SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

32-0457838

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

Unit 701, 7/F, The Phoenix, 21-25 Luard Rd, Wanchai, Hong Kong

|

|

N/A

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Securities registered pursuant to Section 12(b) of the Act:Title of Each Class

|

|

Name of Each Exchange On Which Registered

|

|

N/A

|

|

N/A

|

|

|

|

|

Yes [ ] No [X]

Yes [X] No [ ]

Yes [X] No [ ]

Yes [X] No [ ]

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ] (Do not check if a smaller reporting company)

|

Smaller reporting company [X]

|

|

|

|

Page

|

|

|

PART I

|

|

|

Item 1.

|

4

|

|

|

Item 1A.

|

11

|

|

|

Item 1B.

|

15

|

|

|

Item 2.

|

16

|

|

|

Item 3.

|

16

|

|

|

Item 4.

|

16

|

|

|

|

PART II

|

|

|

Item 5.

|

17

|

|

|

Item 6.

|

18

|

|

|

Item 7.

|

18

|

|

|

Item 7A.

|

21

|

|

|

Item 8.

|

22

|

|

|

Item 9.

|

41

|

|

|

Item 9A.

|

41

|

|

|

Item 9B.

|

41

|

|

|

|

PART III

|

|

|

Item 10.

|

42

|

|

|

Item 11.

|

44

|

|

|

Item 12.

|

45

|

|

|

Item 13.

|

46

|

|

|

Item 14.

|

46

|

|

|

|

PART IV

|

|

|

Item 15.

|

47

|

|

|

|

49

|

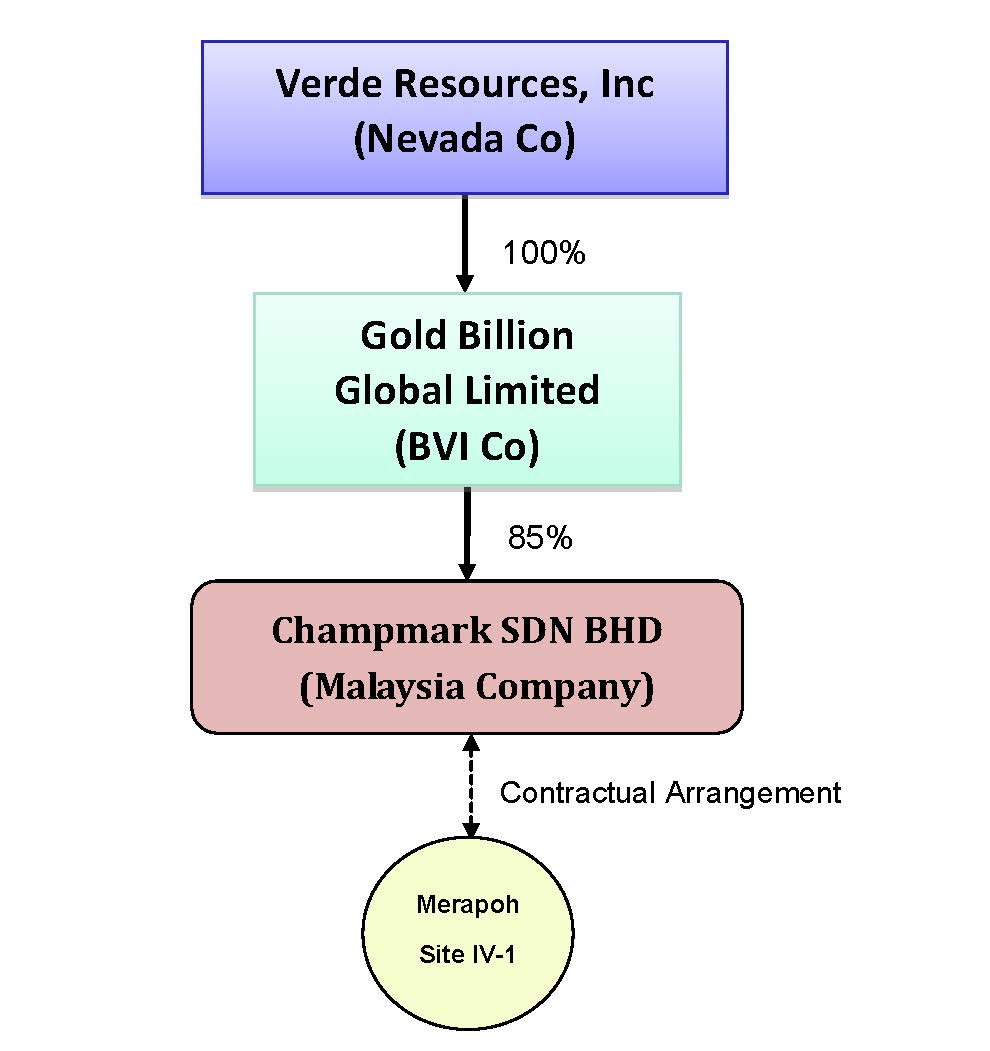

| 1. | Management Agreement, FMR entrusted the management rights of its subsidiary CSB to GBL that include: |

| i.) | management and administrative rights over the day-to-day business affairs of CSB and the mining operation at Site IV-1 of the Merapoh Gold Mine; |

| ii.) | final right for the appointment of members to the Board of Directors and the management team of CSB; |

| iii.) | act as principal of CSB; |

| iv.) | obligation to provide financial support to CSB; |

| v.) | option to purchase an equity interest in CSB; |

| vi.) | entitlement to future benefits and residual value of CSB; |

| vii.) | right to impose no dividend policy; |

| viii.) | human resources management. |

| 2. | Debt Assignment, FMR assigned to GBL the sum of money in the amount of three hundred nine thousand three hundred thirty one dollars and ninety-two cents (US$ 309,331.92), now due to GBL from CSB under the financing obligation from the FMR to CSB. |

|

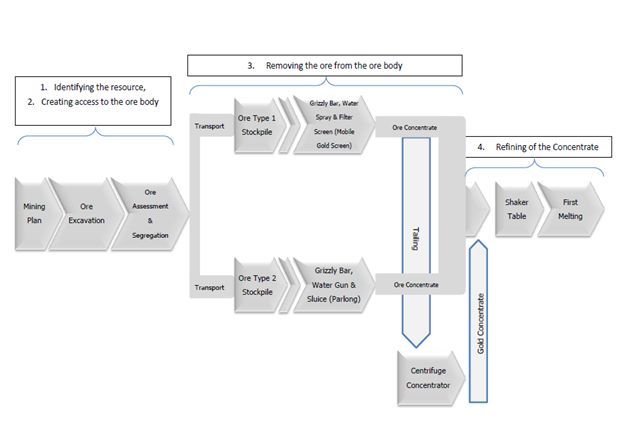

1.

|

The ore body is transported to the treatment plants in vehicles capable of hauling huge, heavy loads.

|

|

2.

|

The ore body is separated into Ore Type 1 Stockpile and Ore Type 2 Stockpile.

|

|

3.

|

The monitor washes finer gold bearing material off larger rocks which is screened on an inclined coarse wire screen.

|

|

4.

|

An excavator is used to turn over the rocks so wash is removed from all sides of the coarse material.

|

|

5.

|

A monitor pushes the rock down the inclined coarse screen where the course is removed and stockpiled at the bottom.

|

|

6.

|

Finer material passes through the mesh screen into the sluice system and runs over the sluice.

|

|

7.

|

The carpets are removed and taken to refining facility for gold recovery.

|

|

8.

|

A suction pipe recovers water of the fine tailings pond for use in the system.

|

|

1.

|

The carpets holding concentrate from the sluice are brought to a shed in the camp site where the gold is refined.

|

|

2.

|

The first stage of the refining is to wash the gold containing concentrate into large bins. This is pumped to a jig and shaking table.

|

|

3.

|

Nuggets are handpicked from the coarse fraction and the fine fraction is amalgamated to remove the gold. After distillation, gold from the amalgam and the coarse are melted with flux and the gold is poured into small bars.

|

| - | Limited amount of drilling completed to date; |

| - | The process testing is limited to small pilot plants and bench scale testing; |

| - | Difficulty in obtaining expected metallurgical recoveries when scaling up to production scale from pilot plant scale; |

| - | Preliminary nature of the mine plans and processing concepts; |

| - | Preliminary nature of operating and capital cost estimates |

| - | Metallurgical flow sheets and recoveries still in development; |

| - | Limited history of prefeasibility studies that might be underestimating capital and operating costs. |

| - | Geologic Uncertainty and Inherent Variability: Estimated reserves and additional mineralized materials are generally derived from appropriately spaced drilling to provide a high degree of assurance in the continuity of the mineralization; however, there is generally variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There are also unknown geologic details that are not always identified or correctly appreciated at the current level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect, and others can have a negative effect on mining operations. Acceptance of these uncertainties is part of any mining operation. |

| - | Gold Price Variability: The prices for gold fluctuate in response to many factors beyond any ability to predict. The prices used in making the reserve estimates are disclosed and differ from daily prices quoted in the news media. The percentage change in the price of a metal cannot be directly related to the estimated reserve quantities, which are affected by a number of additional factors. For example, a ten percent (10%) change in price may have little impact on the estimated reserve quantities and affect only the resultant positive cash flow, or it may result in a significant change in the amount of reserves. Because mining occurs over a number of years, it may be prudent to continue mining for some period during which cash flows are temporarily negative for a variety of reasons, including a belief that the low price is temporary and/or the greater expense would be incurred in closing a property permanently. |

| - | Fuel Price Variability: The cost of fuel can be a major variable in the cost of mining; one that is not necessarily included in the contract mining prices obtained from mining contractors, but is passed on to the overall cost of operation. Future fuel prices and their impact are difficult to predict, but an increase in prices could force us to curtail or cease our business operations. |

| - | Variations in Mining and Processing Parameters: The parameters used in estimating mining and processing efficiency are based on testing and experience with previous operations at the properties or on operations at similar properties. Various unforeseen conditions can occur that may materially affect the estimates. In particular, past operations indicate that care must be taken to ensure that proper ore grade control is employed and that proper steps are taken to ensure that the leaching operations are executed as planned. Unforeseen difficulties may occur in our current or future operations which would force us to curtail or cease our business operations. |

| - | Changes in Environmental and Mining Laws and Regulations: Our reserve estimates contain cost estimates based on compliance with current laws and regulations in Malaysia. While there are no currently known proposed changes in these laws or regulations, significant changes have affected past operations of mining companies in Malaysia, and if additional changes do occur in the future, we may or may not be able to comply with them and continue our operations. |

|

·

|

Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

|

|

|

·

|

Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

|

|

|

·

|

Boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons;

|

|

|

·

|

Excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and,

|

|

|

·

|

The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses.

|

|

Land and Building

|

$

|

85,970

|

||

|

Plant and Machinery

|

$

|

45,146

|

||

|

Office equipment

|

$

|

4,188

|

||

|

Project equipment

|

$

|

291,775

|

||

|

Computer

|

$

|

1,250

|

||

|

Motor Vehicle

|

$

|

49,896

|

||

|

|

$

|

478,225

|

|

Fiscal Quarter Ended

|

|

High

|

|

|

Low

|

|

||

|

December 31, 2014

|

|

$

|

2.99

|

|

|

$

|

0.88

|

|

|

March 31, 2015

|

|

$

|

1.47

|

|

|

$

|

0.81

|

|

|

June 30, 2015

|

|

$

|

1.49

|

|

|

$

|

0.25

|

|

|

Statement of Operation

|

June 30,

2015

|

June 30,

2014

|

Change

|

|||||||||

|

|

Amount

|

Amount

|

%

|

|||||||||

|

Revenue

|

$

|

831,339

|

$

|

1,260,002

|

(34

|

)

|

||||||

|

Cost of revenue

|

$

|

1,563,328

|

$

|

2,184,246

|

(28

|

)

|

||||||

|

Gross Loss

|

$

|

731,989

|

$

|

924,244

|

(21

|

)

|

||||||

|

Operating Expenses

|

$

|

803,741

|

$

|

482,853

|

66

|

|||||||

|

Other Income

|

$

|

38,014

|

$

|

116,303

|

(67

|

)

|

||||||

|

Cash Flow Date

|

June 30,

2015

|

June 30,

2014

|

||||||

|

|

||||||||

|

Net Loss from operation

|

$

|

1,497,716

|

$

|

1,290,794

|

||||

|

Net Cash Generated/(Used) from operating activities

|

$

|

(322,244

|

)

|

$

|

(1,613,072

|

)

|

||

|

Net Cash Generated/(Used) from investing activities

|

$

|

76,456

|

$

|

162,394

|

||||

|

Net Cash Generated/(Used) from financing activities

|

$

|

39,642

|

$

|

1,506,133

|

||||

|

|

Page

|

|

|

|

|

Reports of Independent Registered Accounting Firm

|

F-2

|

|

|

|

|

Consolidated Balance Sheets

|

F-3

|

|

|

|

|

Consolidated Statements of Operations

|

F-4

|

|

|

|

|

Consolidated Statements of Changes in Shareholders' Equity (Deficit)

|

F-5

|

|

|

|

|

Consolidated Statements of Cash Flows

|

F-6

|

|

|

|

|

Notes to Consolidated Financial Statements

|

F-7

|

|

Hong Kong, China

|

AWC (CPA) Limited

|

|

October 13, 2015

|

Certified Public Accountants

|

|

|

As at

June 30,

|

As at

June 30,

|

||||||

|

|

2015

|

2014

|

||||||

|

ASSETS

|

||||||||

|

Current Assets

|

||||||||

|

Cash and cash equivalents

|

$

|

36,927

|

$

|

121,781

|

||||

|

Accounts receivable from related parties

|

3,017

|

15,167

|

||||||

|

Inventories

|

11,865

|

64,204

|

||||||

|

Other deposit & prepayment

|

161,431

|

58,701

|

||||||

|

Total Current Assets

|

$

|

213,240

|

$

|

259,853

|

||||

|

Long Term Assets

|

||||||||

|

Property, plant and equipment

|

$

|

478,225

|

$

|

1,230,295

|

||||

|

Total Long Term Assets

|

$

|

478,225

|

$

|

1,230,295

|

||||

|

|

||||||||

|

TOTAL ASSETS

|

$

|

691,465

|

$

|

1,490,148

|

||||

|

|

||||||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current Liabilities

|

||||||||

|

Accounts payable

|

$

|

1,729,304

|

$

|

2,019,077

|

||||

|

Advanced from related parties

|

524,522

|

161,239

|

||||||

|

Accrual

|

157,026

|

172,223

|

||||||

|

Taxation payable

|

1,495

|

-

|

||||||

|

Loans from banks

|

39,585

|

59,121

|

||||||

|

Other payables

|

-

|

-

|

||||||

|

Total Current Liabilities

|

$

|

2,451,932

|

$

|

2,411,660

|

||||

|

Long term Liabilities

|

||||||||

|

Loans from banks (non-current)

|

$

|

37,207

|

$

|

77,878

|

||||

|

Total Long Term Liabilities

|

$

|

37,207

|

$

|

77,878

|

||||

|

|

||||||||

|

TOTAL LIABILITIES

|

$

|

2,489,139

|

$

|

2,489,538

|

||||

|

|

||||||||

|

STOCKHOLDERS' DEFICIT

|

||||||||

|

Preferred stock, par value $0.001, 50,000,000 shares

authorized, none issued and outstanding

|

-

|

-

|

||||||

|

Common stock, with par value of $0.001 as of June 30, 2015 and June 30, 2014, 250,000,000 shares and 100,000,000 shares authorized as of June 30, 2015 and June 30, 2014, 91,288,909 and 85,388,909 shares issued and outstanding as of June 30, 2015 and June 30, 2014

|

$

|

91,289

|

$

|

85,389

|

||||

|

Additional paid-in capital

|

1,869,993

|

1,580,893

|

||||||

|

Accumulated deficit

|

(3,653,699

|

)

|

(2,281,911

|

)

|

||||

|

Accumulated other comprehensive income(loss)

|

404,021

|

(411

|

)

|

|||||

|

Non-controlled interest

|

(509,278

|

)

|

(383,350

|

)

|

||||

|

Total Stockholders' Deficit

|

$

|

(1,797,674

|

)

|

$

|

(999,390

|

)

|

||

|

|

||||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT

|

$

|

691,465

|

$

|

1,490,148

|

||||

|

|

||||||||

|

|

For the year

|

For the year

|

||||||

|

|

ended

|

Ended

|

||||||

|

|

June 30, 2015

|

June 30, 2014

|

||||||

|

|

||||||||

|

REVENUES

|

||||||||

|

Revenue

|

$

|

831,339

|

$

|

1,260,002

|

||||

|

Cost of revenue

|

(1,563,328

|

)

|

(2,184,246

|

)

|

||||

|

Gross loss

|

(731,989

|

)

|

(924,244

|

)

|

||||

|

|

||||||||

|

OPERATING EXPENSES:

|

||||||||

|

Selling, general & administrative expenses

|

(803,741

|

)

|

(482,853

|

)

|

||||

|

LOSS FROM OPERATIONS

|

$

|

(1,535,730

|

)

|

$

|

(1,407,097

|

)

|

||

|

|

||||||||

|

OTHER INCOME (EXPENSE)

|

38,014

|

116,303

|

||||||

|

|

||||||||

|

NET LOSS BEFORE INCOME TAX

|

$

|

(1,497,716

|

)

|

$

|

(1,290,794

|

)

|

||

|

|

||||||||

|

Provision of Income Tax

|

-

|

-

|

||||||

|

NET LOSS

|

$

|

(1,497,716

|

)

|

$

|

(1,290,794

|

)

|

||

|

|

||||||||

|

Non-controlled interest

|

125,928

|

|

152,425

|

|

||||

|

Net loss contributed to the group

|

(1,371,788

|

)

|

(1,138,369

|

)

|

||||

|

Foreign currency translation gain(loss)

|

|

$

|

404,432

|

|

$

|

(411

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss

|

|

$

|

(967,356

|

)

|

|

$

|

(1,138,780

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Loss per Common Share

|

|

$

|

(0.02

|

)

|

|

$

|

(0.02

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Number of Common Shares Outstanding

|

|

|

87,991,375

|

|

|

|

59,084,742

|

|

|

Common Shares

|

Additional

|

|

Accumulated Other

|

|||||||||||||||||||||||||

|

|

Shares

|

Amount

|

Paid-In

Capital |

Accumulated Deficit

|

Non-Controlling

Interest |

Comprehensive

Income (Loss) |

Total

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance at June 30, 2013

|

1

|

$

|

1

|

$

|

-

|

$

|

(31,603

|

)

|

$

|

-

|

$

|

-

|

$

|

(31,602

|

)

|

|||||||||||||

|

|

||||||||||||||||||||||||||||

|

Effect of reorganization

|

83,977,499

|

83,977

|

80,122

|

(1,111,939

|

)

|

(230,925

|

)

|

- |

(1,178,765

|

)

|

||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Foreign currency translation loss

|

-

|

-

|

-

|

-

|

- |

(7,551

|

)

|

(7,551

|

)

|

|||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Net loss for the period

|

-

|

-

|

-

|

(366,244

|

)

|

(48,627

|

)

|

- |

(414,871

|

)

|

||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Waive of directors' loan

|

-

|

-

|

52,841

|

-

|

- |

- |

52,841

|

|||||||||||||||||||||

|

Balance at October 25, 2013

|

83,977,500

|

$

|

83,978

|

$

|

132,963

|

$

|

(1,509,786

|

)

|

$

|

(279,552

|

)

|

$

|

(7,551

|

)

|

$

|

(1,579,948

|

)

|

|||||||||||

|

|

||||||||||||||||||||||||||||

|

Shares issued

|

1,411,409

|

1,411

|

1,404,834

|

-

|

-

|

-

|

1,406,245

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Net loss for the period

|

-

|

-

|

-

|

(772,125

|

)

|

(103,798

|

)

|

- |

(875,923

|

)

|

||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Foreign currency translation loss

|

-

|

-

|

-

|

- |

- |

7,140 |

7,140 |

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Waive of directors' loan

|

-

|

-

|

43,096

|

- |

- |

- |

43,096

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance – June 30, 2014

|

85,388,909

|

$

|

85,389

|

$

|

1,580,893

|

$

|

(2,281,911

|

)

|

$

|

(383,350

|

)

|

$

|

(411

|

)

|

$

|

(999,390

|

)

|

|||||||||||

|

|

||||||||||||||||||||||||||||

|

Shares issued

|

5,900,000

|

5,900

|

289,100

|

-

|

-

|

-

|

295,000

|

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Net loss for the period

|

-

|

-

|

-

|

(1,371,788

|

)

|

(125,928

|

)

|

- |

(1,497,716

|

)

|

||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Foreign currency translation gain

|

-

|

-

|

-

|

- |

- |

404,432 |

404,432 |

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

|

Balance – June 30, 2015

|

91,288,909

|

$

|

91,289

|

$

|

1,869,993

|

$

|

(3,653,699

|

)

|

$

|

(509,278

|

)

|

$

|

404,021

|

$

|

(1,797,674

|

)

|

||||||||||||

|

|

June 30,

2015

|

June 30,

2014

|

||||||

|

Cash flows from operating activities:

|

||||||||

|

Net loss

|

$

|

(1,497,716

|

)

|

$

|

(1,290,794

|

)

|

||

|

Adjustments to reconcile loss to net cash used in operations

|

||||||||

|

Depreciation

|

564,117

|

763,740

|

||||||

|

Reorganization

|

-

|

(3,387,628

|

)

|

|||||

|

Gain on disposal of fixed assets

|

(16,996

|

)

|

(15,114

|

)

|

||||

|

Issuance of common stock (non-cash)

|

295,000

|

211,250

|

||||||

|

Changes in operating assets and liabilities

|

||||||||

|

(Increase) decrease in:

|

||||||||

|

Accounts receivable from related party

|

9,874

|

(14,969

|

)

|

|||||

|

Deposits and prepayment

|

(103,309

|

)

|

(58,650

|

)

|

||||

|

Inventory

|

42,701

|

(63,361

|

)

|

|||||

|

Increase (decrease) in:

|

||||||||

|

Accounts payable

|

199,373

|

1,992,576

|

||||||

|

Accrued liabilities

|

3,223

|

131,800

|

||||||

|

Advanced from sub-contractor & related parties

|

179,994

|

118,078

|

||||||

|

GST Tax payable

|

1,495

|

-

|

||||||

|

Net cash (used in) operating activities

|

(322,244

|

)

|

(1,613,072

|

)

|

||||

|

|

||||||||

|

Cash flows from investing activities:

|

||||||||

|

Proceeds from disposal of plant and equipment

|

92,646

|

162,394

|

||||||

|

Addition of motor vehicle

|

(16,190

|

)

|

-

|

|||||

|

Net cash provided by investing activities

|

76,456

|

162,394

|

||||||

|

|

||||||||

|

Cash flows from financing activities:

|

||||||||

|

Proceeds from bank loans

|

137,774

|

301,506

|

||||||

|

Repayments of bank loans

|

(98,132

|

)

|

(166,305

|

)

|

||||

|

Shareholders' loan waived

|

-

|

95,938

|

||||||

|

Proceeds from issuance of common stock

|

-

|

1,274,994

|

||||||

|

Net cash provided by financing activities

|

39,642

|

1,506,133

|

||||||

|

|

||||||||

|

Net increase(decrease) in cash and cash equivalents

|

(206,146

|

)

|

55,455

|

|||||

|

|

||||||||

|

Effect of exchange rate changes on cash

|

121,292

|

64,224

|

||||||

|

|

||||||||

|

Net increase (decrease) in cash and cash equivalents

|

(84,854

|

)

|

119,679

|

|||||

|

Cash and cash equivalents at beginning of year

|

121,781

|

2,102

|

||||||

|

Cash and cash equivalents at end of year

|

$

|

36,927

|

$

|

121,781

|

||||

|

|

||||||||

|

Supplementary cash flow information

|

||||||||

|

Income taxes paid

|

$

|

-

|

$

|

-

|

||||

|

Interest paid

|

$

|

5,242

|

$

|

11,406

|

||||

|

Supplementary non-cash information

|

||||||||

|

Reorganization

|

$

|

-

|

$

|

(3,387,628

|

)

|

|||

|

Issuance of common stock (non-cash)

|

$

|

295,000

|

$

|

211,250

|

||||

|

|

1.

|

Management Agreement, FMR entrusted the management rights of its subsidiary CSB to GBL that include:

|

|

|

i)

|

management and administrative rights over the day-to-day business affairs of CSB and the mining operation at Site IV-1 of the Merapoh Gold Mine;

|

|

|

ii)

|

final right for the appointment of members to the Board of Directors and the management team of CSB;

|

|

|

iii)

|

act as principal of CSB;

|

|

|

iv)

|

obligation to provide financial support to CSB;

|

|

|

v)

|

option to purchase an equity interest in CSB;

|

|

|

vi)

|

entitlement to future benefits and residual value of CSB;

|

|

|

vii)

|

right to impose no dividend policy;

|

|

|

viii)

|

human resources management.

|

|

|

2.

|

Debt Assignment, FMR assigned to GBL the sum of money in the amount of US Dollars One Hundred Nine Thousand Eight Hundred One And Cents Seventy-Two Only (US$ 109,801,72), now due to GBL from CSB under the financing obligation from the FMR to CSB.

|

|

|

l

|

Level 1—defined as observable inputs such as quoted prices in active markets;

|

|

|

l

|

Level 2—defined as inputs other than quoted prices in active markets that are either directly or indirectly observable; and

|

|

|

l

|

Level 3—defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions.

|

|

|

|

June 30, 2015

|

|

June 30, 2014

|

|

Year-end MYR : $1 exchange rate

|

|

0.2644

|

|

0.3111

|

|

Average MYR : $1 exchange rate

|

|

0.2883

|

|

0.3070

|

Topic 330, Inventory , currently requires an entity to measure inventory at the lower of cost or market. Market could be replacement cost, net realizable value, or net realizable value less an approximately normal profit margin.

The amendments do not apply to inventory that is measured using last-in, first-out (LIFO) or the retail inventory method. The amendments apply to all other inventory, which includes inventory that is measured using first-in, first-out (FIFO) or average cost.

An entity should measure in scope inventory at the lower of cost and net realizable value. Net realizable value is the estimated selling prices in the ordinary course of business, less reasonably predictable costs of completion, disposal, and transportation. Subsequent measurement is unchanged for inventory measured using LIFO or the retail inventory method.

The amendments more closely align the measurement of inventory in GAAP with the measurement of inventory in International Financial Reporting Standards.

For public business entities, the amendments are effective for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. For all other entities, the amendments are effective for fiscal years beginning after December 15, 2016, and interim periods within fiscal years beginning after December 15, 2017. The amendments should be applied prospectively with earlier application permitted as of the beginning of an interim or annual reporting period.

|

|

June 30,

2015

|

June 30,

2014

|

||||||

|

Amount due from BOG (*1)

|

$

|

-

|

$

|

15,167

|

||||

|

Amount due from Stable Treasure Sdn. Bhd. (*2)

|

3,017

|

-

|

||||||

|

|

$

|

3,017

|

$

|

15,167

|

||||

|

|

June 30,

2015

|

June 30,

2014

|

||||||

|

Inventories

|

$

|

11,865

|

$

|

64,204

|

||||

|

|

June 30,

2015

|

June 30,

2014

|

||||||

|

Due to Changxin Wanlin Technology Co Ltd(*)

|

$

|

1,704,474

|

$

|

2,003,630

|

||||

|

Other accounts payable

|

24,830

|

15,447

|

||||||

|

|

$

|

1,729,304

|

$

|

2,019,077

|

||||

|

|

June 30,

2015

|

June 30,

2014

|

||||||

|

Advanced from BOG (#1)

|

$

|

186,057

|

$

|

18,437

|

||||

|

Advanced from Federal Mining Resources Limited(#2)

|

$

|

173,465

|

$

|

109,802

|

||||

|

Advanced from Federal Capital Investment Limited (#3)

|

$

|

120,000

|

$

|

24,000

|

||||

|

Advanced from Yorkshire Capital Limited (#4)

|

$

|

45,000

|

$

|

9,000

|

||||

|

|

$

|

524,522

|

$

|

161,239

|

||||

|

|

June 30,

2015

|

June 30,

2014

|

||||||

|

Land and Building

|

$

|

1,039,848

|

$

|

1,223,512

|

||||

|

Plant and Machinery

|

163,780

|

213,552

|

||||||

|

Office equipment

|

20,821

|

24,499

|

||||||

|

Project equipment

|

1,179,193

|

1,388,760

|

||||||

|

Computer

|

11,325

|

13,326

|

||||||

|

Motor Vehicle

|

121,904

|

310,477

|

||||||

|

Accumulated depreciation

|

(2,058,646

|

)

|

(1,943,831

|

)

|

||||

|

|

$

|

478,225

|

$

|

1,230,295

|

||||

|

|

June 30,

2015

|

June 30,

2014

|

||||||

|

Loans from banks

|

$

|

39,585

|

$

|

59,121

|

||||

|

Loans from banks(non-current)

|

37,207

|

77,878

|

||||||

|

Total

|

$

|

76,792

|

$

|

136,999

|

||||

|

|

June 30,

2015

|

June 30,

2014

|

||||||||||||||

|

|

Interest Rate

|

Monthly Due

|

||||||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

306

|

$

|

-

|

$

|

3,602

|

|||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

655

|

655

|

9,298

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

300

|

5,085

|

10,212

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

300

|

5,085

|

10,212

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

1,055

|

7,387

|

23,593

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

1,724

|

43,105

|

75,067

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

302

|

8,461

|

14,228

|

|||||||||||

|

Financial institution in Malaysia

|

N/A

|

*

|

226

|

11,050

|

-

|

|||||||||||

|

Hire purchase loans payable to banks

|

$

|

80,828

|

$

|

146,212

|

||||||||||||

|

June 30,

|

|

|

|

|

|

|

||

|

2016

|

|

|

|

|

|

$

|

42,264

|

|

|

2017

|

|

|

|

|

|

|

30,012

|

|

|

2018

|

|

|

|

|

|

|

5,631

|

|

|

2019

|

|

|

|

|

|

|

2,710

|

|

|

2020

|

|

|

|

|

|

|

211

|

|

|

Later years

|

|

|

|

|

|

|

|

|

|

Total minimum hire purchase installment payment

|

|

|

|

|

|

$

|

80,828

|

|

|

Less: Amount representing imprest charges equivalent to interest (current portion: $2,679 and non-current portion:$1,357)

|

|

|

|

|

|

|

4,036

|

|

|

Present value of net minimum lease payments (#)

|

|

|

|

|

|

$

|

76,792

|

|

|

|

|

For the year ended

|

|

For the period ended

|

|

|

|

June 30, 2015

|

|

June 30, 2014

|

|

US Federal Income Tax Rate.

|

|

34%

|

|

34%

|

|

Valuation allowance – US Rate

|

|

(34%)

|

|

(34%)

|

|

BVI Income Tax Rate

|

|

0%

|

|

0%

|

|

Valuation allowance – BVI Rate

|

|

(0%)

|

|

(0%)

|

|

Malaysia Income Tax Rate

|

|

25%

|

|

25%

|

|

Valuation allowance – Malaysia Rate

|

|

(25%)

|

|

(25%)

|

|

Provision for income tax

|

|

-

|

|

-

|

|

|

June 30, 2015

|

|

June 30, 2014

|

|

||||

|

Deferred tax assets:

|

|

|

||||||

|

Tax attribute carryforwards

|

|

$

|

509,223

|

|

|

$

|

438,870

|

|

|

Valuation allowances

|

|

|

(509,223

|

)

|

|

|

(438,870

|

)

|

|

Total

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

Year Ended June 30,

|

|||||||

|

|

|

2015

|

2014

|

||||||

|

|

|

||||||||

|

Net loss applicable to common shares

|

$

|

(1,371,788

|

)

|

$

|

(1,138,369

|

)

|

|||

|

|

|

||||||||

|

Weighted average common shares

|

|||||||||

|

outstanding (Basic)

|

|

87,991,375

|

59,084,742

|

||||||

|

Options

|

`

|

-

|

-

|

||||||

|

Warrants

|

|

-

|

-

|

||||||

|

Weighted average common shares

|

|||||||||

|

outstanding (Diluted)

|

|

87,991,375

|

59,084,742

|

||||||

|

|

|

||||||||

|

Net loss per share (Basic and Diluted)

|

$

|

(0.02

|

)

|

$

|

(0.02

|

)

|

|||

|

|

Subcontractors

|

|

|

Accounts Payable

|

|

|||||||

|

|

|

Year

|

|

|

Year

|

|

|

|

|

|

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

|

|

|

|

Major Suppliers

|

|

June 30,

2015

|

|

|

June 30,

2014 |

|

|

June 30,

2015 |

|

|

June 30,

2014 |

|

|

Company A

|

|

100%

|

|

|

100%

|

|

|

0%

|

|

|

0%

|

|

|

|

Sales

|

|

|

Accounts Receivable

|

|||||||

|

|

|

Year

|

|

|

Year

|

|

|

|

|

|

|

|

|

|

Ended

|

|

|

Ended

|

|

|

|

|

|

|

|

Major Customers

|

|

June 30,

2015

|

|

|

June 30,

2014

|

|

|

June 30,

2015

|

|

|

June 30,

2014

|

|

Company M

|

|

21%

|

|

|

77%

|

|

|

0%

|

|

|

0%

|

|

Company N

|

32% |

|

23% |

|

0% |

|

0% | ||||

|

Company O

|

35% |

|

0% |

|

0% |

|

0% | ||||

|

Company P

|

|

12%

|

|

|

0%

|

|

|

0%

|

|

|

0%

|

|

Name

|

Position Held

with the Company |

Age

|

Date First Elected or Appointed

|

|

Wu Ming Ding

|

President and Director

|

59

|

October 17, 2013

|

|

Balakrishnan B S Muthu

|

Treasurer, Chief Financial Officer, General Manager and Director

|

53

|

October 17, 2013

|

|

Liang Wai Keen

|

Secretary

|

44

|

October 17, 2013

|

|

Sep 1979 - Sep 1983:

|

Major in Economics & Management,

Guangdong Radio & TV University, China

|

|

Apr 2004 - Present:

|

Managing Director, Beijing Changxin Wanlin Technology Co., Ltd.

Director, Federal Capital Investments Limited

|

|

Sep 2010 - Present:

|

Director, Federal Mining Resources Ltd.

|

|

Apr 1987 - Dec 1989:

|

Graduated with Diploma in Business Administration,

The Association of Business Executives ABE, UK.

|

|

Dec 2007 - Present:

|

General Manager, Champmark Sdn. Bhd

|

|

|

(a)

|

our principal executive officer; and

|

|||||||||

|

|

|

|

|||||||||

|

|

(b)

|

each of our two executive officers who were serving as executive officers at the end of the year ended June 30, 2015.

|

|||||||||

|

|

|

|

|||||||||

|

SUMMARY COMPENSATION TABLE

|

|||||||||||

|

Name

and Principal Position |

Year

|

Salary

($) |

Bonus

($) |

Stock Awards

($) |

Option Awards

($) |

Non-Equity Incentive Plan Compensation

($) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings

($) |

All Other Compensation

($) |

Total

($) |

||

|

Wu Ming Ding (1)

President and Director |

2015

2014 |

4,613

14,736

|

0

0 |

0

0 |

0

0 |

0

0 |

0

0 |

0

0 |

4,613

0 |

||

|

Balakrishnan B S Muthu (2)

Treasurer, Chief Financial Officer, General Manager, and Director |

2015

2014 |

52,424

47,892 |

0

0 |

0

0 |

0

0 |

0

0 |

0

0 |

0

0 |

52,424

0 |

||

|

Stephen Spalding (3)

|

2015

2014 |

0

0 |

0

0 |

0

0 |

0

0 |

0

0 |

0

0 |

0

600

|

0

600

|

||

|

(1)

|

Mr. Wu was appointed President and a director of the Company on October 17, 2013. Mr. Wu was paid a total salary of $4,613 for the year ended June 30, 2015.

|

|

(2)

|

Mr. Muthu was appointed Treasurer, Chief Financial Officer, General Manager and a director of the Company on October 17, 2013. Mr. Muthu was paid a total salary of $52,424 for the year ended June 30, 2015.

|

|

(3)

|

Mr. Spalding resigned from all of his positions as officers and director of the Company on October 17, 2013. Mr. Spalding was receiving $200 per month for providing office space for the period between July 1, 2011 and September 30, 2013.

|

|

Name and Address of Beneficial Owner

|

Amount and Nature of

Beneficial Ownership |

Percentage

of Class (1) |

|

Wu Ming Ding

Unit 701, 7/F., The Phoenix, 21-25 Luard Road, Wanchai, Hong Kong |

6,406,910 common shares

Indirect ownership

through Internet.com Ltd

|

7.0%

|

|

Balakrishnan B.S. Muthu

Unit 701, /F., The Phoenix, 21-25 Luard Road, Wanchai, Hong Kong |

500,000 common shares

Indirect ownership

through Banavees Resources

|

0.5%

|

|

Directors and Executive Officers as a Group

(1)

|

6,906,910

common shares

|

7.5%

|

|

Borneo Oil & Gas Corporation Sdn Bhd

|

11,236,409 common shares

Direct ownership

|

12.3%

|

|

Internet.com Ltd

|

6,406,910 common shares

Direct ownership

|

7.0%

|

|

C&K Holdings Pte Ltd

|

6,016,260 common shares

Direct ownership

|

6.6%

|

|

Dynamic State Investments Ltd.

|

5,650,407 common shares

Direct ownership

|

6.2%

|

|

Goldlynn Invest Limited

|

4,746,341 common shares

Direct ownership

|

5.2%

|

| (1) | Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person's actual ownership or voting power with respect to the number of shares of common stock actually outstanding on September 30, 2015. As of October 13, 2015, there were 91,288,909 shares of our company's common stock issued and outstanding. |

| (2) | Balakrishnan Muthu, our CFO and a Director, and Borneo Oil & Gas Corporation Sdn Bhd have not filed their respective Forms 3. Both shareholders expect to file the forms in the near future. |

|

|

|

Year Ended

June 30,

2015

|

|

|

Year Ended

June 30,

2014

|

|

||

|

Audit Fees (1)

|

|

$

|

40,000

|

|

|

$

|

50,000

|

|

|

Audit Related Fees (2)

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Tax Fees (3)

|

|

$

|

2,000

|

|

|

$

|

0

|

|

|

All Other Fees (4)

|

|

$

|

0

|

|

|

$

|

0

|

|

|

Total

|

|

$

|

42,000

|

|

|

$

|

50,000

|

|

| (1) | Audit fees consist of fees incurred for professional services rendered for the audit of our financial statements, for reviews of our interim financial statements included in our quarterly reports on Form 10-Q and for services that are normally provided in connection with statutory or regulatory filings or engagements. |

| (2) | Audit-related fees consist of fees billed for professional services that are reasonably related to the performance of the audit or review of our financial statements, but are not reported under "Audit fees." |

| (3) | Tax fees consist of fees billed for professional services relating to tax compliance only. |

| (4) | All other fees consist of fees billed for all other services. |

|

|

•

|

should not in all instances be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those statements prove to be inaccurate;

|

|

|

•

|

have been qualified by disclosures that were made to the other party in connection with the negotiation of the applicable agreement, which disclosures are not necessarily reflected in the agreement;

|

|

|

•

|

may apply standards of materiality in a way that is different from what may be viewed as material to you or other investors; and

|

|

|

•

|

were made only as of the date of the applicable agreement or such other date or dates as may be specified in the agreement and are subject to more recent developments.

|

|

Exhibit No.

|

|

SEC Report

Reference No.

|

|

Description

|

|

|

|

|

|

|

|

3.1

|

|

3.1

|

|

Articles of Incorporation of Registrant (1)

|

|

|

|

|

|

|

|

3.2

|

|

3.2

|

|

By-Laws of Registrant (2)

|

|

|

|

|

|

|

|

14.1

|

|

14.1

|

|

Code of Ethics (3)

|

|

|

|

|

|

|

|

31.1

|

|

*

|

|

|

|

|

||||

|

31.2

|

*

|

|||

|

|

|

|

|

|

|

32.1

|

|

*

|

|

|

|

|

|

|

|

|

|

32.2

|

*

|

|||

|

|

||||

|

101.INS (4)

|

|

*

|

|

XBRL Instance

|

|

|

|

|

|

|

|

101.SCH (4)

|

|

*

|

|

XBRL Taxonomy Extension Schema

|

|

|

|

|

|

|

|

101.CAL (4)

|

|

*

|

|

XBRL Taxonomy Extension Calculations

|

|

|

|

|

|

|

|

101.DEF (4)

|

|

*

|

|

XBRL Taxonomy Extension Definitions

|

|

|

|

|

|

|

|

101.LAB (4)

|

|

*

|

|

XBRL Taxonomy Extension Labels

|

|

|

|

|

|

|

|

101.PRE (4)

|

|

*

|

|

XBRL Taxonomy Extension Presentation

|

|

|

(1)

|

Filed with the Securities and Exchange Commission on December 2, 2010 as an exhibit, numbered as indicated above, to the Registrant's registration statement on Form S-1 (file no. 333-17093 5), which exhibit is incorporated herein by reference.

|

|

|

(2)

|

Filed with the Securities and Exchange Commission on July 19, 2011 as an exhibit, numbered as indicated above, to the Registrant's Form 8-K (file no. 333-170935), which exhibit is incorporated herein by reference.

|

|

|

(3)

|

Filed with the Securities and Exchange Commission on September 28, 2011 as an exhibit, numbered as indicated above, to the Registrant's Form 10-K (file no. 333-170935), which exhibit is incorporated herein by reference.

|

|

|

(4)

|

XBRL Information is furnished and not filed or a part of a registration statement or prospectus for purposes of sections 11 or 12 of the Securities Act of 1933, as amended, as amended, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections.

|

|

|

VERDE RESOURCES, INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

Dated: October 13, 2015

|

/s/ Wu Ming Ding

|

|

|

|

Wu Ming Ding

|

|

|

|

President and Director

|

|

|

|

(Principal Executive Officer)

|

|

|

|

|

|

Dated: October 13, 2015

|

/s/ Wu Ming Ding

|

|

|

|

Wu Ming Ding

|

|

|

|

President and Director

|

|

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

Date: October 13, 2015

|

/s/ Balakrishnan B S Muthu

|

|

|

|

Balakrishnan B S Muthu

|

|

|

|

Chief Financial Officer, Treasurer, General Manager and Director

|

|

|

|

(Principal Financial Officer)

|