|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[Mark one]

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

NEBRASKA

|

|

47-0648386

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

14507 FRONTIER ROAD

POST OFFICE BOX 45308

OMAHA, NEBRASKA

|

|

68145-0308

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $.01 Par Value

|

|

The NASDAQ Stock Market LLC

|

|

Large accelerated filer

|

ý

|

Accelerated filer

|

o

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

|||

|

|

|

(Do not check if a smaller reporting company)

|

||||||||

|

|

|

PAGE

|

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

ITEM 1.

|

BUSINESS

|

|

ITEM 1A.

|

RISK FACTORS

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

|

ITEM 2.

|

PROPERTIES

|

|

Location

|

|

Owned or Leased

|

|

Description

|

Segment

|

|||||

|

Omaha, Nebraska

|

|

Owned

|

|

Corporate headquarters, maintenance

|

Truckload, VAS, Corporate

|

|||||

|

Omaha, Nebraska

|

|

Owned

|

|

Disaster recovery, warehouse

|

Corporate

|

|||||

|

Phoenix, Arizona

|

|

Owned

|

|

Office, maintenance

|

Truckload

|

|||||

|

Fontana, California

|

|

Owned

|

|

Office, maintenance

|

Truckload

|

|||||

|

Denver, Colorado

|

|

Owned

|

|

Office, maintenance

|

Truckload

|

|||||

|

Atlanta, Georgia

|

|

Owned

|

|

Office, maintenance

|

Truckload, VAS

|

|||||

|

Indianapolis, Indiana

|

|

Leased

|

|

Office, maintenance

|

Truckload

|

|||||

|

Springfield, Ohio

|

|

Owned

|

|

Office, maintenance

|

Truckload

|

|||||

|

Allentown, Pennsylvania

|

|

Leased

|

|

Office, maintenance

|

Truckload

|

|||||

|

Dallas, Texas

|

|

Owned

|

|

Office, maintenance

|

Truckload, VAS

|

|||||

|

Laredo, Texas

|

|

Owned

|

|

Office, maintenance, transloading

|

Truckload, VAS

|

|||||

|

Lakeland, Florida

|

|

Leased

|

|

Office

|

Truckload

|

|||||

|

El Paso, Texas

|

|

Owned

|

|

Office, maintenance

|

Truckload

|

|||||

|

Brownstown, Michigan

|

|

Owned

|

|

Maintenance

|

Truckload

|

|||||

|

Tomah, Wisconsin

|

|

Leased

|

|

Maintenance

|

Truckload

|

|||||

|

Newbern, Tennessee

|

|

Leased

|

|

Maintenance

|

Truckload

|

|||||

|

Chicago, Illinois

|

|

Leased

|

|

Maintenance

|

Truckload

|

|||||

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

|

Coverage Period

|

|

Primary Coverage

|

|

Primary Coverage

SIR/Deductible

|

|

August 1, 2010 – July 31, 2011

|

|

$5.0 million

|

|

$2.0 million

(1)

|

|

August 1, 2011 – July 31, 2012

|

|

$5.0 million

|

|

$2.0 million

(1)

|

|

August 1, 2012 – July 31, 2013

|

|

$5.0 million

|

|

$2.0 million

(1)

|

|

August 1, 2013 – July 31, 2014

|

|

$5.0 million

|

|

$2.0 million

(1)

|

|

(1)

|

Subject to an additional $8.0 million aggregate in the $2.0 to $5.0 million layer and a $5.0 million aggregate in the $5.0 to $10.0 million layer.

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

|

2013

|

2012

|

||||||||||

|

High

|

Low

|

Dividends

Declared Per

Common Share

|

High

|

Low

|

Dividends

Declared Per

Common Share

|

||||||

|

Quarter Ended:

|

|||||||||||

|

March 31

|

$25.02

|

$22.02

|

$0.05

|

$26.67

|

$23.80

|

$0.05

|

|||||

|

June 30

|

25.44

|

21.80

|

0.05

|

25.32

|

22.71

|

0.05

|

|||||

|

September 30

|

25.33

|

22.61

|

0.05

|

24.69

|

20.92

|

0.05

|

|||||

|

December 31

|

25.24

|

22.86

|

0.05

|

23.98

|

20.63

|

1.55

|

|||||

|

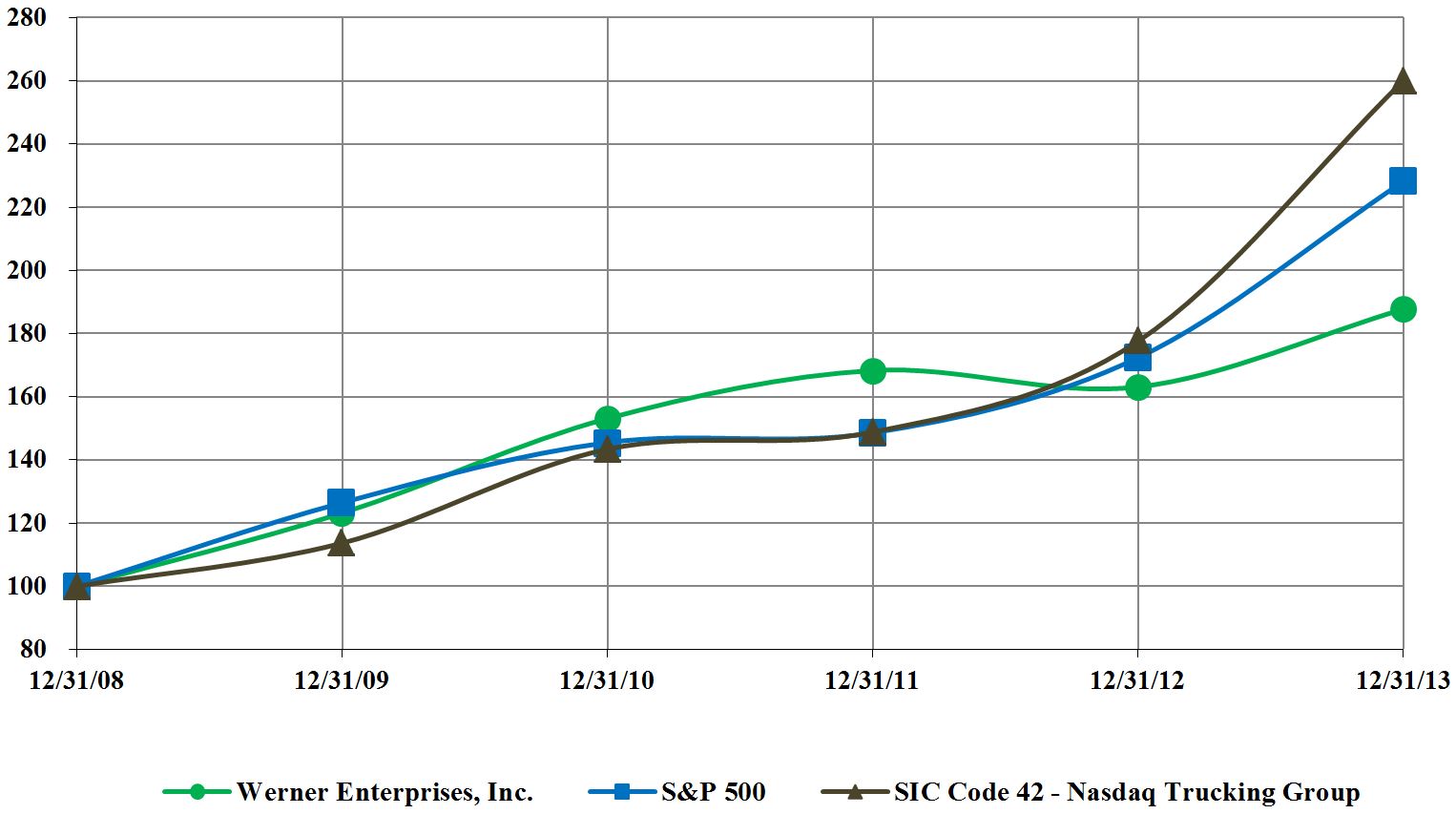

12/31/2008

|

12/31/2009

|

12/31/2010

|

12/31/2011

|

12/31/2012

|

12/31/2013

|

|||||||||||||||||||

|

Werner Enterprises, Inc. (WERN)

|

$

|

100

|

|

$

|

123

|

|

$

|

153

|

|

$

|

168

|

|

$

|

163

|

|

$

|

188

|

|

||||||

|

Standard & Poor’s 500

|

$

|

100

|

|

$

|

126

|

|

$

|

146

|

|

$

|

149

|

|

$

|

172

|

|

$

|

228

|

|

||||||

|

NASDAQ Trucking Group (SIC Code 42)

|

$

|

100

|

|

$

|

114

|

|

$

|

143

|

|

$

|

149

|

|

$

|

178

|

|

$

|

260

|

|

||||||

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

(In thousands, except per share amounts)

|

2013

|

2012

|

2011

|

2010

|

2009

|

||||||||||||||

|

Operating revenues

|

$

|

2,029,183

|

|

$

|

2,036,386

|

|

$

|

2,002,850

|

|

$

|

1,815,020

|

|

$

|

1,666,470

|

|

||||

|

Net income

|

86,785

|

|

103,034

|

|

102,757

|

|

80,039

|

|

56,584

|

|

|||||||||

|

Diluted earnings per share

|

1.18

|

|

1.40

|

|

1.40

|

|

1.10

|

|

0.79

|

|

|||||||||

|

Cash dividends declared per share

|

0.20

|

|

1.70

|

|

0.70

|

|

1.80

|

|

1.45

|

|

|||||||||

|

Total assets

|

1,354,097

|

|

1,334,900

|

|

1,302,416

|

|

1,151,552

|

|

1,173,009

|

|

|||||||||

|

Total debt

|

40,000

|

|

90,000

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Stockholders’ equity

|

772,519

|

|

714,897

|

|

725,147

|

|

668,975

|

|

704,650

|

|

|||||||||

|

Book value per share

(1)

|

10.62

|

|

9.76

|

|

9.95

|

|

9.21

|

|

9.80

|

|

|||||||||

|

Return on average stockholders’ equity

(2)

|

11.7

|

%

|

13.6

|

%

|

14.5

|

%

|

11.1

|

%

|

7.5

|

%

|

|||||||||

|

Return on average total assets

(3)

|

6.5

|

%

|

7.7

|

%

|

8.3

|

%

|

6.6

|

%

|

4.5

|

%

|

|||||||||

|

Operating ratio (consolidated)

(4)

|

93.1

|

%

|

91.6

|

%

|

91.3

|

%

|

92.6

|

%

|

94.2

|

%

|

|||||||||

|

(1)

|

Stockholders’ equity divided by common shares outstanding as of the end of the period. Book value per share indicates the dollar value remaining for common shareholders if all assets were liquidated at recorded amounts and all debts were paid at recorded amounts.

|

|

(2)

|

Net income expressed as a percentage of average stockholders’ equity. Return on equity is a measure of a corporation’s profitability relative to recorded shareholder investment.

|

|

(3)

|

Net income expressed as a percentage of average total assets. Return on assets is a measure of a corporation’s profitability relative to recorded assets.

|

|

(4)

|

Operating expenses expressed as a percentage of operating revenues. Operating ratio is a common measure used in the trucking industry to evaluate profitability.

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

|

•

|

Cautionary Note Regarding Forward-Looking Statements

|

|

•

|

Overview

|

|

•

|

Results of Operations

|

|

•

|

Liquidity and Capital Resources

|

|

•

|

Contractual Obligations and Commercial Commitments

|

|

•

|

Off-Balance Sheet Arrangements

|

|

•

|

Critical Accounting Policies

|

|

•

|

Inflation

|

|

2013

|

2012

|

2011

|

Percentage Change in Dollar Amounts

|

|||||||||||||||||||||||

|

(Amounts in thousands)

|

$

|

%

|

$

|

%

|

$

|

%

|

2013 to 2012 (%)

|

2012 to 2011 (%)

|

||||||||||||||||||

|

Operating revenues

|

$

|

2,029,183

|

|

100.0

|

|

$

|

2,036,386

|

|

100.0

|

|

$

|

2,002,850

|

|

100.0

|

|

(0.4

|

)

|

1.7

|

|

|||||||

|

|

|

|||||||||||||||||||||||||

|

Operating expenses:

|

|

|

||||||||||||||||||||||||

|

Salaries, wages and benefits

|

545,419

|

|

26.9

|

|

544,322

|

|

26.7

|

|

536,509

|

|

26.8

|

|

0.2

|

|

1.5

|

|

||||||||||

|

Fuel

|

371,789

|

|

18.3

|

|

401,417

|

|

19.7

|

|

412,905

|

|

20.6

|

|

(7.4

|

)

|

(2.8

|

)

|

||||||||||

|

Supplies and maintenance

|

179,172

|

|

8.8

|

|

172,505

|

|

8.5

|

|

169,386

|

|

8.5

|

|

3.9

|

|

1.8

|

|

||||||||||

|

Taxes and licenses

|

86,686

|

|

4.3

|

|

90,002

|

|

4.4

|

|

92,917

|

|

4.6

|

|

(3.7

|

)

|

(3.1

|

)

|

||||||||||

|

Insurance and claims

|

71,177

|

|

3.5

|

|

65,593

|

|

3.2

|

|

67,523

|

|

3.4

|

|

8.5

|

|

(2.9

|

)

|

||||||||||

|

Depreciation

|

173,019

|

|

8.5

|

|

166,957

|

|

8.2

|

|

158,634

|

|

7.9

|

|

3.6

|

|

5.2

|

|

||||||||||

|

Rent and purchased transportation

|

456,885

|

|

22.5

|

|

420,480

|

|

20.7

|

|

387,472

|

|

19.3

|

|

8.7

|

|

8.5

|

|

||||||||||

|

Communications and utilities

|

13,506

|

|

0.7

|

|

13,745

|

|

0.7

|

|

15,181

|

|

0.8

|

|

(1.7

|

)

|

(9.5

|

)

|

||||||||||

|

Other

|

(8,196

|

)

|

(0.4

|

)

|

(10,079

|

)

|

(0.5

|

)

|

(11,351

|

)

|

(0.6

|

)

|

18.7

|

|

11.2

|

|

||||||||||

|

Total operating expenses

|

1,889,457

|

|

93.1

|

|

1,864,942

|

|

91.6

|

|

1,829,176

|

|

91.3

|

|

1.3

|

|

2.0

|

|

||||||||||

|

|

|

|||||||||||||||||||||||||

|

Operating income

|

139,726

|

|

6.9

|

|

171,444

|

|

8.4

|

|

173,674

|

|

8.7

|

|

(18.5

|

)

|

(1.3

|

)

|

||||||||||

|

Total other expense (income)

|

(1,985

|

)

|

(0.1

|

)

|

(1,722

|

)

|

(0.1

|

)

|

(1,232

|

)

|

0.0

|

|

(15.3

|

)

|

(39.8

|

)

|

||||||||||

|

Income before income taxes

|

141,711

|

|

7.0

|

|

173,166

|

|

8.5

|

|

174,906

|

|

8.7

|

|

(18.2

|

)

|

(1.0

|

)

|

||||||||||

|

Income taxes

|

54,926

|

|

2.7

|

|

70,132

|

|

3.4

|

|

72,149

|

|

3.6

|

|

(21.7

|

)

|

(2.8

|

)

|

||||||||||

|

Net income

|

$

|

86,785

|

|

4.3

|

|

$

|

103,034

|

|

5.1

|

|

$

|

102,757

|

|

5.1

|

|

(15.8

|

)

|

0.3

|

|

|||||||

|

|

2013

|

2012

|

2011

|

||||||||||||||

|

Truckload Transportation Services (amounts in thousands)

|

$

|

%

|

$

|

%

|

$

|

%

|

|||||||||||

|

Trucking revenues, net of fuel surcharge

|

$

|

1,287,656

|

|

$

|

1,309,503

|

|

$

|

1,310,612

|

|

||||||||

|

Trucking fuel surcharge revenues

|

354,616

|

|

376,104

|

|

373,384

|

|

|||||||||||

|

Non-trucking and other operating revenues

|

15,582

|

|

|

13,742

|

|

10,969

|

|

||||||||||

|

Operating revenues

|

1,657,854

|

|

100.0

|

1,699,349

|

|

100.0

|

1,694,965

|

|

100.0

|

||||||||

|

Operating expenses

|

1,538,257

|

|

92.8

|

1,546,207

|

|

91.0

|

1,537,361

|

|

90.7

|

||||||||

|

Operating income

|

119,597

|

|

7.2

|

153,142

|

|

9.0

|

157,604

|

|

9.3

|

||||||||

|

Truckload Transportation Services

|

2013

|

2012

|

2011

|

||||||||

|

Operating ratio, net of fuel surcharge revenues

|

90.8

|

%

|

88.4

|

%

|

88.1

|

%

|

|||||

|

Average revenues per tractor per week

(1)

|

$

|

3,457

|

|

$

|

3,486

|

|

$

|

3,480

|

|

||

|

Average trip length in miles (loaded)

|

453

|

|

481

|

|

493

|

|

|||||

|

Average percentage of empty miles

(2)

|

12.5

|

%

|

12.3

|

%

|

11.7

|

%

|

|||||

|

Average tractors in service

|

7,162

|

|

7,225

|

|

7,242

|

|

|||||

|

Total trailers (at year end)

|

21,980

|

|

22,415

|

|

22,095

|

|

|||||

|

Total tractors (at year end):

|

|||||||||||

|

Company

|

6,380

|

|

6,505

|

|

6,600

|

|

|||||

|

Independent contractor

|

670

|

|

645

|

|

600

|

|

|||||

|

Total tractors

|

7,050

|

|

7,150

|

|

7,200

|

|

|||||

|

(1)

|

Net of fuel surcharge revenues.

|

|

(2)

|

"Empty" refers to miles without trailer cargo.

|

|

|

2013

|

2012

|

2011

|

|||||||||||||||||

|

Value Added Services (amounts in thousands)

|

$

|

%

|

$

|

%

|

$

|

%

|

||||||||||||||

|

Operating revenues

|

$

|

361,384

|

|

100.0

|

|

$

|

324,155

|

|

100.0

|

|

$

|

292,813

|

|

100.0

|

|

|||||

|

Rent and purchased transportation expense

|

305,582

|

|

84.6

|

|

274,326

|

|

84.6

|

|

245,898

|

|

84.0

|

|

||||||||

|

Gross margin

|

55,802

|

|

15.4

|

|

49,829

|

|

15.4

|

|

46,915

|

|

16.0

|

|

||||||||

|

Other operating expenses

|

41,138

|

|

11.3

|

|

33,830

|

|

10.5

|

|

29,879

|

|

10.2

|

|

||||||||

|

Operating income

|

$

|

14,664

|

|

4.1

|

|

$

|

15,999

|

|

4.9

|

|

$

|

17,036

|

|

5.8

|

|

|||||

|

|

Percentage Change

|

||||||||||||||||

|

Value Added Services

|

2013

|

2012

|

2011

|

2013 to 2012

|

2012 to 20111

|

||||||||||||

|

Total VAS shipments

|

277,430

|

|

265,411

|

|

256,116

|

|

4.5

|

%

|

3.6

|

%

|

|||||||

|

Less: Non-committed shipments to Truckload segment

|

75,852

|

|

79,025

|

|

78,842

|

|

(4.0

|

)%

|

0.2

|

%

|

|||||||

|

Net VAS shipments

|

201,578

|

|

186,386

|

|

177,274

|

|

8.2

|

%

|

5.1

|

%

|

|||||||

|

Average revenue per shipment

|

$

|

1,627

|

|

$

|

1,602

|

|

$

|

1,529

|

|

1.6

|

%

|

4.8

|

%

|

||||

|

|

|

|

|

|

|

||||||||||||

|

Average tractors in service

|

45

|

|

22

|

|

3

|

|

|

|

|||||||||

|

Total trailers (at year end)

|

1,725

|

|

965

|

|

950

|

|

|

|

|||||||||

|

Total tractors (at year end)

|

49

|

|

39

|

|

8

|

|

|

|

|||||||||

|

(Amounts in millions)

|

Total

|

Less than

1 year (2014)

|

1-3 years (2015-2016)

|

3-5 years (2017-2018)

|

More

than 5

years (After 2018)

|

Period

Unknown

|

||||||||||||||||||

|

Contractual Obligations

|

||||||||||||||||||||||||

|

Unrecognized tax benefits

|

$

|

8.6

|

|

$

|

0.1

|

|

$

|

—

|

|

$

|

—

|

|

$

|

—

|

|

$

|

8.5

|

|

||||||

|

Long-term debt, including current maturities

|

40.0

|

|

—

|

|

40.0

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Interest payments on debt

|

0.8

|

|

0.3

|

|

0.5

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Property and equipment purchase commitments

|

23.7

|

|

23.7

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Operating leases

|

2.2

|

|

1.6

|

|

0.6

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Total contractual cash obligations

|

$

|

75.3

|

|

$

|

25.7

|

|

$

|

41.1

|

|

$

|

—

|

|

$

|

—

|

|

$

|

8.5

|

|

||||||

|

Other Commercial Commitments

|

||||||||||||||||||||||||

|

Unused lines of credit

|

$

|

177.3

|

|

$

|

—

|

|

$

|

102.3

|

|

$

|

75.0

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

Standby letters of credit

|

32.7

|

|

32.7

|

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||||

|

Total commercial commitments

|

$

|

210.0

|

|

$

|

32.7

|

|

$

|

102.3

|

|

$

|

75.0

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

Total obligations

|

$

|

285.3

|

|

$

|

58.4

|

|

$

|

143.4

|

|

$

|

75.0

|

|

$

|

—

|

|

$

|

8.5

|

|

||||||

|

•

|

Selections of estimated useful lives and salvage values for purposes of depreciating tractors and trailers.

Depreciable lives of tractors and trailers range from 80 months to 12 years. Estimates of salvage value at the expected date of trade-in or sale are based on the expected market values of equipment at the time of disposal. We continually monitor the adequacy of the lives and salvage values used in calculating depreciation expense and adjust these assumptions appropriately when warranted.

|

|

•

|

Impairment of long-lived assets.

We review our long-lived assets for impairment whenever events or circumstances indicate the carrying amount of a long-lived asset may not be recoverable. An impairment loss would be recognized if the carrying amount of the long-lived asset is not recoverable and the carrying amount exceeds its fair value. For long-lived assets classified as held and used, the carrying amount is not recoverable when the carrying value of the long-lived asset exceeds

|

|

•

|

Estimates of accrued liabilities for insurance and claims for liability and physical damage losses and workers’ compensation.

The insurance and claims accruals (current and non-current) are recorded at the estimated ultimate payment amounts and are based upon individual case estimates (including negative development) and estimates of incurred-but-not-reported losses using loss development factors based upon past experience. An actuary reviews our undiscounted self-insurance reserves for bodily injury and property damage claims and workers’ compensation claims every six months.

|

|

•

|

Policies for revenue recognition.

Operating revenues (including fuel surcharge revenues) and related direct costs are recorded when the shipment is delivered. For shipments where a third-party capacity provider (including independent contractors under contract with us) is utilized to provide some or all of the service and we (i) are the primary obligor in regard to the shipment delivery, (ii) establish customer pricing separately from carrier rate negotiations, (iii) generally have discretion in carrier selection and/or (iv) have credit risk on the shipment, we record both revenues for the dollar value of services we bill to the customer and rent and purchased transportation expense for transportation costs we pay to the third-party provider upon the shipment's delivery. In the absence of the conditions listed above, we record revenues net of those expenses related to third-party providers.

|

|

•

|

Accounting for income taxes.

Significant management judgment is required to determine (i) the provision for income taxes, (ii) whether deferred income taxes will be realized in full or in part and (iii) the liability for unrecognized tax benefits related to uncertain tax positions. Deferred income tax assets and liabilities are measured using enacted tax rates that are expected to apply to taxable income in the years when those temporary differences are expected to be recovered or settled. When it is more likely that all or some portion of specific deferred income tax assets will not be realized, a valuation allowance must be established for the amount of deferred income tax assets that are determined not to be realizable. A valuation allowance for deferred income tax assets has not been deemed necessary due to our profitable operations. Accordingly, if facts or financial circumstances change and consequently impact the likelihood of realizing the deferred income tax assets, we would need to apply management’s judgment to determine the amount of valuation allowance required in any given period.

|

|

•

|

Allowance for doubtful accounts.

The allowance for doubtful accounts is our estimate of the amount of probable credit losses and revenue adjustments in our existing accounts receivable. We review the financial condition of customers for granting credit and monitor changes in customers’ financial conditions on an ongoing basis. We determine the allowance based on analysis of individual customers’ financial condition, our historical write-off experience and national economic conditions. We have formal policies in place to continually monitor credit extended to customers and to manage our credit risk. We evaluate the adequacy of our allowance for doubtful accounts quarterly and believe our allowance for doubtful accounts is adequate based on information currently available.

|

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

|

|

Years Ended December 31,

|

||||||||||

|

(In thousands, except per share amounts)

|

2013

|

2012

|

2011

|

||||||||

|

Operating revenues

|

$

|

2,029,183

|

|

$

|

2,036,386

|

|

$

|

2,002,850

|

|

||

|

Operating expenses:

|

|||||||||||

|

Salaries, wages and benefits

|

545,419

|

|

544,322

|

|

536,509

|

|

|||||

|

Fuel

|

371,789

|

|

401,417

|

|

412,905

|

|

|||||

|

Supplies and maintenance

|

179,172

|

|

172,505

|

|

169,386

|

|

|||||

|

Taxes and licenses

|

86,686

|

|

90,002

|

|

92,917

|

|

|||||

|

Insurance and claims

|

71,177

|

|

65,593

|

|

67,523

|

|

|||||

|

Depreciation

|

173,019

|

|

166,957

|

|

158,634

|

|

|||||

|

Rent and purchased transportation

|

456,885

|

|

420,480

|

|

387,472

|

|

|||||

|

Communications and utilities

|

13,506

|

|

13,745

|

|

15,181

|

|

|||||

|

Other

|

(8,196

|

)

|

(10,079

|

)

|

(11,351

|

)

|

|||||

|

Total operating expenses

|

1,889,457

|

|

1,864,942

|

|

1,829,176

|

|

|||||

|

Operating income

|

139,726

|

|

171,444

|

|

173,674

|

|

|||||

|

Other expense (income):

|

|||||||||||

|

Interest expense

|

454

|

|

288

|

|

85

|

|

|||||

|

Interest income

|

(2,269

|

)

|

(1,837

|

)

|

(1,448

|

)

|

|||||

|

Other

|

(170

|

)

|

(173

|

)

|

131

|

|

|||||

|

Total other income

|

(1,985

|

)

|

(1,722

|

)

|

(1,232

|

)

|

|||||

|

Income before income taxes

|

141,711

|

|

173,166

|

|

174,906

|

|

|||||

|

Income taxes

|

54,926

|

|

70,132

|

|

72,149

|

|

|||||

|

Net income

|

$

|

86,785

|

|

$

|

103,034

|

|

$

|

102,757

|

|

||

|

Earnings per share:

|

|||||||||||

|

Basic

|

$

|

1.19

|

|

$

|

1.41

|

|

$

|

1.41

|

|

||

|

Diluted

|

$

|

1.18

|

|

$

|

1.40

|

|

$

|

1.40

|

|

||

|

Weighted-average common shares outstanding:

|

|||||||||||

|

Basic

|

72,866

|

|

72,909

|

|

72,787

|

|

|||||

|

Diluted

|

73,428

|

|

73,453

|

|

73,225

|

|

|||||

|

|

Years Ended December 31,

|

||||||||||

|

(In thousands)

|

2013

|

2012

|

2011

|

||||||||

|

Net income

|

$

|

86,785

|

|

$

|

103,034

|

|

$

|

102,757

|

|

||

|

Other comprehensive income (loss):

|

|||||||||||

|

Foreign currency translation adjustments

|

(475

|

)

|

1,014

|

|

(1,750

|

)

|

|||||

|

Other comprehensive income (loss)

|

(475

|

)

|

1,014

|

|

(1,750

|

)

|

|||||

|

Comprehensive income

|

$

|

86,310

|

|

$

|

104,048

|

|

$

|

101,007

|

|

||

|

December 31,

|

|||||||

|

(In thousands, except share amounts)

|

2013

|

2012

|

|||||

|

ASSETS

|

|||||||

|

Current assets:

|

|||||||

|

Cash and cash equivalents

|

$

|

23,678

|

|

$

|

15,428

|

|

|

|

Accounts receivable, trade, less allowance of $9,939 and $10,528, respectively

|

231,647

|

|

211,133

|

|

|||

|

Other receivables

|

10,769

|

|

8,004

|

|

|||

|

Inventories and supplies

|

15,743

|

|

23,260

|

|

|||

|

Prepaid taxes, licenses and permits

|

15,064

|

|

14,893

|

|

|||

|

Current deferred income taxes

|

25,315

|

|

25,139

|

|

|||

|

Other current assets

|

27,445

|

|

21,330

|

|

|||

|

Total current assets

|

349,661

|

|

319,187

|

|

|||

|

Property and equipment, at cost:

|

|||||||

|

Land

|

31,445

|

|

31,620

|

|

|||

|

Buildings and improvements

|

132,023

|

|

132,201

|

|

|||

|

Revenue equipment

|

1,364,064

|

|

1,335,897

|

|

|||

|

Service equipment and other

|

200,205

|

|

190,772

|

|

|||

|

Total property and equipment

|

1,727,737

|

|

1,690,490

|

|

|||

|

Less – accumulated depreciation

|

750,219

|

|

696,647

|

|

|||

|

Property and equipment, net

|

977,518

|

|

993,843

|

|

|||

|

Other non-current assets

|

26,918

|

|

21,870

|

|

|||

|

Total assets

|

$

|

1,354,097

|

|

$

|

1,334,900

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|||||||

|

Current liabilities:

|

|||||||

|

Accounts payable

|

$

|

66,678

|

|

$

|

56,397

|

|

|

|

Current portion of long-term debt

|

—

|

|

20,000

|

|

|||

|

Insurance and claims accruals

|

59,811

|

|

57,679

|

|

|||

|

Accrued payroll

|

22,785

|

|

21,134

|

|

|||

|

Other current liabilities

|

18,457

|

|

20,983

|

|

|||

|

Total current liabilities

|

167,731

|

|

176,193

|

|

|||

|

Long-term debt, net of current portion

|

40,000

|

|

70,000

|

|

|||

|

Other long-term liabilities

|

14,710

|

|

15,779

|

|

|||

|

Insurance and claims accruals, net of current portion

|

131,900

|

|

125,500

|

|

|||

|

Deferred income taxes

|

227,237

|

|

232,531

|

|

|||

|

Commitments and contingencies

|

|

|

|||||

|

Stockholders’ equity:

|

|||||||

|

Common stock, $0.01 par value, 200,000,000 shares authorized; 80,533,536 shares

|

|||||||

|

issued; 72,713,920 and 73,246,598 shares outstanding, respectively

|

805

|

|

805

|

|

|||

|

Paid-in capital

|

98,534

|

|

97,457

|

|

|||

|

Retained earnings

|

830,842

|

|

758,617

|

|

|||

|

Accumulated other comprehensive loss

|

(4,631

|

)

|

(4,156

|

)

|

|||

|

Treasury stock, at cost; 7,819,616 and 7,286,938 shares, respectively

|

(153,031

|

)

|

(137,826

|

)

|

|||

|

Total stockholders’ equity

|

772,519

|

|

714,897

|

|

|||

|

Total liabilities and stockholders’ equity

|

$

|

1,354,097

|

|

$

|

1,334,900

|

|

|

|

|

Years Ended December 31,

|

||||||||||

|

(In thousands)

|

2013

|

2012

|

2011

|

||||||||

|

Cash flows from operating activities:

|

|||||||||||

|

Net income

|

$

|

86,785

|

|

$

|

103,034

|

|

$

|

102,757

|

|

||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|||||||||||

|

Depreciation

|

173,019

|

|

166,957

|

|

158,634

|

|

|||||

|

Deferred income taxes

|

(8,389

|

)

|

(9,068

|

)

|

57,863

|

|

|||||

|

Gain on disposal of property and equipment

|

(16,408

|

)

|

(20,533

|

)

|

(21,290

|

)

|

|||||

|

Non-cash equity compensation

|

4,809

|

|

4,602

|

|

2,599

|

|

|||||

|

Insurance and claims accruals, net of current portion

|

6,400

|

|

4,250

|

|

8,000

|

|

|||||

|

Other

|

(541

|

)

|

(237

|

)

|

(1,073

|

)

|

|||||

|

Changes in certain working capital items:

|

|

||||||||||

|

Accounts receivable, net

|

(20,514

|

)

|

7,579

|

|

(28,448

|

)

|

|||||

|

Other current assets

|

3,398

|

|

17,581

|

|

(21,744

|

)

|

|||||

|

Accounts payable

|

2,793

|

|

(20,172

|

)

|

19,381

|

|

|||||

|

Other current liabilities

|

1,105

|

|

1,103

|

|

(12,199

|

)

|

|||||

|

Net cash provided by operating activities

|

232,457

|

|

255,096

|

|

264,480

|

|

|||||

|

Cash flows from investing activities:

|

|||||||||||

|

Additions to property and equipment

|

(211,329

|

)

|

(284,942

|

)

|

(302,340

|

)

|

|||||

|

Retirements of property and equipment

|

59,413

|

|

60,015

|

|

70,142

|

|

|||||

|

Decrease in notes receivable

|

10,679

|

|

8,122

|

|

7,354

|

|

|||||

|

Other

|

979

|

|

—

|

|

—

|

|

|||||

|

Net cash used in investing activities

|

(140,258

|

)

|

(216,805

|

)

|

(224,844

|

)

|

|||||

|

Cash flows from financing activities:

|

|||||||||||

|

Repayments of short-term debt

|

(20,000

|

)

|

(160,000

|

)

|

(50,000

|

)

|

|||||

|

Proceeds from issuance of short-term debt

|

—

|

|

180,000

|

|

50,000

|

|

|||||

|

Repayments of long-term debt

|

(40,000

|

)

|

—

|

|

—

|

|

|||||

|

Proceeds from issuance of long-term debt

|

10,000

|

|

70,000

|

|

—

|

|

|||||

|

Change in net checks issued in excess of cash balances

|

—

|

|

(6,671

|

)

|

6,671

|

|

|||||

|

Dividends on common stock

|

(14,587

|

)

|

(124,391

|

)

|

(50,969

|

)

|

|||||

|

Repurchases of common stock

|

(20,060

|

)

|

—

|

|

—

|

|

|||||

|

Tax withholding related to net share settlements of restricted stock awards

|

(1,804

|

)

|

(674

|

)

|

—

|

|

|||||

|

Stock options exercised

|

2,548

|

|

6,035

|

|

2,940

|

|

|||||

|

Excess tax benefits from equity compensation

|

379

|

|

150

|

|

605

|

|

|||||

|

Net cash used in financing activities

|

(83,524

|

)

|

(35,551

|

)

|

(40,753

|

)

|

|||||

|

Effect of exchange rate fluctuations on cash

|

(425

|

)

|

276

|

|

(437

|

)

|

|||||

|

Net increase (decrease) in cash and cash equivalents

|

8,250

|

|

3,016

|

|

(1,554

|

)

|

|||||

|

Cash and cash equivalents, beginning of period

|

15,428

|

|

12,412

|

|

13,966

|

|

|||||

|

Cash and cash equivalents, end of period

|

$

|

23,678

|

|

$

|

15,428

|

|

$

|

12,412

|

|

||

|

Supplemental disclosures of cash flow information:

|

|||||||||||

|

Interest paid

|

$

|

466

|

|

$

|

245

|

|

$

|

85

|

|

||

|

Income taxes paid

|

66,032

|

|

67,968

|

|

28,802

|

|

|||||

|

Supplemental schedule of non-cash investing activities:

|

|

||||||||||

|

Notes receivable issued upon sale of property and equipment

|

$

|

17,110

|

|

$

|

10,564

|

|

$

|

9,172

|

|

||

|

Property and equipment acquired included in accounts payable

|

5,403

|

|

109

|

|

17,026

|

|

|||||

|

Property and equipment disposed included in other receivables

|

434

|

|

311

|

|

258

|

|

|||||

|

(In thousands, except share and per share amounts)

|

Common

Stock

|

Paid-In

Capital

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Treasury

Stock

|

Total

Stockholders’

Equity

|

|||||||||||||||||

|

BALANCE, December 31, 2010

|

$

|

805

|

|

$

|

91,872

|

|

$

|

728,216

|

|

$

|

(3,420

|

)

|

$

|

(148,498

|

)

|

$

|

668,975

|

|

|||||

|

Comprehensive income

|

—

|

|

—

|

|

102,757

|

|

(1,750

|

)

|

—

|

|

101,007

|

|

|||||||||||

|

Dividends on common stock ($0.70 per share)

|

—

|

|

—

|

|

(50,979

|

)

|

—

|

|

—

|

|

(50,979

|

)

|

|||||||||||

|

Equity compensation activity, 202,578 shares, including excess tax benefits

|

—

|

|

(75

|

)

|

—

|

|

—

|

|

3,620

|

|

3,545

|

|

|||||||||||

|

Non-cash equity compensation expense

|

—

|

|

2,599

|

|

—

|

|

—

|

|

—

|

|

2,599

|

|

|||||||||||

|

BALANCE, December 31, 2011

|

805

|

|

94,396

|

|

779,994

|

|

(5,170

|

)

|

(144,878

|

)

|

725,147

|

|

|||||||||||

|

Comprehensive income

|

—

|

|

—

|

|

103,034

|

|

1,014

|

|

—

|

|

104,048

|

|

|||||||||||

|

Dividends on common stock ($1.70 per share)

|

—

|

|

—

|

|

(124,411

|

)

|

—

|

|

—

|

|

(124,411

|

)

|

|||||||||||

|

Equity compensation activity, 399,022 shares, including excess tax benefits

|

—

|

|

(1,541

|

)

|

—

|

|

—

|

|

7,052

|

|

5,511

|

|

|||||||||||

|

Non-cash equity compensation expense

|

—

|

|

4,602

|

|

—

|

|

—

|

|

—

|

|

4,602

|

|

|||||||||||

|

BALANCE, December 31, 2012

|

805

|

|

97,457

|

|

758,617

|

|

(4,156

|

)

|

(137,826

|

)

|

714,897

|

|

|||||||||||

|

Comprehensive income

|

—

|

|

—

|

|

86,785

|

|

(475

|

)

|

—

|

|

86,310

|

|

|||||||||||

|

Purchases of 821,091 shares of common stock

|

—

|

|

—

|

|

—

|

|

—

|

|

(20,060

|

)

|

(20,060

|

)

|

|||||||||||

|

Dividends on common stock ($0.20 per share)

|

—

|

|

—

|

|

(14,560

|

)

|

—

|

|

—

|

|

(14,560

|

)

|

|||||||||||

|

Equity compensation activity, 288,413 shares, including excess tax benefits

|

—

|

|

(3,732

|

)

|

—

|

|

—

|

|

4,855

|

|

1,123

|

|

|||||||||||

|

Non-cash equity compensation expense

|

—

|

|

4,809

|

|

—

|

|

—

|

|

—

|

|

4,809

|

|

|||||||||||

|

BALANCE, December 31, 2013

|

$

|

805

|

|

$

|

98,534

|

|

$

|

830,842

|

|

$

|

(4,631

|

)

|

$

|

(153,031

|

)

|

$

|

772,519

|

|

|||||

|

|

|

Lives

|

|

Salvage Values

|

|

Building and improvements

|

|

30 years

|

|

0%

|

|

Tractors

|

|

80 months

|

|

0%

|

|

Trailers

|

|

12 years

|

|

$1,000

|

|

Service and other equipment

|

|

3-10 years

|

|

0%

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Net income

|

$

|

86,785

|

|

$

|

103,034

|

|

$

|

102,757

|

|

||

|

Weighted average common shares outstanding

|

72,866

|

|

72,909

|

|

72,787

|

|

|||||

|

Dilutive effect of stock-based awards

|

562

|

|

544

|

|

438

|

|

|||||

|

Shares used in computing diluted earnings per share

|

73,428

|

|

73,453

|

|

73,225

|

|

|||||

|

Basic earnings per share

|

$

|

1.19

|

|

$

|

1.41

|

|

$

|

1.41

|

|

||

|

Diluted earnings per share

|

$

|

1.18

|

|

$

|

1.40

|

|

$

|

1.40

|

|

||

|

December 31,

|

|||||||

|

|

2013

|

2012

|

|||||

|

Notes payable to banks under committed credit facilities

|

$

|

40,000

|

|

$

|

90,000

|

|

|

|

Less current portion

|

—

|

|

20,000

|

|

|||

|

Long-term debt, net

|

$

|

40,000

|

|

$

|

70,000

|

|

|

|

2014

|

$

|

—

|

|

|

2015

|

—

|

|

|

|

2016

|

40,000

|

|

|

|

2017

|

—

|

|

|

|

Total

|

$

|

40,000

|

|

|

|

December 31,

|

||||||

|

|

2013

|

2012

|

|||||

|

Independent contractor notes receivable

|

$

|

18,475

|

|

$

|

12,468

|

|

|

|

Other notes receivable

|

7,331

|

|

6,907

|

|

|||

|

25,806

|

|

19,375

|

|

||||

|

Less current portion

|

8,895

|

|

5,514

|

|

|||

|

Notes receivable – non-current

|

$

|

16,911

|

|

$

|

13,861

|

|

|

|

2014

|

$

|

1,588

|

|

|

2015

|

595

|

|

|

|

Total

|

$

|

2,183

|

|

|

|

|||

|

2013

|

$

|

1,593

|

|

|

2012

|

1,620

|

|

|

|

|

Years Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Current:

|

|||||||||||

|

Federal

|

$

|

55,227

|

|

$

|

69,590

|

|

$

|

6,275

|

|

||

|

State

|

6,616

|

|

10,088

|

|

6,664

|

|

|||||

|

Foreign

|

1,472

|

|

(478

|

)

|

1,347

|

|

|||||

|

63,315

|

|

79,200

|

|

14,286

|

|

||||||

|

Deferred:

|

|||||||||||

|

Federal

|

(9,668

|

)

|

(8,630

|

)

|

50,297

|

|

|||||

|

State

|

1,279

|

|

(438

|

)

|

7,566

|

|

|||||

|

(8,389

|

)

|

(9,068

|

)

|

57,863

|

|

||||||

|

Total income tax expense

|

$

|

54,926

|

|

$

|

70,132

|

|

$

|

72,149

|

|

||

|

|

Years Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Tax at statutory rate

|

$

|

49,599

|

|

$

|

60,608

|

|

$

|

61,217

|

|

||

|

State income taxes, net of federal tax benefits

|

5,132

|

|

6,273

|

|

9,250

|

|

|||||

|

Non-deductible meals and entertainment

|

1,577

|

|

2,686

|

|

2,571

|

|

|||||

|

Income tax credits

|

(1,574

|

)

|

(758

|

)

|

(1,517

|

)

|

|||||

|

Other, net

|

192

|

|

1,323

|

|

628

|

|

|||||

|

Total income tax expense

|

$

|

54,926

|

|

$

|

70,132

|

|

$

|

72,149

|

|

||

|

|

December 31,

|

||||||

|

|

2013

|

2012

|

|||||

|

Deferred tax assets:

|

|||||||

|

Insurance and claims accruals

|

$

|

76,596

|

|

$

|

73,211

|

|

|

|

Allowance for uncollectible accounts

|

5,672

|

|

7,813

|

|

|||

|

Other

|

8,437

|

|

9,416

|

|

|||

|

Gross deferred tax assets

|

90,705

|

|

90,440

|

|

|||

|

Deferred tax liabilities:

|

|||||||

|

Property and equipment

|

282,642

|

|

288,032

|

|

|||

|

Prepaid expenses

|

6,906

|

|

6,774

|

|

|||

|

Other

|

3,079

|

|

3,026

|

|

|||

|

Gross deferred tax liabilities

|

292,627

|

|

297,832

|

|

|||

|

Net deferred tax liability

|

$

|

201,922

|

|

$

|

207,392

|

|

|

|

|

December 31,

|

||||||

|

|

2013

|

2012

|

|||||

|

Current deferred tax asset

|

$

|

25,315

|

|

$

|

25,139

|

|

|

|

Non-current deferred tax liability

|

227,237

|

|

232,531

|

|

|||

|

Net deferred tax liability

|

$

|

201,922

|

|

$

|

207,392

|

|

|

|

|

December 31,

|

||||||

|

|

2013

|

2012

|

|||||

|

Unrecognized tax benefits, beginning balance

|

$

|

11,563

|

|

$

|

10,827

|

|

|

|

Gross increases – tax positions in prior period

|

286

|

|

279

|

|

|||

|

Gross increases – current-period tax positions

|

742

|

|

788

|

|

|||

|

Settlements

|

(3,947

|

)

|

(331

|

)

|

|||

|

Unrecognized tax benefits, ending balance

|

$

|

8,644

|

|

$

|

11,563

|

|

|

|

|

Years Ended December 31,

|

|||||||||||

|

|

2013

|

2012

|

2011

|

|||||||||

|

Stock options:

|

||||||||||||

|

Pre-tax compensation expense

|

$

|

84

|

|

$

|

379

|

|

$

|

343

|

|

|||

|

Tax benefit

|

31

|

|

154

|

|

141

|

|

||||||

|

Stock option expense, net of tax

|

$

|

53

|

|

$

|

225

|

|

$

|

202

|

|

|||

|

Restricted stock and restricted stock units:

|

||||||||||||

|

Pre-tax compensation expense

|

$

|

4,727

|

|

$

|

4,223

|

|

$

|

2,256

|

|

|||

|

Tax benefit

|

1,831

|

|

1,710

|

|

931

|

|

||||||

|

Restricted stock expense, net of tax

|

$

|

2,896

|

|

$

|

2,513

|

|

$

|

1,325

|

|

|||

|

Number of

Options

(in thousands)

|

Weighted

Average

Exercise

Price ($)

|

Weighted

Average

Remaining

Contractual

Term

(Years)

|

Aggregate

Intrinsic Value

(in thousands)

|

|||||||||

|

Outstanding at beginning of period

|

800

|

|

$

|

17.92

|

|

|

|

|||||

|

Options granted

|

—

|

|

—

|

|

|

|

||||||

|

Options exercised

|

(141

|

)

|

18.13

|

|

|

|

||||||

|

Options forfeited

|

(6

|

)

|

20.15

|

|

|

|

||||||

|

Options expired

|

—

|

|

—

|

|

|

|

||||||

|

Outstanding at end of period

|

653

|

|

17.85

|

|

3.36

|

$

|

4,493

|

|

||||

|

Exercisable at end of period

|

570

|

|

17.54

|

|

2.90

|

$

|

4,095

|

|

||||

|

|

Year Ended December 31,

|

|||

|

|

2011

|

|||

|

Number of options granted

|

31,000

|

|

||

|

Risk-free interest rate

|

1.8

|

%

|

||

|

Expected dividend yield

|

0.90

|

%

|

||

|

Expected volatility

|

37

|

%

|

||

|

Expected term (in years)

|

7.0

|

|

||

|

Grant-date fair value

|

$

|

8.27

|

|

|

|

2013

|

$

|

896

|

|

|

2012

|

1,537

|

|

|

|

2011

|

2,128

|

|

|

|

Number of

Restricted

Shares (in

thousands)

|

Weighted

Average Grant

Date Fair

Value ($)

|

|||||

|

Nonvested at beginning of period

|

815

|

|

$

|

20.69

|

|

|

|

Shares granted

|

115

|

|

23.51

|

|

||

|

Shares vested

|

(223

|

)

|

21.08

|

|

||

|

Shares forfeited

|

(9

|

)

|

20.24

|

|

||

|

Nonvested at end of period

|

698

|

|

21.04

|

|

||

|

Years Ended December 31,

|

||||||||||||||

|

2013

|

2012

|

2011

|

||||||||||||

|

Number of shares granted

|

115,000

|

|

268,000

|

|

205,500

|

|

||||||||

|

Dividends per share (quarterly amounts)

|

$

|

0.05

|

|

$

|

0.05

|

|

$

|

0.05

|

|

|||||

|

Risk-free interest rate

|

1.4

|

%

|

0.7

|

%

|

1.0

|

%

|

||||||||

|

2013

|

$

|

210

|

|

|

2012

|

204

|

|

|

|

2011

|

217

|

|

|

|

2013

|

$

|

1,722

|

|

|

2012

|

1,612

|

|

|

|

2011

|

1,471

|

|

|

|

|

December 31,

|

||||||

|

|

2013

|

2012

|

|||||

|

Accumulated benefit obligation

|

$

|

5,773

|

|

$

|

4,311

|

|

|

|

Aggregate market value

|

5,186

|

|

3,971

|

|

|||

|

|

Years Ended December 31,

|

||||||||||

|

|

2013

|

2012

|

2011

|

||||||||

|

Revenues

|

|||||||||||

|

Truckload Transportation Services

|

$

|

1,657,854

|

|

$

|

1,699,349

|

|

$

|

1,694,965

|

|

||

|

Value Added Services

|

361,384

|

|

324,155

|

|

292,813

|

|

|||||

|

Other

|

11,342

|

|

11,782

|

|

12,367

|

|

|||||

|

Corporate

|

3,081

|

|

4,322

|

|

4,409

|

|

|||||

|

Subtotal

|

2,033,661

|

|

2,039,608

|

|

2,004,554

|

|

|||||

|

Inter-segment eliminations

|

(4,478

|

)

|

(3,222

|

)

|

$

|

(1,704

|

)

|

||||

|

Total

|

$

|

2,029,183

|

|

$

|

2,036,386

|

|

$

|

2,002,850

|

|

||

|

Operating Income

|

|||||||||||

|

Truckload Transportation Services

|

$

|

119,597

|

|

$

|

153,142

|

|

$

|

157,604

|

|

||

|

Value Added Services

|

14,664

|

|

15,999

|

|

17,036

|

|

|||||

|

Other

|

3,947

|

|

1,212

|

|

(383

|

)

|

|||||

|

Corporate

|

1,518

|

|

1,091

|

|

(583

|

)

|

|||||

|

Total

|

$

|

139,726

|

|

$

|

171,444

|

|

$

|

173,674

|

|

||

|

2013

|

2012

|

2011

|

|||||||||

|

Revenues

|

|||||||||||

|

United States

|

$

|

1,768,442

|

|

$

|

1,772,179

|

|

$

|

1,772,628

|

|

||

|

Foreign countries

|

|||||||||||

|

Mexico

|

172,009

|

|

172,016

|

|

147,938

|

|

|||||

|

Other

|

88,732

|

|

92,191

|

|

82,284

|

|

|||||

|

Total foreign countries

|

260,741

|

|

264,207

|

|

230,222

|

|

|||||

|

Total

|

$

|

2,029,183

|

|

$

|

2,036,386

|

|

$

|

2,002,850

|

|

||

|

Long-lived Assets

|

|||||||||||

|

United States

|

$

|

955,543

|

|

$

|

979,798

|

|

$

|

931,658

|

|

||

|

Foreign countries

|

|||||||||||

|

Mexico

|

21,654

|

|

13,659

|

|

9,993

|

|

|||||

|

Other

|

321

|

|

386

|

|

485

|

|

|||||

|

Total foreign countries

|

21,975

|

|

14,045

|

|

10,478

|

|

|||||

|

Total

|

$

|

977,518

|

|

$

|

993,843

|

|

$

|

942,136

|

|

||

|

(In thousands, except per share amounts)

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter

|

|||||||||||

|

2013:

|

|||||||||||||||

|

Operating revenues

|

$

|

492,887

|

|

$

|

506,648

|

|

$

|

511,728

|

|

$

|

517,920

|

|

|||

|

Operating income

|

28,693

|

|

42,361

|

|

32,583

|

|

36,089

|

|

|||||||

|

Net income

|

17,511

|

|

25,840

|

|

21,259

|

|

22,175

|

|

|||||||

|

Basic earnings per share

|

0.24

|

|

0.35

|

|

0.29

|

|

0.31

|

|

|||||||

|

Diluted earnings per share

|

0.24

|

|

0.35

|

|

0.29

|

|

0.30

|

|

|||||||

|

(In thousands, except per share amounts)

|

First Quarter

|

Second Quarter

|

Third Quarter

|

Fourth Quarter

|

|||||||||||

|

2012:

|

|||||||||||||||

|

Operating revenues

|

$

|

498,376

|

|

$

|

521,812

|

|

$

|

506,504

|

|

$

|

509,694

|

|

|||

|

Operating income

|

35,402

|

|

51,113

|

|

41,805

|

|

43,124

|

|