|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 10-K

|

|

Iowa

|

42-0802678

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

|

incorporation or organization)

|

||

|

P.O. Box 152, Forest City, Iowa

|

50436

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

|

Common Stock ($.50 par value)

|

The New York Stock Exchange, Inc.

|

|

|

Chicago Stock Exchange, Inc.

|

||

|

Item 1.

|

||

|

Item 1A.

|

||

|

Item 1B.

|

||

|

Item 2.

|

||

|

Item 3.

|

||

|

Item 4.

|

||

|

Item 5.

|

||

|

Item 6.

|

||

|

Item 7.

|

||

|

Item 7A.

|

||

|

Item 8.

|

||

|

Item 9.

|

||

|

Item 9A.

|

||

|

Item 9B.

|

||

|

Item 10.

|

||

|

Item 11.

|

||

|

Item 12.

|

||

|

Item 13.

|

||

|

Item 14.

|

||

|

Item 15.

|

||

|

AOCI

|

Accumulated Other Comprehensive Income (Loss)

|

|

ARS

|

Auction Rate Securities

|

|

ASC

|

Accounting Standards Codification

|

|

ASP

|

Average Sales Price

|

|

ASU

|

Accounting Standards Update

|

|

CCMF

|

Charles City Manufacturing Facility

|

|

COLI

|

Company Owned Life Insurance

|

|

Credit Agreement

|

Credit Agreement dated as of October 31, 2012 by and between Winnebago Industries, Inc. and Winnebago of Indiana, LLC, as Borrowers, and General Electric Capital Corporation, as Agent

|

|

DCF

|

Discounted Cash Flow

|

|

EBITDA

|

Earnings Before Interest, Tax, Depreciation, and Amortization

|

|

EPS

|

Earnings Per Share

|

|

FASB

|

Financial Accounting Standards Board

|

|

FIFO

|

First In, First Out

|

|

GAAP

|

Generally Accepted Accounting Principles

|

|

GECC

|

General Electric Capital Corporation

|

|

IRS

|

Internal Revenue Service

|

|

LIBOR

|

London Interbank Offered Rate

|

|

LIFO

|

Last In, First Out

|

|

Loan Agreement

|

Loan and Security Agreement dated October 13, 2009 by and between Winnebago Industries, Inc. and Wells Fargo Bank, National Association, as successor to Burdale Capital Finance, Inc., as Agent

|

|

MVA

|

Motor Vehicle Act

|

|

NMF

|

Non-Meaningful Figure

|

|

NOL

|

Net Operating Loss

|

|

NYSE

|

New York Stock Exchange

|

|

OCI

|

Other Comprehensive Income

|

|

OEM

|

Original Equipment Manufacturing

|

|

OSHA

|

Occupational Safety and Health Administration

|

|

ROE

|

Return on Equity

|

|

ROIC

|

Return on Invested Capital

|

|

RV

|

Recreation Vehicle

|

|

RVIA

|

Recreation Vehicle Industry Association

|

|

SEC

|

U.S. Securities and Exchange Commission

|

|

SERP

|

Supplemental Executive Retirement Plan

|

|

SIR

|

Self-Insured Retention

|

|

Stat Surveys

|

Statistical Surveys, Inc.

|

|

SunnyBrook

|

SunnyBrook RV, Inc.

|

|

Towables

|

Winnebago of Indiana, LLC, a wholly-owned subsidiary of Winnebago Industries, Inc.

|

|

US

|

United States of America

|

|

Wells Fargo

|

Wells Fargo Bank, National Association

|

|

XBRL

|

eXtensible Business Reporting Language

|

|

Year Ended

(1)

|

|||||||||||||||||||||||||||||

|

(In thousands)

|

August 31, 2013

|

August 25, 2012

|

August 27, 2011

|

August 28, 2010

|

August 29, 2009

|

||||||||||||||||||||||||

|

Motorhomes

(2)

|

$

|

718,580

|

|

89.5

|

%

|

$

|

496,193

|

|

85.3

|

%

|

$

|

456,337

|

|

91.9

|

%

|

$

|

428,932

|

|

95.4

|

%

|

$

|

191,178

|

|

90.4

|

%

|

||||

|

Towables

(3)

|

54,683

|

|

6.8

|

%

|

56,784

|

|

9.8

|

%

|

16,712

|

|

3.4

|

%

|

—

|

|

—

|

%

|

—

|

|

—

|

%

|

|||||||||

|

Other manufactured products

|

29,902

|

|

3.7

|

%

|

28,702

|

|

4.9

|

%

|

23,369

|

|

4.7

|

%

|

20,552

|

|

4.6

|

%

|

20,341

|

|

9.6

|

%

|

|||||||||

|

Total net revenues

|

$

|

803,165

|

|

100.0

|

%

|

$

|

581,679

|

|

100.0

|

%

|

$

|

496,418

|

|

100.0

|

%

|

$

|

449,484

|

|

100.0

|

%

|

$

|

211,519

|

|

100.0

|

%

|

||||

|

(1)

|

The fiscal year ended August 31, 2013 contained 53 weeks; all other fiscal years contained 52 weeks.

|

|

(2)

|

Includes motorhome units, parts, and service.

|

|

(3)

|

Includes towable units and parts.

|

|

•

|

Class A models are conventional motorhomes constructed directly on medium- and heavy-duty truck chassis, which include the engine and drivetrain components. The living area and driver's compartment are designed and produced by the motorhome manufacturer. We manufacture Class A motorhomes with gas and diesel engines.

|

|

•

|

Class B models are panel-type vans to which sleeping, kitchen, and/or toilet facilities are added. These models may also have a top extension to provide more headroom. We manufacture Class B motorhomes with gas and diesel engines.

|

|

•

|

Class C models are motorhomes built on van-type chassis onto which the motorhome manufacturer constructs a living area with access to the driver's compartment. We manufacture Class C motorhomes with gas and diesel engines.

|

|

Type

|

Winnebago

|

Itasca

|

Winnebago Touring Coach

|

|

Class A (gas)

|

Vista, Sightseer, Adventurer

|

Sunstar, Sunova, Suncruiser

|

|

|

Class A (diesel)

|

Via, Forza, Journey, Tour

|

Reyo, Solei, Meridian, Ellipse

|

|

|

Class B (gas and diesel)

|

Travato, Era

|

||

|

Class C

|

Minnie Winnie, Minnie Winnie Premier, Access Premier,Trend, Aspect, View, View Profile

|

Spirit, Spirit Silver, Impulse Silver, Viva!, Cambria, Navion, Navion iQ

|

|

|

Year Ended

(1)(2)

|

||||||||||||||||||||||||

|

Units

|

August 31, 2013

|

August 25, 2012

|

August 27, 2011

|

August 28, 2010

|

August 29, 2009

|

|||||||||||||||||||

|

Class A

|

3,761

|

|

55.1

|

%

|

2,579

|

|

55.6

|

%

|

2,436

|

|

55.4

|

%

|

2,452

|

|

55.3

|

%

|

822

|

|

37.4

|

%

|

||||

|

Class B

|

372

|

|

5.5

|

%

|

319

|

|

6.9

|

%

|

103

|

|

2.3

|

%

|

236

|

|

5.3

|

%

|

149

|

|

6.8

|

%

|

||||

|

Class C

|

2,688

|

|

39.4

|

%

|

1,744

|

|

37.6

|

%

|

1,856

|

|

42.2

|

%

|

1,745

|

|

39.4

|

%

|

1,225

|

|

55.8

|

%

|

||||

|

Total motorhomes

|

6,821

|

|

100.0

|

%

|

4,642

|

|

100.0

|

%

|

4,395

|

|

100.0

|

%

|

4,433

|

|

100.0

|

%

|

2,196

|

|

100.0

|

%

|

||||

|

(1)

|

The fiscal year ended August 31, 2013 contained 53 weeks; all other fiscal years contained 52 weeks.

|

|

(2)

|

Percentages may not add due to rounding differences.

|

|

Type

|

Sunnybrook

|

Winnebago

|

|

Travel trailer

|

Sunset Creek, Remington MicroLite, Remington Ultra Lite, Remington XLT

|

ONE, Minnie, Ultra

|

|

Fifth wheel

|

Raven, Remington

|

Lite Five

|

|

Name

|

Office (Year First Elected an Officer)

|

Age

|

|

Randy J. Potts

(1)

|

Chairman of the Board, Chief Executive Officer and President (2006)

|

54

|

|

S. Scott Degnan

|

Vice President, Sales and Product Management (2012)

|

48

|

|

Scott C. Folkers

|

Vice President, General Counsel & Secretary (2012)

|

51

|

|

Robert L. Gossett

|

Vice President, Administration (1998)

|

62

|

|

Daryl W. Krieger

|

Vice President, Manufacturing (2010)

|

50

|

|

Sarah N. Nielsen

|

Vice President, Chief Financial Officer (2005)

|

40

|

|

William J. O'Leary

|

Vice President, Product Development (2001)

|

64

|

|

Donald L. Heidemann

|

Treasurer and Director of Finance (2007)

|

41

|

|

•

|

overall consumer confidence and the level of discretionary consumer spending;

|

|

•

|

employment trends;

|

|

•

|

the adverse impact of global tensions on consumer spending and travel-related activities; and

|

|

•

|

adverse impact on margins of increases in raw material costs which we are

unable to pass on to customers without negatively affecting sales.

|

|

Location

|

Facility Type/Use

|

# of Buildings

|

Owned or Leased

|

Square

Footage

|

||

|

Forest City, Iowa

|

Manufacturing, maintenance, service and office

|

30

|

|

Owned

|

1,558,000

|

|

|

Forest City, Iowa

|

Warehouse

|

4

|

|

Owned

|

702,000

|

|

|

Charles City, Iowa

|

Manufacturing

|

2

|

|

Owned

|

161,000

|

|

|

Middlebury, Indiana

|

Manufacturing and office

|

4

|

|

Leased

|

277,000

|

|

|

40

|

|

2,698,000

|

|

|||

|

Fiscal 2013

|

High

|

Low

|

Close

|

Fiscal 2012

|

High

|

Low

|

Close

|

|||||||||||||

|

First Quarter

|

$

|

14.49

|

|

$

|

10.99

|

|

$

|

14.22

|

|

First Quarter

|

$

|

8.95

|

|

$

|

6.02

|

|

$

|

6.07

|

|

|

|

Second Quarter

|

20.10

|

|

13.53

|

|

19.49

|

|

Second Quarter

|

10.51

|

|

6.15

|

|

9.44

|

|

|||||||

|

Third Quarter

|

22.34

|

|

16.72

|

|

20.76

|

|

Third Quarter

|

10.65

|

|

8.14

|

|

9.08

|

|

|||||||

|

Fourth Quarter

|

25.15

|

|

19.33

|

|

22.27

|

|

Fourth Quarter

|

11.46

|

|

8.50

|

|

11.01

|

|

|||||||

|

Period

|

Total Number

of Shares

Purchased

|

Average Price

Paid per Share

|

Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs

|

Approximate Dollar Value

of Shares That May Yet Be

Purchased Under the

Plans or Programs

|

|||||||||

|

06/02/13 - 07/06/13

|

—

|

|

$

|

—

|

|

—

|

|

(1)

|

$

|

41,442,000

|

|

||

|

07/07/13 - 08/03/13

|

10,000

|

|

$

|

24.01

|

|

10,000

|

|

|

$

|

41,202,000

|

|

||

|

08/04/13 - 08/31/13

|

55,600

|

|

$

|

23.02

|

|

55,600

|

|

$

|

39,922,000

|

|

|||

|

Total

|

65,600

|

|

$

|

23.17

|

|

65,600

|

|

(1)

|

$

|

39,922,000

|

|

||

|

(a)

|

(b)

|

(c)

|

|||||||

|

(Adjusted for the 2-for-1 Stock

Split on March 5, 2004)

Plan Category

|

Number of Securities to

be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights

|

Weighted Average

Exercise Price of

Outstanding Options,

Warrants and Rights

|

Number of Securities

Remaining Available for

Future Issuance Under Equity

Compensation Plans

(Excluding Securities

Reflected in (a))

|

||||||

|

Equity compensation plans

approved by shareholders

|

664,994

|

|

(1)

|

$

|

29.83

|

|

2,857,171

|

|

(2)

|

|

Equity compensation plans not

approved by shareholders

(3)

|

111,700

|

|

(4)

|

12.89

|

|

—

|

|

(5)

|

|

|

Total

|

776,694

|

|

$

|

27.39

|

|

2,857,171

|

|

||

|

(1)

|

This number includes 552,902 stock options granted under the 2004 Incentive Compensation Plan, as amended (the "Plan"). Also included are 112,092 options granted under the 1997 Stock Option Plan.

|

|

(2)

|

This number represents stock options available for grant under the Plan as of

August 31, 2013

. The Plan replaced the 1997 Stock Option Plan effective January 1, 2004. No new grants may be made under the 1997 Stock Option Plan. Any stock options previously granted under the 1997 Stock Option Plan will continue to be exercisable in accordance with their original terms and conditions.

|

|

(3)

|

Our sole equity compensation plan not previously submitted to our shareholders for approval is the Directors' Deferred Compensation Plan, as amended. The Board of Directors may terminate the Directors' Deferred Compensation Plan at any time. If not terminated earlier, the Directors' Deferred Compensation Plan will automatically terminate on June 30, 2023. For a description of the key provisions of the Directors' Deferred Compensation Plan, see the information in our Proxy Statement for the Annual Meeting of Shareholders scheduled to be held December 17, 2013 under the caption "Director Compensation," which information is incorporated by reference herein.

|

|

(4)

|

Represents shares of common stock issued to a trust which underlie stock units, payable on a one-for-one basis, credited to stock unit accounts as of

August 31, 2013

under the Directors' Deferred Compensation Plan.

|

|

(5)

|

The table does not reflect a specific number of stock units which may be distributed pursuant to the Directors' Deferred Compensation Plan. The Directors' Deferred Compensation Plan does not limit the number of stock units issuable thereunder. The number of stock units to be distributed pursuant to the Directors' Deferred Compensation Plan will be based on the amount of the director's compensation deferred and the per share price of our common stock at the time of deferral.

|

|

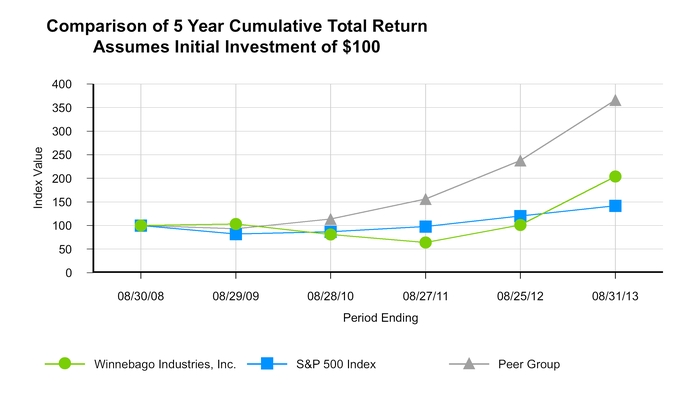

Base Period

|

||||||||||||||||

|

Company/Index

|

8/30/08

|

8/29/09

|

8/28/10

|

8/27/11

|

8/25/12

|

8/31/13

|

||||||||||

|

Winnebago Industries, Inc.

|

100.00

|

|

103.44

|

|

80.56

|

|

63.56

|

|

101.03

|

|

204.36

|

|

||||

|

S&P 500 Index

|

100.00

|

|

82.41

|

|

86.99

|

|

98.07

|

|

120.11

|

|

142.18

|

|

||||

|

Peer Group

|

100.00

|

|

92.57

|

|

113.89

|

|

156.35

|

|

237.56

|

|

366.45

|

|

||||

|

Fiscal Years Ended

|

|||||||||||||||||||

|

(In thousands, except EPS)

|

08/31/13

|

8/25/12

(1)

|

08/27/11

|

08/28/10

|

8/29/09

(1)

|

||||||||||||||

|

Income statement data:

|

|||||||||||||||||||

|

Net revenues

|

$

|

803,165

|

|

$

|

581,679

|

|

$

|

496,418

|

|

$

|

449,484

|

|

$

|

211,519

|

|

||||

|

Net income (loss)

|

31,953

|

|

44,972

|

|

11,843

|

|

10,247

|

|

(78,766

|

)

|

|||||||||

|

Per share data:

|

|||||||||||||||||||

|

Net income (loss) - basic

|

1.14

|

|

1.54

|

|

0.41

|

|

0.35

|

|

(2.71

|

)

|

|||||||||

|

Net income (loss) - diluted

|

1.13

|

|

1.54

|

|

0.41

|

|

0.35

|

|

(2.71

|

)

|

|||||||||

|

Dividends declared and paid per common share

|

—

|

|

—

|

|

—

|

|

—

|

|

0.12

|

|

|||||||||

|

Balance sheet data:

|

|||||||||||||||||||

|

Total assets

|

309,145

|

|

286,072

|

|

239,927

|

|

227,357

|

|

220,466

|

|

|||||||||

|

•

|

|

•

|

|

•

|

|

•

|

|

•

|

|

•

|

|

•

|

|

•

|

|

Through August 31

|

Calendar Year

|

|||||||||||

|

US Retail Motorized:

|

2013

|

2012

|

2012

|

2011

|

2010

|

|||||||

|

Class A gas

|

22.2

|

%

|

22.9

|

%

|

24.2

|

%

|

22.2

|

%

|

23.7

|

%

|

||

|

Class A diesel

|

17.4

|

%

|

20.0

|

%

|

19.4

|

%

|

17.6

|

%

|

15.2

|

%

|

||

|

Total Class A

|

20.3

|

%

|

21.7

|

%

|

22.2

|

%

|

20.2

|

%

|

19.5

|

%

|

||

|

Class C

|

16.3

|

%

|

17.2

|

%

|

18.3

|

%

|

17.4

|

%

|

17.9

|

%

|

||

|

Total Class A and C

|

18.4

|

%

|

19.6

|

%

|

20.5

|

%

|

19.0

|

%

|

18.8

|

%

|

||

|

Class B

|

17.4

|

%

|

16.9

|

%

|

17.6

|

%

|

7.9

|

%

|

15.6

|

%

|

||

|

Through July 31

|

Calendar Year

|

|||||||||||

|

Canadian Retail Motorized:

|

2013

|

2012

|

2012

|

2011

|

2010

|

|||||||

|

Class A gas

|

14.0

|

%

|

14.6

|

%

|

15.3

|

%

|

16.5

|

%

|

14.9

|

%

|

||

|

Class A diesel

|

15.4

|

%

|

15.9

|

%

|

17.3

|

%

|

18.0

|

%

|

9.9

|

%

|

||

|

Total Class A

|

14.5

|

%

|

15.0

|

%

|

16.1

|

%

|

17.1

|

%

|

12.6

|

%

|

||

|

Class C

|

11.7

|

%

|

13.1

|

%

|

14.9

|

%

|

15.9

|

%

|

13.8

|

%

|

||

|

Total Class A and C

|

12.8

|

%

|

14.0

|

%

|

15.5

|

%

|

16.5

|

%

|

13.2

|

%

|

||

|

Class B

|

20.2

|

%

|

11.5

|

%

|

12.7

|

%

|

7.1

|

%

|

4.8

|

%

|

||

|

US

|

Canadian

|

|||||||||||||||||||

|

Through July 31

|

Calendar Year

|

Through July 31

|

Calendar Year

|

|||||||||||||||||

|

Retail Towables:

|

2013

|

2012

|

2012

|

2011

|

2013

|

2012

|

2012

|

2011

|

||||||||||||

|

Travel trailer

|

0.9

|

%

|

0.8

|

%

|

0.8

|

%

|

0.6

|

%

|

0.8

|

%

|

0.5

|

%

|

0.6

|

%

|

0.5

|

%

|

||||

|

Fifth wheel

|

0.8

|

%

|

1.0

|

%

|

1.1

|

%

|

0.5

|

%

|

1.2

|

%

|

1.3

|

%

|

1.5

|

%

|

0.6

|

%

|

||||

|

Total towables

|

0.9

|

%

|

0.8

|

%

|

0.9

|

%

|

0.6

|

%

|

0.9

|

%

|

0.7

|

%

|

0.9

|

%

|

0.5

|

%

|

||||

|

Class A, B & C Motorhomes

|

Travel Trailers & Fifth Wheels

|

|||||||||||||||||

|

As of Quarter End

|

As of Quarter End

|

|||||||||||||||||

|

Wholesale

|

Retail

|

Dealer

|

Order

|

Wholesale

|

Retail

|

Dealer

|

Order

|

|||||||||||

|

(In units)

|

Deliveries

|

Registrations

|

Inventory

|

Backlog

|

Deliveries

|

Registrations

|

Inventory

|

Backlog

|

||||||||||

|

Q1

|

1,040

|

|

1,053

|

|

1,945

|

|

618

|

|

435

|

|

255

|

|

1,146

|

|

460

|

|

||

|

Q2

|

1,001

|

|

872

|

|

2,074

|

|

1,004

|

|

562

|

|

332

|

|

1,376

|

|

417

|

|

||

|

Q3

|

1,280

|

|

1,414

|

|

1,940

|

|

1,237

|

|

646

|

|

652

|

|

1,370

|

|

505

|

|

||

|

Q4

|

1,321

|

|

1,334

|

|

1,927

|

|

1,473

|

|

695

|

|

700

|

|

1,365

|

|

411

|

|

||

|

Fiscal 2012

|

4,642

|

|

4,673

|

|

2,338

|

|

1,939

|

|

||||||||||

|

Q1

|

1,534

|

|

1,416

|

|

2,045

|

|

2,118

|

|

557

|

|

367

|

|

1,555

|

|

687

|

|

||

|

Q2

|

1,419

|

|

1,072

|

|

2,392

|

|

2,752

|

|

548

|

|

328

|

|

1,775

|

|

381

|

|

||

|

Q3

|

1,978

|

|

1,736

|

|

2,634

|

|

2,846

|

|

713

|

|

846

|

|

1,642

|

|

443

|

|

||

|

Q4

|

1,890

|

|

1,870

|

|

2,654

|

|

3,409

|

|

717

|

|

748

|

|

1,611

|

|

221

|

|

||

|

Fiscal 2013

|

6,821

|

|

6,094

|

|

|

|

|

|

2,535

|

|

2,289

|

|

||||||

|

Increase in units

|

2,179

|

|

1,421

|

|

727

|

|

197

|

|

350

|

|

246

|

|

||||||

|

Percentage increase

|

46.9

|

%

|

30.4

|

%

|

37.7

|

%

|

8.4

|

%

|

18.1

|

%

|

18.0

|

%

|

||||||

|

(In thousands)

|

Revenues

|

Gross Profit

|

Gross Margin

|

Operating

Income (Loss)

|

Operating Margin

|

|||||||||||||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

2013

|

2012

|

2013

|

2012

|

2013

|

2012

|

|||||||||||||||||||||

|

Q1

|

$

|

193,554

|

|

$

|

131,837

|

|

$

|

20,747

|

|

$

|

8,496

|

|

10.7

|

%

|

6.4

|

%

|

$

|

9,946

|

|

$

|

627

|

|

5.1

|

%

|

0.5

|

%

|

||||

|

Q2

|

177,166

|

|

131,600

|

|

17,191

|

|

6,846

|

|

9.7

|

%

|

5.2

|

%

|

8,872

|

|

(1,164

|

)

|

5.0

|

%

|

(0.9

|

)%

|

||||||||||

|

Q3

|

218,199

|

|

155,709

|

|

21,197

|

|

12,071

|

|

9.7

|

%

|

7.8

|

%

|

10,248

|

|

3,527

|

|

4.7

|

%

|

2.3

|

%

|

||||||||||

|

Q4

|

214,246

|

|

162,533

|

|

25,496

|

|

16,267

|

|

11.9

|

%

|

10.0

|

%

|

15,332

|

|

6,536

|

|

7.2

|

%

|

4.0

|

%

|

||||||||||

|

Total

|

$

|

803,165

|

|

$

|

581,679

|

|

$

|

84,631

|

|

$

|

43,680

|

|

10.5

|

%

|

7.5

|

%

|

$

|

44,398

|

|

$

|

9,526

|

|

5.5

|

%

|

1.6

|

%

|

||||

|

•

|

Fiscal 2013 motorhome deliveries increased by approximately 47% as compared to Fiscal 2012. In addition delivery retail demand for our motorized products grew over 30% as compared to Fiscal 2012. As a result, dealer inventory grew by nearly 38% when comparing the same time periods. We view this as a reflection of our dealer network's confidence in our products and the overall industry. Our belief of improving dealer confidence is further supported by the continued growth in our sales order backlog. As noted in the above table, our backlog reached 3,409 at the end of the fiscal year. This is the first time our backlog has been in excess of 3,000 since the fourth quarter of Fiscal 2002.

|

|

•

|

The continuing strong demand for our motorized products has led to enhanced financial performance. The sales pricing environment has firmed as compared to a year ago and the incremental volume has provided operating leverage in multiple areas. Approximately 17% of the incremental motorhome revenue flowed through to the operating profit line.

|

|

•

|

Towables generated an operating loss of $3.5 million in Fiscal 2013 compared to an operating loss of $744,000 in Fiscal 2012. Excluding non-cash expense of approximately $550,000 related to the acceleration of acquisition related intangible assets (see further discussion at

Note 7

), Towables was operationally break-even in the fourth quarter of Fiscal 2013.

|

|

•

|

The two most noteworthy issues that negatively impacted Towables' operating performance during Fiscal 2013 were increased warranty expense due to escalating negative claim experience and unfavorable overhead variances due to lower production. Significant changes were made in the first half of Fiscal 2013 in key management positions to address the recent performance problems. Notably, a new Towables president was named in January 2013 and leadership responsibilities of warranty and service were centralized to our company headquarters in Iowa to better leverage our expertise in these areas. During February 2013, production was idled in one of the assembly plants where production issues had been pervasive and only a small core group of employees were retained to train and work in the other assembly plant that has not experienced similar issues. Production resumed in this plant during the fourth quarter of Fiscal 2013.

|

|

•

|

During Fiscal 2013, the Winnebago towable branded products experienced triple digit growth in both wholesale shipments and retail registrations. This growth is attributed to a concerted effort to update existing Winnebago product lines and through the introduction of a new line of Ultralite travel trailers that have successfully penetrated the fastest growing segment in the towable market. The SunnyBrook products have now been realigned with a renewed focus on primary large volume product segments. As a result of this new strategy, we have discontinued several models and focused the three SunnyBrook brands to more effectively penetrate specific segments of the market.

|

|

US and Canada Industry Class A, B & C Motorhomes

|

||||||||||||||||||||

|

Wholesale Shipments

(1)

|

Retail Registrations

(2)

|

|||||||||||||||||||

|

Calendar Year

|

Calendar Year

|

|||||||||||||||||||

|

(In units)

|

2012

|

|

2011

|

|

(Decrease)

Increase

|

Change

|

2012

|

|

2011

|

|

Increase

(Decrease)

|

Change

|

||||||||

|

Q1

|

6,869

|

|

6,888

|

|

(19

|

)

|

(0.3

|

)%

|

5,706

|

|

5,114

|

|

592

|

|

11.6

|

%

|

||||

|

Q2

|

7,707

|

|

7,868

|

|

(161

|

)

|

(2.0

|

)%

|

8,206

|

|

8,140

|

|

66

|

|

0.8

|

%

|

||||

|

Q3

|

6,678

|

|

5,267

|

|

1,411

|

|

26.8

|

%

|

6,916

|

|

6,102

|

|

814

|

|

13.3

|

%

|

||||

|

Q4

|

6,944

|

|

4,807

|

|

2,137

|

|

44.5

|

%

|

4,922

|

|

4,623

|

|

299

|

|

6.5

|

%

|

||||

|

Total

|

28,198

|

|

24,830

|

|

3,368

|

|

13.6

|

%

|

25,750

|

|

23,979

|

|

1,771

|

|

7.4

|

%

|

||||

|

(In units)

|

2013

|

|

2012

|

|

Increase

|

Change

|

2013

|

|

2012

|

|

Increase

|

Change

|

||||||||

|

Q1

|

8,500

|

|

6,869

|

|

1,631

|

|

23.7

|

%

|

7,127

|

|

5,706

|

|

1,421

|

|

24.9

|

%

|

||||

|

Q2

|

10,972

|

|

7,707

|

|

3,265

|

|

42.4

|

%

|

10,747

|

|

8,206

|

|

2,541

|

|

31.0

|

%

|

||||

|

July

|

2,850

|

|

1,955

|

|

895

|

|

45.8

|

%

|

3,272

|

|

2,538

|

|

734

|

|

28.9

|

%

|

||||

|

August

|

3,302

|

|

2,455

|

|

847

|

|

34.5

|

%

|

2,424

|

|

(4

|

)

|

2,287

|

|

|

|

|

|

||

|

September

|

3,138

|

|

(3)

|

2,268

|

|

870

|

|

38.4

|

%

|

(5

|

)

|

2,091

|

|

|||||||

|

Q3

|

9,290

|

|

(3)

|

6,678

|

|

2,612

|

|

39.1

|

%

|

(5

|

)

|

6,916

|

|

|||||||

|

Q4

|

8,500

|

|

(3)

|

6,944

|

|

1,556

|

|

22.4

|

%

|

(5

|

)

|

4,922

|

|

|||||||

|

Total

|

37,262

|

|

(3)

|

28,198

|

|

9,064

|

|

32.1

|

%

|

|

|

25,750

|

|

|

|

|

||||

|

(1)

|

Class A, B and C wholesale shipments as reported by RVIA, rounded to the nearest hundred.

|

|

(2)

|

Class A, B and C retail registrations as reported by Stat Surveys for the US and Canada combined, rounded to the nearest hundred.

|

|

(3)

|

Monthly and quarterly 2013 Class A, B and C wholesale shipments for September and the third and fourth calendar quarters are based upon the forecast prepared by Dr. Richard Curtin of the University of Michigan Consumer Survey Research Center for RVIA and reported in the RoadSigns RV Fall 2013 Industry Forecast Issue. The revised RVIA annual 2013 wholesale shipment forecast is 37,100 and the annual forecast for 2014 is 38,700.

|

|

(4)

|

U.S. retail registrations for Class A, B and C for August, 2013. Canadian retail registrations are not yet available.

|

|

(5)

|

Stat Surveys has not issued a projection for 2013 retail demand for this period.

|

|

US and Canada Travel Trailer & Fifth Wheel Industry

|

|||||||||||||||||||||

|

Wholesale Shipments

(1)

|

Retail Registrations

(2)

|

||||||||||||||||||||

|

Calendar Year

|

Calendar Year

|

||||||||||||||||||||

|

(In units)

|

2012

|

|

2011

|

|

Increase

|

Change

|

2012

|

|

2011

|

|

Increase

|

Change

|

|||||||||

|

Q1

|

60,402

|

|

54,132

|

|

6,270

|

|

11.6

|

%

|

39,093

|

|

33,698

|

|

5,395

|

|

16.0

|

%

|

|||||

|

Q2

|

71,095

|

|

65,987

|

|

5,108

|

|

7.7

|

%

|

83,990

|

|

79,155

|

|

4,835

|

|

6.1

|

%

|

|||||

|

Q3

|

56,601

|

|

47,547

|

|

9,054

|

|

19.0

|

%

|

67,344

|

|

63,014

|

|

4,330

|

|

6.9

|

%

|

|||||

|

Q4

|

54,782

|

|

45,266

|

|

9,516

|

|

21.0

|

%

|

32,469

|

|

30,044

|

|

2,425

|

|

8.1

|

%

|

|||||

|

Total

|

242,880

|

|

212,932

|

|

29,948

|

|

14.1

|

%

|

222,896

|

|

205,911

|

|

16,985

|

|

8.2

|

%

|

|||||

|

(In units)

|

2013

|

|

2012

|

|

Increase

(Decrease)

|

Change

|

2013

|

|

2012

|

|

Increase

|

Change

|

|||||||||

|

Q1

|

66,745

|

|

60,402

|

|

6,343

|

|

10.5

|

%

|

42,710

|

|

39,093

|

|

3,617

|

|

9.3

|

%

|

|||||

|

Q2

|

79,935

|

|

71,095

|

|

8,840

|

|

12.4

|

%

|

93,826

|

|

83,990

|

|

9,836

|

|

11.7

|

%

|

|||||

|

July

|

22,083

|

|

19,654

|

|

2,429

|

|

12.4

|

%

|

30,455

|

|

25,707

|

|

4,748

|

|

18.5

|

%

|

|||||

|

August

|

20,797

|

|

20,963

|

|

(166

|

)

|

(.8

|

)%

|

(4

|

)

|

24,003

|

|

|

|

|

||||||

|

September

|

18,634

|

|

(3

|

)

|

15,984

|

|

2,650

|

|

16.6

|

%

|

(4

|

)

|

17,634

|

|

|||||||

|

Q3

|

61,514

|

|

(3

|

)

|

56,601

|

|

4,913

|

|

8.7

|

%

|

(4

|

)

|

67,344

|

|

|||||||

|

Q4

|

57,000

|

|

(3

|

)

|

54,782

|

|

2,218

|

|

4.0

|

%

|

(4

|

)

|

32,469

|

|

|||||||

|

Total

|

265,194

|

|

(3

|

)

|

242,880

|

|

22,314

|

|

9.2

|

%

|

|

|

222,896

|

|

|

|

|

||||

|

(1)

|

Towable wholesale shipments as reported by RVIA, rounded to the nearest hundred.

|

|

(2)

|

Towable retail registrations as reported by Stat Surveys for the US and Canada combined, rounded to the nearest hundred.

|

|

(3)

|

Monthly and quarterly 2013 towable wholesale shipments for September and the third and fourth calendar quarters are based upon the forecast prepared by Dr. Richard Curtin of the University of Michigan Consumer Survey Research Center for RVIA and reported in the RoadSigns RV Fall 2013 Industry Forecast Issue. The revised annual 2013 wholesale shipment forecast is 267,700 and the annual forecast for 2014 is 281,100.

|

|

(4)

|

Statistical Surveys has not issued a projection for 2013 retail demand for this period.

|

|

As Of

|

|||||||||||||||||

|

(In units)

|

August 31, 2013

|

August 25, 2012

|

Increase (Decrease)

|

%

Change

|

|||||||||||||

|

Class A gas

|

1,405

|

|

41.6

|

%

|

642

|

|

43.6

|

%

|

763

|

|

118.8

|

%

|

|||||

|

Class A diesel

|

607

|

|

18.0

|

%

|

333

|

|

22.6

|

%

|

274

|

|

82.3

|

%

|

|||||

|

Total Class A

|

2,012

|

|

59.5

|

%

|

975

|

|

66.2

|

%

|

1,037

|

|

106.4

|

%

|

|||||

|

Class B

|

300

|

|

8.9

|

%

|

118

|

|

8.0

|

%

|

182

|

|

154.2

|

%

|

|||||

|

Class C

|

1,068

|

|

31.6

|

%

|

380

|

|

25.8

|

%

|

688

|

|

181.1

|

%

|

|||||

|

Total motorhome backlog

(1)

|

3,380

|

|

100.0

|

%

|

1,473

|

|

100.0

|

%

|

1,907

|

|

129.5

|

%

|

|||||

|

Travel trailer

|

180

|

|

81.4

|

%

|

306

|

|

74.5

|

%

|

(126

|

)

|

(41.2

|

)%

|

|||||

|

Fifth wheel

|

41

|

|

18.6

|

%

|

105

|

|

25.5

|

%

|

(64

|

)

|

(61.0

|

)%

|

|||||

|

Total towable backlog

(1)

|

221

|

|

100.0

|

%

|

411

|

|

100.0

|

%

|

(190

|

)

|

(46.2

|

)%

|

|||||

|

Approximate backlog revenue in thousands

|

|||||||||||||||||

|

Motorhome

|

$

|

346,665

|

|

$

|

163,725

|

|

$

|

182,940

|

|

111.7

|

%

|

||||||

|

Towable

|

$

|

4,744

|

|

$

|

8,776

|

|

$

|

(4,032

|

)

|

(45.9

|

)%

|

||||||

|

(1)

|

We include in our backlog all accepted purchase orders from dealers to be shipped within the next six months. Orders in backlog can be canceled or postponed at the option of the dealer at any time without penalty and, therefore, backlog may not necessarily be an accurate measure of future sales.

|

|

Year Ended

|

|||||||||||||||

|

(In thousands, except percent and per share data)

|

August 31,

2013 |

% of

Revenues

(1)

|

August 25,

2012 |

% of

Revenues

(1)

|

Increase

(Decrease)

|

%

Change

|

|||||||||

|

Net revenues

|

$

|

803,165

|

|

100.0

|

%

|

$

|

581,679

|

|

100.0

|

%

|

$

|

221,486

|

|

38.1

|

%

|

|

Cost of goods sold

|

718,534

|

|

89.5

|

%

|

537,999

|

|

92.5

|

%

|

180,535

|

|

33.6

|

%

|

|||

|

Gross profit

|

84,631

|

|

10.5

|

%

|

43,680

|

|

7.5

|

%

|

40,951

|

|

93.8

|

%

|

|||

|

Selling

|

18,318

|

|

2.3

|

%

|

16,837

|

|

2.9

|

%

|

1,481

|

|

8.8

|

%

|

|||

|

General and administrative

|

21,887

|

|

2.7

|

%

|

17,267

|

|

2.7

|

%

|

4,620

|

|

26.8

|

%

|

|||

|

Assets held for sale impairment

|

28

|

|

—

|

%

|

50

|

|

—

|

%

|

(22

|

)

|

NMF

|

|

|||

|

Operating expenses

|

40,233

|

|

5.0

|

%

|

34,154

|

|

5.9

|

%

|

6,079

|

|

17.8

|

%

|

|||

|

Operating income

|

44,398

|

|

5.5

|

%

|

9,526

|

|

1.6

|

%

|

34,872

|

|

NMF

|

|

|||

|

Non-operating income

|

696

|

|

0.1

|

%

|

581

|

|

0.1

|

%

|

115

|

|

19.8

|

%

|

|||

|

Income before income taxes

|

45,094

|

|

5.6

|

%

|

10,107

|

|

1.7

|

%

|

34,987

|

|

NMF

|

|

|||

|

Provision (benefit) for taxes

|

13,141

|

|

1.6

|

%

|

(34,865

|

)

|

(6.0

|

)%

|

48,006

|

|

(137.7

|

)%

|

|||

|

Net income

|

$

|

31,953

|

|

4.0

|

%

|

$

|

44,972

|

|

7.7

|

%

|

$

|

(13,019

|

)

|

(28.9

|

)%

|

|

Diluted income per share

|

$

|

1.13

|

|

$

|

1.54

|

|

$

|

(0.41

|

)

|

(26.6

|

)%

|

||||

|

Diluted average shares outstanding

|

28,170

|

|

29,207

|

|

|

|

|

|

|||||||

|

Year Ended

|

|||||||||||||||

|

(In units)

|

August 31,

2013 |

Product

Mix %

(1)

|

August 25,

2012 |

Product

Mix %

(1)

|

Increase

(Decrease)

|

%

Change

|

|||||||||

|

Motorhomes:

|

|||||||||||||||

|

Class A gas

|

2,446

|

|

35.9

|

%

|

1,648

|

|

35.5

|

%

|

798

|

|

48.4

|

%

|

|||

|

Class A diesel

|

1,315

|

|

19.3

|

%

|

931

|

|

20.1

|

%

|

384

|

|

41.2

|

%

|

|||

|

Total Class A

|

3,761

|

|

55.1

|

%

|

2,579

|

|

55.6

|

%

|

1,182

|

|

45.8

|

%

|

|||

|

Class B

|

372

|

|

5.5

|

%

|

319

|

|

6.9

|

%

|

53

|

|

16.6

|

%

|

|||

|

Class C

|

2,688

|

|

39.4

|

%

|

1,744

|

|

37.6

|

%

|

944

|

|

54.1

|

%

|

|||

|

Total motorhome deliveries

|

6,821

|

|

100.0

|

%

|

4,642

|

|

100.0

|

%

|

2,179

|

|

46.9

|

%

|

|||

|

ASP (in thousands)

(1)

|

$

|

105

|

|

$

|

105

|

|

$

|

(1

|

)

|

(0.9

|

)%

|

||||

|

Towables:

|

|||||||||||||||

|

Travel trailer

|

2,038

|

|

80.4

|

%

|

1,372

|

|

58.7

|

%

|

666

|

|

48.5

|

%

|

|||

|

Fifth wheel

|

497

|

|

19.6

|

%

|

966

|

|

41.3

|

%

|

(469

|

)

|

(48.6

|

)%

|

|||

|

Total towable deliveries

|

2,535

|

|

100.0

|

%

|

2,338

|

|

100.0

|

%

|

197

|

|

8.4

|

%

|

|||

|

ASP (in thousands)

(1)

|

$

|

21

|

|

$

|

24

|

|

$

|

(3

|

)

|

(10.5

|

)%

|

||||

|

Year Ended

|

|||||||||||||||||

|

(In thousands)

|

August 31, 2013

|

August 25, 2012

|

Increase

(Decrease)

|

%

Change

|

|||||||||||||

|

Motorhomes

(1)

|

$

|

718,580

|

|

89.5

|

%

|

$

|

496,193

|

|

85.3

|

%

|

$

|

222,387

|

|

44.8

|

%

|

||

|

Towables

(2)

|

54,683

|

|

6.8

|

%

|

56,784

|

|

9.8

|

%

|

(2,101

|

)

|

(3.7

|

)%

|

|||||

|

Other manufactured products

|

29,902

|

|

3.7

|

%

|

28,702

|

|

4.9

|

%

|

1,200

|

|

4.2

|

%

|

|||||

|

Total net revenues

|

$

|

803,165

|

|

100.0

|

%

|

$

|

581,679

|

|

100.0

|

%

|

$

|

221,486

|

|

38.1

|

%

|

||

|

(1)

|

Includes motorhome units, parts and service

|

|

(2)

|

Includes towable units and parts

|

|

•

|

Total variable costs (materials, direct labor, variable overhead, delivery expense and warranty), as a percent of net revenues, decreased to

83.9%

this year from

85.3%

mainly due to decreased material costs and increased operating efficiencies.

|

|

•

|

Fixed overhead (manufacturing support labor, depreciation and facility costs) and research and development-related costs decreased to

5.7%

of net revenues compared to

7.1%

. The difference was due primarily to increased revenues in

Fiscal 2013

.

|

|

•

|

All factors considered, gross profit increased from

7.5%

to

10.4%

of net revenues.

|

|

Year Ended

|

|||||||||||

|

August 31, 2013

|

August 25, 2012

|

||||||||||

|

(In thousands)

|

Amount

|

Effective

Rate

|

Amount

|

Effective

Rate

|

|||||||

|

Tax expense on current operations

|

$

|

13,551

|

|

30.0

|

%

|

$

|

2,914

|

|

28.8

|

%

|

|

|

Valuation allowance

|

73

|

|

0.2

|

%

|

|

(37,681

|

)

|

(372.8

|

)%

|

||

|

Uncertain tax positions settlements and adjustments

|

(483

|

)

|

(1.1

|

)%

|

(159

|

)

|

(1.6

|

)%

|

|||

|

Amended tax returns

|

—

|

|

—

|

%

|

61

|

|

0.6

|

%

|

|||

|

Total provision (benefit) for taxes

|

$

|

13,141

|

|

29.1

|

%

|

$

|

(34,865

|

)

|

(345.0

|

)%

|

|

|

Year Ended

|

|||||||||||||||

|

(In thousands, except percent and per share data)

|

August 25,

2012 |

% of

Revenues

(1)

|

August 27,

2011 |

% of

Revenues

(1)

|

Increase

(Decrease)

|

%

Change

|

|||||||||

|

Net revenues

|

$

|

581,679

|

|

100.0

|

%

|

$

|

496,418

|

|

100.0

|

%

|

$

|

85,261

|

|

17.2

|

%

|

|

Cost of goods sold

|

537,999

|

|

92.5

|

%

|

456,664

|

|

92.0

|

%

|

81,335

|

|

17.8

|

%

|

|||

|

Gross profit

|

43,680

|

|

7.5

|

%

|

39,754

|

|

8.0

|

%

|

3,926

|

|

9.9

|

%

|

|||

|

Selling

|

16,837

|

|

2.9

|

%

|

14,251

|

|

2.9

|

%

|

2,586

|

|

18.1

|

%

|

|||

|

General and administrative

|

17,267

|

|

3.0

|

%

|

14,263

|

|

2.9

|

%

|

3,004

|

|

21.1

|

%

|

|||

|

Assets held for sale impairment (gain), net

|

50

|

|

—

|

%

|

(39

|

)

|

—

|

%

|

89

|

|

NMF

|

|

|||

|

Operating expenses

|

34,154

|

|

5.9

|

%

|

28,475

|

|

5.7

|

%

|

5,679

|

|

19.9

|

%

|

|||

|

Operating income

|

9,526

|

|

1.6

|

%

|

11,279

|

|

2.3

|

%

|

(1,753

|

)

|

(15.5

|

)%

|

|||

|

Non-operating income

|

581

|

|

0.1

|

%

|

658

|

|

0.1

|

%

|

(77

|

)

|

(11.7

|

)%

|

|||

|

Income before income taxes

|

10,107

|

|

1.7

|

%

|

11,937

|

|

2.4

|

%

|

(1,830

|

)

|

(15.3

|

)%

|

|||

|

(Benefit) provision for taxes

|

(34,865

|

)

|

(6.0

|

)%

|

94

|

|

—

|

%

|

(34,959

|

)

|

NMF

|

|

|||

|

Net income

|

$

|

44,972

|

|

7.7

|

%

|

$

|

11,843

|

|

2.4

|

%

|

$

|

33,129

|

|

279.7

|

%

|

|

Diluted income per share

|

$

|

1.54

|

|

$

|

0.41

|

|

$

|

1.13

|

|

275.6

|

%

|

||||

|

Diluted average shares outstanding

|

29,207

|

|

29,148

|

|

|||||||||||

|

(1)

|

Percentages may not add due to rounding differences.

|

|

Year Ended

|

|||||||||||||||

|

(In units)

|

August 25,

2012 |

Product

Mix %

(1)

|

August 27,

2011 |

Product

Mix % (1) |

Increase

(Decrease)

|

%

Change

|

|||||||||

|

Motorhomes:

|

|||||||||||||||

|

Class A gas

|

1,648

|

|

35.5

|

%

|

1,518

|

|

34.5

|

%

|

130

|

|

8.6

|

%

|

|||

|

Class A diesel

|

931

|

|

20.1

|

%

|

918

|

|

20.9

|

%

|

13

|

|

1.4

|

%

|

|||

|

Total Class A

|

2,579

|

|

55.6

|

%

|

2,436

|

|

55.4

|

%

|

143

|

|

5.9

|

%

|

|||

|

Class B

|

319

|

|

6.9

|

%

|

103

|

|

2.3

|

%

|

216

|

|

209.7

|

%

|

|||

|

Class C

|

1,744

|

|

37.6

|

%

|

1,856

|

|

42.2

|

%

|

(112

|

)

|

(6.0

|

)%

|

|||

|

Total motorhome deliveries

|

4,642

|

|

100.0

|

%

|

4,395

|

|

100.0

|

%

|

247

|

|

5.6

|

%

|

|||

|

ASP (in thousands)

(1)

|

$

|

105

|

|

$

|

102

|

|

$

|

4

|

|

3.4

|

%

|

||||

|

Towables:

|

|||||||||||||||

|

Travel trailer

|

1,372

|

|

58.7

|

%

|

575

|

|

74.8

|

%

|

797

|

|

138.6

|

%

|

|||

|

Fifth wheel

|

966

|

|

41.3

|

%

|

194

|

|

25.2

|

%

|

772

|

|

397.9

|

%

|

|||

|

Total towable deliveries

|

2,338

|

|

100.0

|

%

|

769

|

|

100.0

|

%

|

1,569

|

|

204.0

|

%

|

|||

|

ASP (in thousands)

(1)

|

$

|

24

|

|

$

|

21

|

|

$

|

3

|

|

14.3

|

%

|

||||

|

(1)

|

Percentages and dollars may not add due to rounding differences.

|

|

Year Ended

|

|||||||||||||||||

|

(In thousands)

|

August 25, 2012

|

August 27, 2011

|

Increase

(Decrease)

|

%

Change

|

|||||||||||||

|

Motorhomes

(1)

|

$

|

483,532

|

|

83.1

|

%

|

$

|

443,232

|

|

89.3

|

%

|

$

|

40,300

|

|

9.1

|

%

|

||

|

Towables

(2)

|

56,784

|

|

9.8

|

%

|

16,712

|

|

3.4

|

%

|

40,072

|

|

239.8

|

%

|

|||||

|

Motorhome parts and services

|

12,661

|

|

2.2

|

%

|

13,105

|

|

2.6

|

%

|

(444

|

)

|

(3.4

|

)%

|

|||||

|

Other manufactured products

|

28,702

|

|

4.9

|

%

|

23,369

|

|

4.7

|

%

|

5,333

|

|

22.8

|

%

|

|||||

|

Total net revenues

|

$

|

581,679

|

|

100.0

|

%

|

$

|

496,418

|

|

100.0

|

%

|

$

|

85,261

|

|

17.2

|

%

|

||

|

(1)

|

Includes motorhome units, parts and service

|

|

(2)

|

Includes towable units and parts.

|

|

•

|

Total variable costs (materials, direct labor, variable overhead, delivery expense and warranty), as a percent of net revenues, increased to 85.3% in Fiscal 2012 from 84.0% in Fiscal 2011 which was due to inflationary commodity pressures experienced in the first half of the fiscal year that were not passed on. Also impacting our variable costs were the following two significant items:

|

|

◦

|

In Fiscal 2011, our variable costs were positively impacted by a $3.5 million favorable inventory adjustment as a result of the annual physical inventory. This adjustment in the aggregate favorably impacted our material, labor, variable overhead and fixed overhead costs by 0.7% as a percentage of net revenues in Fiscal 2011.

|

|

◦

|

Our variable costs were favorably impacted by $613,000, or 0.1%, of net revenues for Fiscal 2012 due to a LIFO inventory gain as a result of deflation, as compared to LIFO inventory expense of $2.1 million, or 0.4%, of net revenues for Fiscal 2011.

|

|

•

|

Fixed overhead (manufacturing support labor, depreciation and facility costs) and research and development-related costs decreased to 7.1% of net revenues in Fiscal 2012 compared to 8.0% for Fiscal 2011. With similar spending levels, the difference was due primarily to increased revenues in Fiscal 2012.

|

|

•

|

All factors considered, gross profit decreased from 8.0% to 7.5% of net revenues.

|

|

Year Ended

|

|||||||||||

|

August 25, 2012

|

August 27, 2011

|

||||||||||

|

(In thousands)

|

Amount

|

Effective

Rate

|

Amount

|

Effective

Rate

|

|||||||

|

Tax expense on current operations

|

$

|

2,914

|

|

28.8

|

%

|

$

|

2,597

|

|

21.7

|

%

|

|

|

Valuation allowance decrease

|

(37,681

|

)

|

(372.8

|

)%

|

|

(2,013

|

)

|

(16.8

|

)%

|

||

|

Uncertain tax positions settlements and adjustments

|

(159

|

)

|

(1.6

|

)%

|

(490

|

)

|

(4.1

|

)%

|

|||

|

Amended tax returns

|

61

|

|

0.6

|

%

|

—

|

|

—

|

%

|

|||

|

Total (benefit) provision for taxes

|

$

|

(34,865

|

)

|

(345.0

|

)%

|

$

|

94

|

|

0.8

|

%

|

|

|

•

|

Generated net income of

$32.0 million

|

|

•

|

Increase in inventory of

$24.3 million

: The increase was primarily a result of increased work-in-process and raw material inventory due to increased production levels, and higher average cost per unit due to the mix of product ordered by our dealers.

|

|

•

|

Stock repurchases of approximately

$12.7 million

|

|

•

|

Proceeds from the sale of ARS of

$7.3 million

, as we continued to liquidate this portfolio

|

|

Payments Due By Period

|

|||||||||||||||

|

(In thousands)

|

Total

|

Fiscal

2014

|

Fiscal

2015-2016

|

Fiscal

2017-2018

|

More than

5 Years

|

||||||||||

|

Postretirement health care obligations

(1)

|

$

|

36,244

|

|

$

|

1,202

|

|

$

|

2,974

|

|

$

|

3,628

|

|

$

|

28,440

|

|

|

Deferred compensation obligations

(1)

|

22,471

|

|

2,691

|

|

4,987

|

|

4,429

|

|

10,364

|

|

|||||

|

Executive share option obligations

(1)

|

6,959

|

|

860

|

|

2,115

|

|

2,796

|

|

1,188

|

|

|||||

|

Supplemental executive retirement plan benefit obligations

(1)

|

2,876

|

|

291

|

|

618

|

|

531

|

|

1,436

|

|

|||||

|

Operating leases

(2)

|

2,074

|

|

1,070

|

|

962

|

|

42

|

|

—

|

|

|||||

|

Contracted services

|

240

|

|

118

|

|

122

|

|

—

|

|

—

|

|

|||||

|

Unrecognized tax benefits

(3)

|

3,988

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||

|

Total contractual cash obligations

|

$

|

74,852

|

|

$

|

6,232

|

|

$

|

11,778

|

|

$

|

11,426

|

|

$

|

41,428

|

|

|

Expiration By Period

|

|||||||||||||||

|

(In thousands)

|

Total

|

Fiscal 2014

|

Fiscal

2015-2016

|

Fiscal

2017-2018

|

More than

5 Years

|

||||||||||

|

Contingent repurchase obligations

(2)

|

$

|

165,360

|

|

$

|

60,806

|

|

$

|

104,554

|

|

$

|

—

|

|

$

|

—

|

|

|

(1)

|