|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland

|

|

90-1026709

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

11200 W Plank Ct, Wauwatosa, Wisconsin

|

|

53226

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Common Stock, $0.01 Par Value

|

|

The NASDAQ Stock Market, LLC

|

|

(Title of class)

|

|

(Name of each exchange on which registered)

|

|

Large accelerated filer

|

|

|

Accelerated filer

|

|

|

Non-accelerated filer

(Do not check if a smaller

reporting company)

|

|

|

Smaller Reporting Company

|

|

|

DOCUMENTS INCORPORATED BY REFERENCE

|

||

|

|

|

Part of Form 10-K Into Which

|

|

Document

|

|

Portions of Document are Incorporated

|

|

Proxy Statement for Annual Meeting of

|

|

Part III

|

|

Shareholders on May 16, 2017

|

|

|

|

TABLE OF CONTENTS

|

|||

|

|

|

|

|

|

ITEM

|

|

|

PAGE

|

|

|

|

|

|

|

|

|

3

|

|

|

|

|

|

|

|

1.

|

|

3 - 31 | |

|

1A.

|

|

31 - 37 | |

|

1B.

|

|

37 | |

|

2.

|

|

38 | |

|

3.

|

|

39 | |

|

4.

|

|

39 | |

|

|

|

|

|

|

|

|

39 | |

|

|

|

|

|

|

5.

|

|

39 - 40 | |

|

6.

|

|

41 - 42 | |

|

7.

|

|

43 - 56 | |

|

7A.

|

|

57 | |

|

8.

|

|

58 - 105 | |

|

9.

|

|

106 | |

|

9A.

|

|

106 | |

|

9B.

|

|

107 | |

|

|

|

|

|

|

|

|

107 | |

|

|

|

|

|

|

10.

|

|

107 | |

|

11.

|

|

107 | |

|

12.

|

|

108 | |

|

13.

|

|

108 | |

|

14.

|

|

108 | |

|

|

|

|

|

|

|

|

109 | |

|

|

|

|

|

|

15.

|

|

109 | |

|

|

|

110 | |

|

16.

|

110 | ||

|

|

|||

|

•

|

Statements of our goals, intentions and expectations;

|

|

|

•

|

Statements regarding our business plans, prospects, growth and operating strategies;

|

|

|

•

|

Statements regarding the quality of our loan and investment portfolio;

|

|

|

•

|

Estimates of our risks and future costs and benefits.

|

|

•

|

general economic conditions, either nationally or in our market area, that are different than expected;

|

|

|

•

|

competition among depository and other financial institutions;

|

|

|

•

|

inflation and changes in the interest rate environment that reduce our margins and yields, our mortgage banking revenues or reduce the fair value of financial instruments or reduce the origination levels in our lending business, or increase the level of defaults, losses or prepayments on loans we have made and make whether held in portfolio or sold in the secondary markets;

|

|

|

•

|

adverse changes in the securities or secondary mortgage markets;

|

|

|

•

|

changes in laws or government regulations or policies affecting financial institutions, including changes in regulatory fees and capital requirements;

|

|

|

•

|

our ability to manage market risk, credit risk and operational risk in the current economic conditions;

|

|

|

•

|

our ability to enter new markets successfully and capitalize on growth opportunities;

|

|

|

•

|

our ability to successfully integrate acquired entities;

|

|

|

•

|

decreased demand for our products and services;

|

|

|

•

|

changes in tax policies or assessment policies;

|

|

|

•

|

the inability of third-party provider to perform their obligations to us;

|

|

|

•

|

changes in consumer spending, borrowing and savings habits;

|

|

|

•

|

changes in accounting policies and practices, as may be adopted by the bank regulatory agencies, the Financial Accounting Standards Board, the Securities and Exchange Commission or the Public Company Accounting Oversight Board;

|

|

|

•

|

our ability to retain key employees;

|

|

|

•

|

significant increases in our loan losses; and

|

|

|

•

|

changes in the financial condition, results of operations or future prospects of issuers of securities that we own.

|

|

At December 31,

|

||||||||||||||||||||||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||||||||||||||||||||||

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

Amount

|

Percent

|

|||||||||||||||||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||||||||||||||||||||||

|

Mortgage loans:

|

||||||||||||||||||||||||||||||||||||||||

|

Residential real estate:

|

||||||||||||||||||||||||||||||||||||||||

|

One- to four-family

|

$

|

392,817

|

33.35

|

%

|

$

|

381,992

|

34.26

|

%

|

$

|

411,979

|

37.62

|

%

|

$

|

413,614

|

37.85

|

%

|

$

|

460,821

|

40.65

|

%

|

||||||||||||||||||||

|

Multi-family

|

558,592

|

47.42

|

%

|

547,250

|

49.08

|

%

|

522,281

|

47.70

|

%

|

521,597

|

47.75

|

%

|

514,363

|

45.37

|

%

|

|||||||||||||||||||||||||

|

Home equity

|

21,778

|

1.85

|

%

|

24,326

|

2.18

|

%

|

29,207

|

2.67

|

%

|

35,432

|

3.24

|

%

|

36,494

|

3.22

|

%

|

|||||||||||||||||||||||||

|

Construction and land

|

18,179

|

1.54

|

%

|

19,148

|

1.72

|

%

|

17,081

|

1.56

|

%

|

31,905

|

2.92

|

%

|

33,818

|

2.98

|

%

|

|||||||||||||||||||||||||

|

Commercial real estate

|

159,401

|

13.53

|

%

|

118,820

|

10.66

|

%

|

94,771

|

8.65

|

%

|

71,698

|

6.56

|

%

|

65,495

|

5.78

|

%

|

|||||||||||||||||||||||||

|

Commercial loans

|

26,798

|

2.28

|

%

|

23,037

|

2.07

|

%

|

19,471

|

1.78

|

%

|

18,296

|

1.67

|

%

|

22,549

|

1.99

|

%

|

|||||||||||||||||||||||||

|

Consumer

|

319

|

0.03

|

%

|

361

|

0.03

|

%

|

200

|

0.02

|

%

|

134

|

0.01

|

%

|

132

|

0.01

|

%

|

|||||||||||||||||||||||||

|

Total loans

|

1,177,884

|

100.00

|

%

|

1,114,934

|

100.00

|

%

|

1,094,990

|

100.00

|

%

|

1,092,676

|

100.00

|

%

|

1,133,672

|

100.00

|

%

|

|||||||||||||||||||||||||

|

Allowance for loan losses

|

(16,029

|

)

|

(16,185

|

)

|

(18,706

|

)

|

(24,264

|

)

|

(31,043

|

)

|

||||||||||||||||||||||||||||||

|

Loans, net

|

$

|

1,161,855

|

$

|

1,098,749

|

$

|

1,076,284

|

$

|

1,068,412

|

$

|

1,102,629

|

||||||||||||||||||||||||||||||

|

One- to four-family

|

Multi-family

|

Home Equity

|

Construction and Land

|

|||||||||||||||||||||||||||||

|

Due during the year ended

|

Weighted

|

Weighted

|

Weighted

|

Weighted

|

||||||||||||||||||||||||||||

|

December 31,

|

Amount

|

Average Rate

|

Amount

|

Average Rate

|

Amount

|

Average Rate

|

Amount

|

Average Rate

|

||||||||||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||||||||||||||

|

2017

|

$

|

17,193

|

4.77

|

%

|

$

|

28,856

|

3.98

|

%

|

$

|

2,722

|

4.83

|

%

|

$

|

1,600

|

3.57

|

%

|

||||||||||||||||

|

2018

|

6,611

|

4.48

|

%

|

37,410

|

4.25

|

%

|

2,509

|

5.30

|

%

|

909

|

4.48

|

%

|

||||||||||||||||||||

|

2019

|

5,545

|

4.90

|

%

|

46,663

|

4.36

|

%

|

1,826

|

4.59

|

%

|

1,002

|

4.46

|

%

|

||||||||||||||||||||

|

2020

|

2,731

|

4.71

|

%

|

64,352

|

4.29

|

%

|

3,547

|

4.78

|

%

|

6,504

|

3.26

|

%

|

||||||||||||||||||||

|

2021

|

8,477

|

4.96

|

%

|

88,961

|

4.20

|

%

|

3,233

|

4.88

|

%

|

2,612

|

3.88

|

%

|

||||||||||||||||||||

|

2022 and thereafter

|

352,260

|

4.50

|

%

|

292,350

|

4.18

|

%

|

7,941

|

4.54

|

%

|

5,552

|

4.34

|

%

|

||||||||||||||||||||

|

Total

|

$

|

392,817

|

4.53

|

%

|

$

|

558,592

|

4.20

|

%

|

$

|

21,778

|

4.76

|

%

|

$

|

18,179

|

3.83

|

%

|

||||||||||||||||

|

Commercial Real Estate

|

Commercial

|

Consumer

|

Total

|

|||||||||||||||||||||||||||||

|

Due during the year ended

|

Weighted

|

Weighted

|

Weighted

|

Weighted

|

||||||||||||||||||||||||||||

|

December 31,

|

Amount

|

Average Rate

|

Amount

|

Average Rate

|

Amount

|

Average Rate

|

Amount

|

Average Rate

|

||||||||||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||||||||||||||

|

2017

|

$

|

7,363

|

4.90

|

%

|

$

|

13,593

|

4.02

|

%

|

$

|

154

|

6.71

|

%

|

$

|

71,481

|

4.30

|

%

|

||||||||||||||||

|

2018

|

12,361

|

4.16

|

%

|

5,261

|

3.87

|

%

|

20

|

3.97

|

%

|

65,081

|

4.27

|

%

|

||||||||||||||||||||

|

2019

|

23,763

|

4.49

|

%

|

1,708

|

4.24

|

%

|

14

|

5.00

|

%

|

80,521

|

4.44

|

%

|

||||||||||||||||||||

|

2020

|

17,046

|

4.23

|

%

|

3,539

|

4.48

|

%

|

-

|

0.00

|

%

|

97,719

|

4.25

|

%

|

||||||||||||||||||||

|

2021

|

21,725

|

4.21

|

%

|

2,171

|

4.42

|

%

|

131

|

4.54

|

%

|

127,310

|

4.26

|

%

|

||||||||||||||||||||

|

2022 and thereafter

|

77,143

|

4.17

|

%

|

526

|

4.74

|

%

|

-

|

0.00

|

%

|

735,772

|

4.33

|

%

|

||||||||||||||||||||

|

Total

|

$

|

159,401

|

4.26

|

%

|

$

|

26,798

|

4.11

|

%

|

$

|

319

|

5.57

|

%

|

$

|

1,177,884

|

4.32

|

%

|

||||||||||||||||

|

|

|

|

Due After December 31, 2017

|

||||||||||||

|

Fixed

|

Adjustable

|

Total

|

||||||||||

|

(In Thousands)

|

||||||||||||

|

Mortgage loans

|

||||||||||||

|

Real estate loans:

|

||||||||||||

|

One- to four-family

|

$

|

16,434

|

$

|

359,190

|

$

|

375,624

|

||||||

|

Multi-family

|

181,725

|

348,011

|

529,736

|

|||||||||

|

Home equity

|

4,888

|

14,168

|

19,056

|

|||||||||

|

Construction and land

|

12,857

|

3,722

|

16,579

|

|||||||||

|

Commercial

|

77,973

|

74,065

|

152,038

|

|||||||||

|

Commercial

|

9,084

|

4,121

|

13,205

|

|||||||||

|

Consumer

|

165

|

-

|

165

|

|||||||||

|

Total loans

|

$

|

303,126

|

$

|

803,277

|

$

|

1,106,403

|

||||||

|

As of or for the Year Ended December 31,

|

||||||||||||

|

2016

|

2015

|

2014

|

||||||||||

|

(In Thousands)

|

||||||||||||

|

Total gross loans receivable and held for sale at beginning of year

|

$

|

1,281,450

|

$

|

1,220,063

|

$

|

1,189,697

|

||||||

|

Real estate loans originated for investment:

|

||||||||||||

|

Residential

|

||||||||||||

|

One- to four-family

|

78,045

|

41,835

|

48,325

|

|||||||||

|

Multi-family

|

118,072

|

117,657

|

88,958

|

|||||||||

|

Home equity

|

5,037

|

7,265

|

4,177

|

|||||||||

|

Construction and land

|

5,878

|

11,085

|

8,806

|

|||||||||

|

Commercial real estate

|

35,443

|

43,138

|

29,294

|

|||||||||

|

Total real estate loans originated for investment

|

242,475

|

220,980

|

179,560

|

|||||||||

|

Consumer loans originated for investment

|

-

|

688

|

10

|

|||||||||

|

Commercial loans originated for investment

|

11,692

|

23,467

|

7,863

|

|||||||||

|

Total loans originated for investment

|

254,167

|

245,135

|

187,433

|

|||||||||

|

Principal repayments

|

(185,020

|

)

|

(203,271

|

)

|

(159,619

|

)

|

||||||

|

Transfers to real estate owned

|

(4,590

|

)

|

(15,580

|

)

|

(16,645

|

)

|

||||||

|

Loan principal charged-off

|

(1,607

|

)

|

(6,340

|

)

|

(8,855

|

)

|

||||||

|

Net activity in loans held for investment

|

62,950

|

19,944

|

2,314

|

|||||||||

|

Loans originated for sale

|

2,378,926

|

1,986,147

|

1,661,376

|

|||||||||

|

Loans sold

|

(2,320,194

|

)

|

(1,944,704

|

)

|

(1,633,324

|

)

|

||||||

|

Net activity in loans held for sale

|

58,732

|

41,443

|

28,052

|

|||||||||

|

Total gross loans receivable and held for sale at end of year

|

$

|

1,403,132

|

$

|

1,281,450

|

$

|

1,220,063

|

||||||

|

•

|

A secured one- to four-family mortgage loan up to $500,000 for a borrower with total outstanding loans from us of less than $1,000,000 that is independently underwritten can be approved by select loan officers.

|

|

•

|

A loan up to $500,000 for a borrower with total outstanding loans from us of less than $500,000 can be approved by select commercial loan officers.

|

|

•

|

Any secured mortgage loan ranging from $500,001 to $2,999,999 or any new loan to a borrower with outstanding loans from us exceeding $1,000,000 must be approved by the Officer Loan Committee.

|

|

•

|

Any loan for $3,000,000 or more must be approved by the Officer Loan Committee and the board of directors prior to closing. Any new loan to a borrower with outstanding loans from us exceeding $10,000,000 must be reviewed by the board of directors.

|

|

At December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||

|

Non-accrual loans:

|

||||||||||||||||||||

|

Residential

|

||||||||||||||||||||

|

One- to four-family

|

$

|

7,623

|

$

|

13,888

|

$

|

23,918

|

$

|

30,207

|

$

|

46,467

|

||||||||||

|

Multi-family

|

1,427

|

2,553

|

12,001

|

13,498

|

23,205

|

|||||||||||||||

|

Home equity

|

344

|

437

|

445

|

1,585

|

1,578

|

|||||||||||||||

|

Construction and land

|

-

|

239

|

401

|

4,195

|

2,215

|

|||||||||||||||

|

Commercial real estate

|

422

|

460

|

947

|

938

|

668

|

|||||||||||||||

|

Commercial

|

41

|

27

|

299

|

521

|

511

|

|||||||||||||||

|

Consumer

|

-

|

-

|

-

|

17

|

24

|

|||||||||||||||

|

Total non-accrual loans

|

9,857

|

17,604

|

38,011

|

50,961

|

74,668

|

|||||||||||||||

|

Real estate owned

|

||||||||||||||||||||

|

One- to four-family

|

2,141

|

4,610

|

10,896

|

12,980

|

17,353

|

|||||||||||||||

|

Multi-family

|

-

|

209

|

2,210

|

3,040

|

9,890

|

|||||||||||||||

|

Construction and land

|

5,082

|

5,262

|

5,400

|

6,258

|

7,029

|

|||||||||||||||

|

Commercial real estate

|

300

|

300

|

300

|

385

|

1,702

|

|||||||||||||||

|

Total real estate owned

|

7,523

|

10,381

|

18,806

|

22,663

|

35,974

|

|||||||||||||||

|

Valuation allowance at end of period

|

(1,405

|

)

|

(1,191

|

)

|

(100

|

)

|

-

|

-

|

||||||||||||

|

Total real estate owned, net

|

6,118

|

9,190

|

18,706

|

22,663

|

35,974

|

|||||||||||||||

|

Total non-performing assets

|

$

|

15,975

|

$

|

26,794

|

$

|

56,817

|

$

|

73,624

|

$

|

110,642

|

||||||||||

|

Total non-accrual loans to total loans, net

|

0.84

|

%

|

1.58

|

%

|

3.47

|

%

|

4.66

|

%

|

6.59

|

%

|

||||||||||

|

Total non-accrual loans to total assets

|

0.55

|

%

|

1.00

|

%

|

2.13

|

%

|

2.62

|

%

|

4.50

|

%

|

||||||||||

|

Total non-performing assets to total assets

|

0.89

|

%

|

1.52

|

%

|

3.18

|

%

|

3.78

|

%

|

6.66

|

%

|

||||||||||

|

At and for the Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||

|

Balance at beginning of year

|

$

|

17,604

|

$

|

38,011

|

$

|

50,961

|

$

|

74,668

|

$

|

78,218

|

||||||||||

|

Additions

|

3,114

|

10,165

|

21,585

|

33,488

|

44,617

|

|||||||||||||||

|

Transfers to real estate owned

|

(4,590

|

)

|

(15,580

|

)

|

(16,645

|

)

|

(13,552

|

)

|

(22,282

|

)

|

||||||||||

|

Charge-offs

|

(667

|

)

|

(3,809

|

)

|

(7,099

|

)

|

(11,792

|

)

|

(8,379

|

)

|

||||||||||

|

Returned to accrual status

|

(4,183

|

)

|

(5,824

|

)

|

(4,470

|

)

|

(26,005

|

)

|

(8,194

|

)

|

||||||||||

|

Principal paydowns and other

|

(1,421

|

)

|

(5,359

|

)

|

(6,321

|

)

|

(5,846

|

)

|

(9,312

|

)

|

||||||||||

|

Balance at end of year

|

$

|

9,857

|

$

|

17,604

|

$

|

38,011

|

$

|

50,961

|

$

|

74,668

|

||||||||||

|

At December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||

|

Troubled debt restructurings

|

||||||||||||||||||||

|

Substandard

|

$

|

7,025

|

$

|

14,436

|

$

|

22,629

|

$

|

25,258

|

$

|

48,449

|

||||||||||

|

Watch

|

3,112

|

3,103

|

3,488

|

4,329

|

11,172

|

|||||||||||||||

|

Total troubled debt restructurings

|

$

|

10,137

|

$

|

17,539

|

$

|

26,117

|

$

|

29,587

|

$

|

59,621

|

||||||||||

|

At December 31,

|

||||||||||||||||

|

2016

|

2015

|

|||||||||||||||

|

Accruing

|

Non-accruing

|

Accruing

|

Non-accruing

|

|||||||||||||

|

(In Thousands)

|

||||||||||||||||

|

One- to four-family

|

$

|

3,296

|

$

|

2,399

|

$

|

3,900

|

$

|

5,739

|

||||||||

|

Multi-family

|

2,514

|

1,427

|

2,546

|

2,317

|

||||||||||||

|

Home equity

|

49

|

97

|

-

|

98

|

||||||||||||

|

Construction and land

|

-

|

-

|

1,556

|

-

|

||||||||||||

|

Commercial real estate

|

295

|

60

|

1,306

|

77

|

||||||||||||

|

$

|

6,154

|

$

|

3,983

|

$

|

9,308

|

$

|

8,231

|

|||||||||

|

At or for the Year Ended December 31,

|

||||||||||||||||

|

2016

|

2015

|

|||||||||||||||

|

Accruing

|

Non-accruing

|

Accruing

|

Non-accruing

|

|||||||||||||

|

(In Thousands)

|

||||||||||||||||

|

Balance at beginning of year

|

$

|

9,308

|

$

|

8,231

|

$

|

10,819

|

$

|

15,298

|

||||||||

|

Additions

|

49

|

-

|

-

|

1,005

|

||||||||||||

|

Change in accrual status

|

-

|

-

|

-

|

-

|

||||||||||||

|

Charge-offs

|

-

|

(207

|

)

|

-

|

(358

|

)

|

||||||||||

|

Returned to contractual/market terms

|

(2,567

|

)

|

(2,780

|

)

|

(1,044

|

)

|

(3,965

|

)

|

||||||||

|

Transferred to real estate owned

|

-

|

(839

|

)

|

-

|

(3,039

|

)

|

||||||||||

|

Principal paydowns and other

|

(636

|

)

|

(422

|

)

|

(467

|

)

|

(710

|

)

|

||||||||

|

Balance at end of period

|

$

|

6,154

|

$

|

3,983

|

$

|

9,308

|

$

|

8,231

|

||||||||

|

At December 31,

|

||||||||

|

2016

|

2015

|

|||||||

|

(Dollars in Thousands)

|

||||||||

|

Loans past due less than 90 days

|

$

|

2,910

|

$

|

2,599

|

||||

|

Loans past due 90 days or more

|

5,289

|

8,932

|

||||||

|

Total loans past due

|

$

|

8,199

|

$

|

11,531

|

||||

|

Total loans past due to total loans receivable

|

0.70

|

%

|

1.03

|

%

|

||||

|

At or for the Year

|

||||||||||||||||||||

|

Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||

|

Balance at beginning of year

|

$

|

16,185

|

$

|

18,706

|

$

|

24,264

|

$

|

31,043

|

$

|

32,430

|

||||||||||

|

Provision for loan losses

|

380

|

1,965

|

1,150

|

4,532

|

8,300

|

|||||||||||||||

|

Charge-offs:

|

||||||||||||||||||||

|

Mortgage loans

|

||||||||||||||||||||

|

One- to four-family

|

1,003

|

3,855

|

2,424

|

8,706

|

6,472

|

|||||||||||||||

|

Multi-family

|

489

|

2,281

|

5,247

|

1,640

|

1,108

|

|||||||||||||||

|

Home equity

|

112

|

72

|

191

|

630

|

485

|

|||||||||||||||

|

Construction and land

|

3

|

84

|

496

|

1,480

|

1,668

|

|||||||||||||||

|

Commercial real estate

|

-

|

45

|

199

|

160

|

1,182

|

|||||||||||||||

|

Consumer

|

-

|

3

|

5

|

-

|

4

|

|||||||||||||||

|

Commercial

|

-

|

-

|

293

|

8

|

59

|

|||||||||||||||

|

Total charge-offs

|

1,607

|

6,340

|

8,855

|

12,624

|

10,978

|

|||||||||||||||

|

Recoveries:

|

||||||||||||||||||||

|

Mortgage loans

|

||||||||||||||||||||

|

One- to four-family

|

811

|

649

|

1,833

|

957

|

667

|

|||||||||||||||

|

Multi-family

|

152

|

992

|

189

|

258

|

56

|

|||||||||||||||

|

Home equity

|

36

|

110

|

14

|

35

|

25

|

|||||||||||||||

|

Construction and land

|

72

|

58

|

75

|

51

|

250

|

|||||||||||||||

|

Commercial real estate

|

-

|

40

|

27

|

-

|

-

|

|||||||||||||||

|

Consumer

|

-

|

5

|

6

|

6

|

-

|

|||||||||||||||

|

Commercial

|

-

|

-

|

3

|

6

|

293

|

|||||||||||||||

|

Total recoveries

|

1,071

|

1,854

|

2,147

|

1,313

|

1,291

|

|||||||||||||||

|

Net charge-offs

|

536

|

4,486

|

6,708

|

11,311

|

9,687

|

|||||||||||||||

|

Allowance at end of year

|

$

|

16,029

|

$

|

16,185

|

$

|

18,706

|

$

|

24,264

|

$

|

31,043

|

||||||||||

|

Ratios:

|

||||||||||||||||||||

|

Allowance for loan losses to non-performing loans at end of year

|

162.62

|

%

|

91.94

|

%

|

49.21

|

%

|

47.61

|

%

|

41.58

|

%

|

||||||||||

|

Allowance for loan losses to loans outstanding at end of year

|

1.36

|

%

|

1.45

|

%

|

1.71

|

%

|

2.22

|

%

|

2.74

|

%

|

||||||||||

|

Net charge-offs to average loans outstanding

|

0.05

|

%

|

0.37

|

%

|

0.55

|

%

|

0.94

|

%

|

0.76

|

%

|

||||||||||

|

Current year provision for loan losses to net charge-offs

|

70.90

|

%

|

43.80

|

%

|

17.14

|

%

|

40.07

|

%

|

85.68

|

%

|

||||||||||

|

Net charge-offs to beginning of the year allowance

|

3.31

|

%

|

23.98

|

%

|

27.65

|

%

|

36.44

|

%

|

29.87

|

%

|

||||||||||

|

At December 31,

|

||||||||||||||||||||||||||||||||||||

|

2016

|

2015

|

2014

|

||||||||||||||||||||||||||||||||||

|

Allowance for Loan Losses

|

% of Loans in Category to Total Loans

|

% of Allowance in Category to Total Allowance

|

Allowance for Loan Losses

|

% of Loans in Category to Total Loans

|

% of Allowance in Category to Total Allowance

|

Allowance for Loan Losses

|

% of Loans in Category to Total Loans

|

% of Allowance in Category to Total Allowance

|

||||||||||||||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||||||||||||||||||

|

Real Estate:

|

||||||||||||||||||||||||||||||||||||

|

Residential

|

||||||||||||||||||||||||||||||||||||

|

One- to four-family

|

$

|

7,164

|

33.35

|

%

|

44.69

|

%

|

$

|

7,763

|

34.26

|

%

|

47.96

|

%

|

$

|

9,877

|

37.62

|

%

|

52.80

|

%

|

||||||||||||||||||

|

Multi-family

|

4,809

|

47.42

|

%

|

30.00

|

%

|

5,000

|

49.08

|

%

|

30.89

|

%

|

5,358

|

47.70

|

%

|

28.64

|

%

|

|||||||||||||||||||||

|

Home equity

|

364

|

1.85

|

%

|

2.27

|

%

|

433

|

2.18

|

%

|

2.68

|

%

|

422

|

2.67

|

%

|

2.26

|

%

|

|||||||||||||||||||||

|

Construction and land

|

1,016

|

1.54

|

%

|

6.34

|

%

|

904

|

1.72

|

%

|

5.59

|

%

|

687

|

1.56

|

%

|

3.67

|

%

|

|||||||||||||||||||||

|

Commercial real estate

|

1,951

|

13.53

|

%

|

12.17

|

%

|

1,680

|

10.66

|

%

|

10.38

|

%

|

1,951

|

8.65

|

%

|

10.43

|

%

|

|||||||||||||||||||||

|

Commercial

|

713

|

2.28

|

%

|

4.45

|

%

|

396

|

2.07

|

%

|

2.45

|

%

|

403

|

1.78

|

%

|

2.15

|

%

|

|||||||||||||||||||||

|

Consumer

|

12

|

0.03

|

%

|

0.07

|

%

|

9

|

0.03

|

%

|

0.06

|

%

|

8

|

0.02

|

%

|

0.04

|

%

|

|||||||||||||||||||||

|

Total allowance for loan losses

|

$

|

16,029

|

100.00

|

%

|

100.00

|

%

|

$

|

16,185

|

100.00

|

%

|

100.00

|

%

|

$

|

18,706

|

100.00

|

%

|

100.00

|

%

|

||||||||||||||||||

|

At December 31,

|

||||||||||||||||||||||||

|

2013

|

2012

|

|||||||||||||||||||||||

|

Allowance for Loan Losses

|

% of Loans in Category to Total Loans

|

% of Allowance in Category to Total Allowance

|

Allowance for Loan Losses

|

% of Loans in Category to Total Loans

|

% of Allowance in Category to Total Allowance

|

|||||||||||||||||||

|

(Dollars In Thousands)

|

||||||||||||||||||||||||

|

Real Estate:

|

||||||||||||||||||||||||

|

Residential

|

||||||||||||||||||||||||

|

One- to four-family

|

$

|

11,549

|

37.85

|

%

|

47.59

|

%

|

$

|

17,819

|

40.65

|

%

|

57.40

|

%

|

||||||||||||

|

Multi-family

|

7,211

|

47.75

|

%

|

29.72

|

%

|

7,734

|

45.37

|

%

|

24.90

|

%

|

||||||||||||||

|

Home equity

|

1,807

|

3.24

|

%

|

7.45

|

%

|

2,097

|

3.22

|

%

|

6.76

|

%

|

||||||||||||||

|

Construction and land

|

1,613

|

2.92

|

%

|

6.65

|

%

|

1,323

|

2.98

|

%

|

4.26

|

%

|

||||||||||||||

|

Commercial real estate

|

1,402

|

6.56

|

%

|

5.78

|

%

|

1,259

|

5.78

|

%

|

4.06

|

%

|

||||||||||||||

|

Commercial

|

648

|

1.67

|

%

|

2.67

|

%

|

781

|

1.99

|

%

|

2.52

|

%

|

||||||||||||||

|

Consumer

|

34

|

0.01

|

%

|

0.14

|

%

|

30

|

0.01

|

%

|

0.10

|

%

|

||||||||||||||

|

Total allowance for loan losses

|

$

|

24,264

|

100.00

|

%

|

100.00

|

%

|

$

|

31,043

|

100.00

|

%

|

100.00

|

%

|

||||||||||||

|

At December 31,

|

||||||||||||||||||||||||

|

2016

|

2015

|

2014

|

||||||||||||||||||||||

|

Amortized

|

Amortized

|

Amortized

|

||||||||||||||||||||||

|

Cost

|

Fair Value

|

Cost

|

Fair Value

|

Cost

|

Fair Value

|

|||||||||||||||||||

|

(In Thousands)

|

||||||||||||||||||||||||

|

Securities available for sale:

|

||||||||||||||||||||||||

|

Mortgage-backed securities

|

$

|

72,858

|

$

|

73,413

|

$

|

95,911

|

$

|

96,667

|

$

|

115,670

|

$

|

117,128

|

||||||||||||

|

Collateralized mortgage obligations

|

||||||||||||||||||||||||

|

Government sponsored enterprise issued

|

62,297

|

62,002

|

70,605

|

70,428

|

58,821

|

59,071

|

||||||||||||||||||

|

Government sponsored enterprise bonds

|

2,500

|

2,503

|

3,750

|

3,746

|

6,750

|

6,711

|

||||||||||||||||||

|

Municipal obligations

|

70,311

|

70,696

|

77,509

|

79,159

|

76,037

|

77,108

|

||||||||||||||||||

|

Other debt securities

|

17,399

|

16,950

|

17,401

|

16,963

|

7,404

|

7,528

|

||||||||||||||||||

|

Certificates of deposit

|

1,225

|

1,231

|

2,695

|

2,695

|

5,880

|

5,897

|

||||||||||||||||||

|

Total securities available for sale

|

$

|

226,590

|

$

|

226,795

|

$

|

267,871

|

$

|

269,658

|

$

|

270,562

|

$

|

273,443

|

||||||||||||

|

At December 31, 2016

|

||||||||

|

Amortized Cost

|

Fair Value

|

|||||||

|

(In Thousands)

|

||||||||

|

Fannie Mae

|

$

|

89,866

|

$

|

90,010

|

||||

|

Freddie Mac

|

$

|

43,041

|

$

|

43,143

|

||||

|

One Year or Less

|

More than One Year through Five Years

|

More than Five Years through Ten Years

|

More than Ten Years

|

Total Securities

|

||||||||||||||||||||||||||||||||||||

|

Weighted

|

Weighted

|

Weighted

|

Weighted

|

Weighted

|

||||||||||||||||||||||||||||||||||||

|

Amortized

|

Average

|

Amortized

|

Average

|

Amortized

|

Average

|

Amortized

|

Average

|

Amortized

|

Average

|

|||||||||||||||||||||||||||||||

|

Cost

|

Yield

|

Cost

|

Yield

|

Cost

|

Yield

|

Cost

|

Yield

|

Cost

|

Yield

|

|||||||||||||||||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||||||||||||||||||||||

|

Securities available for sale:

|

||||||||||||||||||||||||||||||||||||||||

|

Mortgage-backed securities

|

$

|

370

|

4.91

|

%

|

$

|

65,925

|

2.32

|

%

|

$

|

2,330

|

2.72

|

%

|

$

|

4,233

|

3.16

|

%

|

$

|

72,858

|

2.39

|

%

|

||||||||||||||||||||

|

Collateralized mortgage obligations

|

||||||||||||||||||||||||||||||||||||||||

|

Government sponsored enterprise issued

|

299

|

3.26

|

%

|

59,462

|

2.12

|

%

|

2,536

|

1.76

|

%

|

-

|

-

|

62,297

|

2.11

|

%

|

||||||||||||||||||||||||||

|

Government sponsored enterprise bonds

|

-

|

-

|

2,500

|

1.18

|

%

|

-

|

-

|

-

|

-

|

2,500

|

1.18

|

%

|

||||||||||||||||||||||||||||

|

Municipal obligations

|

8,492

|

2.22

|

%

|

12,457

|

2.79

|

%

|

41,332

|

3.80

|

%

|

8,030

|

4.84

|

%

|

70,311

|

3.55

|

%

|

|||||||||||||||||||||||||

|

Other debt securities

|

-

|

-

|

5,007

|

2.70

|

%

|

-

|

-

|

12,392

|

5.16

|

%

|

17,399

|

4.45

|

%

|

|||||||||||||||||||||||||||

|

Certificates of deposit

|

245

|

1.45

|

%

|

980

|

1.84

|

%

|

-

|

-

|

-

|

-

|

1,225

|

1.47

|

%

|

|||||||||||||||||||||||||||

|

Total securities available for sale

|

$

|

9,406

|

2.34

|

%

|

$

|

146,331

|

2.27

|

%

|

$

|

46,198

|

3.64

|

%

|

$

|

24,655

|

4.71

|

%

|

$

|

226,590

|

2.81

|

%

|

||||||||||||||||||||

|

At December 31,

|

||||||||||||||||||||||||||||||||||||

|

2016

|

2015

|

2014

|

||||||||||||||||||||||||||||||||||

|

Weighted

|

Weighted

|

Weighted

|

||||||||||||||||||||||||||||||||||

|

Average

|

Average

|

Average

|

||||||||||||||||||||||||||||||||||

|

Balance

|

Percent

|

Rate

|

Balance

|

Percent

|

Rate

|

Balance

|

Percent

|

Rate

|

||||||||||||||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||||||||||||||||||

|

Deposit type:

|

||||||||||||||||||||||||||||||||||||

|

Demand deposits

|

$

|

78,393

|

8.26

|

%

|

0.00

|

%

|

$

|

69,170

|

7.74

|

%

|

0.00

|

%

|

$

|

63,885

|

7.39

|

%

|

0.00

|

%

|

||||||||||||||||||

|

NOW accounts

|

41,978

|

4.42

|

%

|

0.05

|

%

|

33,503

|

3.75

|

%

|

0.06

|

%

|

28,277

|

3.27

|

%

|

0.06

|

%

|

|||||||||||||||||||||

|

Savings

|

62,514

|

6.58

|

%

|

0.04

|

%

|

59,256

|

6.63

|

%

|

0.04

|

%

|

58,783

|

6.80

|

%

|

0.04

|

%

|

|||||||||||||||||||||

|

Money market

|

99,942

|

10.53

|

%

|

0.41

|

%

|

81,375

|

9.11

|

%

|

0.41

|

%

|

60,380

|

6.99

|

%

|

0.14

|

%

|

|||||||||||||||||||||

|

Total transaction accounts

|

282,827

|

29.79

|

%

|

0.16

|

%

|

243,304

|

27.23

|

%

|

0.15

|

%

|

211,325

|

24.45

|

%

|

0.06

|

%

|

|||||||||||||||||||||

|

Certificates of deposit

|

666,584

|

70.21

|

%

|

1.03

|

%

|

650,057

|

72.77

|

%

|

0.97

|

%

|

652,635

|

75.55

|

%

|

0.83

|

%

|

|||||||||||||||||||||

|

Total deposits

|

$

|

949,411

|

100.00

|

%

|

0.77

|

%

|

$

|

893,361

|

100.00

|

%

|

0.75

|

%

|

$

|

863,960

|

100.00

|

%

|

0.64

|

%

|

||||||||||||||||||

|

At December 31,

|

|||||||||||||||||||||||||||

|

2013

|

2012

|

||||||||||||||||||||||||||

|

Weighted

|

Weighted

|

||||||||||||||||||||||||||

|

Average

|

Average

|

||||||||||||||||||||||||||

|

Balance

|

Percent

|

Rate

|

Balance

|

Percent

|

Rate

|

||||||||||||||||||||||

|

(Dollars in Thousands)

|

|||||||||||||||||||||||||||

|

Deposit type:

|

|||||||||||||||||||||||||||

|

Demand deposits

|

$

|

45,850

|

3.68

|

%

|

0.00

|

%

|

$

|

39,767

|

4.23

|

%

|

0.00

|

%

|

|||||||||||||||

|

NOW accounts

|

47,425

|

3.81

|

%

|

0.03

|

%

|

44,373

|

4.72

|

%

|

0.03

|

%

|

|||||||||||||||||

|

Savings

|

451,476

|

36.27

|

%

|

(1

|

)

|

0.01

|

%

|

54,837

|

5.84

|

%

|

0.10

|

%

|

|||||||||||||||

|

Money market

|

62,240

|

5.00

|

%

|

0.11

|

%

|

63,616

|

6.77

|

%

|

0.15

|

%

|

|||||||||||||||||

|

Total transaction accounts

|

606,991

|

48.76

|

%

|

(1

|

)

|

0.02

|

%

|

202,593

|

21.56

|

%

|

0.08

|

%

|

|||||||||||||||

|

Certificates of deposit

|

637,750

|

51.24

|

%

|

0.69

|

%

|

736,920

|

78.44

|

%

|

0.83

|

%

|

|||||||||||||||||

|

Total deposits

|

$

|

1,244,741

|

100.00

|

%

|

(1

|

)

|

0.36

|

%

|

$

|

939,513

|

100.00

|

%

|

0.67

|

%

|

|||||||||||||

|

(In Thousands)

|

||||

|

Due in:

|

||||

|

Three months or less

|

$

|

34,173

|

||

|

Over three months through six months

|

37,188

|

|||

|

Over six months through 12 months

|

97,862

|

|||

|

Over 12 months

|

67,990

|

|||

|

Total

|

237,213

|

|||

|

At or For the Year Ended

|

||||||||||||

|

December 31,

|

||||||||||||

|

2016

|

2015

|

2014

|

||||||||||

|

Borrowings:

|

(Dollars in Thousands)

|

|||||||||||

|

Balance outstanding at end of year

|

$

|

387,155

|

$

|

441,203

|

$

|

434,000

|

||||||

|

Weighted average interest rate at the end of year

|

2.27

|

%

|

3.88

|

%

|

3.89

|

%

|

||||||

|

Maximum amount of borrowings outstanding at any month end during the year

|

$

|

414,745

|

$

|

474,000

|

$

|

454,686

|

||||||

|

Average balance outstanding during the year

|

$

|

381,803

|

$

|

437,964

|

$

|

442,731

|

||||||

|

Weighted average interest rate during the year

|

3.39

|

%

|

3.94

|

%

|

3.93

|

%

|

||||||

|

•

|

for loans secured by raw land, the supervisory loan-to-value limit is 65% of the value of the collateral;

|

|

|

•

|

for land development loans (i.e., loans for the purpose of improving unimproved property prior to the erection of structures), the supervisory limit is 75%;

|

|

|

•

|

for loans for the construction of commercial, over four-family or other non-residential property, the supervisory limit is 80%;

|

|

|

•

|

for loans for the construction of one- to four-family properties, the supervisory limit is 85%; and

|

|

|

•

|

for loans secured by other improved property (e.g., farmland, completed commercial property and other income-producing property, including non-owner occupied, one- to four-family property), the limit is 85%.

|

|

•

|

excessive upfront points and fees (those exceeding 3% of the total loan amount, less "bona fide discount points" for prime loans);

|

|

|

•

|

interest-only payments;

|

|

|

•

|

negative-amortization; and

|

|

|

•

|

terms longer than 30 years

|

|

•

|

difficulty in estimating the value of the target company;

|

|

|

•

|

payment of a premium over book and market values that may dilute our tangible book value and earnings per share in the short and long term;

|

|

|

•

|

potential exposure to unknown or contingent tax or other liabilities of the target company;

|

|

|

•

|

exposure to potential asset quality problems of the target company;

|

|

|

•

|

potential volatility in reported income associated with goodwill impairment losses;

|

|

|

•

|

difficulty and expense of integrating the operations and personnel of the target company;

|

|

|

•

|

inability to realize the expected revenue increases, cost savings, increases in geographic or product presence, and/or other projected benefits;

|

|

|

•

|

potential disruption to our business;

|

|

|

•

|

potential diversion of our management's time and attention;

|

|

|

•

|

the possible loss of key employees and customers of the target company; and

|

|

|

•

|

potential changes in banking or tax laws or regulations that may affect the target company.

|

|

Corporate Center

11200 West Plank Court

Wauwatosa, Wisconsin 53226 |

Wauwatosa

7500 West State Street

Wauwatosa, Wisconsin 53213 |

Brookfield (1)

17495 W Capitol Dr.

Brookfield, WI 53045 |

|

Franklin/Hales Corners

6555 South 108th Street

Franklin, Wisconsin 53132 |

Germantown/Menomonee Falls

W188N9820 Appleton Avenue

Germantown, Wisconsin 53022 |

Oak Creek

6560 South 27th Street

Oak Creek, Wisconsin 53154 |

|

Oconomowoc/Lake Country (1)

1233 Corporate Center Drive

Oconomowoc, Wisconsin 53066 |

Pewaukee

1230 George Towne Drive

Pewaukee, Wisconsin 53072 |

Waukesha/Brookfield

21505 East Moreland Blvd.

Waukesha, Wisconsin 53186 |

|

West Allis

10101 West Greenfield Avenue

West Allis, Wisconsin 53214 |

Fox Point

8607 North Port Washington Road

Fox Point, WI 53217

|

Greenfield

5000 West Loomis Road

Greenfield, WI 53220

|

|

Commercial Real Estate Loan Production Office (1)

701 Washington Avenue N

Suite 525

Minneapolis, MN 55401 |

|

(1)

|

Leased property

|

|

Period

|

Total

Number of Shares Purchased |

Average

Price Paid per Share |

Total Number of

Shares Purchased as Part of Publicly Announced Plans |

Maximum

Number of Shares that May Yet Be Purchased Under the Plan (a) |

||||||||||||

|

October 1, 2016 - October 31, 2016

|

-

|

$

|

-

|

-

|

989,500

|

|||||||||||

|

November 1, 2016 - November 30, 2016

|

-

|

-

|

-

|

989,500

|

||||||||||||

|

December 1, 2016 - December 31, 2016

|

-

|

-

|

-

|

989,500

|

||||||||||||

|

Total

|

-

|

$

|

-

|

-

|

989,500

|

|||||||||||

|

(a) On September 4, 2015, the Board of Directors terminated the existing plan and authorized the repurchase of 1,500,000 shares of common stock.

|

||||||||||||||||

|

2016

|

||||||||||||

|

High

|

Low

|

Dividends Declared

|

||||||||||

|

1st Quarter

|

$

|

14.12

|

$

|

13.42

|

$

|

0.05

|

||||||

|

2nd Quarter

|

15.33

|

13.69

|

0.08

|

|||||||||

|

3rd Quarter

|

17.08

|

15.15

|

0.08

|

|||||||||

|

4th Quarter

|

19.20

|

16.50

|

0.12

|

|||||||||

|

2015

|

||||||||||||

|

High

|

Low

|

Dividends Declared

|

||||||||||

|

1st Quarter

|

$

|

13.24

|

$

|

12.67

|

$

|

0.05

|

||||||

|

2nd Quarter

|

13.28

|

12.70

|

0.05

|

|||||||||

|

3rd Quarter

|

13.60

|

12.43

|

0.05

|

|||||||||

|

4th Quarter

|

14.44

|

13.14

|

0.05

|

|||||||||

|

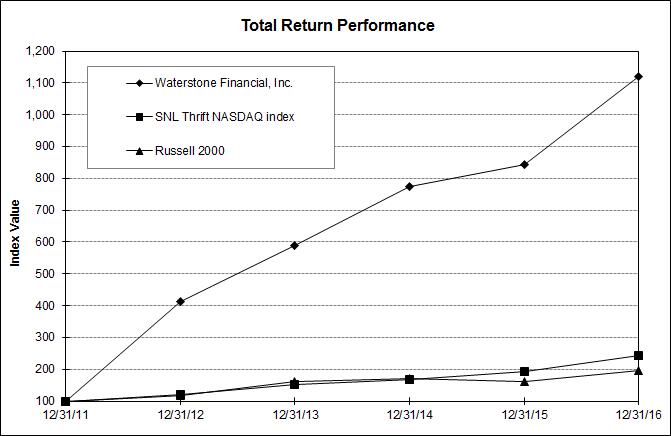

Index

|

12/31/11

|

12/31/12

|

12/31/13

|

12/31/14

|

12/31/15

|

12/31/16

|

|

Waterstone Financial, Inc.

|

100.00

|

412.70

|

587.30

|

773.86

|

842.48

|

1,118.36

|

|

SNL Thrift NASDAQ index

|

100.00

|

119.34

|

151.33

|

167.60

|

191.52

|

243.50

|

|

Russell 2000

|

100.00

|

116.35

|

161.52

|

169.43

|

161.95

|

196.45

|

|

At or for the Year Ended December 31,

|

||||||||||||||||||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

||||||||||||||||

|

(In Thousands, except per share amounts)

|

||||||||||||||||||||

|

Selected Financial Condition Data:

|

||||||||||||||||||||

|

Total assets

|

$

|

1,790,619

|

$

|

1,762,729

|

$

|

1,783,380

|

$

|

1,947,039

|

$

|

1,661,076

|

||||||||||

|

Cash and cash equivalents

|

47,217

|

100,471

|

172,820

|

429,169

|

71,469

|

|||||||||||||||

|

Securities available for sale

|

226,795

|

269,658

|

273,443

|

213,418

|

205,017

|

|||||||||||||||

|

Loans held for sale

|

225,248

|

166,516

|

125,073

|

97,021

|

133,613

|

|||||||||||||||

|

Loans receivable

|

1,177,884

|

1,114,934

|

1,094,990

|

1,092,676

|

1,133,672

|

|||||||||||||||

|

Allowance for loan losses

|

16,029

|

16,185

|

18,706

|

24,264

|

31,043

|

|||||||||||||||

|

Loans receivable, net

|

1,161,855

|

1,098,749

|

1,076,284

|

1,068,412

|

1,102,629

|

|||||||||||||||

|

Real estate owned, net

|

6,118

|

9,190

|

18,706

|

22,663

|

35,974

|

|||||||||||||||

|

Deposits

|

949,411

|

893,361

|

863,960

|

1,244,741

|

939,513

|

|||||||||||||||

|

Borrowings

|

387,155

|

441,203

|

434,000

|

455,197

|

479,888

|

|||||||||||||||

|

Total shareholders' equity

|

410,690

|

391,930

|

450,237

|

214,472

|

202,634

|

|||||||||||||||

|

Selected Operating Data:

|

||||||||||||||||||||

|

Interest income

|

$

|

63,736

|

$

|

61,963

|

$

|

63,634

|

$

|

62,864

|

$

|

69,846

|

||||||||||

|

Interest expense

|

20,292

|

23,119

|

22,327

|

23,658

|

27,901

|

|||||||||||||||

|

Net interest income

|

43,444

|

38,844

|

41,307

|

39,206

|

41,945

|

|||||||||||||||

|

Provision for loan losses

|

380

|

1,965

|

1,150

|

4,532

|

8,300

|

|||||||||||||||

|

Net interest income after provision for loan losses

|

43,064

|

36,879

|

40,157

|

34,674

|

33,645

|

|||||||||||||||

|

Noninterest income

|

126,365

|

104,474

|

84,568

|

87,799

|

91,203

|

|||||||||||||||

|

Noninterest expense

|

127,435

|

115,534

|

104,818

|

99,144

|

102,138

|

|||||||||||||||

|

Income before income taxes

|

41,994

|

25,819

|

19,907

|

23,329

|

22,710

|

|||||||||||||||

|

Provision for income taxes (benefit)

|

16,462

|

9,249

|

7,175

|

8,621

|

(12,204

|

)

|

||||||||||||||

|

Net income

|

$

|

25,532

|

$

|

16,570

|

$

|

12,732

|

$

|

14,708

|

$

|

34,914

|

||||||||||

|

Per common share:

|

||||||||||||||||||||

|

Income per share - basic

|

$

|

0.94

|

$

|

0.57

|

$

|

0.38

|

$

|

0.43

|

$

|

1.02

|

||||||||||

|

Income per share - diluted

|

$

|

0.93

|

$

|

0.56

|

$

|

0.38

|

$

|

0.43

|

$

|

1.02

|

||||||||||

|

Book value

|

$

|

13.95

|

$

|

13.33

|

$

|

13.08

|

$

|

6.84

|

$

|

6.52

|

||||||||||

|

Dividends declared

|

$

|

0.33

|

$

|

0.20

|

$

|

0.20

|

N/A

|

N/A

|

||||||||||||

|

At or for the Year Ended December 31,

|

|||||

|

2016

|

2015

|

2014

|

2013

|

2012

|

|

|

Selected Financial Ratios and Other Data:

|

|||||

|

Performance Ratios:

|

|||||

|

Return on average assets

|

1.45 %

|

0.94 %

|

0.71 %

|

0.90%

|

2.07%

|

|

Return on average equity

|

6.33

|

3.99

|

2.89

|

7.01

|

18.89

|

|

Interest rate spread

(1)

|

2.26

|

1.91

|

2.03

|

2.36

|

2.45

|

|

Net interest margin

(2)

|

2.64

|

2.36

|

2.44

|

2.56

|

2.62

|

|

Noninterest expense to average assets

|

7.24

|

6.58

|

5.82

|

6.05

|

6.04

|

|

Efficiency ratio

(3)

|

75.05

|

80.61

|

83.27

|

78.31

|

76.71

|

|

Average interest-earning assets to average interest-bearing liabilities

|

130.56

|

131.54

|

139.98

|

113.96

|

109.84

|

|

Dividend payout ratio

(4)

|

27.66

|

35.20

|

52.48

|

N/A

|

N/A

|

|

Capital Ratios:

|

|||||

|

Waterstone Financial, Inc.:

|

|||||

|

Equity to total assets at end of period

|

22.94 %

|

22.23 %

|

25.25 %

|

11.02 %

|

12.20 %

|

|

Average equity to average assets

|

22.90

|

23.62

|

24.51

|

12.82

|

10.94

|

|

Total capital to risk-weighted assets

|

32.23

|

33.41

|

41.25

|

N/A

|

N/A

|

|

Tier 1 capital to risk-weighted assets

|

31.02

|

32.16

|

39.99

|

N/A

|

N/A

|

|

Common equity tier 1 capital to risk-weighted assets

|

31.02

|

32.16

|

N/A

|

N/A

|

N/A

|

|

Tier 1 capital to average assets

|

23.20

|

22.20

|

24.80

|

N/A

|

N/A

|

|

WaterStone Bank:

|

|||||

|

Total capital to risk-weighted assets

|

29.50

|

30.92

|

31.98

|

21.67

|

17.34

|

|

Tier I capital to risk-weighted assets

|

28.29

|

29.67

|

30.73

|

20.41

|

16.07

|

|

Common equity tier 1 capital to risk-weighted assets

|

28.29

|

29.67

|

N/A

|

N/A

|

N/A

|

|

Tier I capital to average assets

|

21.17

|

20.45

|

19.04

|

12.48

|

11.13

|

|

Asset Quality Ratios:

|

|||||

|

Allowance for loan losses as a percent of total loans

|

1.36 %

|

1.45 %

|

1.71 %

|

2.22 %

|

2.74 %

|

|

Allowance for loan losses as a percent of non-performing loans

|

162.62

|

91.94

|

49.21

|

47.61

|

41.58

|

|

Net charge-offs to average outstanding loans during the period

|

0.05

|

0.37

|

0.55

|

0.94

|

0.76

|

|

Non-performing loans as a percent of total loans

|

0.84

|

1.58

|

3.47

|

4.66

|

6.59

|

|

Non-performing assets as a percent of total assets

|

0.89

|

1.52

|

3.18

|

3.78

|

6.66

|

|

Other Data:

|

|||||

|

Number of full-service banking offices

|

11

|

11

|

9

|

8

|

8

|

|

Number of full-time equivalent employees

|

895

|

770

|

731

|

849

|

726

|

|

•

|

Obtaining updated real estate appraisals or performing updated discounted cash flow analysis;

|

|

|

•

|

Confirming that the physical condition of the real estate has not significantly changed since the last valuation date;

|

|

|

•

|

Comparing the estimated current book value to that of updated sales values experienced on similar real estate owned;

|

|

|