing price) was $

The number of shares outstanding of the registrant’s Common Stock as of January 31, 2020 was

|

|

Documents Incorporated by Reference – Portions of the registrant’s definitive Proxy Statement for the Annual Meeting of Shareholders to be held on May 14, 2020, are incorporated by reference into Part III of this report. The registrant’s Proxy Statement will be filed with the Securities and Exchange Commission pursuant to Regulation 14A.

UNION PACIFIC CORPORATION

TABLE OF CONTENTS

|

|

|

| 3 | |

| 5 | |

|

|

|

| ||

|

|

|

Item 1. | 6 | |

Item 1A. | 11 | |

Item 1B. | 15 | |

Item 2. | 16 | |

Item 3. | 18 | |

Item 4. | 20 | |

| Executive Officers of the Registrant and Principal Executive Officers of Subsidiaries | 21 |

|

|

|

| ||

|

|

|

Item 5. | 22 | |

Item 6. | 24 | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 25 |

| 39 | |

| 43 | |

Item 7A. | 43 | |

Item 8. | 44 | |

| 45 | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 81 |

Item 9A. | 81 | |

| Management’s Annual Report on Internal Control Over Financial Reporting | 82 |

| 83 | |

Item 9B. | 84 | |

|

|

|

| ||

|

|

|

Item 10. | 84 | |

Item 11. | 84 | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 84 |

Item 13. | Certain Relationships and Related Transactions and Director Independence | 85 |

Item 14. | 85 | |

|

|

|

| ||

|

|

|

Item 15. | 86 | |

Item 16. | 91 | |

| Certifications | 92 96 |

February 7, 2020

Fellow Shareholders:

Union Pacific exited 2019 as a much different, much better company than we started the year. The implementation of Unified Plan 2020 is transforming how we do business – making us more efficient and reliable for our customers. Change of this magnitude is difficult, but the men and women of Union Pacific met the challenge head on - driving us to new levels of profitability in a year that included historic flooding and a declining freight environment. We are pleased to report earnings per diluted share of $8.38, which is a 6 percent increase versus 2018, despite volume declines of 6 percent. Our operating ratio was a record 60.6 percent, 2.1 points better than last year’s 62.7 percent.

The adoption of Unified Plan 2020 is a key part of Union Pacific’s push to become the best freight railroad in North America. We think of this strategy as a flywheel that is driven by a Proud and Engaged Workforce. Our employees are at the core of everything we do and are critical to our long-term success.

The first “cog” in the flywheel is to provide the Safest and Most Reliable Freight Rail Products and Services. Everything we do must be done safely and reliably. Unfortunately, our 2019 safety results were not good enough. Our reportable personal injury rate was 0.90, compared to 0.82 in 2018, while our reportable derailment rate was 4.28, compared to 3.28 in 2018. We want every employee to return home safely every day and to eliminate all derailments. We must do better in 2020.

The first “cog” in the flywheel is to provide the Safest and Most Reliable Freight Rail Products and Services. Everything we do must be done safely and reliably. Unfortunately, our 2019 safety results were not good enough. Our reportable personal injury rate was 0.90, compared to 0.82 in 2018, while our reportable derailment rate was 4.28, compared to 3.28 in 2018. We want every employee to return home safely every day and to eliminate all derailments. We must do better in 2020.

We did, however, make great strides to improve the reliability of our service product. Trip plan compliance improved 6 points, demonstrating our commitment to be there when we say we will. Local service metrics like to and from industry, also showed solid improvement. Additionally, increased asset utilization and fewer car classifications led to a 6 percent improvement in freight car velocity and a 17 percent improvement in freight car terminal dwell.

In order to be cost competitive for our customers in a quickly changing freight environment, we must have Highly Efficient Operations. This includes emphasizing on-time performance and turning assets more quickly, driving costs out of our network so we can better compete in both new and existing markets. I am very pleased to report that the team did an excellent job across the board in this area as we drove our operating ratio to record levels.

Combining an enhanced service product with advancing technology allows us to provide an Industry-Leading Customer Experience. One example is the transparency we are providing customers into their supply chain. Use of Mobile Work Order devices has allowed us to provide streamlined interfaces, better notifications and improved local inventory reporting. And we’re just getting started!

Efficient operations and an excellent customer experience are the foundation that enables us to Secure Appropriate Business. Despite a difficult freight environment where freight volumes decreased 6 percent compared to 2018, we continue to win new business. We’re excited to participate in the development of the new Butler Intermodal Terminal in Central Iowa, providing an alternative to larger Midwest rail hubs and giving shippers a cost-competitive solution to reduce long-haul trucking miles.

A safe, reliable and efficient service product positions us to generate Best-in-Industry Cash Returns. Total shareholder return, including price appreciation and dividends, increased 33.7 percent in 2019, compared to 31.5 percent for the S&P 500. We paid dividends in 2019 of $2.6 billion, as we raised our quarterly dividend with two 10 percent increases during the year. In addition, we repurchased 35 million Union Pacific shares, decreasing our full-year average share count by 6 percent. Combining dividends and share repurchases, Union Pacific returned $8.4 billion to our shareholders in 2019.

Capital investments in our business form the foundation for future improvements in safety, reliability and efficiency, making it critical that we make Optimal Investments annually. In 2019, we invested $3.2 billion, including just under $2 billion in replacement capital to harden our infrastructure, replace older assets and improve the safety and resiliency of our network. We also invested for growth and productivity through the addition of five extended sidings on our Sunset Corridor, a key competitive route for us.

As we enter the new decade, we are looking forward to leveraging the Unified Plan 2020 service gains to safely and reliably grow the business. We understand that opportunity comes with responsibility; we will continue to be a positive force in sustainability efforts, ensuring all stakeholders are heard. Our goal and our path are clear: Be the best freight railroad in North America, and use that platform to grow with our customers. Thank you for joining us on this value-creating journey.

Chairman, President and Chief Executive Officer

DIRECTORS AND SENIOR MANAGEMENT

|

|

|

|

|

BOARD OF DIRECTORS |

|

|

|

|

|

|

|

|

|

Andrew H. Card, Jr. |

| Lance M. Fritz |

| Thomas F. McLarty III |

Former White House |

| Chairman, President and |

| President |

Chief of Staff |

| Chief Executive Officer |

| McLarty Associates |

Board Committees: Audit, |

| Union Pacific Corporation and |

| Board Committees: Finance (Chair), |

Compensation and Benefits |

| Union Pacific Railroad Company |

| Corporate Governance and |

|

|

|

| Nominating |

Erroll B. Davis, Jr. |

| Deborah C. Hopkins |

|

|

Former Chairman, |

| Former Chief Executive Officer |

| Bhavesh V. Patel |

President & CEO |

| Citi Ventures |

| Chief Executive Officer and |

Alliant Energy Corporation |

| Former Chief Innovation Officer |

| Chairman of the Management Board |

Board Committees: Compensation |

| Citi |

| LyondellBasell Industries N.V. |

and Benefits (Chair), Corporate |

| Board Committees: Audit, Finance |

| Board Committees: Finance, |

Governance and Nominating |

|

|

| Compensation and Benefits |

|

| Jane H. Lute |

|

|

William J. DeLaney |

| President and Chief Executive Officer |

| Jose H. Villarreal |

Former Chief Executive Officer, |

| SICPA North America |

| Advisor |

Sysco Corporation |

| Board Committees: Audit, Corporate |

| Akin, Gump, Strauss, Hauer & |

Board Committees: Audit, |

| Governance and Nominating |

| Feld, LLP |

Compensation and Benefits |

|

|

| Board Committees: Compensation |

|

| Michael R. McCarthy |

| and Benefits, Corporate Governance |

David B. Dillon |

| Chairman |

| and Nominating |

Former Chairman |

| McCarthy Group, LLC |

|

|

The Kroger Company |

| Lead Independent Director |

| Christopher J. Williams |

Board Committees: Audit (Chair), |

| Board Committees: Corporate |

| Chairman |

Compensation and Benefits |

| Governance and Nominating (Chair), |

| Siebert Williams Shank & Co. |

|

| Finance |

| Board Committees: Audit, Finance* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SENIOR MANAGEMENT**

|

|

|

|

|

|

|

|

|

|

Lance M. Fritz |

| Jennifer L. Hamann |

| Kenny G. Rocker |

Chairman, President and |

| Executive Vice President |

| Executive Vice President-Marketing |

Chief Executive Officer |

| and Chief Financial Officer |

| and Sales |

|

|

|

|

|

Prentiss W. Bolin, Jr. |

| Thomas A. Lischer |

| Todd M. Rynaski |

Vice President-External Relations |

| Executive Vice President-Operations |

| Vice President and Controller |

|

|

|

|

|

Bryan L. Clark |

| Scott D. Moore |

| V. James Vena |

Vice President-Tax |

| Senior Vice President-Corporate |

| Chief Operating Officer |

|

| Relations and |

|

|

Rhonda S. Ferguson |

| Chief Administrative Officer |

| Elizabeth F. Whited |

Executive Vice President, Chief Legal |

|

|

| Executive Vice President and |

Officer and Corporate Secretary |

| Jon T. Panzer |

| Chief Human Resource Officer |

|

| Senior Vice President-Technology |

|

|

Gary W. Grosz |

| and Strategic Planning |

|

|

Vice President and Treasurer |

|

|

|

|

|

| Clark J. Ponthier |

|

|

|

| Senior Vice President-Supply Chain |

|

|

|

| And Continuous Improvement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Committee appointments effective March 18, 2020.

**Senior management are elected officers of both Union Pacific Corporation and Union Pacific Railroad Company, except Messrs. Lischer, Ponthier and Rocker are elected officers for Union Pacific Railroad Company. | ||||

.

PART I

Item 1. Business

GENERAL

Union Pacific Railroad Company is the principal operating company of Union Pacific Corporation. One of America's most recognized companies, Union Pacific Railroad Company links 23 states in the western two-thirds of the country by rail, providing a critical link in the global supply chain. The Railroad’s diversified business mix includes Agricultural Products, Energy, Industrial and Premium. Union Pacific serves many of the fastest-growing U.S. population centers, operates from all major West Coast and Gulf Coast ports to eastern gateways, connects with Canada's rail systems and is the only railroad serving all six major Mexico gateways. Union Pacific provides value to its roughly 10,000 customers by delivering products in a safe, reliable, fuel-efficient and environmentally responsible manner.

Union Pacific Corporation was incorporated in Utah in 1969 and maintains its principal executive offices at 1400 Douglas Street, Omaha, NE 68179. The telephone number at that address is (402) 544-5000. The common stock of Union Pacific Corporation is listed on the New York Stock Exchange (NYSE) under the symbol “UNP”.

For purposes of this report, unless the context otherwise requires, all references herein to “UPC”, “Corporation”, “Company”, “we”, “us”, and “our” shall mean Union Pacific Corporation and its subsidiaries, including Union Pacific Railroad Company, which we separately refer to as “UPRR” or the “Railroad”.

Available Information – Our Internet website is www.up.com. We make available free of charge on our website (under the “Investors” caption link) our Annual Reports on Form 10-K; our Quarterly Reports on Form 10-Q; our current reports on Form 8-K; our proxy statements; Forms 3, 4, and 5, filed on behalf of our directors and certain executive officers; and amendments to such reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (the Exchange Act). We provide these reports and statements as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (SEC). We also make available on our website previously filed SEC reports and exhibits via a link to EDGAR on the SEC’s Internet site at www.sec.gov. Additionally, our corporate governance materials, including By-Laws, Board Committee charters, governance guidelines and policies, and codes of conduct and ethics for directors, officers, and employees are available on our website. From time to time, the corporate governance materials on our website may be updated as necessary to comply with rules issued by the SEC and the NYSE or as desirable to promote the effective and efficient governance of our Company. Any security holder wishing to receive, without charge, a copy of any of our SEC filings or corporate governance materials should send a written request to: Secretary, Union Pacific Corporation, 1400 Douglas Street, Omaha, NE 68179.

References to our website address in this report, including references in Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7, are provided as a convenience and do not constitute, and should not be deemed, an incorporation by reference of the information contained on, or available through, the website. Therefore, such information should not be considered part of this report.

OPERATIONS

The Railroad, along with its subsidiaries and rail affiliates, is our one reportable operating segment. Although we provide revenue by commodity group, we analyze the net financial results of the Railroad as one segment due to the integrated nature of our rail network. Additional information regarding our business and operations, including revenue and financial information and data and other information regarding environmental matters, is presented in Risk Factors, Item 1A; Legal Proceedings, Item 3; Selected Financial Data, Item 6; Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7; and the Financial Statements and Supplementary Data, Item 8 (which include information regarding revenues, statements of income, and total assets).

|

|

|

|

Operations – UPRR is a Class I railroad operating in the U.S. We have 32,340 route miles, linking Pacific Coast and Gulf Coast ports with the Midwest and eastern U.S. gateways and providing several corridors to key Mexican gateways. We serve the Western two-thirds of the country and maintain coordinated schedules with other rail carriers to move freight to and from the Atlantic Coast, the Pacific Coast, the Southeast, the Southwest, Canada, and Mexico. Export and import traffic moves through Gulf Coast and Pacific Coast ports and across the Mexican and Canadian borders. Our freight traffic consists of bulk, manifest, and premium business. Bulk traffic primarily consists of coal, grain, soda |

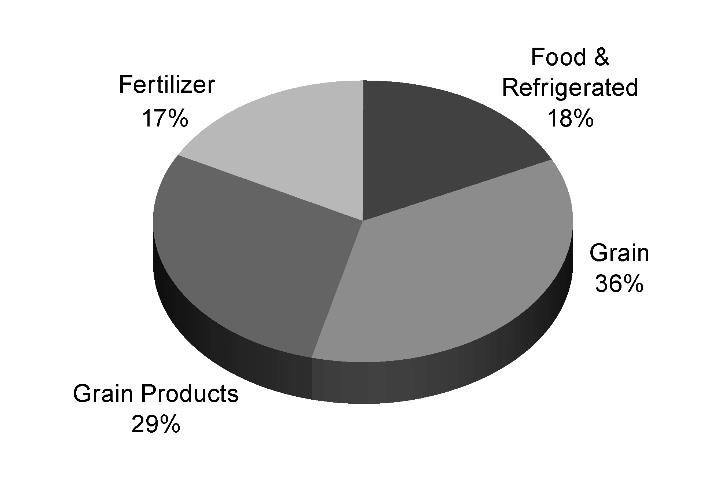

2019 Freight Revenue |

|

ash, ethanol, and rock shipped in unit trains – trains transporting a single commodity from one origin to one destination. Manifest traffic includes individual carload or less than train-load business involving commodities such as lumber, steel, paper, food and chemicals. The transportation of finished vehicles, auto parts, intermodal containers and truck trailers are included as part of our premium business. In 2019, we generated freight revenues totaling $20.2 billion from the following four commodity groups:

Agricultural Products – Transportation of grains, commodities produced from these grains, fertilizer, and food and beverage products generated 22% of the Railroad’s 2019 freight revenue. We access most major grain markets, linking the Midwest and Western U.S. producing areas to export terminals in the Pacific Northwest and Gulf Coast ports, as well as Mexico. We also serve significant domestic markets, including grain processors, animal feeders and ethanol producers in the Midwest and West. Fertilizer movements originate in the Gulf Coast region, Midwest, western U.S. and Canada (through interline access) for delivery to major agricultural users in those areas, as well as abroad.

Energy – The Company’s Energy shipments are grouped into the following three categories: (i) coal, (ii) sand and (iii) petroleum, liquid petroleum gases (LPG) and renewables. In 2019, this group generated 18% of our freight revenue. The Railroad’s network supports the transportation of coal shipments to independent and regulated power companies and industrial facilities throughout the U.S. Through interchange gateways and ports, UPRR’s reach extends to eastern U.S. utilities, as well as to Mexico and other international destinations. Coal traffic originating in the Powder River Basin (PRB) area of Wyoming is the largest segment of the Railroad’s coal business. Demand for hydraulic fracturing sand, or frac-sand, is generated by oil and gas drilling, whereas, the Company’s petroleum and LPG shipments are primarily impacted by refinery utilization rates, regional crude pricing differentials, pipeline capacity, and the use of asphalt for road programs. Renewable shipments consist primarily of biomass exports and wind turbine components.

Industrial – Our extensive network facilitates the movement of numerous commodities between thousands of origin and destination points throughout North America. The Industrial group consists of several categories, including construction, industrial chemicals, plastics, forest products, specialized products (primarily waste, lime, salt and government), metals and ores, and soda ash. Transportation of these products accounted for 29% of our freight revenue in 2019. Commercial, residential and governmental infrastructure investments drive shipments of steel, aggregates, cement and wood products. Industrial and light manufacturing plants receive steel, nonferrous materials, minerals and other raw materials.

The industrial chemicals market consists of a vast number of chemical compounds that support the manufacturing of more complex chemicals. Plastics shipments support automotive, housing, and the durable and disposable consumer goods markets. Forest product shipments include lumber and paper commodities. Lumber shipments originate primarily in the Pacific Northwest or western Canada and move throughout the U.S. for use in new home construction and repairs and remodeling. Paper shipments primarily support packaging needs. Oil and gas drilling generates demand for raw steel, finished pipe, stone and drilling fluid commodities. Soda ash originates in southwestern Wyoming and California, destined for chemical and glass producing markets in North America and abroad.

Premium – In 2019, the Premium franchise generated 31% of Union Pacific’s total freight revenue. Our Premium franchise includes three segments: international intermodal, domestic intermodal, and finished vehicles. International business consists of import and export traffic moving in 20 or 40-foot shipping containers, that mainly passes through West Coast ports served by UP’s extensive terminal network. Domestic business includes container and trailer traffic picked up and delivered within North America for intermodal marketing companies (primarily shipper agents and logistics companies), as well as truckload carriers.

We are the largest automotive carrier west of the Mississippi River and operate or access 38 vehicle distribution centers. The Railroad’s extensive franchise serves five vehicle assembly plants and connects to West Coast ports, all six major Mexico gateways, and the Port of Houston to accommodate both import and export shipments. In addition to transporting finished vehicles, UPRR provides expedited handling of automotive parts in both boxcars and intermodal containers destined for Mexico, the U.S. and Canada.

Seasonality – Some of the commodities we carry have peak shipping seasons, reflecting either or both the nature of the commodity and the demand cycle for the commodity (such as certain agricultural and food products that have specific growing and harvesting seasons). The peak shipping seasons for these commodities can vary considerably each year depending upon various factors, including the strength of domestic and international economies and currencies and the strength of harvests and market prices for agricultural products.

Working Capital – At both December 31, 2019 and December 31, 2018, we had a working capital deficit. The deficits are primarily due to upcoming debt maturities. As past years indicate, it is not unusual for us to have a working capital deficit; however, we believe it is not an indication of a lack of liquidity. We also maintain adequate resources, including our credit facility, and when necessary, access to capital markets to meet any foreseeable cash requirements.

Competition – We are subject to competition from other railroads, motor carriers, ship and barge operators, and pipelines. Our main railroad competitor is Burlington Northern Santa Fe LLC. Its primary subsidiary, BNSF Railway Company (BNSF), operates parallel routes in many of our main traffic corridors. In addition, we operate in corridors served by other railroads and motor carriers. Motor carrier competition exists for all four of our commodity groups (excluding most coal shipments). Because of the proximity of our routes to major inland and Gulf Coast waterways, barges can be particularly competitive, especially for grain and bulk commodities in certain areas where we operate. In addition to price competition, we also face competition with respect to transit times, quality and reliability of service from motor carriers and other railroads. Motor carriers in particular can have an advantage over railroads with respect to transit times and timeliness of service. However, railroads are much more fuel-efficient than trucks, which reduces the impact of transporting goods on the environment and public infrastructure, and we have been making efforts to convert certain truck traffic to rail. Additionally, we must build or acquire and maintain our rail system; trucks and barges are able to use public rights-of-way maintained by public entities. Any of the following could also affect the competitiveness of our transportation services for some or all of our commodities: (i) improvements or expenditures materially increasing the quality or reducing the costs of these alternative modes of transportation, (ii) legislation that eliminates or significantly increases the size or weight limitations applied to motor carriers, or (iii) legislation or regulatory changes that impose operating restrictions on railroads or that adversely affect the profitability of some or all railroad traffic. Finally, many movements face product or geographic competition where our customers can use different products (e.g. natural gas instead of coal, sorghum instead of corn) or commodities from different locations (e.g. grain from states or countries that we do not serve, crude oil from different regions). Sourcing different commodities or different locations allows shippers to substitute different carriers and such competition may reduce our volume or constrain prices. For more information regarding risks we face from competition, see the Risk Factors in Item 1A of this report.

Key Suppliers – We depend on two key domestic suppliers of high horsepower locomotives. Due to the capital intensive nature of the locomotive manufacturing business and sophistication of this equipment, potential new suppliers face high barriers of entry into this industry. Therefore, if one of these domestic suppliers discontinues manufacturing locomotives, supplying parts or providing maintenance for any reason, including insolvency or bankruptcy, we could experience a significant cost increase and risk reduced availability of the locomotives that are necessary to our operations. Additionally, for a high percentage of our rail purchases, we utilize two steel producers (one domestic and one international) that meet our specifications. Rail is critical for maintenance, replacement, improvement, and expansion of our network and facilities. Rail manufacturing also has high barriers of entry, and, if one of those suppliers

discontinues operations for any reason, including insolvency or bankruptcy, we could experience cost increases and difficulty obtaining rail.

Employees – Approximately 85% of our full-time employees are represented by 14 major rail unions. Pursuant to the Railway Labor Act (RLA), our collective bargaining agreements are subject to modification every five years. The RLA procedures include mediation, potential arbitration, cooling-off periods, and the possibility of Presidential Emergency Boards and Congressional intervention. The current round of negotiations began on January 1, 2020 related to years 2020-2024. Contract negotiations historically continue for an extended period of time, and work stoppages during negotiations are rare.

Railroad Security – Our security efforts consist of a wide variety of measures including employee training, engagement with our customers, training of emergency responders, and partnerships with numerous federal, state, and local government agencies. While federal law requires us to protect the confidentiality of our security plans designed to safeguard against terrorism and other security incidents, the following provides a general overview of our security initiatives.

UPRR Security Measures – We maintain a comprehensive security plan designed to both deter and respond to any potential or actual threats as they arise. The plan includes four levels of alert status, each with its own set of countermeasures. We employ our own police force, consisting of commissioned and highly-trained officers. Our employees also undergo recurrent security and preparedness training, as well as federally-mandated hazardous materials and security training. We regularly review the sufficiency of our employee training programs. We maintain the capability to move critical operations to back-up facilities in different locations.

We operate an emergency response management center 24 hours a day. The center receives reports of emergencies, dangerous or potentially dangerous conditions, and other safety and security issues from our employees, the public, law enforcement and other government officials. In cooperation with government officials, we monitor both threats and public events, and, as necessary, we may alter rail traffic flow at times of concern to minimize risk to communities and our operations. We comply with the hazardous materials routing rules and other requirements imposed by federal law. We also design our operating plan to expedite the movement of hazardous material shipments to minimize the time rail cars remain idle at yards and terminals located in or near major population centers. Additionally, in compliance with Transportation Security Agency regulations, we deployed information systems and instructed employees in tracking and documenting the handoff of Rail Security Sensitive Materials with customers and interchange partners.

We also have established a number of our own innovative safety and security-oriented initiatives ranging from various investments in technology to The Officer on Train program, which provides local law enforcement officers with the opportunity to ride with train crews to enhance their understanding of railroad operations and risks. Our staff of information security professionals continually assesses cyber security risks and implements mitigation programs that evolve with the changing technology threat environment. To date, we have not experienced any material disruption of our operations due to a cyber threat or attack directed at us.

Cooperation with Federal, State, and Local Government Agencies – We work closely on physical and cyber security initiatives with government agencies, including the U.S. Department of Transportation (DOT) and the Department of Homeland Security (DHS) as well as local police departments, fire departments, and other first responders. In conjunction with the Association of American Railroads (AAR), we sponsor Ask Rail, a mobile application which provides first responders with secure links to electronic information, including commodity and emergency response information required by emergency personnel to respond to accidents and other situations. We also participate in the National Joint Terrorism Task Force, a multi-agency effort established by the U.S. Department of Justice and the Federal Bureau of Investigation to combat and prevent terrorism.

We work with the Coast Guard, U.S. Customs and Border Protection (CBP), and the Military Transport Management Command, which monitor shipments entering the UPRR rail network at U.S. border crossings and ports. We were the first railroad in the U.S. to be named a partner in CBP’s Customs-Trade Partnership Against Terrorism, a partnership designed to develop, enhance, and maintain effective security processes throughout the global supply chain.

Cooperation with Customers and Trade Associations – Through TransCAER (Transportation Community Awareness and Emergency Response) we work with the AAR, the American Chemistry Council, the American Petroleum Institute, and other chemical trade groups to provide communities with preparedness tools, including the training of emergency responders. In cooperation with the Federal Railroad Administration (FRA) and other interested groups, we are also working to develop additional improvements to tank car design that will further limit the risk of releases of hazardous materials.

GOVERNMENTAL AND ENVIRONMENTAL REGULATION

Governmental Regulation – Our operations are subject to a variety of federal, state, and local regulations, generally applicable to all businesses. (See also the discussion of certain regulatory proceedings in Legal Proceedings, Item 3.)

The operations of the Railroad are also subject to the regulatory jurisdiction of the Surface Transportation Board (STB). The STB has jurisdiction over rates charged on certain regulated rail traffic; common carrier service of regulated traffic; freight car compensation; transfer, extension, or abandonment of rail lines; and acquisition of control of rail common carriers. The STB continues its efforts to explore expanding rail regulation and is reviewing proposed rulemaking in various areas, including reciprocal switching, commodity exemptions, and expanding and easing procedures for smaller rate complaints. The STB also continues to develop a methodology for determining railroad revenue adequacy and the possible use of a revenue adequacy constraint in regulating railroad rates. The STB posts quarterly reports on rate reasonableness cases and maintains a database on service complaints, and has the authority to initiate investigations, among other things.

The operations of the Railroad also are subject to the regulations of the FRA and other federal and state agencies. In 2010, the FRA issued initial rules governing installation of Positive Train Control (PTC). PTC is a collision avoidance technology intended to override engineer controlled locomotives and stop train-to-train and overspeed accidents, misaligned switch derailments, and unauthorized entry to work zones. The Surface Transportation Extension Act of 2015 amended the Rail Safety Improvement Act to require implementation of PTC by the end of 2018, which deadline may be extended to December 31, 2020, provided certain other criteria are satisfied. On December 10, 2018, we received FRA approval for an alternative schedule to implement, test and refine our PTC during 2019-2020. As of December 31, 2019, PTC has been implemented and installed on 100 percent of our required rail lines, including required passenger train routes and interoperability efforts with other railroads will continue through 2020. Through 2019, we have invested approximately $2.9 billion in the ongoing development of PTC. Final implementation of PTC will require us to adapt and integrate our system with other railroads whose implementation plan may be different than ours.

DOT, the Occupational Safety and Health Administration, the Pipeline and Hazardous Materials Safety Administration, and DHS, along with other federal agencies, have jurisdiction over certain aspects of safety, movement of hazardous materials and hazardous waste, emissions requirements, and equipment standards. Additionally, various state and local agencies have jurisdiction over disposal of hazardous waste and seek to regulate movement of hazardous materials in ways not preempted by federal law.

Environmental Regulation – We are subject to extensive federal and state environmental statutes and regulations pertaining to public health and the environment. The statutes and regulations are administered and monitored by the Environmental Protection Agency (EPA) and by various state environmental agencies. The primary laws affecting our operations are the Resource Conservation and Recovery Act, regulating the management and disposal of solid and hazardous wastes; the Comprehensive Environmental Response, Compensation, and Liability Act, regulating the cleanup of contaminated properties; the Clean Air Act, regulating air emissions; and the Clean Water Act, regulating waste water discharges.

Information concerning environmental claims and contingencies and estimated remediation costs is set forth in Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies – Environmental, Item 7 and Note 18 to the Consolidated Financial Statements in Item 8, Financial Statements and Supplementary Data.

Item 1A. Risk Factors

The following discussion addresses significant factors, events and uncertainties that make an investment in our securities risky and provides important information for the understanding of our “forward-looking statements,” which are discussed immediately preceding Item 7A of this Form 10-K and elsewhere. The risk factors set forth in this Item 1A should be read in conjunction with the rest of the information included in this report, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, Item 7, and Financial Statements and Supplementary Data, Item 8.

We urge you to consider carefully the factors described below and the risks that they present for our operations, as well as the risks addressed in other reports and materials that we file with the SEC and the other information included or incorporated by reference in this Form 10-K. When the factors, events and contingencies described below or elsewhere in this Form 10-K materialize, our business, reputation, financial condition, results of operations, cash flows or prospects can be materially adversely affected. In such case, the trading price of our common stock could decline and you could lose part or all of you investment. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also materially adversely affect our business, reputation, financial condition, results of operations, cash flows and prospects.

We Must Manage Fluctuating Demand for Our Services and Network Capacity – If there are significant reductions in demand for rail services with respect to one or more commodities or changes in consumer preferences that affect the businesses of our customers, we may experience increased costs associated with resizing our operations, including higher unit operating costs and costs for the storage of locomotives, rail cars, and other equipment; work-force adjustments; and other related activities, which could have a material adverse effect on our results of operations, financial condition, and liquidity. If there is significant demand for our services that exceeds the designed capacity of our network, we may experience network difficulties, including congestion and reduced velocity, that could compromise the level of service we provide to our customers. This level of demand may also compound the impact of weather and weather-related events on our operations and velocity. Although we continue to improve our transportation plan, add capacity, improve operations at our yards and other facilities, and improve our ability to address surges in demand for any reason with adequate resources, we cannot be sure that these measures will fully or adequately address any service shortcomings resulting from demand exceeding our planned capacity. We may experience other operational or service difficulties related to network capacity, dramatic and unplanned fluctuations in our customers’ demand for rail service with respect to one or more commodities or operating regions, or other events that could negatively impact our operational efficiency, any of which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Transport Hazardous Materials – We transport certain hazardous materials and other materials, including crude oil, ethanol, and toxic inhalation hazard (TIH) materials, such as chlorine, that pose certain risks in the event of a release or combustion. Additionally, U.S. laws impose common carrier obligations on railroads that require us to transport certain hazardous materials regardless of risk or potential exposure to loss. A rail accident or other incident or accident on our network, at our facilities, or at the facilities of our customers involving the release or combustion of hazardous materials could involve significant costs and claims for personal injury, property damage, and environmental penalties and remediation in excess of our insurance coverage for these risks, which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Are Subject to Significant Governmental Regulation – We are subject to governmental regulation by a significant number of federal, state, and local authorities covering a variety of health, safety, labor, environmental, economic (as discussed below), and other matters. Many laws and regulations require us to obtain and maintain various licenses, permits, and other authorizations, and we cannot guarantee that we will continue to be able to do so. Our failure to comply with applicable laws and regulations could have a material adverse effect on us. Governments or regulators may change the legislative or regulatory frameworks within which we operate without providing us any recourse to address any adverse effects on our business, including, without limitation, regulatory determinations or rules regarding dispute resolution, increasing the amount of our traffic subject to common carrier regulation, business relationships with other railroads, calculation of our cost of capital or other inputs relevant to computing our revenue adequacy, the prices we charge, and costs and expenses. Significant legislative activity in Congress or regulatory activity by the STB could expand regulation of railroad operations and prices for rail services, which could reduce capital spending on our rail network, facilities and equipment and have a material adverse effect on our results of operations, financial condition, and liquidity. For example, enacted federal legislation mandated the implementation of PTC by December 31, 2020. Although we have completed implementation on all

required rail lines, final implementation of PTC will require us to adapt and integrate our system with other railroads whose implementation plan may be different than ours. This implementation could have a material adverse effect on our results of operations and financial condition. Additionally, one or more consolidations of Class I railroads could also lead to increased regulation of the rail industry.

We Are Affected by General Economic Conditions – Prolonged severe adverse domestic and global economic conditions or disruptions of financial and credit markets may affect the producers and consumers of the commodities we carry and may have a material adverse effect on our access to liquidity and our results of operations and financial condition.

We Face Competition from Other Railroads and Other Transportation Providers – We face competition from other railroads, motor carriers, ships, barges, and pipelines. In addition to price competition, we face competition with respect to transit times and quality and reliability of service. We must build or acquire and maintain our rail system, while trucks, barges and maritime operators are able to use public rights-of-way maintained by public entities. Any future improvements or expenditures materially increasing the quality or reducing the cost of alternative modes of transportation, or legislation that eliminates or significantly increases the size or weight limitations currently applicable to motor carriers, could have a material adverse effect on our results of operations, financial condition, and liquidity. Additionally, any future consolidation of the rail industry could materially affect the competitive environment in which we operate.

We Rely on Technology and Technology Improvements in Our Business Operations – We rely on information technology in all aspects of our business, including technology systems operated by us or under control of third parties. If we do not have sufficient capital to acquire new technology or if we are unable to develop or implement new technology such as PTC or the latest version of our transportation control systems, we may suffer a competitive disadvantage within the rail industry and with companies providing other modes of transportation service, which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Are Subject to Cybersecurity Risks – We rely on information technology in all aspects of our business, including technology systems operated by us or under control of third parties. Although we devote significant resources to protect our technology systems and proprietary data, we have experienced and will continue to experience varying degrees of cyber incidents in the normal course of business. While there can be no assurance that the systems we have designed to prevent or limit the effects of cyber incidents or attacks will be sufficient to prevent or detect such incidents or attacks, or to avoid a material adverse impact on our systems after such incidents or attacks do occur, we are continually evaluating attackers’ techniques and tactics and we are diligent in our monitoring, training, planning and prevention. However, breach or circumvention of our systems or the systems of third parties, including by ransomware, other cyber attacks, or human error may result in significant service interruption, safety failure, other operational difficulties, unauthorized access to (or the loss of access to) competitively sensitive, confidential or other critical data or systems; loss of customers; financial losses; regulatory fines; and misuse or corruption of critical data and proprietary information, any of which could have a material adverse impact on our results of operations, financial condition, and liquidity.

We May Be Subject to Various Claims and Lawsuits That Could Result in Significant Expenditures – As a railroad with operations in densely populated urban areas and other cities and a vast rail network, we are exposed to the potential for various claims and litigation related to labor and employment, personal injury, property damage, environmental liability, and other matters. Any material changes to litigation trends or a catastrophic rail accident or series of accidents involving any or all of property damage, personal injury, and environmental liability that exceed our insurance coverage for such risks could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Are Subject to Significant Environmental Laws and Regulations – Due to the nature of the railroad business, our operations are subject to extensive federal, state, and local environmental laws and regulations concerning, among other things, emissions to the air; discharges to waters; handling, storage, transportation, disposal of waste and other materials; and hazardous material or petroleum releases. We generate and transport hazardous and non-hazardous waste in our operations, and we did so in our former operations. Environmental liability can extend to previously owned or operated properties, leased properties, and properties owned by third parties, as well as to properties we currently own. Environmental liabilities have arisen and may also arise from claims asserted by adjacent landowners or other third parties in toxic tort litigation. We have been and may be subject to allegations or findings that we have violated, or are strictly liable under, these laws or regulations. We currently have certain obligations at existing sites for investigation, remediation and monitoring, and we likely will have obligations at other sites in the future.

Liabilities for these obligations affect our estimate based on our experience and, as necessary, the advice and assistance of our consultants. However, actual costs may vary from our estimates due to any or all of several factors, including changes to environmental laws or interpretations of such laws, technological changes affecting investigations and remediation, the participation and financial viability of other parties responsible for any such liability and the corrective action or change to corrective actions required to remediate any existing or future sites. We could incur significant costs as a result of any of the foregoing, and we may be required to incur significant expenses to investigate and remediate known, unknown, or future environmental contamination, which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We May Be Affected by Climate Change and Market or Regulatory Responses to Climate Change – Climate change, including the impact of global warming, could have a material adverse effect on our results of operations, financial condition, and liquidity. Restrictions, caps, taxes, or other controls on emissions of greenhouse gasses, including diesel exhaust, could significantly increase our operating costs. Restrictions on emissions could also affect our customers that (a) use commodities that we carry to produce energy, (b) use significant amounts of energy in producing or delivering the commodities we carry, or (c) manufacture or produce goods that consume significant amounts of energy or burn fossil fuels, including chemical producers, farmers and food producers, and automakers and other manufacturers. Significant cost increases, government regulation, or changes of consumer preferences for goods or services relating to alternative sources of energy or emissions reductions could materially affect the markets for the commodities we carry, which in turn could have a material adverse effect on our results of operations, financial condition, and liquidity. Government incentives encouraging the use of alternative sources of energy could also affect certain of our customers and the markets for certain of the commodities we carry in an unpredictable manner that could alter our traffic patterns, including, for example, increasing royalties charged to producers of PRB coal by the U.S. Department of Interior and the impacts of ethanol incentives on farming and ethanol producers. Finally, we could face increased costs related to defending and resolving legal claims and other litigation related to climate change and the alleged impact of our operations on climate change. Any of these factors, individually or in operation with one or more of the other factors, or other unforeseen impacts of climate change could reduce the amount of traffic we handle and have a material adverse effect on our results of operations, financial condition, and liquidity.

Severe Weather Could Result in Significant Business Interruptions and Expenditures – As a railroad with a vast network, we are exposed to severe weather conditions and other natural phenomena, including earthquakes, hurricanes, fires, floods, mudslides or landslides, extreme temperatures, and significant precipitation. Line outages and other interruptions caused by these conditions can adversely affect our entire rail network and can adversely affect revenue, costs, and liabilities, which could have a material adverse effect on our results of operations, financial condition, and liquidity despite efforts we undertake to plan for these events.

Strikes or Work Stoppages Could Adversely Affect Our Operations – The U.S. Class I railroads are party to collective bargaining agreements with various labor unions. The majority of our employees belong to labor unions and are subject to these agreements. Disputes with regard to the terms of these agreements or our potential inability to negotiate acceptable contracts with these unions could result in, among other things, strikes, work stoppages, slowdowns, or lockouts, which could cause a significant disruption of our operations and have a material adverse effect on our results of operations, financial condition, and liquidity. Additionally, future national labor agreements, or renegotiation of labor agreements or provisions of labor agreements, could compromise our service reliability or significantly increase our costs for health care, wages, and other benefits, which could have a material adverse impact on our results of operations, financial condition, and liquidity. Labor disputes, work stoppages, slowdowns or lockouts at loading/unloading facilities, ports or other transport access points could compromise our service reliability and have a material adverse impact on our results of operations, financial condition, and liquidity. Labor disputes, work stoppages, slowdowns or lockouts by employees of our customers or our suppliers could compromise our service reliability and have a material adverse impact on our results of operations, financial condition, and liquidity.

The Availability of Qualified Personnel Could Adversely Affect Our Operations – Changes in demographics, training requirements, and the availability of qualified personnel could negatively affect our ability to meet demand for rail service. Unpredictable increases in demand for rail services and a lack of network fluidity may exacerbate such risks, which could have a negative impact on our operational efficiency and otherwise have a material adverse effect on our results of operations, financial condition, and liquidity.

We Are Affected By Fluctuating Fuel Prices – Fuel costs constitute a significant portion of our transportation expenses. Diesel fuel prices can be subject to dramatic fluctuations, and significant price increases could have a material adverse effect on our operating results. Although we currently are able to recover a significant amount of our fuel expenses from our customers through revenue from fuel surcharges, we cannot be certain that we will always be able to mitigate rising or elevated fuel costs through our fuel surcharges. Additionally, future market conditions or legislative or regulatory activities could adversely affect our ability to apply fuel surcharges or adequately recover increased fuel costs through fuel surcharges. As fuel prices fluctuate, our fuel surcharge programs trail such fluctuations in fuel price by approximately two months, and may be a significant source of quarter-over-quarter and year-over-year volatility, particularly in periods of rapidly changing prices. International, political, and economic factors, events and conditions affect the volatility of fuel prices and supplies. Weather can also affect fuel supplies and limit domestic refining capacity. A severe shortage of, or disruption to, domestic fuel supplies could have a material adverse effect on our results of operations, financial condition, and liquidity. Alternatively, lower fuel prices could have a positive impact on the economy by increasing consumer discretionary spending that potentially could increase demand for various consumer products we transport. However, lower fuel prices could have a negative impact on other commodities we transport, such as coal and domestic drilling-related shipments, which could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Rely on Capital Markets – Due to the significant capital expenditures required to operate and maintain a safe and efficient railroad, we rely on the capital markets to provide some of our capital requirements. We utilize long-term debt instruments, bank financing and commercial paper from time-to-time, and we pledge certain of our receivables. Significant instability or disruptions of the capital markets, including the credit markets, or deterioration of our financial condition due to internal or external factors could restrict or prohibit our access to, and significantly increase the cost of, commercial paper and other financing sources, including bank credit facilities and the issuance of long-term debt, including corporate bonds. A significant deterioration of our financial condition could result in a reduction of our credit rating to below investment grade, which could restrict, or at certain credit levels below investment grade may prohibit us, from utilizing our current receivables securitization facility. This may also limit our access to external sources of capital and significantly increase the costs of short and long-term debt financing.

A Significant Portion of Our Revenue Involves Transportation of Commodities to and from International Markets – Although revenues from our operations are attributable to transportation services provided in the U.S., a significant portion of our revenues involves the transportation of commodities to and from international markets, including Mexico and Southeast Asia, by various carriers and, at times, various modes of transportation. Significant and sustained interruptions of trade with Mexico or countries in Southeast Asia, including China, could adversely affect customers and other entities that, directly or indirectly, purchase or rely on rail transportation services in the U.S. as part of their operations, and any such interruptions could have a material adverse effect on our results of operations, financial condition and liquidity. Any one or more of the following could cause a significant and sustained interruption of trade with Mexico or countries in Southeast Asia: (a) a deterioration of security for international trade and businesses; (b) the adverse impact of new laws, rules and regulations or the interpretation of laws, rules and regulations by government entities, courts or regulatory bodies, including replacing the North American Free Trade Agreement (NAFTA) with the ratification of the United States-Mexico-Canada Agreement (USMCA) and a “Phase One” trade agreement with China; (c) actions of taxing authorities that affect our customers doing business in foreign countries; (d) any significant adverse economic developments, such as extended periods of high inflation, material disruptions in the banking sector or in the capital markets of these foreign countries, and significant changes in the valuation of the currencies of these foreign countries that could materially affect the cost or value of imports or exports; (e) shifts in patterns of international trade that adversely affect import and export markets; (f) a material reduction in foreign direct investment in these countries; and (g) public health crises, including the outbreak of pandemic or contagious disease, such as the novel coronavirus.

We Are Subject to Legislative, Regulatory, and Legal Developments Involving Taxes – Taxes are a significant part of our expenses. We are subject to U.S. federal, state, and foreign income, payroll, property, sales and use, fuel, and other types of taxes. Changes in tax rates, such as those included in the Tax Cuts and Jobs Act, enactment of new tax laws, revisions of tax regulations, and claims or litigation with taxing authorities could result in a material effect to our results of operations, financial condition, and liquidity. Higher tax rates could have a material adverse effect on our results of operations, financial condition, and liquidity.

We Are Dependent on Certain Key Suppliers of Locomotives and Rail – Due to the capital intensive nature and sophistication of locomotive equipment, parts and maintenance, potential new suppliers face high barriers to entry. Therefore, if one of the domestic suppliers of high horsepower locomotives discontinues manufacturing locomotives, supplying parts or providing maintenance for any reason, including bankruptcy or insolvency, we could experience significant cost increases and reduced availability of the locomotives that are necessary for our operations. Additionally, for a high percentage of our rail purchases, we utilize two steel producers (one domestic and one international) that meet our specifications. Rail is critical to our operations for rail replacement programs, maintenance, and for adding additional network capacity, new rail and storage yards, and expansions of existing facilities. This industry similarly has high barriers to entry, and if one of these suppliers discontinues operations for any reason, including bankruptcy or insolvency, we could experience both significant cost increases for rail purchases and difficulty obtaining sufficient rail for maintenance and other projects. Changes to trade agreements or policies that result in increased tariffs on goods imported into the United States could also result in significant cost increases for rail purchases and difficulty obtaining sufficient rail.

We May Be Affected by Acts of Terrorism, War, or Risk of War – Our rail lines, facilities, and equipment, including rail cars carrying hazardous materials, could be direct targets or indirect casualties of terrorist attacks. Terrorist attacks, or other similar events, any government response thereto, and war or risk of war may adversely affect our results of operations, financial condition, and liquidity. In addition, insurance premiums for some or all of our current coverages could increase dramatically, or certain coverages may not be available to us in the future.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We employ a variety of assets in the management and operation of our rail business. Our rail network covers 23 states in the western two-thirds of the U.S.

TRACK

Our rail network includes 32,340 route miles. We own 26,094 miles and operate on the remainder pursuant to trackage rights or leases. The following table describes track miles at December 31, 2019, and 2018:

|

|

|

|

|

|

| 2019 | 2018 |

Route | 32,340 | 32,236 |

Other main line | 7,095 | 7,074 |

Passing lines and turnouts | 3,301 | 3,274 |

Switching and classification yard lines | 9,007 | 8,970 |

Total miles | 51,743 | 51,554 |

HEADQUARTERS BUILDING

We own our headquarters building in Omaha, Nebraska. The facility has 1.2 million square feet of space that can accommodate approximately 4,000 employees.

HARRIMAN DISPATCHING CENTER

The Harriman Dispatching Center (HDC), located in Omaha, Nebraska, is our primary dispatching facility. It is linked to regional dispatching and locomotive management facilities at various locations along our network. HDC employees coordinate moves of locomotives and trains, manage traffic and train crews on our network, and coordinate interchanges with other railroads. Approximately 900 employees currently work on-site in the facility. In the event of a disruption of operations at HDC due to a cyber attack, flooding or severe weather or other event, we maintain the capability to conduct critical operations at back-up facilities in different locations.

RAIL FACILITIES

In addition to our track structure, we operate numerous facilities, including terminals for intermodal and other freight; rail yards for building trains (classification yards), switching, storage-in-transit (the temporary storage of customer goods in rail cars prior to shipment) and other activities; offices to administer and manage our operations; dispatching centers to direct traffic on our rail network; crew on duty locations for train crews along our network; and shops and other facilities for fueling, maintenance, and repair of locomotives and repair and maintenance of rail cars and other equipment. The following table includes the major yards and terminals on our system:

|

|

|

|

Major Classification Yards | Major Intermodal Terminals |

North Platte, Nebraska | Joliet (Global 4), Illinois |

North Little Rock, Arkansas | ICTF (Los Angeles), California |

Englewood (Houston), Texas | East Los Angeles, California |

Fort Worth, Texas | DIT (Dallas), Texas |

Livonia, Louisiana | Marion (Memphis), Tennessee |

West Colton, California | Global II (Chicago), Illinois |

Proviso (Chicago), Illinois | City of Industry, California |

Roseville, California | Global I (Chicago), Illinois |

RAIL EQUIPMENT

Our equipment includes owned and leased locomotives and rail cars; heavy maintenance equipment and machinery; other equipment and tools in our shops, offices, and facilities; and vehicles for maintenance, transportation of crews, and other activities. As of December 31, 2019, we owned or leased the following units of equipment:

|

|

|

|

|

|

|

|

|

|

|

|

| Average | |

Locomotives | Owned | Leased | Total | Age (yrs.) |

Multiple purpose | 6,206 | 1,214 | 7,420 | 21.2 |

Switching | 182 | - | 182 | 39.1 |

Other | 28 | 61 | 89 | 40.2 |

Total locomotives | 6,416 | 1,275 | 7,691 | N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average |

Freight cars | Owned | Leased | Total | Age (yrs.) |

Covered hoppers | 13,357 | 9,727 | 23,084 | 20.1 |

Open hoppers | 5,781 | 2,330 | 8,111 | 31.4 |

Gondolas | 5,662 | 2,152 | 7,814 | 28.2 |

Boxcars | 2,430 | 6,639 | 9,069 | 38.1 |

Refrigerated cars | 2,625 | 2,546 | 5,171 | 25.4 |

Flat cars | 2,186 | 1,093 | 3,279 | 34.0 |

Other | 3 | 345 | 348 | 31.4 |

Total freight cars | 32,044 | 24,832 | 56,876 | N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average |

Highway revenue equipment | Owned | Leased | Total | Age (yrs.) |

Containers | 47,270 | 6,602 | 53,872 | 8.9 |

Chassis | 30,446 | 17,408 | 47,854 | 11.2 |

Total highway revenue equipment | 77,716 | 24,010 | 101,726 | N/A |

We continuously assess our need for equipment to run an efficient and reliable network. Many factors cause us to adjust the size of our active fleets, including changes in carload volume, weather events, seasonality, customer preferences and productivity initiatives. As some of these factors are difficult to assess or can change rapidly, we maintain a surge fleet to remain agile. Without the surge fleet, our ability to react quickly is hindered as equipment suppliers are limited and lead times to acquire equipment are long and may be in excess of a year. We believe that we have sufficient capacity to adapt to changes in freight volumes and adjust the utilization of our assets accordingly. Moreover, we believe our locomotive and freight car fleets are appropriately sized and suitable to meet our current and future business requirements. Locomotive and freight car in service utilization percentages for the year ended December 31, 2019 were 71% and 72%, respectively.

CAPITAL EXPENDITURES

Our rail network requires significant annual capital investments for replacement, improvement, and expansion. These investments enhance safety, support the transportation needs of our customers, and improve our operational efficiency. Additionally, we add new locomotives and freight cars to our fleet to replace older, less efficient equipment, to support growth and customer demand, and to reduce our impact on the environment through the acquisition of more fuel-efficient and low-emission locomotives.

2019 Capital Program – During 2019, our capital program totaled approximately $3.2 billion. (See the cash capital investments table in Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources, Item 7.)

2020 Capital Plan – In 2020, we expect our capital plan to be approximately $3.1 billion, down slightly compared to 2019. The plan includes expenditures for capacity and facility investments intended to improve productivity and operational efficiency. The capital plan may be revised if business conditions warrant or if new laws or regulations affect our ability to generate sufficient returns on these investments. (See further discussion of our 2020 capital plan in Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources, Item 7.)

OTHER

Equipment Encumbrances – Equipment with a carrying value of approximately $1.6 billion and $1.8 billion at December 31, 2019, and 2018, respectively served as collateral for finance leases and other types of equipment obligations in accordance with the secured financing arrangements utilized to acquire or refinance such railroad equipment.

Environmental Matters – Certain of our properties are subject to federal, state, and local laws and regulations governing the protection of the environment. (See discussion of environmental issues in Business – Governmental and Environmental Regulation, Item 1, Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies – Environmental, Item 7, and Note 18 of the Consolidated Financial Statements.)

Item 3. Legal Proceedings

From time to time, we are involved in legal proceedings, claims, and litigation that occur in connection with our business. We routinely assess our liabilities and contingencies in connection with these matters based upon the latest available information and, when necessary, we seek input from our third-party advisors when making these assessments. Consistent with SEC rules and requirements, we describe below material pending legal proceedings (other than ordinary routine litigation incidental to our business), material proceedings known to be contemplated by governmental authorities, other proceedings arising under federal, state, or local environmental laws and regulations (including governmental proceedings involving potential fines, penalties, or other monetary sanctions in excess of $100,000), and such other pending matters that we may determine to be appropriate.

ENVIRONMENTAL MATTERS

In October 2016, the Colorado Department of Public Health & Environment (the agency) expressed concerns over construction activities performed by UPRR inside the Moffat Tunnel. Those activities, which were deemed safety critical, had caused contaminants from inside the tunnel to be discharged into the adjacent Frasier River in violation of the tunnel's National Pollutant Discharge Elimination System (NPDES) permit. Following extensive discussions with the agency, and UPRR's commitment to install and operate best management practices (BMPs), the agency agreed to allow UPRR to resume safety-related construction activities. In February 2018, the agency issued a notice of violation (NOV) which alleged violations of State water laws and the NPDES permit. The NOV mandated a number of corrective actions to be implemented immediately and reserved for a later date the issue of penalties. In June 2019, the agency contacted UPRR to engage in discussions regarding an appropriate monetary penalty. In September 2019, the parties reached a preliminary agreement on the amount of the penalty of $140,000. The agreement was finalized and the penalty payment was made on January 21, 2020 in the amount of $140,000.

We receive notices from the EPA and state environmental agencies alleging that we are or may be liable under federal or state environmental laws for remediation costs at various sites throughout the U.S., including sites on the Superfund National Priorities List or state superfund lists. We cannot predict the ultimate impact of these proceedings and suits because of the number of potentially responsible parties involved, the degree of contamination by various wastes, the scarcity and quality of volumetric data related to many of the sites, and the speculative nature of remediation costs.

Information concerning environmental claims and contingencies and estimated remediation costs is set forth in Management’s Discussion and Analysis of Financial Condition and Results of Operations – Critical Accounting Policies – Environmental, Item 7. See also Note 18 of the Consolidated Financial Statements.

OTHER MATTERS

Antitrust Litigation – As we reported in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2007, 20 rail shippers (many of whom are represented by the same law firms) filed virtually identical antitrust lawsuits in various federal district courts against us and four other Class I railroads in the U.S. Currently, UPRR and three other Class I railroads are the named defendants in the lawsuit. The original plaintiff filed the first of these claims in the U.S. District Court in New Jersey on May 14, 2007. These suits alleged that the named railroads engaged in price-fixing by establishing common fuel surcharges for certain rail traffic.

As previously reported in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2019, an appellate hearing related to the U.S. District Court for the District of Columbia’s denial of class certification for the rail shippers was held on September 28, 2018. On August 16, 2019, the U.S. Court of Appeals for the District of Columbia Circuit affirmed the decision of U.S. District Court denying class certification (the Certification Denial). Since the Certification Denial, approximately 50 lawsuits have been filed in federal court based on claims identical to those alleged in the class certification case. The Judicial Panel on Multidistrict Litigation is currently evaluating the appropriate forum and process for the administration of these cases. Union Pacific believes these claims are without merit.

As we reported in our Current Report on Form 8-K, filed on June 10, 2011, the Railroad received a complaint filed in the U.S. District Court for the District of Columbia on June 7, 2011, by Oxbow Carbon & Minerals LLC and related entities (Oxbow). The fuel surcharge antitrust claim remains and was stayed pending the decision on class certification discussed above. As a result of the Certification Denial, and the individual cases, a status conference with the Court is expected to determine how the case will proceed.

We continue to deny the allegations that our fuel surcharge programs violate the antitrust laws or any other laws. We believe that these lawsuits are without merit, and we will vigorously defend our actions. Therefore, we currently believe that these matters will not have a material adverse effect on any of our results of operations, financial condition, and liquidity.

In 2016, a lawsuit was filed in U.S. District Court for the Western District of Washington alleging violations of the Americans with Disabilities Act (ADA) and Genetic Information Nondiscrimination Act relating to Fitness for Duty requirements for safety sensitive positions.

On August 8, 2016, the U.S. District Court for the Western District of Washington granted plaintiffs' motion to transfer their claim to the U.S. District Court of Nebraska. On February 5, 2019, the U.S. District Court of Nebraska granted plaintiffs’ motion to certify the ADA allegations as a class action. We were granted the right to appeal this class certification to the U.S. Court of Appeals for the Eighth Circuit on March 13, 2019. The matter was argued before the U.S. Court of Appeals for the Eighth Circuit in November 2019. The District Court proceedings have been stayed pending the decision by the Eighth Circuit. We continue to deny these allegations, believe this lawsuit is without merit and will defend our actions. We believe this lawsuit will not have a material adverse effect on any of our results of operations, financial condition, and liquidity.

Item 4. Mine Safety Disclosures

Not applicable.

Information About Our Executive Officers and Principal Executive Officers of Our Subsidiaries

The Board of Directors typically elects and designates our executive officers on an annual basis at the board meeting held in conjunction with the Annual Meeting of Shareholders, and they hold office until their successors are elected. Executive officers also may be elected and designated throughout the year, as the Board of Directors considers appropriate. There are no family relationships among the officers, nor is there any arrangement or understanding between any officer and any other person pursuant to which the officer was selected. The following table sets forth certain information current as of February 7, 2020, relating to the executive officers.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Business |

|

|

|