|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2010

|

||

|

OR

|

||

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

Yukon Territory

|

98-0542444

|

|

|

(State of other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

Suite 5, 7961 Shaffer Parkway

|

||

|

Littleton, Colorado

|

80127

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

Common Shares without par value

|

NYSE Amex

|

|

Page

|

|

| 91 | |

|

To Convert Imperial Measurement Units

|

To Metric Measurement Units

|

Multiply by

|

|

Acres

|

Hectares

|

0.4047

|

|

Feet

|

Meters

|

0.3048

|

|

Miles

|

Kilometers

|

1.6093

|

|

Tons (short)

|

Tonnes

|

0.9071

|

|

Gallons

|

Liters

|

3.7850

|

|

Ounces (troy)

|

Grams

|

31.103

|

|

Ounces (troy) per ton (short)

|

Grams per tonne

|

34.286

|

|

|

●

|

proposed use of proceeds from our private placement completed in October 2010;

|

|

|

●

|

estimates of future operating and financial performance;

|

|

|

●

|

potential funding requirements and sources of capital;

|

|

|

●

|

the timing, performance and results of feasibility studies;

|

|

|

●

|

timing, plans and anticipated effects of the proposed transfer of our equity interests in Idaho Holdco (as defined in “Part I – Item 1. Business – Subsequent Events”) in exchange for 35% of the shares of Midas Gold Corp., on a fully diluted basis, following completion of the transaction;

|

|

|

●

|

timing and receipt of required land use, environmental and other permits for the Concordia gold project and timing for completion of drilling and testing programs at the Concordia gold project;

|

|

|

●

|

results of the drilling program and other test results at the Concordia gold project;

|

|

|

●

|

timing and outcome for the amendment to our application for the Change of Forest Land Use Permit (“CUSF”) for the Concordia gold project and the anticipated re-filing of the application with the Mexican Secretariat of the Environment and Natural Resources (“SEMARNAT”);

|

|

|

●

|

our belief that SEMARNAT’s comments on our CUSF application are without legal merit or beyond the scope of SEMARNAT’s legal authority;

|

|

|

●

|

our strategy for advancement of the permitting process for the Concordia gold project including the possible court challenge to SEMARNAT’s notice;

|

|

|

●

|

plans to purchase remaining surface land or obtain rights-of-way required for the Concordia gold project;

|

|

|

●

|

capital and operating cost estimates for the Concordia gold project, and anticipated timing for the commencement of construction at the Concordia gold project;

|

|

|

●

|

plans for evaluation of the Mt. Todd gold project;

|

|

|

●

|

preliminary assessment and preliminary feasibility study results and plans for a definitive feasibility study at the Mt. Todd gold project;

|

|

|

●

|

production estimates and timing for gold production at the Concordia gold project and the Mt. Todd gold project;

|

|

|

●

|

potential for gold production at the Amayapampa gold project, timing and receipt of future payments in connection with the disposal of the Amayapampa gold project and status of legal proceedings in Bolivia;

|

|

|

●

|

future gold prices;

|

|

|

●

|

future business strategy, competitive strengths, goals and expansion and growth of our business;

|

|

|

●

|

our potential status as a producer;

|

|

|

●

|

plans and estimates concerning potential project development, including matters such as schedules, estimated completion dates and estimated capital and operating costs;

|

|

|

●

|

plans and proposed timetables for exploration programs and estimates of exploration expenditures;

|

|

|

●

|

estimates of mineral reserves and mineral resources;

|

|

|

●

|

potential joint venture and partnership strategies in relation to our properties; and

|

|

|

●

|

future share and warrant prices and valuation for the Corporation and for marketable securities held by us.

|

|

|

●

|

our likely status as a PFIC for U.S. federal tax purposes;

|

|

|

●

|

feasibility study results and preliminary assessment results and the estimates on which they are based;

|

|

|

●

|

economic viability of a deposit;

|

|

|

●

|

anticipated consequences of the transactions (the “Combination”) contemplated by the Combination Agreement (as defined in “Part I – Item 1. Business – Subsequent Events”);

|

|

|

●

|

our ability to complete the proposed Combination (including obtaining any shareholder or other third party approvals);

|

|

|

●

|

delays in commencement of construction on the Concordia gold project;

|

|

|

●

|

status of our required governmental permits for the Concordia gold project;

|

|

|

●

|

the amendment and re-filing of our CUSF application and the uncertainty regarding SEMARNAT’s review of our amended CUSF application;

|

|

|

●

|

uncertainty regarding potential court action against SEMARNAT in relation to the dismissal of our CUSF application and risks related to the outcome of such court action, including failure to receive approval of the CUSF application, uncertainty regarding our legal challenges to SEMARNAT’s issues with our CUSF application and SEMARNAT’s authority in reviewing our CUSF application;

|

|

|

●

|

political factors influencing the approval of our CUSF application;

|

|

|

●

|

possible impairment or write-down of the carrying value of the Concordia gold project if the CUSF is not granted;

|

|

|

●

|

increased costs that affect our financial condition;

|

|

|

●

|

a shortage of equipment and supplies;

|

|

|

●

|

whether our acquisition, exploration and development activities will be commercially successful;

|

|

|

●

|

fluctuations in the price of gold;

|

|

|

●

|

inherent hazards of mining exploration, development and operating activities;

|

|

|

●

|

calculation of mineral reserves, mineral resources and mineralized material and the fluctuations thereto based on metal prices, inherent vulnerability of the ore and recoverability of metal in the mining process;

|

|

|

●

|

environmental regulations to which our exploration and development operations are subject;

|

|

|

●

|

our receipt of future payments in connection with our disposal of the Amayapampa gold project;

|

|

|

●

|

intense competition in the mining industry;

|

|

|

●

|

our potential inability to raise additional capital on favorable terms, if at all;

|

|

|

●

|

conflicts of interest of some of our directors as a result of their involvement with other natural resource companies;

|

|

|

●

|

potential challenges to our title to our mineral properties;

|

|

|

●

|

political and economic instability in Mexico and Indonesia;

|

|

|

●

|

fluctuation in foreign currency values;

|

|

|

●

|

trading price of our securities and our ability to raise funds in new share offerings due to future sales of our Common Shares in the public or private market and our ability to raise funds from the exercise of our Warrants;

|

|

|

●

|

difficulty in bringing actions or enforcing judgments against us and certain of our directors or officers outside of the United States;

|

|

|

●

|

acquisitions and integration issues;

|

|

|

●

|

potential negative impact of the issuance of additional Common Shares on the trading price of our securities;

|

|

|

●

|

fluctuation in the price of our securities;

|

|

|

●

|

the lack of dividend payments by us;

|

|

|

●

|

future joint ventures and partnerships relating to our properties;

|

|

|

●

|

our lack of recent production and limited experience in producing;

|

|

|

●

|

reclamation liabilities, including reclamation requirements at the Mt. Todd gold project;

|

|

|

●

|

our historical losses from operations;

|

|

|

●

|

historical production not being indicative of potential future production;

|

|

|

●

|

water supply issues;

|

|

|

●

|

governmental authorizations and permits;

|

|

|

●

|

environmental lawsuits;

|

|

|

●

|

lack of adequate insurance to cover potential liabilities;

|

|

|

●

|

our ability to retain and hire key personnel;

|

|

|

●

|

recent market events and conditions; and

|

|

|

●

|

general economic conditions.

|

|

Executive Office

|

Registered and Records Office

|

|

Suite 5 - 7961 Shaffer Parkway

Littleton, Colorado, USA 80127

Telephone: (720) 981-1185

Facsimile: (720) 981-1186

|

200 - 204 Lambert Street

Whitehorse, Yukon Territory, Canada Y1A 3T2

Telephone: (867) 667-7600

Facsimile: (867) 667-7885

|

|

|

·

|

On December 7, 2010, we announced that we entered into a letter of intent with Midas Gold, Inc., a privately held company based in Spokane Valley, Washington (“Midas”), for the combination of the respective holdings of Vista Gold and Midas in the Yellow Pine – Stibnite Mining District located in Valley County, Idaho. See section heading “Item 2. Properties – Yellow Pine, Idaho” below.

|

|

|

·

|

On October 22, 2010, we announced that we had closed our private placement of Special Warrants. We issued an aggregate of 14,666,739 Special Warrants for gross proceeds of approximately $33.7 million. The proceeds from the financing were placed into an escrow account and, upon receipt of approval of the private placement of Special Warrants by our shareholders on December 15, 2010, were released to us.

|

|

|

·

|

In 2010, we undertook two drilling programs consisting of 15 core holes and six reverse circulation drill holes totaling 9,017 meters at the Batman deposit at our Mt. Todd gold project designed to add resources through in-fill drilling, test possible extensions and to provide core for metallurgical testing. See the section heading “Item 2. Properties – Mt. Todd, Northern Territory, Australia” below.

|

|

|

·

|

On September 8, 2010, we announced a mineral resource estimate for the Quigleys deposit at our Mt. Todd gold project. See the section heading “Item 2. Properties – Mt. Todd, Northern Territory, Australia” below.

|

|

|

·

|

On September 7, 2010, we announced that we had changed the name of our wholly-owned Paredones Amarillos gold project to the Concordia gold project (“Concordia” means “agreement” or “oneness”). We believe this will better reflect the integration of the project with the environmental, social and economic priorities of the region. See the section heading “Item 2. Properties – Concordia (formerly Paredones Amarillos) gold project, Baja California Sur, Mexico” below.

|

|

|

·

|

On August 8, 2010, we announced the positive results of a preliminary feasibility study (“PFS”) for the Batman

|

|

|

deposit at Mt. Todd. The PFS was constrained to consider tailings from mineral reserves that could be accommodated by the existing tailings storage capacity of 60 million tonnes. See the section heading “Item 2. Properties – Mt. Todd, Northern Territory, Australia” below.

|

|

|

·

|

On July 19, 2010, we announced an update on the Concordia gold project concerning the status of our CUSF application, technical programs in progress, and a general overview of the development of the project. See the section heading “Item 2. Properties – Concordia (formerly Paredones Amarillos) gold project, Baja California Sur, Mexico” below.

|

|

|

·

|

On June 29, 2010, we announced that we were testing four new exploration targets identified by us at our Mt. Todd gold project through additional soil and rock-chip sampling and testing, followed, where appropriate, by drilling. Four core holes were completed at one target prior to the onset of the wet season. See the section heading “Item 2. Properties – Mt. Todd, Northern Territory, Australia” below.

|

|

|

·

|

On May 20, 2010, we entered into a Notes Repurchase Agreement whereby we agreed to repurchase Notes in the principal amount of $5.667 million and interest payable through maturity of $0.7 million. See Item 7. Consolidated Financial Statements – Note 7.

|

|

|

·

|

On February 19, 2010, we announced that SEMARNAT had dismissed our application on administrative grounds for the CUSF at the Concordia (formerly Paredones Amarillos) gold project. We have been aggressively trying to rectify this turn of events and hope to be in a position to submit a new CUSF application. The timing for completion of these types of bureaucratic processes is uncertain and at this time it is not possible to provide an estimate of timing for the filing of the new CUSF application.. See the section heading “Item 2. Properties – Concordia (formerly Paredones Amarillos) gold project, Baja California Sur, Mexico” below.

|

|

|

·

|

Vista US will: (a) organize Idaho Gold Holding Company, as a wholly-owned Idaho corporation (“Idaho Holdco”); (b) contribute its equity interests in Idaho Gold to Idaho Holdco; and (c) at closing, contribute all of the issued and outstanding shares of common stock of Idaho Holdco to Midas Canada as a capital contribution, in exchange for that number of Midas Gold Shares equal to, on a fully diluted basis, thirty-five percent (35%) of the Midas Gold Shares that are issued and outstanding at the time the transactions specified in the Combination Agreement and the Plan of Exchange are completed;

|

|

|

·

|

The shareholders of Midas, other than any dissenting shareholders, will contribute their Midas Shares to Midas Gold in exchange for that number of Midas Gold Shares equal to, on a fully diluted basis, sixty-five percent (65%) of the Midas Gold Shares that are issued and outstanding at the time the transactions specified in the Combination Agreement and the Plan of Share Exchange are completed; and

|

|

|

·

|

The holders of Midas Options will exchange their Midas Options for Midas Gold Options of like tenor. Additionally, as a condition to closing the Combination, Vista US and each officer, director, and holder of 5% or greater of the Midas Shares (the “Midas Affiliates”) have entered into lock up agreements (the “Lock Up Agreements”) and voting support agreements (the “Voting Agreements”). Pursuant to the Lock Up Agreements, Vista US and each of the Midas Affiliates have agreed that their respective Midas Canada Shares will not be transferable except in specific circumstances and for a specific period of time. Pursuant to the Voting Agreements, Vista US has, amongst other items, agreed, for a specified period of time, to vote in favor of the nominees to the Midas Canada board of directors as designated by the nominating and corporate governance committee, or similar committee, of Midas Canada and the Midas Affiliates have, amongst other items, agreed, for a specified period of time, to vote in favor of the Combination and for the nominee to the Midas Canada board of directors as designated by Vista US.\

|

|

Year

|

High

|

Low

|

Average

|

|||||||||

|

2006

|

725 | 525 | 603 | |||||||||

|

2007

|

841 | 608 | 695 | |||||||||

|

2008

|

1,011 | 713 | 872 | |||||||||

|

2009

|

1,213 | 810 | 972 | |||||||||

|

2010

|

1,421 | 1,058 | 1,225 | |||||||||

|

2011 (to March 11)

|

1,437 | 1,319 | 1,375 | |||||||||

|

|

Data Source:

www.kitco.com

|

|

|

·

|

material events in our business;

|

|

|

·

|

trends in the gold mining industry and the markets in which we operate;

|

|

|

·

|

changes in the price of gold;

|

|

|

·

|

changes in financial estimates and recommendations by securities analysts;

|

|

|

·

|

acquisitions and financings;

|

|

|

·

|

global and regional political and economic conditions and other factors;

|

|

|

·

|

general stock market conditions;

|

|

|

·

|

the operating and share performance of other companies that investors may deem comparable to us; and

|

|

|

·

|

purchase or sales of blocks of our Common Shares or Warrants.

|

|

|

·

|

the timing and cost, which are considerable, of the construction of mining and processing facilities;

|

|

|

·

|

the ability to find sufficient gold reserves to support a profitable mining operation;

|

|

|

·

|

the availability and costs of skilled labor and mining equipment;

|

|

|

·

|

compliance with environmental and other governmental approval and permit requirements;

|

|

|

·

|

the availability of funds to finance construction and development activities;

|

|

|

·

|

potential opposition from non-governmental organizations, environmental groups, local groups or local inhabitants which may delay or prevent development activities; and

|

|

|

·

|

potential increases in construction and operating costs due to changes in the cost of fuel, power, materials and supplies.

|

We have a history of losses and may incur losses in the future.

|

|

·

|

approximately $10 million for the year ended December 31, 2010;

|

|

|

·

|

approximately $2 million for the year ended December 31, 2009; and

|

|

|

·

|

approximately $10 million for the year ended December 31, 2008.

|

There may be challenges to our title in our mineral properties.

|

|

·

|

to enforce in courts outside the United States judgments obtained in United States courts based upon the civil liability provisions of United States federal securities laws against these persons and us; or

|

|

|

·

|

to bring in courts outside the United States an original action to enforce liabilities based upon United States federal securities laws against these persons and us.

|

|

|

·

|

“Measured mineral resources” and “indicated mineral resources”—

we advise U.S. investors that while these terms are recognized and required by Canadian regulations, these terms are not defined in SEC Industry Guide 7 and the SEC does not normally permit such terms to be used in reports and registration statements filed with the SEC.

U.S. investors are cautioned not to assume that any part or all of the mineral deposits in these categories will ever be converted into reserves.

|

|

|

·

|

“Inferred mineral resources”—

we advise U.S. investors that while this term is recognized by Canadian regulations, the SEC does not recognize it. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits an issuer to report mineralization that does not constitute “reserves” only as in-place tonnage and grade without reference to unit measures.

U.S. investors are cautioned not to assume that any part or all of an inferred mineral resource exists or is economically or legally minable.

|

|

|

·

|

“Proven mineral reserves” and “probable mineral reserves”—

The definitions of proven and probable mineral reserves used in NI 43-101 differ from the definitions for “proven reserves” and “probable reserves” as found in SEC Industry Guide 7. Accordingly, Vista Gold’s disclosure of mineral reserves herein may not be compatible to information from U.S. companies subject to reporting and disclosure requirements of the SEC.

|

|

|

(i)

|

“Feasibility Study Update, NI 43-101 Technical Report, Vista Gold Corp., Paredones Amarillos Gold Project, Baja California Sur, Mexico” dated September 1, 2009 prepared by or under the supervision of Terry Braun of SRK Consulting (US), Inc., Steven Ristorcelli and Thomas Dyer of Mine Development Associates Inc. and David Kidd of Golder Associates Inc., each an independent qualified person;

|

|

|

(ii)

|

“Mt. Todd Gold Project Updated Preliminary Economic Assessment Report, Northern Territory, Australia” dated June 11, 2009 prepared by or under the supervision of Mr. John Rozelle of Tetra Tech MM, Inc., an independent qualified person;

|

|

|

(iii)

|

“Mt. Todd Gold Project Prefeasibility Study, Northern Territory, Australia” dated October 1, 2010 prepared by or under the supervision of Mr. John Rozelle of Tetra Tech MM, Inc., and Mr. Thomas Dyer of Mine Development Associates Inc., each an independent qualified person;

|

|

|

(iv)

|

"10.65 MTPY Preliminary Feasibility Study, Mt. Todd Gold Project, Northern Territory, Australia" dated January 28, 2011 prepared by or under the supervision of Mr. John Rozelle of Tetra Tech MM, Inc., and Mr. Thomas Dyer of Mine Development Associates Inc., each and independent qualified person;

|

|

|

(v)

|

“CNI 43-101 Technical Report, Preliminary Assessment of the Yellow Pine Project, Yellow Pine, Idaho” dated December 13, 2006 prepared by or under the supervision of Mr. Richard Lambert and Mr. Barton Stone of Pincock, Allen & Holt, each an independent qualified person;

|

|

|

(vi)

|

“Technical Report for the Guadalupe de los Reyes Gold-Silver Project, Sinaloa, Mexico” dated August 12, 2009 and amended and restated on December 8, 2009 prepared by or under the supervision of Mr. Leonel Lopez of Pincock, Allen & Holt, an independent qualified person;

|

|

|

(vii)

|

“Technical Report, Preliminary Assessment, Long Valley Project, Mono County, California, USA” dated January 9, 2008 prepared by or under the supervision of Mr. Neil Prenn and Mr. Thomas Dyer of Mine Development Associates, each an independent qualified person; and

|

|

|

(viii)

|

“Preliminary Assessment, Awak Mas Gold Project, Sulawesi, Indonesia” dated January 16, 2008 prepared by or under the supervision of Mr. John Rozelle of Gustavson Associates, LLC, an independent qualified person.

|

The technical information has been updated with current information where applicable.

|

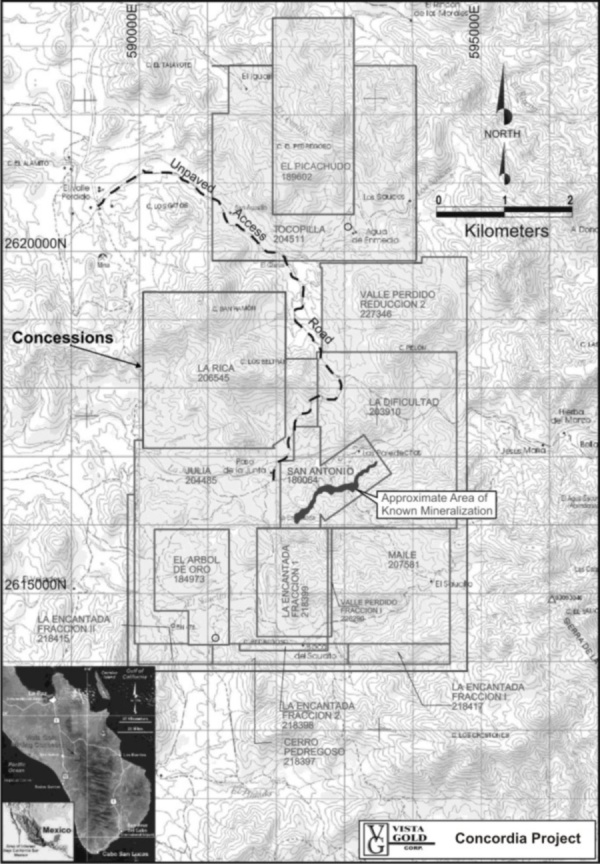

Project is centered at approximately UTM coordinates 592500E, 2618000N (NAD27)

All concessions are located on INEGI official map number F12B23

|

|||||

|

Concession Name

|

Serial

Number

|

Surface Area

(hectares)

|

Location

Date

|

Expiration

Date

|

Annual Fees

(in Mexican Pesos, “MP”)

|

|

San Antonio

|

180064

|

151.3647

|

3/23/1987

|

3/22/2037

|

30,512

|

|

El Arbol De Oro

|

184973

|

162.0000

|

12/13/1989

|

12/12/2039

|

32,656

|

|

El Picachudo

|

189602

|

348.0000

|

12/5/1990

|

12/4/2040

|

70,150

|

|

La Dificultad

|

203910

|

454.0218

|

11/5/1996

|

11/4/2046

|

91,522

|

|

Julia

|

204485

|

469.4073

|

2/21/1997

|

2/20/2047

|

94,624

|

|

Tocopilla

|

204511

|

582.4949

|

2/28/1997

|

2/27/2047

|

117,420

|

|

La Rica

|

206545

|

481.1593

|

1/23/1998

|

1/22/2048

|

96,992

|

|

Maile

|

207581

|

296.9883

|

6/30/1998

|

6/29/2048

|

59,866

|

|

Cerro Pedregoso

|

218397

|

46.6493

|

11/5/2002

|

11/4/2052

|

1,328

|

|

La Encantada Fracc. 2

|

218398

|

12.9992

|

11/5/2002

|

11/4/2052

|

370

|

|

La Encantada Fracc. 1

|

218399

|

166.2248

|

11/5/2002

|

11/4/2052

|

4,734

|

|

La Encantada Fracc. II

|

218415

|

32.4883

|

11/5/2002

|

11/4/2052

|

926

|

|

La Encantada Fracc. I

|

218417

|

44.9991

|

11/5/2002

|

11/4/2052

|

1,282

|

|

Valle Perdido Fracc. I

|

226290

|

9.7752

|

12/6/2005

|

12/5/2055

|

134

|

|

Valle Perdido Reduccion 2

|

227346

|

451.5862

|

6/9/2006

|

11/4/2052

|

6,214

|

|

Totals

|

3,710.1584

|

608,730

|

|||

|

15 Concessions

|

Total in US$ @ an exchange rate on 3/11/2011 of = US$1.00 = MP $11.94

|

US$50,982

|

|||

|

Type

|

No. Holes

|

Lengths (meters)

|

|

Combined*

|

4

|

2,182

|

|

Core

|

87

|

14,280

|

|

RC

|

347

|

62,473

|

|

Grand Total

|

438

|

78,934

|

|

Company

|

No. Holes

|

Lengths (meters)

|

|

Baja

|

18

|

1,217

|

|

Echo Bay

|

369

|

73,026

|

|

IMC

|

18

|

957

|

|

Noranda

|

26

|

2,520

|

|

Vista Gold

|

7

|

1,215

|

|

Grand Total

|

438

|

78,934

|

|

Year

|

No. Holes

|

Lengths (meters)

|

|

1974

|

26

|

2,520

|

|

1984

|

9

|

655

|

|

1985

|

9

|

302

|

|

1991

|

18

|

1,217

|

|

1994

|

82

|

15,890

|

|

1995

|

119

|

26,146

|

|

1996

|

127

|

24,724

|

|

1997

|

41

|

6,266

|

|

2005

|

7

|

1,215

|

|

Grand Total

|

438

|

78,934

|

|

Used/Not Used in Database

|

No. Holes

|

Lengths (meters)

|

|

Historic (not used)

|

44

|

3,477

|

|

Outside the area (not used)

|

7

|

1,215

|

|

Database (used)

|

387

|

74,242

|

|

Grand Total

|

438

|

78,934

|

|

Reserve Classification

|

Tonnes (x1000)

|

Average Gold Grade (grams/tonne)

|

|

Proven

(1)

|

7,147

|

1.17

|

|

Probable

(1)

|

30,801

|

1.06

|

|

Proven & Probable

(1)

|

37,948

|

1.08

|

|

|

(1)

|

Mineral reserves are reported separately from mineral resources.

|

|

|

(2)

|

Cautionary Note to U.S. Investors

: Proven and Probable Mineral Reserves as described in this table are based on Canadian definitions under NI 43-101. See the section heading

“

Cautionary Note to United States Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves” above.

|

|

|

(3)

|

See the section heading “Item 1A. Risk Factors” in this annual report.

|

|

Gold Price Scenario

|

IRR

|

Pre- Tax NPV

5

($)

|

|

Base Case Gold Price Profile ($850 first three years and $725 for the remainder, production- weighted average $771)

|

24.7% pre-tax

19.6% after tax

|

$150,000,000

|

|

Fixed $950 Gold Price

|

37.8% pre-tax

31.0% after tax

|

$303,000,000

|

Preliminary Project Design, Permitting Support and Other Activities

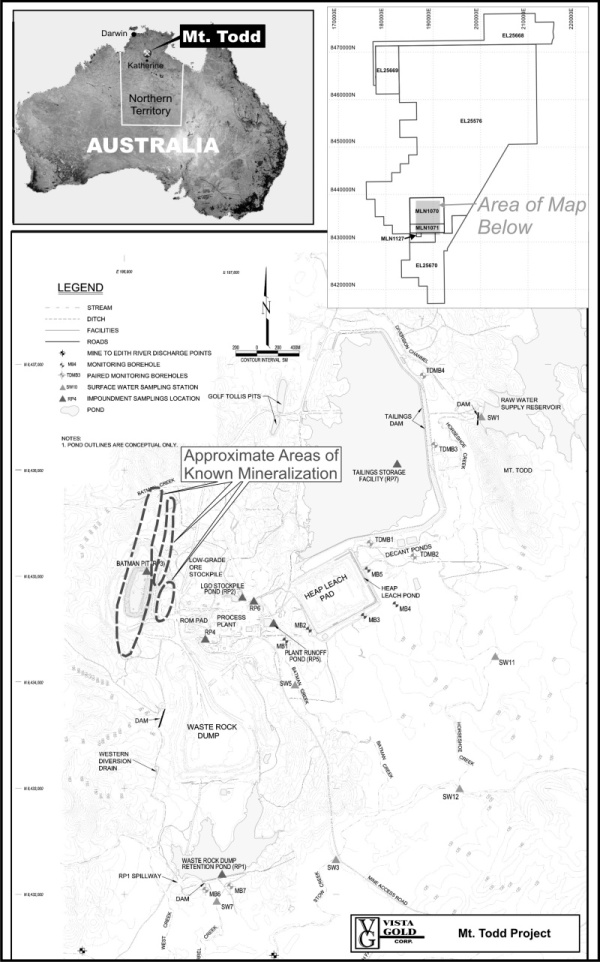

|

License

Name

|

Serial

Number

|

Federal

Claim Type

|

Surface

Area

(hectares)

|

Location

Description

(UTM)

|

Location

Date

|

Expiration

Date

|

Estimated

Holding

Requirements

Annual Rent

including

GST

(Australian

Dollars)

|

Annual

Work

Requirement

(Australian

Dollars)

|

Annual

Reports

Due

|

|

Mining Licenses:

|

|||||||||

|

MLN 1070

|

MLN 1070

|

Mining License

|

3,982

|

Mining

License Block

|

March 5, 1993

|

March 4, 2018

|

$43,802 (due March 4)

|

N/A

|

June 4

|

|

|

|||||||||

|

MLN 1071

|

MLN 1071

|

Mining License

|

1,327

|

centered at approximately

|

March 5, 1993

|

March 4, 2018

|

$14,597 (due March 4)

|

N/A

|

June 4

|

|

|

|||||||||

|

MLN 1127

|

MLN 1127

|

Mining License

|

80

|

188555E,

435665N

|

March 5, 1993

|

March 4, 2018

|

$880 (due March 4)

|

N/A

|

June 4

|

|

Subtotals

|

5,389

|

AUD$59,279

|

AUD$0

|

||||||

|

Exploration Licenses:

|

|||||||||

|

EL 25576

|

EL 25576

|

Exploration License

|

91,240

|

Centered at approximately 192557E, 8446405N

|

March 15, 2007

|

March 14, 2013

|

$6,732 (due March 14)

|

$200,000

|

April 14

|

|

EL 25668

|

EL 25668

|

Exploration License

|

11,410

|

Centered at approximately 199000E, 8463964N

|

March 17, 2007

|

March 16, 2013

|

$1,122 (due August 16)

|

30,000

|

September 16

|

|

EL 25669

|

EL 25669

|

Exploration License

|

4,972

|

Centered at approximately 178272E, 8457220N

|

March 15, 2007

|

March 14, 2013

|

$396 (due March 14)

|

20,000

|

April 14

|

|

EL 25670

|

EL 25670

|

Exploration License

|

10,010

|

Centered at approximately 185445E, 8424349N

|

March 15, 2007

|

March 15, 2013

|

$748 (due March 14)

|

20,000

|

April 14

|

|

Subtotals

|

117,632

|

AUD$8,998

|

AUD$270,000

|

||||||

|

Totals A$

|

Total = AUD$68,277

|

Total = AUD$270,000

|

|||||||

|

Totals US$

|

Total in US$ @ an exchange rate on 3/11/2011 of US$1.00 = AUD$0.99 = US$68,544

|

Total in US$ @ an exchange rate on 3/11/2011 of US$1.00 = AUD$0.99 = US$271,256

|

|||||||

|

Grand Totals

|

3 Mining Licenses, 4 Exploration Licenses

|

123,021

hectares

|

US$339,800

|

Surface use rights have been negotiated with the JAAC and are part of that agreement (see discussion above). There is sufficient space on these lands for all necessary facilities including processing plant, tailings disposal and waste dump areas.

|

1986

October 1986 –

January 1987:

|

Conceptual Studies, Australia Gold PTY LTD (a subsidiary of BHP Billiton Limited);

Regional Screening; (Higgins), Ground Acquisition by Zapopan N.L. (“Zapopan”).

|

|

1987

February:

June-July:

October:

|

Joint Venture finalized between Zapopan and Billiton. Geological Reconnaissance, Regional

BCL, stream sediment sampling.

Follow-up BCL stream sediment sampling, rock chip sampling and geological mapping (Geonorth)

|

|

1988

Feb-March:

March-April:

May:

May-June:

July:

July-Dec:

|

Data reassessment (Truelove)

Gridding, BCL grid soil sampling, grid based rock chip sampling and geological mapping (Truelove)

Percussion drilling Batman (Truelove) - (BP1-17, 1,475m percussion)

Follow-up BCL soil and rock chip sampling (Ruxton, Mackay)

Percussion drilling Robin (Truelove, Mackay) - RP1-14, (1,584m percussion)

Batman diamond, percussion and RC drilling (Kenny, Wegmann, Fuccenecco) - BP18-70, (6,263m percussion); BD1-71, (85,62m Diamond); BP71-100, (3,065m R.C.)

|

|

1989

Feb-June:

June:

July-Dec:

|

Batman diamond and RC drilling: BD72-85 (5,060m diamond); BP101-208, (8072m RC). Penguin, Regatta, Golf, Tollis Reef Exploration Drilling: PP1-8, PD1, RGP132, GP1-8, BP108, TP1-7 (202m diamond, 3090m RC); TR1-159 (501m RAB).

Mining lease application (MLA's 1070, 1071) lodged.

Resource Estimates; mining-related studies; Batman EM-drilling: BD12, BD8690 (1,375m diamond); RC pre-collars and H/W drilling, BP209-220 (1,320m RC); Exploration EM and exploration drilling: Tollis, Quigleys, TP9, TD1, QP1-3, QD1-4 (1,141 diamond, 278m RC); Negative Exploration Tailings Dam: E1-16 (318m RC); DR1-144 (701m RAB) (Kenny, Wegmann, Fuccenecco, Gibbs).

|

|

1990

Jan-March:

|

Pre-feasibility related studies; Batman Inclined Infill RC drilling: BP222-239 (2,370m RC); Tollis RC drilling, TP10-25 (1,080m RC). (Kenny, Wegmann, Fuccenecco, Gibbs)

|

|

1993 - 1997

Pegasus Gold Australia Pty Ltd.

|

Pegasus reported investing more than US$200 million in the development of the Mt Todd mine and operated it from 1993 to 1997, when the project closed as a result of technical difficulties and low gold prices. The deed administrators were appointed in 1997 and sold the mine in March 1999 to a joint venture comprised of Multiplex Resources Pty Ltd. and General Gold Resources Ltd.

|

|

1999 - 2000

March - June

|

Operated by a joint venture comprised of Multiplex Resources Pty Ltd. and General Gold Resources Ltd. Operations ceased in July 2000, Pegasus, through the Deed Administrators, regained possession of various parts of the mine assets in order to recoup the balance of purchase price owed it. Most of the equipment was sold in June 2001 and removed from the mine. The tailings facility and raw water facilities still remain at the site.

|

|

2000 – 2006

|

The Deed Administrators, Pegasus, the government of the Northern Territory and the JAAC held the property.

|

|

2006

March

|

Vista Gold Corp. acquired concession rights from the Deed Administrators, surface use rights from the JAAC and entered into a contract with the Government of the Northern Territory of Australia.

|

|

|

·

|

one-meter intervals were marked out on the core by a member of the geologic staff;

|

|

|

·

|

geotechnical logging was done in accordance with the instructions received from SRK;

|

|

|

·

|

geologic logging was then done by a member of the geologic staff. Assay intervals were selected at this time and a cut line marked on the core. The standard sample interval was one meter. During the early part of the program some flexibility was allowed for portions of the core that were not expected to return significant values based on visual inspection. These portions of the core were sampled in two meter intervals. This was discontinued when numerous greater than one part per million assays were received from the two meter intervals;

|

|

|

·

|

blind sample numbers were then assigned and sample tickets prepared. Duplicate sample tickets were placed in the core tray at the appropriate locations; and

|

|

|

·

|

each core tray was photographed and restacked on pallets pending sample cutting.

|

|

Reserves and Production Estimates at $950 per gold ounce

|

|

|

Proven and Probable Mineral Reserves (at a 0.55 grams gold per tonne cut-off)*

|

60,049,000 tonnes

at 1.05 grams gold per tonne

|

|

Life of Mine Production

|

1,662,000 gold ounces

|

|

Average Annual Production (based on 8.86 year mine life)

|

187,500 gold ounces per year

|

|

Mining Rate (ore plus waste)

|

22,900,000 tonnes per year

|

|

Mill Throughput Rate

|

18,500 tonnes per day

|

|

Stripping Ratio (waste:ore)

|

2.37

|

|

Mine Life

|

8.86 years

|

|

$950 per gold ounce & $0.85/A$1.00

|

$1,200 per gold ounce & $0.90/A$1.00

|

|

|

Average Cash Operating Cost ($ per gold ounce produced)

|

$476

|

$493

|

|

Average Total Cash Production Costs ($ per gold ounce produced)

|

$487

|

$507

|

|

Pre-Production Capital Cost:

|

$441,258,000

|

$459,820,000

|

|

Sustaining Capital Cost:

|

$32,981,000

|

$32,981,000

|

|

Internal Rate of Return

|

14.9% before tax

9.8% after tax

|

25.4% before tax

16.2% after tax

|

|

Cumulative Cash Flow (pre-tax)

|

$472,615,000

|

$848,724,000

|

|

Net Present Value at 5% discount (pre-tax)

|

$210,144,000

|

$487,156,000

|

|

Reserve Classification

|

Tonnes

|

Average Gold Grade

(grams gold per tonne)

|

|

Proven

(1,2, 3)

|

24,458,000

|

1.09

|

|

Probable

(1, 2, 3)

|

35,592,000

|

1.02

|

|

Proven & Probable

(1,2 3)

|

60,050,000

|

1.05

|

|

|

(1)

|

Mineral reserves are reported separately from mineral resources.

|

|

|

(2)

|

Cautionary Note to U.S. Investors

: Proven and Probable Mineral Reserves as described in this table are based on Canadian definitions under NI 43-101. These Reserves are based on a pre-feasibility study. Reserves for SEC Industry Guide 7 purposes require definitive or “final” feasibility study. See the section heading

“

Cautionary Note to United States Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves” above.

|

|

|

(3)

|

See the section heading “Item 1A. Risk Factors” in this annual report.

|

|

|

·

|

Ore hardness - the plant built by the previous operator was poorly designed to handle the hard ore and failed to produce a satisfactory product or achieve design capacity. We tested and determined the expected ore hardness and then evaluated various combinations of equipment. The best combination of equipment involved primary and secondary crushing, tertiary crushing employing high pressure grinding rolls (“HPGR”) followed by a large ball mill. The use of HPGR is expected to result in a product which significantly improves the efficiency of the grinding circuit. For the base case, the circuit is very simple with a large primary gyratory crusher, a secondary cone crusher, a single HPGR unit and a single ball mill.

HPGR technology is currently being successfully used by Newmont Mining Corporation, at Australia’s largest gold mine, the 20 million ounce Boddington mine in Western Australia

.

The circuit has been designed to reflect the results of leach tests which indicate that the optimum grind size should be 80% passing 100 mesh, coarser than used in previous operations.

|

|

|

·

|

Metallurgy - A number of metallurgical problems were encountered in the past, mostly related to copper minerals in the ore. Our test program focused first on understanding the form and distribution of the copper minerals in the ore body and then on the best metallurgical approach to deal with the copper. In the mineralogical review it became apparent that the form of the copper minerals changes with depth. In the upper part of the ore body, mostly mined out by previous operators, the copper existed mainly as secondary copper minerals such as chalcocite, bornite and covellite; these minerals are very soluble in cyanide which greatly increased the expense of leaching. The remaining ore contains mainly primary copper minerals like chalcopyrite which generally has a very minor effect on leaching and cyanide consumption. The tests we undertook on representative samples of the ore to be mined showed that whole-ore leaching combined with a carbon-in-pulp recovery circuit yields acceptable recoveries of 82%.

|

|

Gold Price Scenario

|

Before Tax

IRR

|

Before Tax

NPV

5%

|

Before Tax

Cumulative Cash Flow

|

|

$950 Gold Price

|

14.9 %

|

$ 210,144,000

|

$ 472,615,000

|

|

$1000 Gold Price

|

17.5 %

|

$ 272,260,000

|

$ 554,865,000

|

|

$1,100 Gold Price

|

22.6 %

|

$ 396,494,000

|

$ 719,366,000

|

|

$1,200 Gold Price

|

25.4 %

|

$ 487,156,000

|

$ 848,724,000

|

|

$1,500 Gold Price

|

39.3 %

|

$ 859,856,000

|

$ 1,342,227,000

|

|

Gold Price Scenario

|

After Tax

IRR

|

After Tax

NPV

5%

|

After Tax

Cumulative Cash Flow

|

|

$950 Gold Price

|

9.8 %

|

$ 71,127,000

|

$ 252,490,000

|

|

$,1,000 Gold Price

|

11.4 %

|

$ 100,497,000

|

$ 207,598,000

|

|

$1,100 Gold Price

|

14.5 %

|

$ 158,192,000

|

$ 359,190,000

|

|

$1,200 Gold Price

|

16.2 %

|

$ 198,827,000

|

$ 418,218,000

|

|

$1,500 Gold Price

|

23.9 %

|

$ 359,612,000

|

$ 624,317,000

|

|

Reserves and Production Estimates at $1,000 per ounce gold

|

|

|

Proven and Probable Mineral Reserves (at a 0.40 grams gold per tonne cut-off)

|

149.9 million tonnes

at 0.85 grams gold per tonne

|

|

Life of Mine Production

|

3,372,000 ounces

|

|

Average Annual Production

|

239,500 gold ounces per year

|

|

Mining Rate

|

29.5 million tonnes per year

|

|

Mill Throughput Rate

|

30,000 tonnes per day

|

|

Stripping Ratio (waste:ore)

|

1.8

|

|

Mine Life

|

14 years

|

|

|

(1)

|

Cautionary Note to U.S. Investors

: Proven and Probable Mineral Reserves as described in this table are based on Canadian definitions under NI 43-101. These Reserves are based on a pre-feasibility study. Reserves for SEC Industry Guide 7 purposes require definitive or “final” feasibility study. See the section heading

“

Cautionary Note to United States Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves” above

|

|

$1,000 per gold ounce & $0.85/AUD$1.00

|

$1,350 per gold ounce & $1.00/AUD$1.00

|

|

|

Average Cash Operating Cost ($ per gold ounce produced)

|

$520

|

$587

|

|

Average Total Cash Production Costs ($ per gold ounce produced)

|

$530

|

$600

|

|

Pre-Production Capital Cost:

|

$589,583,000

|

$675,957,000

|

|

Sustaining Capital Cost:

|

$260,522,000

|

$261,183,000

|

|

Internal Rate of Return

|

13.9% before tax

10.7% after tax

|

23.2% before tax

16.6% after tax

|

|

Cumulative Cash Flow (pre-tax)

|

$964,514,000

|

$1,860,112,000

|

|

Net Present Value at 5% discount (pre-tax)

|

$385,336,000

|

$944,470,000

|

|

Reserve Classification

|

Tonnes

|

Average Gold Grade

(grams gold per tonne)

|

|

Proven

(1,2 and 3)

|

48,961,000

|

0.91

|

|

Probable

(1, 2 and 3)

|

100,914,000

|

0.83

|

|

Proven & Probable

(1,2 and 3)

|

149,875,000

|

0.85

|

|

|

(1)

|

Mineral reserves are reported separately from mineral resources.

|

|

|

(2)

|

Cautionary Note to U.S. Investors

: Proven and Probable Mineral Reserves as described in this table are based on Canadian definitions under NI 43-101. These Reserves are based on a pre-feasibility study. Reserves for SEC Industry Guide 7 purposes require definitive or “final” feasibility study. See the section heading

“

Cautionary Note to United States Investors Regarding Estimates of Measured, Indicated and Inferred Resources and Proven and Probable Reserves” above.

|

|

|

(3)

|

See the section heading “Item 1A. Risk Factors” in this annual report.

|

|

Gold Price Scenario

|

Before Tax

IRR

|

Before Tax

NPV

5%

|

Before Tax

Cumulative Cash Flow

|

|

$1,000 Gold Price

|

13.9 %

|

$ 385,336,000

|

$ 964,514,000

|

|

$1,200 Gold Price

|

17.1 %

|

$ 610,603,000

|

$ 1,359,383,000

|

|

$1,350 Gold Price

|

23.2 %

|

$ 944,470,000

|

$ 1,860,112,000

|

|

$1,500 Gold Price

|

29.1 %

|

$ 1,278,336,000

|

$ 2,360,841,000

|

|

Gold Price Scenario

|

After Tax

IRR

|

After Tax

NPV

5%

|

After Tax

Cumulative Cash Flow

|

|

$1000 Gold Price

|

10.7 %

|

$ 184,312,000

|

$ 584,562,000

|

|

$1200 Gold Price

|

12.4 %

|

$ 284,528,000

|

$ 777,849,000

|

|

$1350 Gold Price

|

16.6 %

|

$ 475,309,000

|

$ 1,059,338,000

|

|

$1500 Gold Price

|

20.6 %

|

$ 664,986,000

|

$ 1,339,945,000

|

|

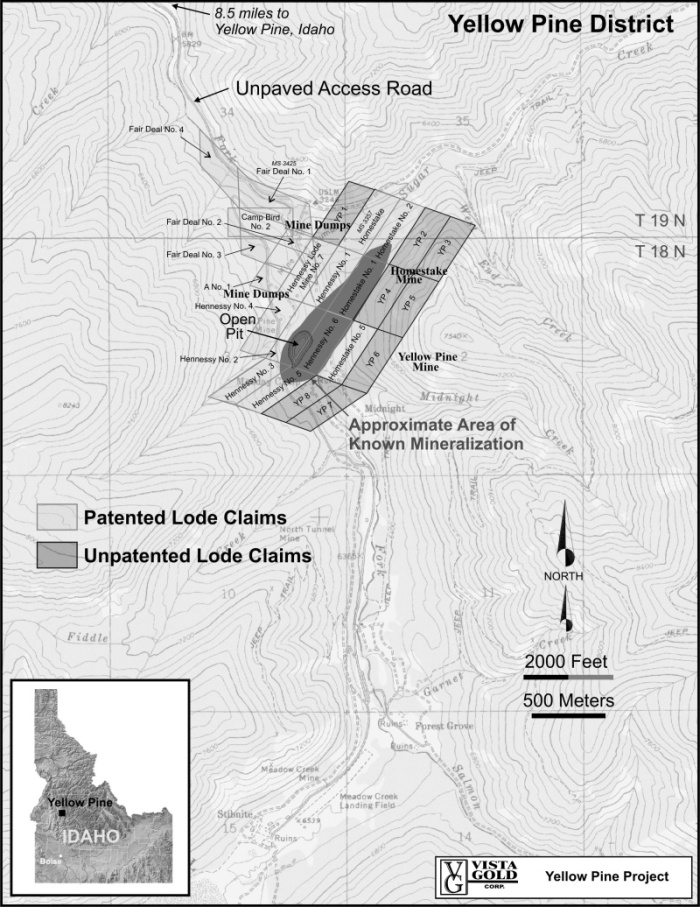

Claim Name

|

Mineral Survey Number

|

Patent Number

|

Federal Claim Type

|

Surface Area (acres)

|

Location Description (Section, Township and Range)

|

Date Patent Recorded

|

Annual Holding Requirements

|

|

Fair Deal No. 1

|

3246

|

1064103

|

Patented Lode Mining Claim

|

Section 34, T19N, R9E, BM

|

6/7/1933

|

None to Vista Gold, Bradley (as defined

|

|

|

|

|||||||

|

Fair Deal No. 2

|

3246

|

1064103

|

Patented Lode Mining Claim

|

Section 34, T19N, R9E, BM

|

6/7/1933

|

below) pays County Property Taxes

|

|

|

|

|||||||

|

Fair Deal No. 3

|

3246

|

1064103

|

Patented Lode Mining Claim

|

81.174

|

Section 3, T18N, R9E, BM

|

6/7/1933

|

|

|

|

|||||||

|

Fair Deal No. 4

|

3246

|

1064103

|

Patented Lode Mining Claim

|

Section 34, T19N, R9E, BM

|

6/7/1933

|

||

|

|

|||||||

|

Camp Bird No. 2

|

3246

|

1064103

|

Patented Lode Mining Claim

|

Section 34, T19N, R9E, BM

|

6/7/1933

|

||

|

|

|||||||

|

A No. 1

|

3246

|

1064103

|

Patented Lode Mining Claim

|

Section 3, T18N, R9E, BM

|

6/7/1933

|

|

|

|

Hennessy No. 1

|

3357

|

1111588

|

Patented Lode Mining Claim

|

218.897

|

Sections 2 & 3, T18N, R9E, BM

|

7/9/1941

|

|

|

|

|||||||

|

Hennessy No. 2

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Section 3, T18N, R9E, BM

|

7/9/1941

|

||

|

|

|||||||

|

Hennessy No. 3

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Section 3, T18N, R9E, BM

|

7/9/1941

|

||

|

|

|||||||

|

Hennessy No. 4

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Section 3, T18N, R9E, BM

|

7/9/1941

|

||

|

|

|||||||

|

Hennessy No. 5

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Section 3, T18N, R9E, BM

|

7/9/1941

|

||

|

|

|||||||

|

Hennessy No. 6

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Sections 2 & 3, T18N, R9E, BM

|

7/9/1941

|

||

|

|

|||||||

|

Hennessy Lode Mine No. 7

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Section 3, T18N, R9E, BM

|

7/9/1941

|

|

Claim Name

|

Mineral Survey Number

|

Patent Number

|

Federal Claim Type

|

Surface Area (acres)

|

Location Description (Section, Township and Range)

|

Date Patent Recorded

|

Annual Holding Requirements

|

|

Homestake

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Section 35, T19N, R9E, BM

|

7/9/1941

|

||

|

|

|||||||

|

Homestake No. 1

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Sections 2 & 3, T18N, R9E, BM

|

7/9/1941

|

||

|

|

|||||||

|

Homestake No. 2

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Section 35, T19N, R9E, BM

|

7/9/1941

|

||

|

|

|||||||

|

Homestake No. 5

|

3357

|

1111588

|

Patented Lode Mining Claim

|

Sections 2 & 3, T18N, R9E, BM

|

7/9/1941

|

||

|

Totals

|

17 Patented Lode Mining Claims

|

300.071

|

$0

|

|

Claim Name

|

Serial Number

|

Federal Claim Type

|

Surface Area (acres)

|

Location Description (Section, Township and Range)

|

Location Date

|

Annual Holding Fee

|

|

YP 1

|

186740

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 34 & 35, T19N, R9E, BM

|

10/15/2003

|

$125.00

|

|

YP 2

|

186741

|

Unpatented Lode Mining Claim

|

20.66

|

Section 2, T18N, R9E, BM

|

10/15/2003

|

$125.00

|

|

YP 3

|

186742

|

Unpatented Lode Mining Claim

|

20.66

|

Section 2, T18N, R9E, BM

|

10/15/2003

|

$125.00

|

|

YP 4

|

186743

|

Unpatented Lode Mining Claim

|

20.66

|

Section 2, T18N, R9E, BM

|

10/15/2003

|

$125.00

|

|

YP 5

|

186744

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 2 & 3, T18N, R9E, BM

|

10/15/2003

|

$125.00

|

|

YP 6

|

186745

|

Unpatented Lode Mining Claim

|

20.66

|

Section 2, T18N, R9E, BM

|

10/15/2003

|

$125.00

|

|

YP 7

|

186746

|

Unpatented Lode Mining Claim

|

20.66

|

Section 2 & 3, T18N, R9E, BM

|

10/15/2003

|

$125.00

|

|

YP 8

|

186747

|

Unpatented Lode Mining Claim

|

20.66

|

Section 3, T18N, R9E, BM

|

10/15/2003

|

$125.00

|

|

Totals

|

8 Unpatented Lode Mining Claims

|

165.28

|

$1,000.00

|

|

Date

|

Company

|

Number of Feet Drilled

|

Type of Drilling

|

|

BMC

|

1933-1952

|

14,500

|

Core

|

|

BMC

|

1933-1952

|

36,000

|

Churn Drill and Rotary

|

|

U.S. Bureau of Mines

|

1939-1941

|

15,800

|

Core

|

|

Ranchers

|

1970-1984

|

16,300

|

Core

|

|

Ranchers

|

1970-1984

|

5,500

|

Reverse Circulation

|

|

Hecla

|

1985-1988

|

21,300

|

Reverse Circulation

|

|

Hecla

|

1989

|

2,200

|

Shallow Reverse Circulation

|

|

Barrick

|

1992

|

11,400

|

Core

|

|

Barrick

|

1992

|

850

|

Reverse Circulation

|

|

Concession Name

|

Serial Number

|

Surface Area (hectares)

|

Location Coordinates UTM (NAD27)

|

(INEGI Official Map No.)

|

Location Date

|

Expiration Date

|

Annual Fees (in Mexican Pesos, “MP”)

|

|

Gaitan Concessions

|

|||||||

|

|

|||||||

|

La Victoria

|

210803

|

199.8708

|

G13C75

|

11/30/1999

|

11/29/2049

|

11,448.60

|

|

|

|

|||||||

|

Prolongación del Recuerdo

|

210497

|

91.4591

|

G13C75

|

10/8/1999

|

10/7/2049

|

5,238.78

|

|

|

|

|||||||

|

Prolongación del Recuerdo Dos

|

209397

|

26.6798

|

G13C75

|

4/9/1999

|

4/8/2049

|

3,055.38

|

|

|

|

|||||||

|

Arcelia Isabel

|

193499

|

60.3723

|

G13C75

|

12/19/1991

|

12/18/2041

|

12,169.84

|

|

|

|

|||||||

|

Dolores

|

180909

|

222.0385

|

G13C75

|

8/6/1987

|

8/5/2012

|

44,758.52

|

|

|

|

|||||||

|

San Luis Concessions:

|

|||||||

|

|

|||||||

|

Los Reyes 8

|

226037

|

9.0000

|

G13C75

|

11/15/2005

|

11/14/2055

|

130

|

|

|

|

|||||||

|

Los Reyes Fracción Oeste

|

210703

|

476.9373

|

G13C75 and G13C85

|

11/18/1999

|

11/17/2049

|

56,278

|

|

|

|

|||||||

|

Los Reyes Fracción Norte

|

212757

|

1,334.4710

|

G13C75

|

11/22/2000

|

10/7/2049

|

78,762

|

|

|

|

|||||||

|

Los Reyes Fracción Sur

|

212758

|

598.0985

|

G13C75

|

11/22/2000

|

10/7/2049

|

35,302

|

|

|

|

|||||||

|

Los Reyes Dos

|

214131

|

17.3662

|

G13C75

|

8/10/2001

|

8/9/2051

|

1,024

|

|

|

|

|||||||

|

Los Reyes Tres

|

214302

|

197.0000

|

G13C75

|

6/9/2001

|

5/9/2051

|

11,628

|

|

|

|

|||||||

|

Los Reyes Cinco

|

216632

|

319.9852

|

G13C75

|

5/17/2002

|

5/16/2052

|

18,886

|

|

|

|

|||||||

|

Los Reyes Cuatro

|

217757

|

11.1640

|

Project centered

|

G13C75

|

8/13/2002

|

8/12/2052

|

328

|

|

|

|||||||

|

Los Reyes Seis

|

225122

|

427.6609

|

at approximately

|

G13C75

|

7/22/2005

|

7/21/2055

|

6,064

|

|

|

|||||||

|

Los Reyes Siete

|

225123

|

4.8206

|

345000E,

|

G13C75

|

7/22/2005

|

7/21/2055

|

70

|

|

|

|||||||

|

San Miguel Concessions:

|

2686000N

|

||||||

|

|

|||||||

|

Norma

|

177858

|

150.0000

|

G13C75

|

4/29/1986

|

4/28/2011

|

30,237

|

|

|

|

|||||||

|

San Manuel

|

188187

|

55.7681

|

G13C75

|

11/22/1990

|

11/21/2015

|

11,241.74

|

|

|

|

|||||||

|

El Padre Santo

|

196148

|

50.0000

|

G13C75

|

7/16/1993

|

7/15/2043

|

10,079

|

|

|

|

|||||||

|

Santo Niño

|

211513

|

44.0549

|

G13C75

|

5/31/2000

|

5/30/2050

|

2,523.46

|

|

|

|

|||||||

|

El Faisan

|

211471

|

2.6113

|

G13C75

|

5/31/2000

|

3/30/2050

|

149.58

|

|

|

|

|||||||

|

Patricia

|

212775

|

26.2182

|

G13C75

|

1/31/2001

|

1/30/2051

|

1,501.78

|

|

|

|

|||||||

|

Martha I

|

213234

|

46.6801

|

G13C75

|

4/10/2001

|

4/9/2051

|

2,673.84

|

|

|

|

|||||||

|

San Pedro

|

212753

|

9.0000

|

G13C75

|

11/22/2000

|

11/21/2050

|

515.52

|

|

|

|

|||||||

|

San Pablo

|

212752

|

11.1980

|

G13C75

|

11/22/2000

|

11/21/2050

|

641.42

|

|

|

|

|||||||

|

Nueva Esperanza

|

184912

|

33.0000

|

G13C75

|

12/6/1989

|

12/5/2039

|

6,652.14

|

|

|

|

|||||||

|

San Miguel

|

185761

|

11.7455

|

G13C75

|

12/14/1989

|

12/13/2014

|

2,367.66

|

|

|

|

|||||||

|

MPA Concessions:

|

|||||||

|

|

Application for title was filed in January 2008

|

||||||

|

Elota

|

To be determined when title is granted

|

To be determined when title is granted

|

|||||

|

|

353,726.26 Mexican Pesos

|

||||||

|

Totals

|

4,437.2003 hectares

|

||||||

|

|

Total in US$ @

an exchange rate on

3/11/2011 of US$1.00 = MP$11.96 = US$29,581

|

||||||

|

Claim Name

|

Serial Number

|

Federal Claim Type

|

Surface Area (acres)

|

Location Description (Section, Township and Range)

|

Location Date

|

Annual Holding Fee

|

|

Long Valley 1

|

231947

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

9/25/1989

|

$125

|

|

Long Valley 2

|

231948

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

9/25/1989

|

$125

|

|

Long Valley 3

|

231949

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

9/25/1989

|

$125

|

|

Long Valley 4

|

231950

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

9/25/1989

|

$125

|

|

Long Valley 5

|

231951

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

9/25/1989

|

$125

|

|

Long Valley 6

|

231952

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

9/25/1989

|

$125

|

|

Long Valley 7

|

231953

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

9/25/1989

|

$125

|

|

Long Valley 8

|

231954

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

9/25/1989

|

$125

|

|

Long Valley 9

|

231955

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

11/13/1989

|

$125

|

|

Long Valley 10

|

231956

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

11/13/1989

|

$125

|

|

Long Valley 11

|

231957

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

11/13/1989

|

$125

|

|

Long Valley 12

|

237721

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

7/6/1990

|

$125

|

|

Long Valley 13

|

237722

|

Unpatented Lode Mining Claim

|

20.66

|

Section 24, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 14

|

237723

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 23 & 26, T3S, R28E, MDM

|

7/6/1990

|

$125

|

|

Long Valley 15

|

237724

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 23 & 26, T3S, R28E, MDM

|

7/6/1990

|

$125

|

|

Long Valley 16

|

237725

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 23 & 26, T3S, R28E, MDM

|

7/6/1990

|

$125

|

|

Claim Name

|

Serial Number

|

Federal Claim Type

|

Surface Area (acres)

|

Location Description (Section, Township and Range)

|

Location Date

|

Annual Holding Fee

|

|

Long Valley 17

|

237726

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 23 & 26, T3S, R28E, MDM

|

7/6/1990

|

$125

|

|

Long Valley 18

|

237727

|

Unpatented Lode Mining Claim

|

20.66

|

Section 24, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 19

|

237728

|

Unpatented Lode Mining Claim

|

20.66

|

Section 24, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 20

|

237729

|

Unpatented Lode Mining Claim

|

20.66

|

Section 23, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 21

|

237730

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 14 & 23, T3S, R28E, MDM

|

7/8/1990

|

$125

|

|

Long Valley 22

|

237731

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 14 & 23, T3S, R28E, MDM

|

7/8/1990

|

$125

|

|

Long Valley 23

|

237732

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 14 & 23, T3S, R28E, MDM

|

7/8/1990

|

$125

|

|

Long Valley 24

|

237733

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 14 & 23, T3S, R28E, MDM

|

7/8/1990

|

$125

|

|

Long Valley 25

|

237734

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 14 & 23, T3S, R28E, MDM

|

7/8/1990

|

$125

|

|

Long Valley 26

|

237735

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 14 & 23, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 27

|

237736

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 14, 15, 22 & 23, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 28

|

237737

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 15 and 22, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 29

|

237738

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 15 and 22, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 30

|

237739

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 15 and 22, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 31

|

237740

|

Unpatented Lode Mining Claim

|

20.66

|

Section 15, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 32

|

237741

|

Unpatented Lode Mining Claim

|

20.66

|

Section 15, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 33

|

237742

|

Unpatented Lode Mining Claim

|

20.66

|

Section 15, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Claim Name

|

Serial Number

|

Federal Claim Type

|

Surface Area (acres)

|

Location Description (Section, Township and Range)

|

Location Date

|

Annual Holding Fee

|

|

Long Valley 34

|

237743

|

Unpatented Lode Mining Claim

|

20.66

|

Sections 14, 15, 22, & 23 T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 35

|

237744

|

Unpatented Lode Mining Claim

|

20.66

|

Section 14, T3S, R28E, MDM

|

7/7/1990

|

$125

|

|

Long Valley 36

|

237745

|

Unpatented Lode Mining Claim

|

20.66

|

Section 14, T3S, R28E, MDM

|

7/8/1990

|

$125

|

|

Long Valley 37

|

237746

|

Unpatented Lode Mining Claim

|

20.66

|

Section 14, T3S, R28E, MDM

|

7/8/1990

|

$125

|

|

Long Valley 38

|

237747

|

Unpatented Lode Mining Claim

|

20.66

|

Section 14, T3S, R28E, MDM

|

7/8/1990

|

$125

|

|

LVR 45

|

275118

|

Unpatented Lode Mining Claim

|

20.66

|

Section 25, T3S, R28E, MDM

|

11/18/1998

|

$125

|

|

LVR 46

|

275119

|

Unpatented Lode Mining Claim

|

20.66

|

Section 25, T3S, R28E, MDM

|

11/19/1998

|

$125

|

|

LVR 47

|

275120

|

Unpatented Lode Mining Claim

|

20.66

|

Section 25, T3S, R28E, MDM

|

11/20/1998

|

$125

|

|

LVR 48

|

275121

|

Unpatented Lode Mining Claim

|

20.66

|

Section 25, T3S, R28E, MDM

|

11/21/1998

|

$125

|

|

LVR 49

|

275122

|

Unpatented Lode Mining Claim

|

20.66

|

Section 25, T3S, R28E, MDM

|

11/22/1998

|

$125

|

|

LVR 50

|

275123

|

Unpatented Lode Mining Claim

|

20.66