|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

|

|

OR

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to

|

|

Commission File Number 1-8097

|

|

|

Ensco plc

(Exact name of registrant as specified in its charter)

|

|

|

England and Wales

(State or other jurisdiction of

incorporation or organization)

6 Chesterfield Gardens

London, England

(Address of principal executive offices)

|

|

98-0635229

(I.R.S. Employer

Identification No.)

W1J5BQ

(Zip Code)

|

|

Registrant's telephone number, including area code:

+44 (0) 20 7659 4660

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class

Class A Ordinary Shares, U.S. $0.10 par value

4.50% Senior Notes due 2024

5.75% Senior Notes due 2044

5.20% Senior Notes due 2025

4.70% Senior Notes due 2021

|

|

Name of each exchange on which registered

New York Stock Exchange

|

|

Large accelerated filer

|

|

x

|

|

Accelerated filer

|

|

o

|

|

Non-Accelerated filer

|

|

o

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

o

|

|

TABLE OF CONTENTS

|

|||

|

|

|

|

|

|

PART I

|

ITEM 1.

|

||

|

|

ITEM 1A.

|

||

|

|

ITEM 1B.

|

||

|

|

ITEM 2.

|

||

|

|

ITEM 3.

|

||

|

|

ITEM 4.

|

||

|

|

|

|

|

|

PART II

|

ITEM 5.

|

|

|

|

|

ITEM 6.

|

||

|

|

ITEM 7.

|

||

|

|

ITEM 7A.

|

||

|

|

ITEM 8.

|

||

|

|

ITEM 9.

|

||

|

|

ITEM 9A.

|

||

|

|

ITEM 9B.

|

||

|

|

|||

|

PART III

|

ITEM 10.

|

|

|

|

|

ITEM 11.

|

|

|

|

|

ITEM 12.

|

|

|

|

|

ITEM 13.

|

|

|

|

|

ITEM 14.

|

|

|

|

PART IV

|

ITEM 15.

|

|

|

|

SIGNATURES

|

|||

|

•

|

downtime and other risks associated with offshore rig operations, including rig or equipment failure, damage and other unplanned repairs, the limited availability of transport vessels, hazards, self-imposed drilling limitations and other delays due to severe storms and hurricanes and the limited availability or high cost of insurance coverage for certain offshore perils, such as hurricanes in the Gulf of Mexico or associated removal of wreckage or debris;

|

|

•

|

changes in worldwide rig supply and demand, competition or technology, including as a result of delivery of newbuild drilling rigs;

|

|

•

|

changes in future levels of drilling activity and expenditures by our customers, whether as a result of global capital markets and liquidity, prices of oil and natural gas or otherwise, which may cause us to idle or stack additional rigs;

|

|

•

|

governmental action, terrorism, piracy, military action and political and economic uncertainties, including uncertainty or instability resulting from civil unrest, political demonstrations, mass strikes, or an escalation or additional outbreak of armed hostilities or other crises in oil or natural gas producing areas of the Middle East, North Africa, West Africa or other geographic areas, which may result in expropriation, nationalization, confiscation or deprivation of our assets or suspension and/or termination of contracts based on force majeure events;

|

|

•

|

risks inherent to shipyard rig construction, repair, modification or upgrades, including risks associated with concentration of our construction contracts with three shipyards, unexpected delays in equipment delivery, engineering, design or commissioning issues following delivery, or changes in the commencement, completion or service dates;

|

|

•

|

possible cancellation, suspension, renegotiation or termination (with or without cause) of drilling contracts as a result of general and industry-specific economic conditions, mechanical difficulties, performance or other reasons;

|

|

•

|

our ability to enter into, and the terms of, future drilling contracts, including contracts for our newbuild units, for rigs currently idled and for rigs whose contracts are expiring;

|

|

•

|

the outcome of litigation, legal proceedings, investigations or other claims or contract disputes, including any inability to collect receivables or resolve significant contractual or day rate disputes, any renegotiation, nullification, cancellation or breach of contracts with customers or other parties and any failure to execute definitive contracts following announcements of letters of intent;

|

|

•

|

governmental regulatory, legislative and permitting requirements affecting drilling operations, including limitations on drilling locations (such as the Gulf of Mexico during hurricane season);

|

|

•

|

new and future regulatory, legislative or permitting requirements, future lease sales, changes in laws, rules and regulations that have or may impose increased financial responsibility, additional oil spill abatement contingency plan capability requirements and other governmental actions that may result in claims of force majeure or otherwise adversely affect our existing drilling contracts;

|

|

•

|

our ability to attract and retain skilled personnel on commercially reasonable terms, whether due to labor regulations, unionization or otherwise;

|

|

•

|

environmental or other liabilities, risks, damages or losses, whether related to storms or hurricanes (including wreckage or debris removal), collisions, groundings, blowouts, fires, explosions, other accidents, terrorism or otherwise, for which insurance coverage and contractual indemnities may be insufficient, unenforceable or otherwise unavailable;

|

|

•

|

our ability to obtain financing and pursue other business opportunities may be limited by our debt levels, debt agreement restrictions and the credit ratings assigned to our debt by independent credit rating agencies;

|

|

•

|

tax matters, including our effective tax rates, tax positions, results of audits, changes in tax laws, treaties and regulations, tax assessments and liabilities for taxes;

|

|

•

|

delays in contract commencement dates or the cancellation of drilling programs by operators;

|

|

•

|

adverse changes in foreign currency exchange rates, including their effect on the fair value measurement of our derivative instruments; and

|

|

•

|

potential long-lived asset impairments.

|

|

•

|

contract duration or term for a specific period of time or a period necessary to drill one or more wells,

|

|

•

|

term extension options in favor of our customer, exercisable upon advance notice to us, at mutually agreed, indexed, fixed rates or current rate at the date of extension,

|

|

•

|

provisions permitting early termination of the contract (i) if the rig is lost or destroyed, (ii) by the customer if operations are suspended for a specified period of time due to breakdown of major rig equipment, unsatisfactory performance, or "force majeure" events beyond the control of either party or (iii) at the convenience (without cause) of the customer (in most cases obligating the customer to pay us an early termination fee providing some level of compensation to us for the remaining term),

|

|

•

|

payment of compensation to us (generally in U.S. dollars although some contracts require a portion of the compensation to be paid in local currency) on a "day work" basis such that we receive a fixed amount for each day ("day rate") that the drilling unit is operating under contract (lower rates, shorter periods that a rate is payable or no payments ("zero rate") generally apply during periods of equipment breakdown and repair, during re-drilling lost or damaged portions of wells or suspension of operations due to negligence or in the event operations are suspended or interrupted due to unsatisfactory performance or other specified conditions),

|

|

•

|

payment by us of the operating expenses of the drilling unit, including crew labor and incidental rig supply and maintenance costs,

|

|

•

|

mobilization and demobilization requirements of us to move the drilling unit to and from the planned drilling site, and such terms may include reimbursement of these costs by the customer by in the form of up-front payment, additional day rate over the contract term, or direct reimbursement, and

|

|

•

|

provisions allowing us to recover certain labor and other operating cost increases, and certain cost increases due to changes in applicable law, from our customers through day rate adjustment or direct reimbursement.

|

|

2015

|

2014

|

||||||

|

Floaters

(1)

|

$

|

3,919.5

|

|

$

|

6,756.1

|

|

|

|

Jackups

|

1,751.7

|

|

2,743.8

|

|

|||

|

Other

|

86.2

|

|

190.0

|

|

|||

|

Total

|

$

|

5,757.4

|

|

$

|

9,689.9

|

|

|

|

(1)

|

Contract drilling backlog as of December 31, 2015 for our floaters excludes

$79 million

in backlog attributable to contracted work for ENSCO DS-5.

Petrobras has asserted that the ENSCO DS-5 drilling services contract is void. We disagree with Petrobras' assertion and plan to pursue our legal rights in connection with this dispute. See "Item 3. Legal Proceedings - DSA Dispute" for further information.

|

|

2016

|

2017

|

2018

|

2019

and Beyond |

Total

|

|||||||||||||||

|

Floaters

(1)

|

$

|

1,765.6

|

|

$

|

1,239.7

|

|

$

|

453.8

|

|

$

|

460.4

|

|

$

|

3,919.5

|

|

||||

|

Jackups

|

906.6

|

|

544.4

|

|

292.3

|

|

8.4

|

|

1,751.7

|

|

|||||||||

|

Other

|

83.7

|

|

2.5

|

|

—

|

|

—

|

|

86.2

|

|

|||||||||

|

Total

|

$

|

2,755.9

|

|

$

|

1,786.6

|

|

$

|

746.1

|

|

$

|

468.8

|

|

$

|

5,757.4

|

|

||||

|

(1)

|

Floater backlog for 2016 excludes

$79 million

attributable to the ENSCO DS-5 drilling services contract with Petrobras. Petrobras has asserted that the ENSCO DS-5 drilling services contract is void. We disagree with Petrobras' assertion and plan to pursue our legal rights in connection with this dispute. See "Item 3. Legal Proceedings - DSA Dispute" for further information.

|

|

•

|

terrorist acts, war and civil disturbances,

|

|

•

|

expropriation, nationalization, deprivation or confiscation of our equipment,

|

|

•

|

expropriation or nationalization of a customer's property or drilling rights,

|

|

•

|

repudiation or nationalization of contracts,

|

|

•

|

assaults on property or personnel,

|

|

•

|

piracy, kidnapping and extortion demands,

|

|

•

|

significant governmental influence over many aspects of local economies and customers,

|

|

•

|

unexpected changes in law and regulatory requirements, including changes in interpretation or enforcement of existing laws,

|

|

•

|

work stoppages,

|

|

•

|

complications associated with repairing and replacing equipment in remote locations,

|

|

•

|

limitations on insurance coverage, such as war risk coverage, in certain areas,

|

|

•

|

imposition of trade barriers,

|

|

•

|

wage and price controls,

|

|

•

|

import-export quotas,

|

|

•

|

exchange restrictions,

|

|

•

|

currency fluctuations,

|

|

•

|

changes in monetary policies,

|

|

•

|

uncertainty or instability resulting from hostilities or other crises in the Middle East, West Africa, Latin America or other geographic areas in which we operate,

|

|

•

|

changes in the manner or rate of taxation,

|

|

•

|

limitations on our ability to recover amounts due,

|

|

•

|

increased risk of government and vendor/supplier corruption,

|

|

•

|

increased local content requirements,

|

|

•

|

the occurrence or threat of epidemic or pandemic diseases or any government response to such occurrence or threat;

|

|

•

|

changes in political conditions, and

|

|

•

|

other forms of government regulation and economic conditions that are beyond our control.

|

|

Name

|

Age

|

Position

|

|||

|

Carl G. Trowell

|

47

|

|

President and Chief Executive Officer

|

||

|

P. Carey Lowe

|

57

|

|

Executive Vice President - Chief Operating Officer

|

||

|

Jonathan Baksht

|

40

|

|

Senior Vice President and Chief Financial Officer

|

||

|

Steven J. Brady

|

56

|

|

Senior Vice President - Eastern Hemisphere

|

||

|

John S. Knowlton

|

56

|

|

Senior Vice President - Technical

|

||

|

Gilles Luca

|

44

|

|

Senior Vice President - Western Hemisphere

|

||

|

Michael T. McGuinty

|

53

|

|

Senior Vice President - General Counsel and Secretary

|

||

|

•

|

regional and global economic conditions and changes therein,

|

|

•

|

oil and natural gas supply and demand,

|

|

•

|

expectations regarding future energy prices,

|

|

•

|

the ability of the Organization of Petroleum Exporting Countries ("OPEC") to set and maintain production levels and pricing,

|

|

•

|

capital allocation decisions by our customers, including the relative economics of offshore development versus onshore prospects,

|

|

•

|

the level of production by non-OPEC countries,

|

|

•

|

U.S. and non-U.S. tax policy,

|

|

•

|

advances in exploration and development technology,

|

|

•

|

costs associated with exploring for, developing, producing and delivering oil and natural gas,

|

|

•

|

rate of discovery of new oil and gas reserves and the rate of decline of existing oil and gas reserves,

|

|

•

|

laws and government regulations that limit, restrict or prohibit exploration and development of oil and natural gas in various jurisdictions, or materially increase the cost of such exploration and development,

|

|

•

|

the development and exploitation of alternative fuels,

|

|

•

|

disruption to exploration and development activities due to hurricanes and other severe weather conditions and the risk thereof,

|

|

•

|

natural disasters or incidents resulting from operating hazards inherent in offshore drilling, such as oil spills, and

|

|

•

|

the worldwide military or political environment, including uncertainty or instability resulting from an escalation or additional outbreak of armed hostilities or other crises in oil or natural gas producing areas of the Middle East or geographic areas in which we operate, or acts of terrorism.

|

|

•

|

the early termination, repudiation or renegotiation of contracts,

|

|

•

|

breakdowns of equipment,

|

|

•

|

work stoppages, including labor strikes,

|

|

•

|

shortages of material and skilled labor,

|

|

•

|

surveys by government and maritime authorities,

|

|

•

|

periodic classification surveys,

|

|

•

|

severe weather, strong ocean currents or harsh operating conditions,

|

|

•

|

the occurrence or threat of epidemic or pandemic diseases or any government response to such occurrence or threat, and

|

|

•

|

force majeure events.

|

|

•

|

terrorist acts, war and civil disturbances,

|

|

•

|

expropriation, nationalization, deprivation or confiscation of our equipment,

|

|

•

|

expropriation or nationalization of a customer's property or drilling rights,

|

|

•

|

repudiation or nationalization of contracts,

|

|

•

|

assaults on property or personnel,

|

|

•

|

piracy, kidnapping and extortion demands,

|

|

•

|

significant governmental influence over many aspects of local economies and customers,

|

|

•

|

unexpected changes in law and regulatory requirements, including changes in interpretation or enforcement of existing laws,

|

|

•

|

work stoppages, often due to strikes over which we have little or no control,

|

|

•

|

complications associated with repairing and replacing equipment in remote locations,

|

|

•

|

limitations on insurance coverage, such as war risk coverage, in certain areas,

|

|

•

|

imposition of trade barriers,

|

|

•

|

wage and price controls,

|

|

•

|

import-export quotas,

|

|

•

|

exchange restrictions,

|

|

•

|

currency fluctuations,

|

|

•

|

changes in monetary policies,

|

|

•

|

uncertainty or instability resulting from hostilities or other crises in the Middle East, West Africa, Latin America or other geographic areas in which we operate,

|

|

•

|

changes in the manner or rate of taxation,

|

|

•

|

limitations on our ability to recover amounts due,

|

|

•

|

increased risk of government and vendor/supplier corruption,

|

|

•

|

increased local content requirements,

|

|

•

|

the occurrence or threat of epidemic or pandemic diseases or any government response to such occurrence or threat,

|

|

•

|

changes in political conditions, and

|

|

•

|

other forms of government regulation and economic conditions that are beyond our control.

|

|

•

|

failure of third-party equipment to meet quality and/or performance standards,

|

|

•

|

delays in equipment deliveries or shipyard construction,

|

|

•

|

shortages of materials or skilled labor,

|

|

•

|

damage to shipyard facilities or construction work in progress, including damage resulting from fire, explosion, flooding, severe weather, terrorism, war or other armed hostilities,

|

|

•

|

unforeseen design or engineering problems, including those relating to the commissioning of newly designed equipment,

|

|

•

|

unanticipated actual or purported change orders,

|

|

•

|

strikes, labor disputes or work stoppages,

|

|

•

|

financial or operating difficulties of equipment vendors or the shipyard while constructing, enhancing, upgrading, improving or repairing a rig or rigs,

|

|

•

|

unanticipated cost increases,

|

|

•

|

foreign currency exchange rate fluctuations impacting overall cost,

|

|

•

|

inability to obtain the requisite permits or approvals,

|

|

•

|

client acceptance delays,

|

|

•

|

disputes with shipyards and suppliers,

|

|

•

|

latent damages or deterioration to hull, equipment and machinery in excess of engineering estimates and assumptions,

|

|

•

|

claims of force majeure events, and

|

|

•

|

additional risks inherent to shipyard projects in a non-U.S. location.

|

|

•

|

a portion of our cash flows from operations will be dedicated to the payment of principal and interest,

|

|

•

|

covenants contained in our debt arrangements require us to meet certain financial tests, which may affect our flexibility in planning for, and reacting to, changes in our business and may limit our ability to dispose of assets or place restrictions on the use of proceeds from such dispositions, withstand current or future economic or industry downturns and compete with others in our industry for strategic opportunities, and

|

|

•

|

our ability to obtain additional financing to fund working capital requirements, capital expenditures, acquisitions, dividend payments and general corporate or other cash requirements may be limited.

|

|

•

|

offshore drilling technology,

|

|

•

|

the cost of labor and materials,

|

|

•

|

customer requirements,

|

|

•

|

fleet size,

|

|

•

|

the cost of replacement parts for existing drilling rigs,

|

|

•

|

the geographic location of the drilling rigs,

|

|

•

|

length of drilling contracts,

|

|

•

|

governmental regulations and maritime self-regulatory organization and technical standards relating to safety, security or the environment, and

|

|

•

|

industry standards.

|

|

Rig Name

|

Rig Type

|

Year Built/

Rebuilt

|

Design

|

Maximum

Water Depth/

Drilling Depth

|

Location

|

Customer

|

||||

|

Floaters

|

|

|

|

|||||||

|

ENSCO DS-1

|

Drillship

|

1999/2012

|

Dynamically Positioned

|

6,000'/30,000'

|

Spain

|

Cold stacked

|

||||

|

ENSCO DS-2

|

Drillship

|

1999

|

Dynamically Positioned

|

6,000'/30,000'

|

Spain

|

Cold stacked

|

||||

|

ENSCO DS-3

|

Drillship

|

2010

|

Dynamically Positioned

|

10,000'/40,000'

|

Gulf of Mexico

|

BP

|

||||

|

ENSCO DS-4

|

Drillship

|

2010

|

Dynamically Positioned

|

10,000'/40,000'

|

Gulf of Mexico

|

Not contracted

|

||||

|

ENSCO DS-5

|

Drillship

|

2011

|

Dynamically Positioned

|

10,000'/40,000'

|

Gulf of Mexico

|

Petrobras

(1)

|

||||

|

ENSCO DS-6

|

Drillship

|

2012

|

Dynamically Positioned

|

10,000'/40,000'

|

Spain

|

BP

|

||||

|

ENSCO DS-7

|

Drillship

|

2013

|

Dynamically Positioned

|

10,000'/40,000'

|

Angola

|

TOTAL

|

||||

|

ENSCO DS-8

|

Drillship

|

2015

|

Dynamically Positioned

|

10,000'/40,000'

|

Angola

|

TOTAL

|

||||

|

ENSCO DS-9

|

Drillship

|

2015

|

Dynamically Positioned

|

10,000'/40,000'

|

Singapore

|

Not contracted

|

||||

|

ENSCO DS-10

|

Drillship

|

2017

|

Dynamically Positioned

|

10,000'/40,000'

|

South Korea

|

Under construction

(2)

|

||||

|

ENSCO 5004

|

Semisubmersible

|

1982/2001/2014

|

F&G Enhanced Pacesetter

|

1,500'/25,000'

|

Mediterranean

|

Mellitah

|

||||

|

ENSCO 5005

|

Semisubmersible

|

1982/2014

|

F&G Enhanced Pacesetter

|

1,500'/25,000'

|

Brunei

|

Petronas Carigali

|

||||

|

ENSCO 5006

|

Semisubmersible

|

1999/2014

|

Bingo 8000

|

7,000'/25,000'

|

Australia

|

Inpex

|

||||

|

ENSCO 6000

|

Semisubmersible

|

1987/1996

|

Dynamically Positioned

|

3,400'/12,000'

|

Spain

|

Cold stacked

|

||||

|

ENSCO 6001

|

Semisubmersible

|

2000/2010/2014

|

Megathyst

|

5,600'/25,000'

|

Brazil

|

Petrobras

|

||||

|

ENSCO 6002

|

Semisubmersible

|

2001/2009/2015

|

Megathyst

|

5,600'/25,000'

|

Brazil

|

Petrobras

|

||||

|

ENSCO 6003

|

Semisubmersible

|

2004

|

Megathyst

|

5,600'/25,000'

|

Brazil

|

Petrobras

|

||||

|

ENSCO 6004

|

Semisubmersible

|

2004

|

Megathyst

|

5,600'/25,000'

|

Brazil

|

Petrobras

|

||||

|

ENSCO 7500

|

Semisubmersible

|

2000

|

Dynamically Positioned

|

8,000'/30,000'

|

Spain

|

Cold stacked

|

||||

|

ENSCO 8500

|

Semisubmersible

|

2008

|

Dynamically Positioned

|

8,500'/35,000'

|

Gulf of Mexico

|

Not contracted

|

||||

|

ENSCO 8501

|

Semisubmersible

|

2009

|

Dynamically Positioned

|

8,500'/35,000'

|

Gulf of Mexico

|

Cold stacked

|

||||

|

ENSCO 8502

|

Semisubmersible

|

2010/2012

|

Dynamically Positioned

|

8,500'/35,000'

|

Gulf of Mexico

|

Cold stacked

|

||||

|

ENSCO 8503

|

Semisubmersible

|

2010

|

Dynamically Positioned

|

8,500'/35,000'

|

Gulf of Mexico

|

Stone Energy

|

||||

|

ENSCO 8504

|

Semisubmersible

|

2011

|

Dynamically Positioned

|

8,500'/35,000'

|

Malaysia

|

Chevron

|

||||

|

ENSCO 8505

|

Semisubmersible

|

2012

|

Dynamically Positioned

|

8,500'/35,000'

|

Gulf of Mexico

|

Marubeni

|

||||

|

ENSCO 8506

|

Semisubmersible

|

2012

|

Dynamically Positioned

|

8,500'/35,000'

|

Gulf of Mexico

|

Not contracted

|

||||

|

Jackups

|

|

|

|

|

|

|

||||

|

ENSCO 52

|

Jackup

|

1983/1997/2013

|

F&G L-780 MOD II-C

|

300'/25,000'

|

Malaysia

|

Murphy

|

||||

|

ENSCO 53

|

Jackup

|

1982/2009

|

F&G L-780 MOD II-C

|

300'/25,000'

|

UAE

|

NDC

|

||||

|

ENSCO 54

|

Jackup

|

1982/1997/2014

|

F&G L-780 MOD II-C

|

300'/25,000'

|

Saudi Arabia

|

Saudi Aramco

|

||||

|

ENSCO 56

|

Jackup

|

1982/1997

|

F&G L-780 MOD II-C

|

300'/25,000'

|

Malaysia

|

Cold stacked

|

||||

|

ENSCO 58

|

Jackup

|

1981/2002

|

F&G L-780 MOD II

|

250'/30,000'

|

Bahrain

|

Cold stacked

|

||||

|

ENSCO 67

|

Jackup

|

1976/2005

|

MLT 84-CE

|

400'/30,000'

|

Malaysia

|

Not contracted

|

||||

|

ENSCO 68

|

Jackup

|

1976/2004

|

MLT 84-CE

|

400'/30,000'

|

Gulf of Mexico

|

Chevron

|

||||

|

ENSCO 70

|

Jackup

|

1981/1996/2014

|

Hitachi K1032N

|

250'/30,000

|

United Kingdom

|

Not contracted

|

||||

|

ENSCO 71

|

Jackup

|

1982/1995/2012

|

Hitachi K1032N

|

225'/25,000'

|

Denmark

|

Maersk

|

||||

|

ENSCO 72

|

Jackup

|

1981/1996

|

Hitachi K1025N

|

225'/25,000'

|

Denmark

|

Maersk

|

||||

|

ENSCO 75

|

Jackup

|

1999

|

MLT Super 116-C

|

400'/30,000'

|

Gulf of Mexico

|

Fieldwood

|

||||

|

ENSCO 76

|

Jackup

|

2000

|

MLT Super 116-C

|

350'/30,000'

|

Saudi Arabia

|

Saudi Aramco

|

||||

|

ENSCO 80

|

Jackup

|

1978/1995

|

MLT 116-CE

|

225'/30,000'

|

United Kingdom

|

GDF

|

||||

|

ENSCO 81

|

Jackup

|

1979/2003

|

MLT 116-C

|

350'/30,000'

|

Gulf of Mexico

|

Cold stacked

|

||||

|

Rig Name

|

Rig Type

|

Year Built/

Rebuilt

|

Design

|

Maximum

Water Depth/

Drilling Depth

|

Location

|

Customer

|

||||

|

Jackups

|

|

|

|

|

||||||

|

ENSCO 82

|

Jackup

|

1979/2003

|

MLT 116-C

|

300'/30,000'

|

Gulf of Mexico

|

Cold stacked

|

||||

|

ENSCO 84

|

Jackup

|

1981/2005/2012

|

MLT 82-SD-C

|

250'/25,000'

|

Bahrain

|

Cold stacked

|

||||

|

ENSCO 86

|

Jackup

|

1981/2006

|

MLT 82-SD-C

|

250'/30,000'

|

Gulf of Mexico

|

Cold stacked

|

||||

|

ENSCO 87

|

Jackup

|

1982/2006

|

MLT 116-C

|

350'/25,000'

|

Gulf of Mexico

|

Not contracted

|

||||

|

ENSCO 88

|

Jackup

|

1982/2004/2014

|

MLT 82-SD-C

|

250'/25,000'

|

Saudi Arabia

|

Saudi Aramco

|

||||

|

ENSCO 90

|

Jackup

|

1982/2002

|

MLT 82-SD-C

|

250'/25,000'

|

Gulf of Mexico

|

Cold stacked

|

||||

|

ENSCO 91

|

Jackup

|

1980/2001/2012

|

Hitachi Zosen

|

270'/20,000'

|

Bahrain

|

Cold stacked

|

||||

|

ENSCO 92

|

Jackup

|

1982/1996

|

MLT 116-C

|

225'/25,000'

|

United Kingdom

|

ConocoPhillips

|

||||

|

ENSCO 94

|

Jackup

|

1981/2001/2013

|

Hitachi 250-C

|

250'/25,000'

|

Saudi Arabia

|

Saudi Aramco

|

||||

|

ENSCO 96

|

Jackup

|

1982/1997/2012

|

Hitachi 250-C

|

250'/25,000'

|

Saudi Arabia

|

Saudi Aramco

|

||||

|

ENSCO 97

|

Jackup

|

1980/1997/2012

|

MLT 82 SD-C

|

250'/25,000'

|

Saudi Arabia

|

Saudi Aramco

|

||||

|

ENSCO 99

|

Jackup

|

1985/2005

|

MLT 82 SD-C

|

250'/30,000'

|

Gulf of Mexico

|

Cold stacked

|

||||

|

ENSCO 100

|

Jackup

|

1987/2009

|

MLT 150-88-C

|

350'/30,000

|

United Kingdom

|

Premier

|

||||

|

ENSCO 101

|

Jackup

|

2000

|

KELFS MOD V-A

|

400'/30,000'

|

United Kingdom

|

BP

|

||||

|

ENSCO 102

|

Jackup

|

2002

|

KELFS MOD V-A

|

400'/30,000'

|

United Kingdom

|

GDF

|

||||

|

ENSCO 104

|

Jackup

|

2002

|

KELFS MOD V-B

|

400'/30,000'

|

UAE

|

NDC

|

||||

|

ENSCO 105

|

Jackup

|

2002

|

KELFS MOD V-B

|

400'/30,000'

|

Singapore

|

Not contracted

|

||||

|

ENSCO 106

|

Jackup

|

2005

|

KELFS MOD V-B

|

400'/30,000'

|

Malaysia

|

Not contracted

|

||||

|

ENSCO 107

|

Jackup

|

2006

|

KELFS MOD V-B

|

400'/30,000'

|

New Zealand

|

Not contracted

|

||||

|

ENSCO 108

|

Jackup

|

2007

|

KELFS MOD V-B

|

400'/30,000'

|

Thailand

|

PTTEP

|

||||

|

ENSCO 109

|

Jackup

|

2008

|

KELFS MOD V-Super B

|

350'/35,000'

|

Angola

|

Chevron

|

||||

|

ENSCO 110

|

Jackup

|

2015

|

KELFS MOD V-B

|

400'/30,000'

|

UAE

|

NDC

|

||||

|

ENSCO 120

|

Jackup

|

2013

|

KFELS Super A

|

400'/40,000'

|

United Kingdom

|

Nexen

|

||||

|

ENSCO 121

|

Jackup

|

2013

|

KFELS Super A

|

400'/40,000'

|

Denmark

|

Wintershall

|

||||

|

ENSCO 122

|

Jackup

|

2014

|

KFELS Super A

|

400'/40,000'

|

Netherlands

|

NAM

|

||||

|

ENSCO 123

|

Jackup

|

2018

|

KFELS Super A

|

400'/40,000'

|

Singapore

|

Under construction

(1)

|

||||

|

ENSCO 140

|

Jackup

|

2016

|

Cameron Letourneau Super 116E

|

400'/30,000'

|

UAE

|

Under construction

(1)

|

||||

|

ENSCO 141

|

Jackup

|

2016

|

Cameron Letourneau Super 116E

|

400'/30,000'

|

UAE

|

Under construction

(1)

|

||||

|

(1)

|

Petrobras has asserted that the ENSCO DS-5 drilling services contract is void. We disagree with Petrobras' assertion and plan to pursue our legal rights in connection with this dispute. See "Item 3. Legal Proceedings - DSA Dispute" for further information.

|

|

(2)

|

Rig is currently under construction and is not contracted. The "year built" provided is based on the current construction schedule.

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

|

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

Year

|

||||||||||||||||

|

2015 High

|

$

|

32.28

|

|

$

|

28.40

|

|

$

|

22.21

|

|

$

|

18.93

|

|

$

|

32.28

|

|

|||||

|

2015 Low

|

$

|

19.78

|

|

$

|

21.04

|

|

$

|

13.42

|

|

$

|

13.26

|

|

$

|

13.26

|

|

|||||

|

2014 High

|

$

|

57.45

|

|

$

|

55.89

|

|

$

|

55.74

|

|

$

|

41.99

|

|

$

|

57.45

|

|

|||||

|

2014 Low

|

$

|

47.85

|

|

$

|

48.53

|

|

$

|

40.91

|

|

$

|

25.88

|

|

$

|

25.88

|

|

|||||

|

First

Quarter

|

Second

Quarter

|

Third

Quarter

|

Fourth

Quarter

|

Year

|

||||||||||||||||

|

2015

|

$

|

.15

|

|

$

|

.15

|

|

$

|

.15

|

|

$

|

.15

|

|

$

|

0.60

|

|

|||||

|

2014

|

$

|

.75

|

|

$

|

.75

|

|

$

|

.75

|

|

$

|

.75

|

|

$

|

3.00

|

|

|||||

|

•

|

dividends paid by the Company on or after April 6, 2016 will not carry a tax credit,

|

|

•

|

all dividends received by an individual shareholder from the Company (or from other sources) will, except to the extent that they are earned through an Individual Savings Account ("ISA"), self-invested pension plan or other regime which exempts the dividends from income tax, form part of the shareholder's total income for income tax purposes,

|

|

•

|

a nil rate of income tax will apply to the first £5,000 of taxable dividend income received by an individual shareholder in a tax year (the “Nil Rate Amount”), regardless of what tax rate would otherwise apply to that dividend income,

|

|

•

|

any taxable dividend income received by an individual shareholder in a tax year in excess of the Nil Rate Amount will be taxed at a special rate, as set out below, and

|

|

•

|

that tax will be applied to the amount of the dividend income actually received by the individual shareholder (rather than to a grossed-up amount).

|

|

•

|

at the rate of 7.5%, to the extent that the Relevant Dividend Income falls below the threshold for the higher rate of income tax,

|

|

•

|

at the rate of 32.5%, to the extent that the Relevant Dividend Income falls above the threshold for the higher rate of income tax but below the threshold for the additional rate of income tax, or

|

|

•

|

at the rate of 38.1%, to the extent that the Relevant Dividend Income falls above the threshold for the additional rate of income tax.

|

|

Issuer Purchases of Equity Securities

|

|||||||||||||

|

Period

|

Total Number of Securities Purchased

(1)

|

Average Price Paid per Security

|

Total Number of Securities Purchased as Part of Publicly Announced Plans or Programs

(2)

|

Approximate Dollar Value of Securities that May Yet Be Purchased Under Plans or Programs

|

|||||||||

|

October 1 - October 31

|

2,217

|

|

$

|

13.87

|

|

—

|

|

$

|

2,000,000,000

|

|

|||

|

November 1 - November 30

|

5,758

|

|

$

|

17.70

|

|

—

|

|

$

|

2,000,000,000

|

|

|||

|

December 1 - December 31

|

11,107

|

|

$

|

16.57

|

|

—

|

|

$

|

2,000,000,000

|

|

|||

|

Total

|

19,082

|

|

$

|

16.59

|

|

—

|

|

|

|

||||

|

(1)

|

During the

quarter ended December 31, 2015

, equity securities were repurchased from employees and non-employee directors by an affiliated employee benefit trust in connection with the settlement of income tax withholding obligations arising from the vesting of share awards. Such securities remain available for re-issuance in connection with employee share awards.

|

|

(2)

|

During 2013, our shareholders approved a new share repurchase program. Subject to certain provisions under English law, including the requirement of Ensco plc to have sufficient distributable reserves, we may purchase up to a maximum of $2.0 billion in the aggregate under the program, but in no case more than 35.0 million shares. The program terminates in May 2018.

|

|

|

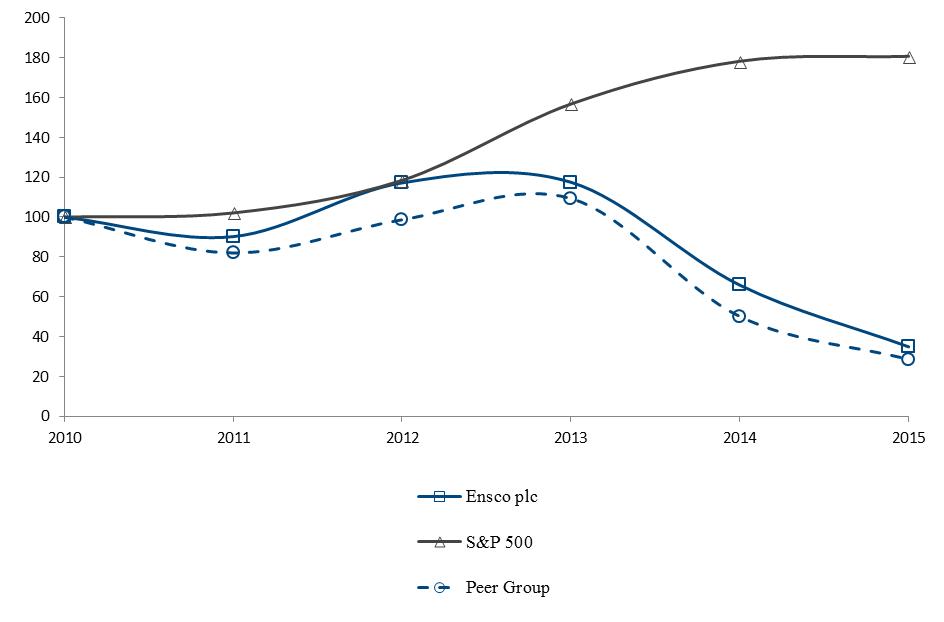

12/10

|

12/11

|

12/12

|

12/13

|

12/14

|

12/15

|

|||||||||||

|

Ensco plc

|

100.0

|

|

90.2

|

|

117.2

|

|

117.5

|

|

65.9

|

|

34.9

|

|

|||||

|

S&P 500

|

100.0

|

|

102.1

|

|

118.5

|

|

156.8

|

|

178.3

|

|

180.8

|

|

|||||

|

Peer Group

|

100.0

|

|

82.0

|

|

98.7

|

|

109.4

|

|

50.1

|

|

28.6

|

|

|||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

2015

|

2014

|

2013

|

2012

|

2011

(1)

|

|||||||||||||||

|

|

(in millions, except per share amounts)

|

||||||||||||||||||

|

Consolidated Statement of Operations Data

|

|

|

|

|

|

|

|

|

|||||||||||

|

Revenues

|

$

|

4,063.4

|

|

$

|

4,564.5

|

|

$

|

4,323.4

|

|

$

|

3,638.8

|

|

$

|

2,443.2

|

|

||||

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Contract drilling (exclusive of depreciation)

|

1,869.6

|

|

2,076.9

|

|

1,947.1

|

|

1,642.8

|

|

1,218.3

|

|

|||||||||

|

Loss on impairment

|

2,746.4

|

|

4,218.7

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Depreciation

|

572.5

|

|

537.9

|

|

496.2

|

|

443.8

|

|

334.9

|

|

|||||||||

|

General and administrative

|

118.4

|

|

131.9

|

|

146.8

|

|

148.9

|

|

158.6

|

|

|||||||||

|

Operating (loss) income

|

(1,243.5

|

)

|

|

(2,400.9

|

)

|

|

1,733.3

|

|

|

1,403.3

|

|

|

731.4

|

|

|||||

|

Other (expense) income, net

|

(227.7

|

)

|

(147.9

|

)

|

(100.1

|

)

|

(98.6

|

)

|

(57.9

|

)

|

|||||||||

|

Income tax (benefit) expense

|

(13.9

|

)

|

140.5

|

|

203.1

|

|

228.6

|

|

105.6

|

|

|||||||||

|

(Loss) income from continuing operations

|

(1,457.3

|

)

|

(2,689.3

|

)

|

|

1,430.1

|

|

|

1,076.1

|

|

|

567.9

|

|

||||||

|

(Loss) income from discontinued operations, net

(2)

|

(128.6

|

)

|

(1,199.2

|

)

|

(2.2

|

)

|

100.6

|

|

37.7

|

|

|||||||||

|

Net (loss) income

|

(1,585.9

|

)

|

(3,888.5

|

)

|

|

1,427.9

|

|

|

1,176.7

|

|

|

605.6

|

|

||||||

|

Net income attributable to noncontrolling interests

|

(8.9

|

)

|

(14.1

|

)

|

(9.7

|

)

|

(7.0

|

)

|

(5.2

|

)

|

|||||||||

|

Net (loss) income attributable to Ensco

|

$

|

(1,594.8

|

)

|

$

|

(3,902.6

|

)

|

|

$

|

1,418.2

|

|

|

$

|

1,169.7

|

|

|

$

|

600.4

|

|

|

|

(Loss) earnings per share – basic

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Continuing operations

|

$

|

(6.33

|

)

|

$

|

(11.70

|

)

|

$

|

6.09

|

|

$

|

4.62

|

|

$

|

2.90

|

|

||||

|

Discontinued operations

|

(0.55

|

)

|

(5.18

|

)

|

(0.01

|

)

|

0.43

|

|

0.19

|

|

|||||||||

|

|

$

|

(6.88

|

)

|

$

|

(16.88

|

)

|

|

$

|

6.08

|

|

|

$

|

5.05

|

|

|

$

|

3.09

|

|

|

|

(Loss) earnings per share - diluted

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Continuing operations

|

$

|

(6.33

|

)

|

$

|

(11.70

|

)

|

$

|

6.08

|

|

$

|

4.61

|

|

$

|

2.89

|

|

||||

|

Discontinued operations

|

(0.55

|

)

|

(5.18

|

)

|

(0.01

|

)

|

0.43

|

|

0.19

|

|

|||||||||

|

|

$

|

(6.88

|

)

|

$

|

(16.88

|

)

|

|

$

|

6.07

|

|

|

$

|

5.04

|

|

|

$

|

3.08

|

|

|

|

Net (loss) income attributable to Ensco shares - Basic and Diluted

|

$

|

(1,596.8

|

)

|

$

|

(3,910.5

|

)

|

$

|

1,403.1

|

|

$

|

1,157.4

|

|

$

|

593.5

|

|

||||

|

Weighted-average shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Basic

|

232.2

|

|

231.6

|

|

230.9

|

|

229.4

|

|

192.2

|

|

|||||||||

|

Diluted

|

232.2

|

|

231.6

|

|

231.1

|

|

229.7

|

|

192.6

|

|

|||||||||

|

Cash dividends per share

|

$

|

0.60

|

|

$

|

3.00

|

|

$

|

2.25

|

|

$

|

1.50

|

|

$

|

1.40

|

|

||||

|

|

Year Ended December 31,

|

||||||||||||||||||

|

|

2015

|

2014

|

2013

|

2012

|

2011

(1)

|

||||||||||||||

|

|

(in millions)

|

||||||||||||||||||

|

Consolidated Balance Sheet (as of period end) and Cash Flow Statement Data

|

|||||||||||||||||||

|

Working capital

(3)

|

$

|

1,509.6

|

|

$

|

1,788.9

|

|

$

|

466.9

|

|

$

|

720.4

|

|

$

|

338.3

|

|

||||

|

Total assets

(3)

|

13,637.0

|

|

16,040.8

|

|

19,456.4

|

|

18,555.4

|

|

17,900.0

|

|

|||||||||

|

Long-term debt, net of current portion

|

5,895.1

|

|

5,885.6

|

|

4,718.9

|

|

4,798.4

|

|

4,877.6

|

|

|||||||||

|

Ensco shareholders' equity

|

6,512.9

|

|

8,215.0

|

|

12,791.6

|

|

11,846.4

|

|

10,879.3

|

|

|||||||||

|

Cash flows from operating activities of continuing operations

|

1,697.9

|

|

2,057.9

|

|

1,811.2

|

|

1,954.6

|

|

659.8

|

|

|||||||||

|

(1)

|

Includes the results of Pride International, Inc. ("Pride") from May 31, 2011, the date of the Pride acquisition.

|

|

(2)

|

See Note 10 to our consolidated financial statements included in "Item 8. Financial Statements and Supplementary Data" for information on discontinued operations.

|

|

(3)

|

Prior year amounts have been restated to reflect the adoption of Accounting Standard Update 2015-17

Income Taxes (Topic 740): Balance Sheet Classification of Deferred Taxes

, which requires that deferred tax assets and liabilities be classified as noncurrent on the balance sheet. See Note 1 to our consolidated financial statements included in "Item 8. Financial Statements and Supplementary Data" for additional information.

|

|

2015

|

2014

|

2013

|

||||||||||

|

Revenues

|

$

|

4,063.4

|

|

$

|

4,564.5

|

|

$

|

4,323.4

|

|

|||

|

Operating expenses

|

|

|

|

|

|

|

||||||

|

Contract drilling (exclusive of depreciation)

|

1,869.6

|

|

2,076.9

|

|

1,947.1

|

|

||||||

|

Loss on impairment

|

2,746.4

|

|

4,218.7

|

|

—

|

|

||||||

|

Depreciation

|

572.5

|

|

537.9

|

|

496.2

|

|

||||||

|

General and administrative

|

118.4

|

|

131.9

|

|

146.8

|

|

||||||

|

Operating (loss) income

|

(1,243.5

|

)

|

(2,400.9

|

)

|

1,733.3

|

|

||||||

|

Other expense, net

|

(227.7

|

)

|

(147.9

|

)

|

(100.1

|

)

|

||||||

|

Provision for income taxes

|

(13.9

|

)

|

140.5

|

|

203.1

|

|

||||||

|

(Loss) income from continuing operations

|

(1,457.3

|

)

|

(2,689.3

|

)

|

1,430.1

|

|

||||||

|

Loss from discontinued operations, net

|

(128.6

|

)

|

(1,199.2

|

)

|

(2.2

|

)

|

||||||

|

Net (loss) income

|

(1,585.9

|

)

|

(3,888.5

|

)

|

1,427.9

|

|

||||||

|

Net income attributable to noncontrolling interests

|

(8.9

|

)

|

(14.1

|

)

|

(9.7

|

)

|

||||||

|

Net (loss) income attributable to Ensco

|

$

|

(1,594.8

|

)

|

$

|

(3,902.6

|

)

|

$

|

1,418.2

|

|

|||

|

2015

|

2014

|

2013

|

|||

|

Floaters

(1)(3)

|

22

|

20

|

26

|

||

|

Jackups

(2)(3)

|

36

|

36

|

44

|

||

|

Under construction

(3)(4)

|

4

|

7

|

6

|

||

|

Held-for-sale

(1)(2)

|

6

|

7

|

—

|

||

|

Total

|

68

|

70

|

76

|

||

|

(1)

|

During 2014, we sold ENSCO 5000 and classified ENSCO 5001, ENSCO 5002, ENSCO 6000, ENSCO 7500 and ENSCO DS-2 as held-for-sale. During 2015, we sold ENSCO 5001 and ENSCO 5002.

|

|

(2)

|

During 2014, we sold ENSCO 83, ENSCO 89, ENSCO 93, ENSCO 98, ENSCO 85, ENSCO 69 and Pride Wisconsin and classified ENSCO 58 and ENSCO 90 as held-for-sale. During 2015, we classified ENSCO 91 as held-for-sale.

|

|

(3)

|

During 2015, we accepted delivery of two ultra-deepwater drillships (ENSCO DS-8 and ENSCO DS-9) and one premium jackup rig (ENSCO 110). ENSCO DS-8 commenced a long-term drilling contract during the fourth quarter. ENSCO DS-9 was delivered during the second quarter and is uncontracted following receipt of notice of termination for convenience from our customer. ENSCO 110 commenced a long-term drilling contract during the second quarter.

|

|

(4)

|

During 2014, we entered into an agreement with Lamprell plc to construct two high-specification jackup rigs, ENSCO 140 and ENSCO 141, which are scheduled for delivery during the second quarter and third quarter of 2016, respectively. Both rigs remain uncontracted.

|

|

|

2015

|

2014

|

2013

|

|||||||||

|

Rig Utilization

(1)

|

|

|

|

|

|

|

||||||

|

Floaters

|

69%

|

79%

|

84%

|

|||||||||

|

Jackups

|

73%

|

89%

|

92%

|

|||||||||

|

Total

|

72%

|

85%

|

89%

|

|||||||||

|

Average Day Rates

(2)

|

|

|

|

|||||||||

|

Floaters

|

$

|

416,346

|

|

$

|

456,023

|

|

$

|

435,526

|

|

|||

|

Jackups

|

136,451

|

|

140,033

|

|

125,700

|

|

||||||

|

Total

|

$

|

233,325

|

|

$

|

242,884

|

|

$

|

226,703

|

|

|||

|

(1)

|

Rig utilization is derived by dividing the number of days under contract by the number of days in the period. Days under contract equals the total number of days that rigs have earned and recognized day rate revenue, including days associated with early contract terminations, compensated downtime and mobilizations. When revenue is earned but is deferred and amortized over a future period, for example when a rig earns revenue while mobilizing to commence a new contract or while being upgraded in a shipyard, the related days are excluded from days under contract.

|

|

(2)

|

Average day rates are derived by dividing contract drilling revenues, adjusted to exclude certain types of non-recurring reimbursable revenues, lump sum revenues and revenues attributable to amortization of drilling contract intangibles, by the aggregate number of contract days, adjusted to exclude contract days associated with certain mobilizations, demobilizations, shipyard contracts and standby contracts.

|

|

Floaters

|

Jackups

|

Other

|

Operating Segments Total

|

Reconciling Items

|

Consolidated Total

|

||||||||||||||||||

|

Revenues

|

$

|

2,466.0

|

|

$

|

1,445.6

|

|

$

|

151.8

|

|

$

|

4,063.4

|

|

$

|

—

|

|

$

|

4,063.4

|

|

|||||

|

Operating expenses

|

|||||||||||||||||||||||

|

Contract drilling

(exclusive of depreciation)

|

1,052.8

|

|

693.5

|

|

123.3

|

|

1,869.6

|

|

—

|

|

1,869.6

|

|

|||||||||||

|

Loss on impairment

|

1,778.4

|

|

968.0

|

|

|

|

2,746.4

|

|

—

|

|

2,746.4

|

|

|||||||||||

|

Depreciation

|

382.4

|

|

175.7

|

|

—

|

|

558.1

|

|

14.4

|

|

572.5

|

|

|||||||||||

|

General and administrative

|

—

|

|

—

|

|

—

|

|

—

|

|

118.4

|

|

118.4

|

|

|||||||||||

|

Operating (loss) income

|

$

|

(747.6

|

)

|

$

|

(391.6

|

)

|

$

|

28.5

|

|

$

|

(1,110.7

|

)

|

$

|

(132.8

|

)

|

$

|

(1,243.5

|

)

|

|||||

|

Floaters

|

Jackups

|

Other

|

Operating Segments Total

|

Reconciling Items

|

Consolidated Total

|

||||||||||||||||||

|

Revenues

|

$

|

2,697.6

|

|

$

|

1,774.6

|

|

$

|

92.3

|

|

$

|

4,564.5

|

|

$

|

—

|

|

$

|

4,564.5

|

|

|||||

|

Operating expenses

|

|||||||||||||||||||||||

|

Contract drilling

(exclusive of depreciation)

|

1,201.2

|

|

807.4

|

|

68.3

|

|

2,076.9

|

|

—

|

|

2,076.9

|

|

|||||||||||

|

Loss in impairment

|

3,982.3

|

|

236.4

|

|

—

|

|

4,218.7

|

|

—

|

|

4,218.7

|

|

|||||||||||

|

Depreciation

|

358.1

|

|

171.2

|

|

—

|

|

529.3

|

|

8.6

|

|

537.9

|

|

|||||||||||

|

General and administrative

|

—

|

|

—

|

|

—

|

|

—

|

|

131.9

|

|

131.9

|

|

|||||||||||

|

Operating (loss) income

|

$

|

(2,844.0

|

)

|

$

|

559.6

|

|

$

|

24.0

|

|

$

|

(2,260.4

|

)

|

$

|

(140.5

|

)

|

$

|

(2,400.9

|

)

|

|||||

|

Floaters

|

Jackups

|

Other

|

Operating Segments Total

|

Reconciling Items

|

Consolidated Total

|

||||||||||||||||||

|

Revenues

|

$

|

2,659.6

|

|

$

|

1,588.7

|

|

$

|

75.1

|

|

$

|

4,323.4

|

|

$

|

—

|

|

$

|

4,323.4

|

|

|||||

|

Operating expenses

|

|||||||||||||||||||||||

|

Contract drilling

(exclusive of depreciation)

|

1,126.0

|

|

762.6

|

|

58.5

|

|

1,947.1

|

|

—

|

|

1,947.1

|

|

|||||||||||

|

Depreciation

|

342.2

|

|

147.5

|

|

—

|

|

489.7

|

|

6.5

|

|

496.2

|

|

|||||||||||

|

General and administrative

|

—

|

|

—

|

|

—

|

|

—

|

|

146.8

|

|

146.8

|

|

|||||||||||

|

Operating income (loss)

|

$

|

1,191.4

|

|

$

|

678.6

|

|

$

|

16.6

|

|

$

|

1,886.6

|

|

$

|

(153.3

|

)

|

$

|

1,733.3

|

|

|||||

|

2015

|

2014

|

2013

|

|||||||||

|

Interest income

|

$

|

9.9

|

|

$

|

13.0

|

|

$

|

16.6

|

|

||

|

Interest expense, net:

|

|||||||||||

|

Interest expense

|

(303.7

|

)

|

(239.6

|

)

|

(226.5

|

)

|

|||||

|

Capitalized interest

|

87.4

|

|

78.2

|

|

67.7

|

|

|||||

|

|

(216.3

|

)

|

(161.4

|

)

|

(158.8

|

)

|

|||||

|

Other, net

|

(21.3

|

)

|

.5

|

|

42.1

|

|

|||||

|

|

$

|

(227.7

|

)

|

$

|

(147.9

|

)

|

$

|

(100.1

|

)

|

||

|

Rig

(3)

|

Date of Rig Sale

|

Segment

(1)

|

Net Proceeds

|

Net Book Value

(2)

|

Pre-tax(Loss)/Gain

|

|||||||||||

|

ENSCO 5001

|

December 2015

|

Floaters

|

$

|

2.4

|

|

$

|

2.5

|

|

$

|

(.1

|

)

|

|||||

|

ENSCO 5002

|

June 2015

|

Floaters

|

1.6

|

|

—

|

|

1.6

|

|

||||||||

|

ENSCO 5000

|

December 2014

|

Floaters

|

1.3

|

|

.5

|

|

.8

|

|

||||||||

|

ENSCO 93

|

September 2014

|

Jackups

|

51.7

|

|

52.9

|

|

(1.2

|

)

|

||||||||

|

ENSCO 85

|

April 2014

|

Jackups

|

64.4

|

|

54.1

|

|

10.3

|

|

||||||||

|

ENSCO 69 & Pride Wisconsin

|

January 2014

|

Jackups

|

32.2

|

|

8.6

|

|

23.6

|

|

||||||||

|

Pride Pennsylvania

|

March 2013

|

Jackups

|

15.5

|

|

15.7

|

|

(.2

|

)

|

||||||||

|

|

$

|

169.1

|

|

$

|

134.3

|

|

$

|

34.8

|

|

|||||||

|

2015

|

2014

|

2013

|

||||||||||

|

Revenues

|

$

|

19.5

|

|

$

|

325.0

|

|

$

|

596.4

|

|

|||

|

Operating expenses

|

39.5

|

|

372.0

|

|

577.6

|

|

||||||

|

Operating (loss) income

|

(20.0

|

)

|

(47.0

|

)

|

18.8

|

|

||||||

|

Other income

|

—

|

|

—

|

|

.3

|

|

||||||

|

Income tax benefit (expense)

|

7.7

|

|

(30.7

|

)

|

(20.2

|

)

|

||||||

|

Loss on impairment, net

|

(120.6

|

)

|

(1,158.8

|

)

|

—

|

|

||||||

|

Gain (loss) on disposal of discontinued operations, net

|

4.3

|

|

37.3

|

|

(1.1

|

)

|

||||||

|

Loss from discontinued operations

|

$

|

(128.6

|

)

|

$

|

(1,199.2

|

)

|

$

|

(2.2

|

)

|

|||

|

2015

|

2014

|

2013

|

||||||||||

|

Cash flows from operating activities of continuing operations

|

$

|

1,697.9

|

|

$

|

2,057.9

|

|

$

|

1,811.2

|

|

|||

|

Capital expenditures on continuing operations:

|

|

|

|

|

|

|

||||||

|

New rig construction

|

$

|

1,238.8

|

|

$

|

699.5

|

|

$

|

1,282.5

|

|

|||

|

Rig enhancements

|

164.5

|

|

537.4

|

|

239.0

|

|

||||||

|

Minor upgrades and improvements

|

216.2

|

|

329.8

|

|

242.0

|

|

||||||

|

|

$

|

1,619.5

|

|

$

|

1,566.7

|

|

$

|

1,763.5

|

|

|||

|

2015

|

2014

|

2013

|

|||||||||

|

Total debt

|

$

|

5,895.1

|

|

$

|

5,920.4

|

|

$

|

4,766.4

|

|

||

|

Total capital

*

|

12,408.0

|

|

14,135.4

|

|

17,558.0

|

|

|||||

|

Total debt to total capital

|

47.5

|

%

|

41.9

|

%

|

27.1

|

%

|

|||||

|

|

Payments due by period

|

||||||||||||||||||

|

2016

|

2017

and

2018

|

2019

and

2020

|

Thereafter

|

Total

|

|||||||||||||||

|

Principal payments on long-term debt

|

$

|

—

|

|

$

|

—

|

|

$

|

1,400.0

|

|

$

|

4,300.0

|

|

$

|

5,700.0

|

|

||||

|

Interest payments on long-term debt

|

332.8

|

|

665.5

|

|

601.8

|

|

2,244.2

|

|

3,844.3

|

|

|||||||||

|

New rig construction agreements

|

169.6

|

|

535.4

|

|

—

|

|

—

|

|

$

|

705.0

|

|

||||||||

|

Operating leases

|

45.3

|

|

30.3

|

|

20.7

|

|

53.4

|

|

149.7

|

|

|||||||||

|

Derivative instruments

|

21.6

|

|

1.5

|

|

—

|

|

—

|

|

23.1

|

|

|||||||||

|

Total contractual obligations

(1)

|

$

|

569.3

|

|

$

|

1,232.7

|

|

$

|

2,022.5

|

|

$

|

6,597.6

|

|

$

|

10,422.1

|

|

||||

|

(1)

|

Contractual obligations do not include

$171.0 million

of unrecognized tax benefits, inclusive of interest and penalties, included on our consolidated balance sheet as of

December 31, 2015

. We are unable to specify with certainty the future periods in which we may be obligated to settle such amounts.

|

|

Commitment expiration by period

|

|||||||||||||||||||

|

2016

|

2017

and

2018

|

|

2019

and

2020

|

Thereafter

|

Total

|

||||||||||||||