|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Delaware

|

|

58-2480149

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

55 Glenlake Parkway, N.E. Atlanta, Georgia

|

|

30328

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Class B common stock, par value $.01 per share

|

|

New York Stock Exchange

|

|

Floating-Rate Senior Notes due 2020

|

New York Stock Exchange

|

|

|

1.625% Senior Notes due 2025

|

New York Stock Exchange

|

|

|

1% Senior Notes due 2028

|

New York Stock Exchange

|

|

|

0.375% Senior Notes due 2023

|

New York Stock Exchange

|

|

|

1.500% Senior Notes due 2032

|

New York Stock Exchange

|

|

|

Large accelerated filer

x

|

|

Accelerated filer

¨

|

|

Non-accelerated filer

¨

|

|

Smaller reporting company

¨

|

Emerging growth company

¨

|

|

|

PART I

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

PART II

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

PART III

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

PART IV

|

||

|

Item 15.

|

||

|

Item 16.

|

||

|

Item 1.

|

Business

|

|

•

|

Services and solutions for small and medium-sized businesses.

|

|

•

|

International growth markets.

|

|

•

|

Global Business to Consumer (“B2C”) and Business to Business (“B2B”) e-commerce.

|

|

•

|

Healthcare and life-sciences logistics.

|

|

•

|

Operational advancements and efficiencies through our technology-enabled network.

|

|

•

|

Customers can select from same day, next day, two day and three day delivery alternatives. UPS’s Air portfolio offers options enabling customers to specify a time-of-day guarantee for their delivery (e.g., by 8:00 A.M., 10:30 A.M., noon, end of day, etc.).

|

|

•

|

Customers can also leverage our extensive ground network to ship using our day-definite guaranteed ground service that serves every U.S. business and residential address. We deliver more ground packages in the U.S. than any other carrier, with average daily package volume of 14.5 million, most within one to three business days.

|

|

•

|

We also offer UPS SurePost, an economy residential ground service for customers with non-urgent, lightweight residential shipments. UPS SurePost is a contractual residential ground service that combines the consistency and reliability of the UPS Ground network with final delivery often provided by the U.S. Postal Service. We utilize our operational technology to identify multiple package delivery opportunities and redirect UPS SurePost packages for final delivery, improving time in transit, customer service and operational efficiency.

|

|

•

|

In 2018, we continued expansion of our Express time-definite portfolios:

|

|

▪

|

We expanded UPS WorldWide Express to 14 new countries around the globe.

|

|

▪

|

UPS Express now reaches 137 countries with guaranteed mid-day delivery and 57 countries with guaranteed morning delivery with Express Plus.

|

|

▪

|

Express Saver reaches 220 countries and territories with guaranteed end-of-day delivery.

|

|

▪

|

We grew our Worldwide Express Freight Midday footprint by five times in 12 European countries by expanding this service to 39,000 new postal codes.

|

|

▪

|

Worldwide Express Freight is available from 71 origin countries to 67 destination countries.

|

|

▪

|

For international package shipments that do not require Express services, UPS Worldwide Expedited offers a reliable, deferred, guaranteed day-definite service option. The service is available from more than 80 origin countries to more than 220 countries and territories.

|

|

▪

|

For cross-border ground package delivery, we offer UPS Standard delivery services within Europe, between the U.S. and Canada and between the U.S. and Mexico.

|

|

Item 1A.

|

Risk Factors

|

|

Item 1B.

|

Unresolved Staff Comments

|

|

Item 2.

|

Properties

|

|

Description

|

Owned and

Capital

Leases

|

Short-term

Leased or

Chartered

From

Others

|

On

Order

|

Under

Option

|

|||||||

|

Boeing 757-200

|

75

|

|

—

|

|

—

|

|

—

|

|

|||

|

Boeing 767-200

|

—

|

|

2

|

|

|||||||

|

Boeing 767-300

|

59

|

|

—

|

|

9

|

|

—

|

|

|||

|

Boeing 767-300BCF

|

3

|

|

—

|

|

—

|

|

—

|

|

|||

|

Airbus A300-600

|

52

|

|

—

|

|

—

|

|

—

|

|

|||

|

Boeing MD-11

|

37

|

|

5

|

|

—

|

|

—

|

|

|||

|

Boeing 747-400F

|

11

|

|

—

|

|

—

|

|

—

|

|

|||

|

Boeing 747-400BCF

|

2

|

|

—

|

|

—

|

|

—

|

|

|||

|

Boeing 747-8F

|

9

|

|

—

|

|

19

|

|

—

|

|

|||

|

Other

|

—

|

|

309

|

|

—

|

|

—

|

|

|||

|

Total

|

248

|

|

316

|

|

28

|

|

—

|

|

|||

|

Item 3.

|

Legal Proceedings

|

|

Item 4.

|

Mine Safety Disclosures

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

|

Total Number

of Shares

Purchased

(1)

|

Total Number

of Shares Purchased

as Part of Publicly

Announced Program

|

Average

Price Paid

Per Share

|

Approximate Dollar

Value of Shares that

May Yet be Purchased

Under the Program

(as of month-end)

|

||||||||||

|

October 1—October 31

|

0.8

|

|

0.8

|

|

$

|

116.96

|

|

$

|

3,495

|

|

|||

|

November 1—November 30

|

0.7

|

|

0.7

|

|

110.33

|

|

3,416

|

|

|||||

|

December 1—December 31

|

0.8

|

|

0.8

|

|

101.13

|

|

3,339

|

|

|||||

|

Total October 1—December 31

|

2.3

|

|

2.3

|

|

$

|

109.41

|

|

||||||

|

(1)

|

Includes shares repurchased through our publicly announced share repurchase program and shares tendered to pay the exercise price and tax withholding on employee stock options.

|

|

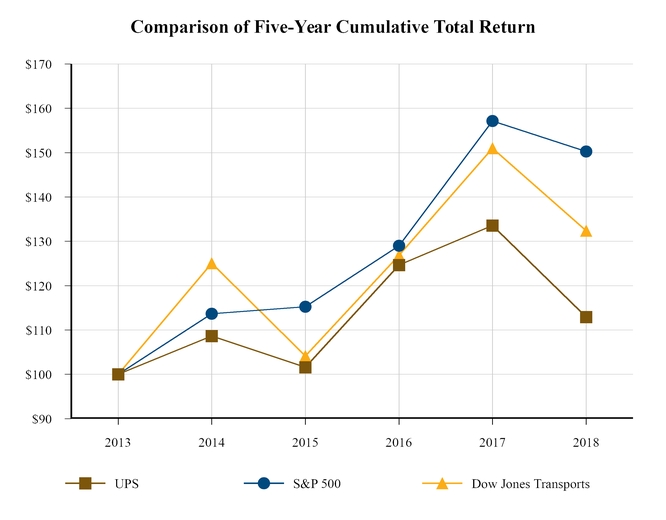

12/31/2013

|

|

12/31/2014

|

|

12/31/2015

|

|

12/31/2016

|

|

12/31/2017

|

|

12/31/2018

|

|

||||||||||||

|

United Parcel Service, Inc.

|

$

|

100.00

|

|

$

|

108.67

|

|

$

|

101.61

|

|

$

|

124.68

|

|

$

|

133.59

|

|

$

|

112.91

|

|

|||||

|

Standard & Poor’s 500 Index

|

$

|

100.00

|

|

$

|

113.68

|

|

$

|

115.24

|

|

$

|

129.02

|

|

$

|

157.17

|

|

$

|

150.27

|

|

|||||

|

Dow Jones Transportation Average

|

$

|

100.00

|

|

$

|

125.07

|

|

$

|

104.11

|

|

$

|

126.87

|

|

$

|

151.00

|

|

$

|

132.38

|

|

|||||

|

Item 6.

|

Selected Financial Data

|

|

|

Years Ended December 31,

|

||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||

|

Selected Income Statement Data

|

|||||||||||||||||||

|

Revenue:

|

|||||||||||||||||||

|

U.S. Domestic Package

|

$

|

43,593

|

|

$

|

40,761

|

|

$

|

38,284

|

|

$

|

36,744

|

|

$

|

35,851

|

|

||||

|

International Package

|

14,442

|

|

13,342

|

|

12,346

|

|

12,142

|

|

13,032

|

|

|||||||||

|

Supply Chain & Freight

|

13,826

|

|

12,482

|

|

10,980

|

|

10,300

|

|

10,295

|

|

|||||||||

|

Total Revenue

|

71,861

|

|

66,585

|

|

61,610

|

|

59,186

|

|

59,178

|

|

|||||||||

|

Operating Expenses:

|

|||||||||||||||||||

|

Compensation and benefits

|

37,235

|

|

34,577

|

|

32,534

|

|

31,448

|

|

30,247

|

|

|||||||||

|

Other

|

27,602

|

|

24,479

|

|

21,388

|

|

20,495

|

|

22,161

|

|

|||||||||

|

Total Operating Expenses

|

64,837

|

|

59,056

|

|

53,922

|

|

51,943

|

|

52,408

|

|

|||||||||

|

Operating Profit:

|

|||||||||||||||||||

|

U.S. Domestic Package

|

3,643

|

|

4,303

|

|

4,628

|

|

4,427

|

|

4,244

|

|

|||||||||

|

International Package

|

2,529

|

|

2,429

|

|

2,417

|

|

2,123

|

|

1,884

|

|

|||||||||

|

Supply Chain and Freight

|

852

|

|

797

|

|

643

|

|

693

|

|

642

|

|

|||||||||

|

Total Operating Profit

|

7,024

|

|

7,529

|

|

7,688

|

|

7,243

|

|

6,770

|

|

|||||||||

|

Other Income and (Expense):

|

|||||||||||||||||||

|

Investment income (expense) and other

|

(400

|

)

|

61

|

|

(2,186

|

)

|

435

|

|

(1,776

|

)

|

|||||||||

|

Interest expense

|

(605

|

)

|

(453

|

)

|

(381

|

)

|

(341

|

)

|

(353

|

)

|

|||||||||

|

Income Before Income Taxes

|

6,019

|

|

7,137

|

|

5,121

|

|

7,337

|

|

4,641

|

|

|||||||||

|

Income Tax Expense

|

1,228

|

|

2,232

|

|

1,699

|

|

2,497

|

|

1,607

|

|

|||||||||

|

Net Income

|

$

|

4,791

|

|

$

|

4,905

|

|

$

|

3,422

|

|

$

|

4,840

|

|

$

|

3,034

|

|

||||

|

Per Share Amounts:

|

|||||||||||||||||||

|

Basic Earnings Per Share

|

$

|

5.53

|

|

$

|

5.63

|

|

$

|

3.88

|

|

$

|

5.37

|

|

$

|

3.31

|

|

||||

|

Diluted Earnings Per Share

|

$

|

5.51

|

|

$

|

5.61

|

|

$

|

3.86

|

|

$

|

5.34

|

|

$

|

3.28

|

|

||||

|

Dividends Declared Per Share

|

$

|

3.64

|

|

$

|

3.32

|

|

$

|

3.12

|

|

$

|

2.92

|

|

$

|

2.68

|

|

||||

|

Weighted Average Shares Outstanding:

|

|||||||||||||||||||

|

Basic

|

866

|

|

871

|

|

883

|

|

901

|

|

916

|

|

|||||||||

|

Diluted

|

870

|

|

875

|

|

887

|

|

906

|

|

924

|

|

|||||||||

|

|

As of December 31,

|

||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||

|

Selected Balance Sheet Data:

|

|||||||||||||||||||

|

Cash and marketable securities

|

$

|

5,035

|

|

$

|

4,069

|

|

$

|

4,567

|

|

$

|

4,726

|

|

$

|

3,283

|

|

||||

|

Total assets

|

50,016

|

|

45,574

|

|

40,545

|

|

38,497

|

|

35,634

|

|

|||||||||

|

Long-term debt

|

19,931

|

|

20,278

|

|

12,394

|

|

11,316

|

|

9,856

|

|

|||||||||

|

Shareowners’ equity

|

3,037

|

|

1,024

|

|

430

|

|

2,501

|

|

2,173

|

|

|||||||||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018/ 2017

|

2017/ 2016

|

||||||||||||

|

Revenue (in millions)

|

$

|

71,861

|

|

$

|

66,585

|

|

$

|

61,610

|

|

7.9

|

%

|

8.1

|

%

|

||||

|

Operating Expenses (in millions)

|

64,837

|

|

59,056

|

|

53,922

|

|

9.8

|

%

|

9.5

|

%

|

|||||||

|

Operating Profit (in millions)

|

$

|

7,024

|

|

$

|

7,529

|

|

$

|

7,688

|

|

(6.7

|

)%

|

(2.1

|

)%

|

||||

|

Operating Margin

|

9.8

|

%

|

11.3

|

%

|

12.5

|

%

|

|||||||||||

|

Average Daily Package Volume (in thousands)

|

20,677

|

|

20,030

|

|

19,083

|

|

3.2

|

%

|

5.0

|

%

|

|||||||

|

Average Revenue Per Piece

|

$

|

10.98

|

|

$

|

10.53

|

|

$

|

10.29

|

|

4.3

|

%

|

2.3

|

%

|

||||

|

Net Income (in millions)

|

$

|

4,791

|

|

$

|

4,905

|

|

$

|

3,422

|

|

(2.3

|

)%

|

43.3

|

%

|

||||

|

Basic Earnings Per Share

|

$

|

5.53

|

|

$

|

5.63

|

|

$

|

3.88

|

|

(1.8

|

)%

|

45.1

|

%

|

||||

|

Diluted Earnings Per Share

|

$

|

5.51

|

|

$

|

5.61

|

|

$

|

3.86

|

|

(1.8

|

)%

|

45.3

|

%

|

||||

|

|

Year Ended December 31,

|

||||||||||

|

Non-GAAP Adjustments

|

2018

|

2017

|

2016

|

||||||||

|

Operating Expenses:

|

|||||||||||

|

Transformation Strategy Costs

|

$

|

360

|

|

$

|

—

|

|

$

|

—

|

|

||

|

Total Adjustments to Operating Expenses

|

360

|

|

—

|

|

—

|

|

|||||

|

Other Income and (Expense):

|

—

|

|

—

|

|

|||||||

|

Defined Benefit Plans Mark-to-Market Charges

|

$

|

1,627

|

|

$

|

800

|

|

$

|

2,651

|

|

||

|

Total Adjustments to Other Income and (Expense)

|

1,627

|

|

800

|

|

2,651

|

|

|||||

|

Total Adjustments to Income Before Income Taxes

|

1,987

|

|

800

|

|

2,651

|

|

|||||

|

Income Tax Benefit from the Mark-to-Market Charges

|

(390

|

)

|

(193

|

)

|

(978

|

)

|

|||||

|

Income Tax Benefit from Transformation Strategy Costs

|

(87

|

)

|

—

|

|

—

|

|

|||||

|

Income Tax Benefit from the Tax Cuts and Jobs Act and Other Non-U.S. Tax Law Changes

|

—

|

|

(258

|

)

|

—

|

|

|||||

|

Total Adjustments to Income Tax Expense

|

$

|

(477

|

)

|

$

|

(451

|

)

|

$

|

(978

|

)

|

||

|

Total Adjustments to Net Income

|

$

|

1,510

|

|

$

|

349

|

|

|

$

|

1,673

|

|

|

|

Year Ended December 31,

|

||||||||||||

|

Components of mark-to-market gain (loss) (in millions):

|

2018

|

2017

|

2016

|

|||||||||

|

Discount rates

|

$

|

845

|

|

$

|

(2,288

|

)

|

$

|

(1,953

|

)

|

|||

|

Return on assets

|

(1,057

|

)

|

1,525

|

|

(732

|

)

|

||||||

|

Demographic and assumption changes

|

(22

|

)

|

(37

|

)

|

34

|

|

||||||

|

Coordinating benefits attributable to the Central States Pension Fund

|

(1,393

|

)

|

—

|

|

—

|

|

||||||

|

Total mark-to-market gain (loss)

|

$

|

(1,627

|

)

|

$

|

(800

|

)

|

$

|

(2,651

|

)

|

|||

|

Year Ended December 31,

|

||||||||||||

|

Weighted-average actuarial assumptions used to determine net periodic benefit cost:

|

2018

|

2017

|

2016

|

|||||||||

|

Expected rate of return on plan assets

|

7.68

|

%

|

8.65

|

%

|

8.65

|

%

|

||||||

|

Actual rate of return on plan assets

|

(2.38

|

)%

|

14.25

|

%

|

6.06

|

%

|

||||||

|

Discount rate used for net periodic benefit cost

|

3.81

|

%

|

4.34

|

%

|

4.81

|

%

|

||||||

|

Discount rate at measurement date

|

4.45

|

%

|

3.81

|

%

|

4.34

|

%

|

||||||

|

•

|

Return on Assets

($1.057 billion pre-tax loss): In 2018, the actual (2.38)% rate of return on plan assets was lower than our expected rate of return of 7.68%, primarily due to weak global equity markets.

|

|

•

|

Coordinating benefits attributable to the Central States Pension Fund

($1.393 billion pre-tax loss): This represents our current best estimate of potential coordinating benefits that may be required to be paid related to the Central States Pension Fund.

|

|

•

|

Discount Rates

($845 million pre-tax gain):

The weighted-average discount rate for our pension and postretirement medical plans increased from 3.81% at December 31, 2017 to 4.45% at December 31, 2018, primarily due to both an increase in U.S. treasury yields and an increase in credit spreads on AA-rated corporate bonds in 2018.

|

|

•

|

Demographic and Assumption Changes

($22 million pre-tax loss): This represents the difference between actual and estimated participant data and demographic factors, including items such as healthcare cost trends, compensation rate increases and rates of termination, retirement and mortality.

|

|

•

|

Discount Rates

($2.288 billion pre-tax loss):

The weighted-average discount rate for our pension and postretirement medical plans decreased from 4.34% at December 31, 2016 to 3.81% at December 31, 2017, primarily due to both a decline in U.S. treasury yields and a decrease in credit spreads on AA-rated corporate bonds in 2017.

|

|

•

|

Return on Assets

($1.525 billion pre-tax gain): In 2017, the actual 14.25% rate of return on plan assets exceeded our expected rate of return of 8.65%, primarily due to strong global equity and U.S. bond markets.

|

|

•

|

Demographic and Assumption Changes

($37 million pre-tax loss): This represents the difference between actual and estimated participant data and demographic factors, including items such as healthcare cost trends, compensation rate increases and rates of termination, retirement and mortality.

|

|

•

|

Discount Rates

($1.953 billion pre-tax loss):

The weighted-average discount rate for our pension and postretirement medical plans decreased from 4.81% at December 31, 2015 to 4.34% at December 31

2016

, primarily due to a decrease in credit spreads on AA-rated corporate bonds in

2016

.

|

|

•

|

Return on Assets

($732 million pre-tax loss): In 2016, the actual 6.06% rate of return on plan assets fell short of our expected rate of return of 8.65%, primarily due to weak bond markets.

|

|

•

|

Demographic and Assumption Changes

($34 million pre-tax gain): This represents the difference between actual and estimated participant data and demographic factors, including items such as healthcare cost trends, compensation rate increases and rates of termination, retirement and mortality.

|

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018/ 2017

|

2017/ 2016

|

||||||||||||

|

Average Daily Package Volume (in thousands):

|

|||||||||||||||||

|

Next Day Air

|

1,542

|

|

1,460

|

|

1,379

|

|

5.6

|

%

|

5.9

|

%

|

|||||||

|

Deferred

|

1,432

|

|

1,400

|

|

1,350

|

|

2.3

|

%

|

3.7

|

%

|

|||||||

|

Ground

|

14,498

|

|

14,060

|

|

13,508

|

|

3.1

|

%

|

4.1

|

%

|

|||||||

|

Total Avg. Daily Package Volume

|

17,472

|

|

16,920

|

|

16,237

|

|

3.3

|

%

|

4.2

|

%

|

|||||||

|

Average Revenue Per Piece:

|

|||||||||||||||||

|

Next Day Air

|

$

|

19.53

|

|

$

|

19.11

|

|

$

|

19.20

|

|

2.2

|

%

|

(0.5

|

)%

|

||||

|

Deferred

|

13.12

|

|

12.44

|

|

11.85

|

|

5.5

|

%

|

5.0

|

%

|

|||||||

|

Ground

|

8.51

|

|

8.19

|

|

7.97

|

|

3.9

|

%

|

2.8

|

%

|

|||||||

|

Total Avg. Revenue Per Piece

|

$

|

9.86

|

|

$

|

9.48

|

|

$

|

9.25

|

|

4.0

|

%

|

2.5

|

%

|

||||

|

Operating Days in Period

|

253

|

|

254

|

|

255

|

|

|||||||||||

|

Revenue (in millions):

|

|||||||||||||||||

|

Next Day Air

|

$

|

7,618

|

|

$

|

7,088

|

|

$

|

6,752

|

|

7.5

|

%

|

5.0

|

%

|

||||

|

Deferred

|

4,752

|

|

4,422

|

|

4,080

|

|

7.5

|

%

|

8.4

|

%

|

|||||||

|

Ground

|

31,223

|

|

29,251

|

|

27,452

|

|

6.7

|

%

|

6.6

|

%

|

|||||||

|

Total Revenue

|

$

|

43,593

|

|

$

|

40,761

|

|

$

|

38,284

|

|

6.9

|

%

|

6.5

|

%

|

||||

|

Operating Expenses (in millions):

|

|||||||||||||||||

|

Operating Expenses

|

$

|

39,950

|

|

$

|

36,458

|

|

$

|

33,656

|

|

9.6

|

%

|

8.3

|

%

|

||||

|

Transformation Strategy Costs

|

(235

|

)

|

—

|

|

—

|

|

|||||||||||

|

Adjusted Operating Expenses

|

$

|

39,715

|

|

$

|

36,458

|

|

$

|

33,656

|

|

8.9

|

%

|

8.3

|

%

|

||||

|

Operating Profit (in millions) and Operating Margin:

|

|||||||||||||||||

|

Operating Profit

|

$

|

3,643

|

|

$

|

4,303

|

|

$

|

4,628

|

|

(15.3

|

)%

|

(7.0

|

)%

|

||||

|

Adjusted Operating Profit

|

$

|

3,878

|

|

$

|

4,303

|

|

$

|

4,628

|

|

(9.9

|

)%

|

(7.0

|

)%

|

||||

|

Operating Margin

|

8.4

|

%

|

10.6

|

%

|

12.1

|

%

|

|||||||||||

|

Adjusted Operating Margin

|

8.9

|

%

|

10.6

|

%

|

12.1

|

%

|

|||||||||||

|

Volume

|

Rates /

Product Mix

|

Fuel

Surcharge

|

Total

Revenue

Change

|

||||||||

|

Revenue Change Drivers:

|

|||||||||||

|

2018/ 2017

|

2.9

|

%

|

2.5

|

%

|

1.5

|

%

|

6.9

|

%

|

|||

|

2017/ 2016

|

3.8

|

%

|

1.8

|

%

|

0.9

|

%

|

6.5

|

%

|

|||

|

|

Year Ended December 31,

|

% Point Change

|

||||||||||||

|

|

2018

|

2017

|

2016

|

2018/ 2017

|

2017/ 2016

|

|||||||||

|

Next Day Air / Deferred

|

7.7

|

%

|

5.1

|

%

|

3.6

|

%

|

2.6

|

%

|

1.5

|

%

|

||||

|

Ground

|

7.0

|

%

|

5.6

|

%

|

4.9

|

%

|

1.4

|

%

|

0.7

|

%

|

||||

|

•

|

We incurred higher employee compensation and benefit costs largely resulting from volume growth, which impacted an increase in average daily union labor hours (up 5.2%), scheduled union pay rate and benefit increases and growth in the overall size of the workforce due to facility expansions. Labor hour increases were also related to the continued expansion in Saturday operations. In addition, pension expense increased due to lower year-end discount rates used to measure the pension benefit obligation, driving higher service costs.

|

|

•

|

We incurred higher fuel expense in 2018 primarily due to higher fuel prices and increased volume which resulted in higher fuel usage (increase in aircraft block hours of 6.2% and package delivery miles driven of 4.4%), partially offset by alternative fuel tax credits. The manner in which we purchase fuel also influences the net impact of fuel on our results. The majority of our contracts for fuel purchases utilize index-based pricing formulas plus or minus a fixed locational/supplier differential. While many of the indices are aligned, each index may fluctuate at a different pace, driving variability in the prices paid for fuel. Because of this, our operating results may be affected should the market price of fuel suddenly change by a significant amount or change by amounts that do not result in an adjustment in our fuel surcharges, which can significantly affect our earnings either positively or negatively in the short-term.

|

|

•

|

We incurred higher costs associated with outside contract carriers, primarily due to volume growth (including SurePost), higher fuel surcharges passed to us by carriers and general rate increases.

|

|

•

|

In order to contain costs, we continually adjust our air and ground networks to better match higher volume levels. In addition, we continue to deploy and utilize technology to increase package sorting and delivery productivity.

|

|

•

|

We incurred higher employee compensation, largely resulting from volume growth, an increase in average daily union labor hours (up 6.5%), growth in the overall size of the workforce and an increase in wage rates.

|

|

•

|

Employee benefit costs increased, largely due to increased employee healthcare, partially offset by a decrease in pension expense and workers' compensation expense.

|

|

•

|

We incurred higher fuel expense in 2017 primarily due to higher fuel prices and increased volume, which resulted in higher fuel usage (increase in aircraft block hours of 7.0% and package delivery miles driven of 4.1%).

|

|

•

|

We incurred higher costs associated with outside contract carriers, primarily due to volume growth (including SurePost), higher fuel surcharges passed to us by carriers and general rate increases.

|

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||||

|

|

2018

|

2017

|

2016

|

2018/ 2017

|

2017/ 2016

|

||||||||||||||

|

Average Daily Package Volume (in thousands):

|

|||||||||||||||||||

|

Domestic

|

1,723

|

|

1,715

|

|

1,635

|

|

0.5

|

%

|

4.9

|

%

|

|||||||||

|

Export

|

1,482

|

|

1,395

|

|

1,211

|

|

6.2

|

%

|

15.2

|

%

|

|||||||||

|

Total Avg. Daily Package Volume

|

3,205

|

|

3,110

|

|

2,846

|

|

3.1

|

%

|

9.3

|

%

|

|||||||||

|

Average Revenue Per Piece:

|

|||||||||||||||||||

|

Domestic

|

$

|

6.59

|

|

$

|

6.07

|

|

$

|

5.85

|

|

8.6

|

%

|

3.8

|

%

|

||||||

|

Export

|

29.27

|

|

28.70

|

|

30.34

|

|

2.0

|

%

|

(5.4

|

)%

|

|||||||||

|

Total Avg. Revenue Per Piece

|

$

|

17.08

|

|

$

|

16.22

|

|

$

|

16.27

|

|

5.3

|

%

|

(0.3

|

)%

|

||||||

|

Operating Days in Period

|

253

|

|

254

|

|

255

|

|

|||||||||||||

|

Revenue (in millions):

|

|||||||||||||||||||

|

Domestic

|

$

|

2,874

|

|

$

|

2,646

|

|

$

|

2,441

|

|

8.6

|

%

|

8.4

|

%

|

||||||

|

Export

|

10,973

|

|

10,170

|

|

9,369

|

|

7.9

|

%

|

8.5

|

%

|

|||||||||

|

Cargo & Other

|

595

|

|

526

|

|

536

|

|

13.1

|

%

|

(1.9

|

)%

|

|||||||||

|

Total Revenue

|

$

|

14,442

|

|

$

|

13,342

|

|

$

|

12,346

|

|

8.2

|

%

|

8.1

|

%

|

||||||

|

Operating Expenses (in millions):

|

|||||||||||||||||||

|

Operating Expenses

|

$

|

11,913

|

|

$

|

10,913

|

|

$

|

9,929

|

|

9.2

|

%

|

9.9

|

%

|

||||||

|

Transformation Strategy Costs

|

(76

|

)

|

—

|

|

—

|

|

|||||||||||||

|

Adjusted Operating Expenses

|

$

|

11,837

|

|

$

|

10,913

|

|

$

|

9,929

|

|

8.5

|

%

|

9.9

|

%

|

||||||

|

Operating Profit (in millions) and Operating Margin:

|

|||||||||||||||||||

|

Operating Profit

|

$

|

2,529

|

|

$

|

2,429

|

|

$

|

2,417

|

|

4.1

|

%

|

0.5

|

%

|

||||||

|

Adjusted Operating Profit

|

$

|

2,605

|

|

$

|

2,429

|

|

$

|

2,417

|

|

7.2

|

%

|

0.5

|

%

|

||||||

|

Operating Margin

|

17.5

|

%

|

18.2

|

%

|

19.6

|

%

|

|||||||||||||

|

Adjusted Operating Margin

|

18.0

|

%

|

18.2

|

%

|

19.6

|

%

|

|||||||||||||

|

Currency Translation Benefit / (Cost)—(in millions)*:

|

|||||||||||||||||||

|

Revenue

|

$

|

147

|

|

$

|

(325

|

)

|

|||||||||||||

|

Operating Expenses

|

(157

|

)

|

(50

|

)

|

|||||||||||||||

|

Operating Profit

|

$

|

(10

|

)

|

$

|

(375

|

)

|

|||||||||||||

|

*

|

Net of currency hedging; amount represents the change compared to the prior year.

|

|

Volume

|

Rates /

Product Mix

|

Fuel

Surcharge

|

Currency

|

Total

Revenue

Change

|

||||||||||

|

Revenue Change Drivers:

|

||||||||||||||

|

2018/ 2017

|

2.6

|

%

|

1.8

|

%

|

2.7

|

%

|

1.1

|

%

|

8.2

|

%

|

||||

|

2017/ 2016

|

8.8

|

%

|

(0.7

|

)%

|

2.6

|

%

|

(2.6

|

)%

|

8.1

|

%

|

||||

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||||

|

|

2018

|

2017

|

2016

|

2018/ 2017

|

2017/ 2016

|

||||||||||||||

|

Freight LTL Statistics:

|

|||||||||||||||||||

|

Revenue (in millions)

|

$

|

2,706

|

|

$

|

2,598

|

|

$

|

2,385

|

|

4.2

|

%

|

8.9

|

%

|

||||||

|

Revenue Per Hundredweight

|

$

|

25.52

|

|

$

|

24.08

|

|

$

|

23.44

|

|

6.0

|

%

|

2.7

|

%

|

||||||

|

Shipments (in thousands)

|

9,720

|

|

10,210

|

|

9,961

|

|

(4.8

|

)%

|

2.5

|

%

|

|||||||||

|

Shipments Per Day (in thousands)

|

38.4

|

|

40.5

|

|

39.4

|

|

(5.2

|

)%

|

2.8

|

%

|

|||||||||

|

Gross Weight Hauled (in millions of lbs)

|

10,605

|

|

10,788

|

|

10,174

|

|

(1.7

|

)%

|

6.0

|

%

|

|||||||||

|

Weight Per Shipment (in lbs)

|

1,091

|

|

1,057

|

|

1,021

|

|

3.2

|

%

|

3.5

|

%

|

|||||||||

|

Operating Days in Period

|

253

|

|

252

|

|

253

|

|

|||||||||||||

|

Revenue (in millions):

|

|||||||||||||||||||

|

Forwarding

|

6,580

|

|

5,674

|

|

4,873

|

|

16.0

|

%

|

16.4

|

%

|

|||||||||

|

Logistics

|

3,234

|

|

3,017

|

|

2,644

|

|

7.2

|

%

|

14.1

|

%

|

|||||||||

|

Freight

|

3,218

|

|

3,000

|

|

2,737

|

|

7.3

|

%

|

9.6

|

%

|

|||||||||

|

Other

|

794

|

|

791

|

|

726

|

|

0.4

|

%

|

9.0

|

%

|

|||||||||

|

Total Revenue

|

$

|

13,826

|

|

$

|

12,482

|

|

$

|

10,980

|

|

10.8

|

%

|

13.7

|

%

|

||||||

|

Operating Expenses (in millions):

|

|||||||||||||||||||

|

Operating Expenses

|

$

|

12,974

|

|

$

|

11,685

|

|

$

|

10,337

|

|

11.0

|

%

|

13.0

|

%

|

||||||

|

Transformation Strategy Costs

|

(49

|

)

|

—

|

|

—

|

|

|||||||||||||

|

Adjusted Operating Expenses

|

$

|

12,925

|

|

$

|

11,685

|

|

$

|

10,337

|

|

10.6

|

%

|

13.0

|

%

|

||||||

|

Operating Profit (in millions) and Operating Margins:

|

|||||||||||||||||||

|

Operating Profit

|

$

|

852

|

|

$

|

797

|

|

$

|

643

|

|

6.9

|

%

|

24.0

|

%

|

||||||

|

Adjusted Operating Profit

|

$

|

901

|

|

$

|

797

|

|

$

|

643

|

|

13.0

|

%

|

24.0

|

%

|

||||||

|

Operating Margin

|

6.2

|

%

|

6.4

|

%

|

5.9

|

%

|

|||||||||||||

|

Adjusted Operating Margin

|

6.5

|

%

|

6.4

|

%

|

5.9

|

%

|

|||||||||||||

|

Currency Translation Benefit / (Cost)—(in millions)*:

|

|||||||||||||||||||

|

Revenue

|

$

|

39

|

|

$

|

10

|

|

|||||||||||||

|

Operating Expenses

|

(44

|

)

|

(12

|

)

|

|||||||||||||||

|

Operating Profit

|

$

|

(5

|

)

|

$

|

(2

|

)

|

|||||||||||||

|

*

|

Amount represents the change compared to the prior year.

|

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||||

|

|

2018

|

2017

|

2016

|

2018/ 2017

|

2017/ 2016

|

||||||||||||||

|

Operating Expenses (in millions):

|

|||||||||||||||||||

|

Compensation and Benefits:

|

$

|

37,235

|

|

$

|

34,577

|

|

$

|

32,534

|

|

7.7

|

%

|

6.3

|

%

|

||||||

|

Transformation Strategy Costs

|

(262

|

)

|

—

|

|

—

|

|

|||||||||||||

|

Adjusted Compensation and Benefits

|

36,973

|

|

34,577

|

|

32,534

|

|

6.9

|

%

|

6.3

|

%

|

|||||||||

|

Repairs and Maintenance

|

1,732

|

|

1,601

|

|

1,542

|

|

8.2

|

%

|

3.8

|

%

|

|||||||||

|

Depreciation and Amortization

|

2,207

|

|

2,282

|

|

2,224

|

|

(3.3

|

)%

|

2.6

|

%

|

|||||||||

|

Purchased Transportation

|

13,409

|

|

11,696

|

|

9,848

|

|

14.6

|

%

|

18.8

|

%

|

|||||||||

|

Fuel

|

3,427

|

|

2,690

|

|

2,118

|

|

27.4

|

%

|

27.0

|

%

|

|||||||||

|

Other Occupancy

|

1,362

|

|

1,155

|

|

1,037

|

|

17.9

|

%

|

11.4

|

%

|

|||||||||

|

Other Expenses

|

5,465

|

|

5,055

|

|

4,619

|

|

8.1

|

%

|

9.4

|

%

|

|||||||||

|

Total Other Expenses

|

27,602

|

|

24,479

|

|

21,388

|

|

12.8

|

%

|

14.5

|

%

|

|||||||||

|

Other Transformation Strategy Costs

|

(98

|

)

|

—

|

|

—

|

|

|||||||||||||

|

Adjusted Total Other Expenses

|

$

|

27,504

|

|

$

|

24,479

|

|

$

|

21,388

|

|

12.4

|

%

|

14.5

|

%

|

||||||

|

Total Operating Expenses

|

$

|

64,837

|

|

$

|

59,056

|

|

$

|

53,922

|

|

9.8

|

%

|

9.5

|

%

|

||||||

|

Adjusted Total Operating Expenses

|

$

|

64,477

|

|

$

|

59,056

|

|

$

|

53,922

|

|

9.2

|

%

|

9.5

|

%

|

||||||

|

Currency Translation Cost / (Benefit)*

|

$

|

201

|

|

$

|

62

|

|

|||||||||||||

|

*

|

Amount represents the change compared to the prior year.

|

|

•

|

Health and welfare costs increased $341 million in 2018 compared to 2017, largely due to increased contributions to multiemployer plans resulting from contractual contribution rate increases and an overall increase in the size of the workforce.

|

|

•

|

Pension and retirement benefits expense increased $312 million in 2018 compared to 2017 primarily due to increased expense in UPS sponsored pension plans due to lower discount rates and additional expenses related to multiemployer plan contributions, which were impacted by contractual contribution rate increases and an overall increase in the size of the workforce. These increases were partially offset by lower Pension Benefit Guaranty Corporation premiums due to prior voluntary pension contributions, as well as the amendment of the UPS Retirement Plan in the prior year.

|

|

•

|

Vacation, holiday, excused absence, payroll tax and other expenses increased $244 million in 2018 due to salary increases and growth in the overall size of the workforce.

|

|

•

|

Workers' compensation expense increased $40 million in 2018 compared to 2017 as we experienced less favorable actuarial adjustments.

|

|

•

|

Pension costs increased $342 million in 2017 compared to 2016, primarily due to increased expense in UPS sponsored pension plans due to lower discount rates and additional expenses related to multiemployer plan contributions, which were impacted by contractual contribution rate increases and an overall increase in the size of the workforce.

|

|

•

|

Health and welfare costs increased $240 million in 2017, largely due to increased contributions to multiemployer plans resulting from contractual contribution rate increases and an overall increase in the size of the workforce.

|

|

•

|

Vacation, holiday, excused absence, payroll tax and other expenses increased $251 million in 2017 due to salary increases and growth in the overall size of the workforce.

|

|

•

|

Workers' compensation expense decreased $63 million in 2017 as we experienced more favorable actuarial adjustments. This decrease was partially offset by increases in work hours, medical trends and wage increases. Insurance reserves are established for estimates of the loss that we will ultimately incur on reported workers' compensation claims, as well as estimates of claims that have been incurred but not reported, and take into account a number of factors, including our history of claim losses, payroll growth and the impact of safety improvement initiatives.

|

|

•

|

An increase in expense of $257 million arising from capital investments in several large facilities and other new projects coming into service. This had the effect of decreasing net income by $205 million or $0.24 per share on a basic and diluted basis in 2018; and

|

|

•

|

A decrease in expense of $286 million resulting from prospective revisions to our estimates of useful lives for building improvements, vehicles and plant equipment as part of our ongoing investment in transformation. This had the effect of increasing net income by $228 million or $0.26 per share on a basic and diluted basis.

|

|

•

|

Expense for our Forwarding and Logistics business increased $824 million in 2018, primarily due to increased truckload brokerage freight loads per day; increased tonnage in our international air freight forwarding business, and increased volume and rates for mail services. Additionally, expenses increased due to additional fuel surcharges passed onto us from outside contract carriers.

|

|

•

|

U.S. Domestic Package expense increased $326 million in 2018, primarily due to increased volume, general rate increases and higher fuel surcharges passed to us from outside contract carriers.

|

|

•

|

International Package expense increased $180 million in 2018, primarily due to the increased usage of third-party carriers to handle higher transborder volume and an unfavorable impact from currency exchange rate movements.

|

|

•

|

UPS Freight expense increased $153 million in 2018, due to an increase in our ground freight pricing product, LTL tonnage and higher fuel surcharges passed to us from outside transportation providers, partially offset by declines in our LTL shipments due to fourth quarter labor uncertainties around the Teamsters contract ratification.

|

|

•

|

We incurred additional purchased transportation expense of $230 million in 2018 compared to 2017, which was primarily due to leasing additional aircraft to handle increases in air volume and higher jet fuel surcharges associated with aircraft charters.

|

|

•

|

Expense for our Forwarding and Logistics business increased $937 million in 2017, primarily due to increased truckload brokerage freight loads per day and the resulting increased fuel surcharges passed to us from outside transportation providers; increased volume and rates for mail services; and increased tonnage in our North American and international air freight forwarding businesses. Additionally, purchased transportation expense increased due to the acquisition of Marken in December 2016.

|

|

•

|

U.S. Domestic Package expense increased $421 million in 2017, primarily due to increased volume (including SurePost), higher rates and higher fuel surcharges passed to us from outside contract carriers.

|

|

•

|

International Package expense increased $270 million in 2017, primarily due to the increased usage of third-party carriers (due to higher volume); higher fuel surcharges passed to us from outside transportation providers and an unfavorable impact of currency exchange rate movements.

|

|

•

|

UPS Freight expense increased $163 million in 2017, due to an increase in LTL shipments and higher fuel surcharges passed to us from outside transportation providers.

|

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018/ 2017

|

2017/ 2016

|

||||||||||||

|

Investment Income (Expense) and Other

|

$

|

(400

|

)

|

61

|

|

(2,186

|

)

|

NA

|

|

(102.8

|

)%

|

||||||

|

Defined Benefit Plans Mark-to-Market Charges

|

1,627

|

|

800

|

|

2,651

|

|

103.4

|

%

|

(69.8

|

)%

|

|||||||

|

Adjusted Investment Income (Expense) and Other

|

1,227

|

|

861

|

|

465

|

|

42.5

|

%

|

85.2

|

%

|

|||||||

|

Interest Expense

|

(605

|

)

|

(453

|

)

|

(381

|

)

|

33.6

|

%

|

18.9

|

%

|

|||||||

|

Total Other Income and (Expense)

|

$

|

(1,005

|

)

|

$

|

(392

|

)

|

$

|

(2,567

|

)

|

156.4

|

%

|

(84.7

|

)%

|

||||

|

Adjusted Other Income and (Expense)

|

$

|

622

|

|

$

|

408

|

|

$

|

84

|

|

52.5

|

%

|

NA

|

|

||||

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||

|

|

2018

|

2017

|

2016

|

2018/ 2017

|

2017/ 2016

|

||||||||||||

|

Income Tax Expense:

|

$

|

1,228

|

|

$

|

2,232

|

|

$

|

1,699

|

|

(45.0

|

)%

|

31.4

|

%

|

||||

|

Income Tax Impact of:

|

|||||||||||||||||

|

Defined Benefit Plans Mark-to-Market Charge

|

390

|

|

193

|

|

978

|

|

|||||||||||

|

Transformation Strategy Costs

|

87

|

|

—

|

|

—

|

|

|||||||||||

|

Income Tax Benefit from the Tax Cuts and Jobs Act and Other Non-U.S. Tax Law Changes

|

—

|

|

258

|

|

—

|

|

|||||||||||

|

Adjusted Income Tax Expense

|

$

|

1,705

|

|

$

|

2,683

|

|

$

|

2,677

|

|

(36.5

|

)%

|

0.2

|

%

|

||||

|

Effective Tax Rate

|

20.4

|

%

|

31.3

|

%

|

33.2

|

%

|

|||||||||||

|

Adjusted Effective Tax Rate

|

21.3

|

%

|

33.8

|

%

|

34.4

|

%

|

|||||||||||

|

2018

|

2017

|

2016

|

|||||||||

|

Net Income

|

$

|

4,791

|

|

$

|

4,905

|

|

$

|

3,422

|

|

||

|

Non-cash operating activities

(1)

|

6,048

|

|

5,770

|

|

6,438

|

|

|||||

|

Pension and postretirement plan contributions (UPS sponsored plans)

|

(186

|

)

|

(7,794

|

)

|

(2,668

|

)

|

|||||

|

Hedge margin receivables and payables

|

482

|

|

(732

|

)

|

(142

|

)

|

|||||

|

Income tax receivables and payables

|

469

|

|

(550

|

)

|

(505

|

)

|

|||||

|

Changes in working capital and other non-current assets and liabilities

|

1,091

|

|

(168

|

)

|

(47

|

)

|

|||||

|

Other operating activities

|

16

|

|

48

|

|

(25

|

)

|

|||||

|

Net cash from operating activities

|

$

|

12,711

|

|

$

|

1,479

|

|

$

|

6,473

|

|

||

|

(1)

|

Represents depreciation and amortization, gains and losses on derivative transactions and foreign exchange, deferred income taxes, provisions for uncollectible accounts, pension and postretirement benefit expense, stock compensation expense and other non-cash items.

|

|

2018

|

2017

|

2016

|

|||||||||

|

Net cash used in investing activities

|

$

|

(6,330

|

)

|

$

|

(4,971

|

)

|

$

|

(2,563

|

)

|

||

|

Capital Expenditures:

|

|||||||||||

|

Buildings, facilities and plant equipment

|

$

|

(3,147

|

)

|

$

|

(2,954

|

)

|

$

|

(1,316

|

)

|

||

|

Aircraft and parts

|

(1,496

|

)

|

(789

|

)

|

(350

|

)

|

|||||

|

Vehicles

|

(931

|

)

|

(924

|

)

|

(864

|

)

|

|||||

|

Information technology

|

(709

|

)

|

(560

|

)

|

(435

|

)

|

|||||

|

Total Capital Expenditures :

(1)

|

$

|

(6,283

|

)

|

$

|

(5,227

|

)

|

$

|

(2,965

|

)

|

||

|

Capital Expenditures as a % of Revenue

|

8.7

|

%

|

7.9

|

%

|

4.9

|

%

|

|||||

|

Other Investing Activities:

|

|||||||||||

|

Proceeds from disposals of property, plant and equipment

|

$

|

37

|

|

$

|

24

|

|

$

|

88

|

|

||

|

Net decrease in finance receivables

|

$

|

4

|

|

$

|

5

|

|

$

|

9

|

|

||

|

Net (purchases), sales of marketable securities

|

$

|

(87

|

)

|

$

|

360

|

|

$

|

911

|

|

||

|

Cash paid for business acquisitions

|

$

|

(2

|

)

|

$

|

(134

|

)

|

$

|

(547

|

)

|

||

|

Other investing activities

|

$

|

1

|

|

$

|

1

|

|

$

|

(59

|

)

|

||

|

2018

|

2017

|

2016

|

|||||||||

|

Net cash used in financing activities

|

$

|

(5,692

|

)

|

$

|

3,287

|

|

$

|

(3,140

|

)

|

||

|

Share Repurchases:

|

|||||||||||

|

Cash expended for shares repurchased

|

$

|

(1,011

|

)

|

$

|

(1,813

|

)

|

$

|

(2,678

|

)

|

||

|

Number of shares repurchased

|

(8.9

|

)

|

(16.1

|

)

|

(25.4

|

)

|

|||||

|

Shares outstanding at year-end

|

858

|

|

859

|

|

868

|

|

|||||

|

Percent reduction in shares outstanding

|

(0.1

|

)%

|

(1.0

|

)%

|

(2.0

|

)%

|

|||||

|

Dividends:

|

|||||||||||

|

Dividends declared per share

|

$

|

3.64

|

|

$

|

3.32

|

|

$

|

3.12

|

|

||

|

Cash expended for dividend payments

|

$

|

(3,011

|

)

|

$

|

(2,771

|

)

|

$

|

(2,643

|

)

|

||

|

Borrowings:

|

|||||||||||

|

Net borrowings (repayments) of debt principal

|

$

|

(1,622

|

)

|

$

|

7,827

|

|

$

|

2,034

|

|

||

|

Other Financing Activities:

|

|||||||||||

|

Cash received for common stock issuances

|

$

|

240

|

|

$

|

247

|

|

$

|

245

|

|

||

|

Other financing activities

|

$

|

(288

|

)

|

$

|

(203

|

)

|

$

|

(98

|

)

|

||

|

Capitalization:

|

|||||||||||

|

Total debt outstanding at year-end

|

$

|

22,736

|

|

$

|

24,289

|

|

$

|

16,075

|

|

||

|

Total shareowners’ equity at year-end

|

3,037

|

|

1,024

|

|

430

|

|

|||||

|

Total capitalization

|

$

|

25,773

|

|

$

|

25,313

|

|

$

|

16,505

|

|

||

|

Principal Amount in USD

|

|||

|

2017

|

|||

|

Fixed-rate senior notes:

|

|||

|

2.050% senior notes

|

$

|

700

|

|

|

2.350% senior notes

|

600

|

|

|

|

2.500% senior notes

|

1,000

|

|

|

|

2.800% senior notes

|

500

|

|

|

|

3.050% senior notes

|

1,000

|

|

|

|

3.750% senior notes

|

1,150

|

|

|

|

Floating-rate senior notes (multiple issuances)

|

1,461

|

|

|

|

Euro senior notes:

|

|||

|

0.375% senior notes (€700)

|

815

|

|

|

|

1.500% senior notes (€500)

|

582

|

|

|

|

Canadian senior notes:

|

|||

|

2.125% senior notes (C$750)

|

547

|

|

|

|

Total

|

$

|

8,355

|

|

|

Principal Amount in USD

|

|||

|

2016

|

|||

|

Fixed-rate senior notes:

|

|||

|

2.400% senior notes

|

$

|

500

|

|

|

3.400% senior notes

|

500

|

|

|

|

Floating-rate senior notes (multiple issuances)

|

226

|

|

|

|

Euro senior notes:

|

|||

|

1.000% senior notes (€500)

|

549

|

|

|

|

$

|

1,775

|

|

|

|

Functional currency outstanding balance at year-end

|

Outstanding balance at year-end ($)

|

Average balance outstanding

|

Average balance outstanding ($)

|

Average interest rate

|

||||||||||||||

|

2018

|

||||||||||||||||||

|

USD

|

$

|

1,968

|

|

$

|

1,968

|

|

$

|

2,137

|

|

$

|

2,137

|

|

1.81

|

%

|

||||

|

EUR

|

€

|

606

|

|

$

|

694

|

|

€

|

360

|

|

$

|

425

|

|

(0.38

|

)%

|

||||

|

Total

|

$

|

2,662

|

|

|||||||||||||||

|

Functional currency outstanding balance at year-end

|

Outstanding balance at year-end ($)

|

Average balance outstanding

|

Average balance outstanding ($)

|

Average interest rate

|

||||||||||||||

|

2017

|

||||||||||||||||||

|

USD

|

$

|

2,458

|

|

$

|

2,458

|

|

$

|

2,163

|

|

$

|

2,163

|

|

0.88

|

%

|

||||

|

EUR

|

€

|

622

|

|

$

|

745

|

|

€

|

941

|

|

$

|

1,062

|

|

(0.39

|

)%

|

||||

|

Total

|

$

|

3,203

|

|

|||||||||||||||

|

Functional currency outstanding balance at year-end

|

Outstanding balance at year-end ($)

|

Average balance outstanding

|

Average balance outstanding ($)

|

Average interest rate

|

||||||||||||||

|

2016

|

||||||||||||||||||

|

USD

|

$

|

2,406

|

|

$

|

2,406

|

|

$

|

1,838

|

|

$

|

1,838

|

|

0.44

|

%

|

||||

|

EUR

|

€

|

801

|

|

$

|

844

|

|

€

|

776

|

|

$

|

817

|

|

(0.28

|

)%

|

||||

|

GBP

|

£

|

—

|

|

$

|

—

|

|

£

|

94

|

|

$

|

116

|

|

0.50

|

%

|

||||

|

Total

|

$

|

3,250

|

|

|||||||||||||||

|

Commitment Type

|

2019

|

2020

|

2021

|

2022

|

2023

|

After 2023

|

Total

|

||||||||||||||||||||

|

Capital Leases

|

$

|

158

|

|

$

|

95

|

|

$

|

42

|

|

$

|

39

|

|

$

|

36

|

|

$

|

293

|

|

$

|

663

|

|

||||||

|

Operating Leases

|

578

|

|

477

|

|

399

|

|

325

|

|

262

|

|

926

|

|

2,967

|

|

|||||||||||||

|

Debt Principal

|

3,667

|

|

998

|

|

2,551

|

|

2,000

|

|

2,303

|

|

10,830

|

|

22,349

|

|

|||||||||||||

|

Debt Interest

|

624

|

|

582

|

|

525

|

|

461

|

|

389

|

|

5,626

|

|

8,207

|

|

|||||||||||||

|

Purchase Commitments

(1)

|

3,686

|

|

1,732

|

|

1,150

|

|

383

|

|

22

|

|

8

|

|

6,981

|

|

|||||||||||||

|

Tax Act Repatriation Liability

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

96

|

|

96

|

|

|||||||||||||

|

Pension Funding

|

2,192

|

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

2,192

|

|