|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934

|

|

For the fiscal year ended December 31, 2018

|

|

|

or

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from __________ to __________

|

|

|

WEST BANCORPORATION, INC.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

IOWA

|

42-1230603

|

|

(State of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

1601 22

nd

STREET, WEST DES MOINES, IOWA

|

50266

|

|

(Address of principal executive offices)

|

(Zip code)

|

|

Title of Class

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, No Par Value

|

The Nasdaq Global Select Market

|

|

|

Large accelerated filer

|

o

|

|

|

Accelerated filer

|

x

|

|

|

Non-accelerated filer

|

o

|

|

|

Smaller reporting company

|

x

|

|

|

Emerging growth company

|

o

|

|

|

FORM 10-K

|

||

|

TABLE OF CONTENTS

|

||

|

|

||

|

|

|

|

|

PART I

|

||

|

|

|

|

|

ITEM 1.

|

||

|

|

|

|

|

ITEM 1A.

|

||

|

|

|

|

|

ITEM 1B.

|

||

|

|

|

|

|

ITEM 2.

|

||

|

|

|

|

|

ITEM 3.

|

||

|

|

|

|

|

ITEM 4.

|

||

|

|

|

|

|

PART II

|

||

|

|

|

|

|

ITEM 5.

|

||

|

|

|

|

|

ITEM 6.

|

||

|

|

|

|

|

ITEM 7.

|

||

|

|

|

|

|

ITEM 7A.

|

||

|

|

|

|

|

ITEM 8.

|

||

|

|

|

|

|

ITEM 9.

|

||

|

|

|

|

|

ITEM 9A.

|

||

|

|

|

|

|

ITEM 9B.

|

||

|

|

|

|

|

PART III

|

||

|

|

|

|

|

ITEM 10.

|

||

|

|

|

|

|

ITEM 11.

|

||

|

|

|

|

|

ITEM 12.

|

||

|

|

|

|

|

ITEM 13.

|

||

|

|

|

|

|

ITEM 14.

|

||

|

|

|

|

|

PART IV

|

||

|

|

|

|

|

ITEM 15.

|

||

|

ITEM 16.

|

||

|

l

|

Return on average assets:

|

1.31

|

%

|

|

l

|

Return on average equity:

|

15.68

|

%

|

|

l

|

Efficiency ratio

(1)

:

|

48.92

|

%

|

|

l

|

Texas ratio:

|

0.93

|

%

|

|

•

|

West Bancorporation received national recognition from investment bank and research firm Raymond James in the annual Raymond James Community Bankers Cup, which identifies America’s top performing publicly traded community banks with assets between $500 million and $10 billion. The Raymond James Community Bankers Cup recognizes the top 10% of exchange-traded community banks based on various profitability, operational efficiency, and balance sheet metrics. Raymond James ranked West Bancorporation number seven in the nation for 2017. This is the fifth consecutive year we have made this list.

|

|

•

|

West Bancorporation was ranked number 12 among the publicly traded banks with assets between $1 billion and $5 billion in

Bank Director Magazine’s

2017 Bank Performance Scorecard. In addition to this ranking, West Bancorporation was ranked number 21 in the nation across banks of all sizes in the same Bank Performance Scorecard. The rankings were based on five measures related to profitability, capitalization and asset quality. This is the sixth consecutive year we have made this list.

|

|

•

|

A ratio of minimum Common Equity Tier 1 Capital equal to 4.5 percent of total risk-weighted assets;

|

|

•

|

An increase in the minimum required amount of Tier 1 Capital from 4 percent to 6 percent of total risk-weighted assets;

|

|

•

|

A continuation of the minimum required amount of Total Capital (Tier 1 plus Tier 2) at 8 percent of total risk-weighted assets; and

|

|

•

|

A minimum leverage ratio of Tier 1 Capital to total quarterly average assets equal to 4 percent in all circumstances.

|

|

•

|

A Common Equity Tier 1 Capital ratio to total risk-weighted assets of 6.5 percent or more;

|

|

•

|

A ratio of Tier 1 Capital to total risk-weighted assets of 8 percent or more (6 percent under Basel I);

|

|

•

|

A ratio of Total Capital to total risk-weighted assets of 10 percent or more (the same as Basel I); and

|

|

•

|

A leverage ratio of Tier 1 Capital to total adjusted average quarterly assets of 5 percent or greater.

|

|

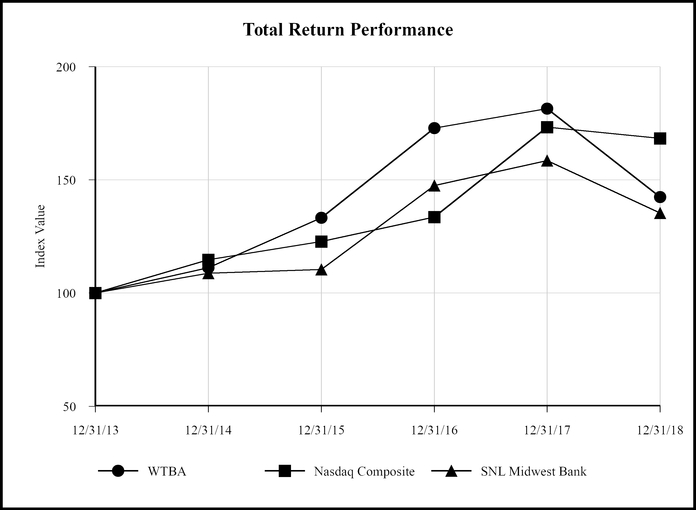

Period Ending

|

||||||||||||

|

Index

|

12/31/2013

|

12/31/2014

|

12/31/2015

|

12/31/2016

|

12/31/2017

|

12/31/2018

|

||||||

|

West Bancorporation, Inc.

|

100.00

|

|

111.20

|

|

133.27

|

|

172.88

|

|

181.47

|

|

142.39

|

|

|

Nasdaq Composite

|

100.00

|

|

114.75

|

|

122.74

|

|

133.62

|

|

173.22

|

|

168.30

|

|

|

SNL Midwest Bank

|

100.00

|

|

108.71

|

|

110.36

|

|

147.46

|

|

158.46

|

|

135.31

|

|

|

West Bancorporation, Inc. and Subsidiary

|

|

|

|

|

||||||||||||||||

|

Selected Financial Data

|

|

|

|

|

||||||||||||||||

|

|

As of and for the Years Ended December 31

|

|||||||||||||||||||

|

(in thousands, except per share amounts)

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|||||||||||

|

Operating Results

|

|

|

|

|

||||||||||||||||

|

Interest income

|

$

|

84,793

|

|

$

|

73,034

|

|

$

|

64,994

|

|

$

|

60,147

|

|

$

|

55,301

|

|

|||||

|

Interest expense

|

22,735

|

|

12,977

|

|

7,876

|

|

5,993

|

|

6,156

|

|

||||||||||

|

Net interest income

|

62,058

|

|

60,057

|

|

57,118

|

|

54,154

|

|

49,145

|

|

||||||||||

|

Provision for loan losses

|

(250

|

)

|

—

|

|

1,000

|

|

850

|

|

750

|

|

||||||||||

|

Net interest income after provision for loan losses

|

62,308

|

|

60,057

|

|

56,118

|

|

53,304

|

|

48,395

|

|

||||||||||

|

Noninterest income

|

7,752

|

|

8,648

|

|

7,982

|

|

8,203

|

|

10,296

|

|

||||||||||

|

Noninterest expense

|

34,992

|

|

32,267

|

|

31,148

|

|

30,068

|

|

32,002

|

|

||||||||||

|

Income before income taxes

|

35,068

|

|

36,438

|

|

32,952

|

|

31,439

|

|

26,689

|

|

||||||||||

|

Income taxes

|

6,560

|

|

13,368

|

|

9,936

|

|

9,697

|

|

6,649

|

|

||||||||||

|

Net income

|

$

|

28,508

|

|

$

|

23,070

|

|

$

|

23,016

|

|

$

|

21,742

|

|

$

|

20,040

|

|

|||||

|

|

|

|

|

|

||||||||||||||||

|

Dividends and Per Share Data

|

|

|

|

|

||||||||||||||||

|

Cash dividends

|

$

|

12,696

|

|

$

|

11,499

|

|

$

|

10,800

|

|

$

|

9,952

|

|

$

|

7,842

|

|

|||||

|

Cash dividends per common share

|

0.78

|

|

0.71

|

|

0.67

|

|

0.62

|

|

0.49

|

|

||||||||||

|

Basic earnings per common share

|

1.75

|

|

1.42

|

|

1.43

|

|

1.35

|

|

1.25

|

|

||||||||||

|

Diluted earnings per common share

|

1.74

|

|

1.41

|

|

1.42

|

|

1.35

|

|

1.25

|

|

||||||||||

|

Closing stock price per common share

|

19.09

|

|

25.15

|

|

24.70

|

|

19.75

|

|

17.02

|

|

||||||||||

|

Book value per common share

|

11.72

|

|

10.98

|

|

10.25

|

|

9.49

|

|

8.75

|

|

||||||||||

|

Average common shares outstanding

|

16,275

|

|

16,194

|

|

16,117

|

|

16,050

|

|

16,004

|

|

||||||||||

|

|

|

|

|

|

||||||||||||||||

|

Year-End and Average Balances

|

|

|

|

|

||||||||||||||||

|

Total assets

|

$

|

2,296,568

|

|

$

|

2,114,377

|

|

$

|

1,854,204

|

|

$

|

1,748,396

|

|

$

|

1,615,566

|

|

|||||

|

Average assets

|

2,169,399

|

|

1,954,242

|

|

1,806,250

|

|

1,675,652

|

|

1,512,506

|

|

||||||||||

|

Investment securities

|

465,795

|

|

498,920

|

|

319,794

|

|

384,420

|

|

339,208

|

|

||||||||||

|

Loans

|

1,721,830

|

|

1,510,500

|

|

1,399,870

|

|

1,246,688

|

|

1,184,045

|

|

||||||||||

|

Allowance for loan losses

|

(16,689

|

)

|

(16,430

|

)

|

(16,112

|

)

|

(14,967

|

)

|

(13,607

|

)

|

||||||||||

|

Deposits

|

1,894,529

|

|

1,810,813

|

|

1,546,605

|

|

1,440,729

|

|

1,270,462

|

|

||||||||||

|

Borrowings

|

185,343

|

|

119,711

|

|

125,410

|

|

127,175

|

|

129,916

|

|

||||||||||

|

Stockholders’ equity

|

191,023

|

|

178,098

|

|

165,376

|

|

152,377

|

|

140,175

|

|

||||||||||

|

Average stockholders’ equity

|

181,757

|

|

173,568

|

|

160,420

|

|

146,089

|

|

131,924

|

|

||||||||||

|

Performance Ratios

|

|

|

|

|

||||||||||||||||

|

Average equity to average assets ratio

|

8.38

|

%

|

8.88

|

%

|

8.88

|

%

|

8.72

|

%

|

8.72

|

%

|

||||||||||

|

Return on average assets

|

1.31

|

%

|

1.18

|

%

|

1.27

|

%

|

1.30

|

%

|

1.32

|

%

|

||||||||||

|

Return on average equity

|

15.68

|

%

|

13.29

|

%

|

14.35

|

%

|

14.88

|

%

|

15.19

|

%

|

||||||||||

|

Efficiency ratio

(1)(2)

|

48.92

|

%

|

45.39

|

%

|

46.03

|

%

|

46.30

|

%

|

49.93

|

%

|

||||||||||

|

Texas ratio

(1)

|

0.93

|

%

|

0.32

|

%

|

0.56

|

%

|

0.87

|

%

|

2.71

|

%

|

||||||||||

|

Net interest margin

(2)

|

3.02

|

%

|

3.37

|

%

|

3.49

|

%

|

3.59

|

%

|

3.59

|

%

|

||||||||||

|

Dividend payout ratio

|

44.53

|

%

|

49.84

|

%

|

46.92

|

%

|

45.77

|

%

|

39.13

|

%

|

||||||||||

|

Dividend yield

|

4.09

|

%

|

2.82

|

%

|

2.71

|

%

|

3.14

|

%

|

2.88

|

%

|

||||||||||

|

•

|

Average equity to average assets ratio - average equity divided by average assets.

|

|

•

|

Return on average assets - net income divided by average assets.

|

|

•

|

Return on average equity - net income divided by average equity.

|

|

•

|

Efficiency ratio - noninterest expense (excluding other real estate owned expense and write-down of premises) divided by noninterest income (excluding net securities gains/losses and gains/losses on disposition of premises and equipment) plus tax-equivalent net interest income.

|

|

•

|

Texas ratio - total nonperforming assets divided by tangible common equity plus the allowance for loan losses.

|

|

•

|

Net interest margin - tax-equivalent net interest income divided by average interest-earning assets.

|

|

•

|

Dividend payout ratio - dividends paid to common stockholders divided by net income.

|

|

•

|

Dividend yield - dividends per share paid to common stockholders divided by closing year-end stock price.

|

|

West Bancorporation, Inc.

|

Peer Group Range

|

||

|

Year ended December 31, 2018

|

Nine months ended September 30, 2018

|

||

|

Return on average assets

|

1.31%

|

0.77% - 1.80%

|

|

|

Return on average equity

|

15.68%

|

7.22% - 11.94%

|

|

|

Efficiency ratio*

(1)

|

48.92%

|

52.99% - 75.83%

|

|

|

Texas ratio*

|

0.93%

|

1.23% - 21.25%

|

|

|

* A lower ratio is better.

|

|||

|

(1)

|

As presented, this is a non-GAAP financial measure. For further information, refer to the section “Non-GAAP Financial Measures” of this Item.

|

|

|

As and for the Years Ended December 31

|

|||||||||||||||||||

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||||

|

Reconciliation of net interest income and net interest margin on an FTE basis to GAAP:

|

||||||||||||||||||||

|

Net interest income (GAAP)

|

$

|

62,058

|

|

$

|

60,057

|

|

$

|

57,118

|

|

$

|

54,154

|

|

$

|

49,145

|

|

|||||

|

Tax-equivalent adjustment

(1)

|

661

|

|

2,677

|

|

2,623

|

|

2,604

|

|

2,205

|

|

||||||||||

|

Net interest income on an FTE basis (non-GAAP)

|

$

|

62,719

|

|

$

|

62,734

|

|

$

|

59,741

|

|

$

|

56,758

|

|

$

|

51,350

|

|

|||||

|

Average interest-earning assets

|

$

|

2,075,372

|

|

$

|

1,863,791

|

|

$

|

1,711,612

|

|

$

|

1,583,059

|

|

$

|

1,429,593

|

|

|||||

|

Net interest margin on an FTE basis (non-GAAP)

|

3.02

|

%

|

3.37

|

%

|

3.49

|

%

|

3.59

|

%

|

3.59

|

%

|

||||||||||

|

Reconciliation of efficiency ratio on an FTE basis to GAAP:

|

||||||||||||||||||||

|

Net interest income on an FTE basis (non-GAAP)

|

$

|

62,719

|

|

$

|

62,734

|

|

$

|

59,741

|

|

$

|

56,758

|

|

$

|

51,350

|

|

|||||

|

Noninterest income

|

7,752

|

|

8,648

|

|

7,982

|

|

8,203

|

|

10,296

|

|

||||||||||

|

Adjustment for realized investment securities (gains) losses, net

|

263

|

|

(326

|

)

|

(66

|

)

|

(47

|

)

|

(223

|

)

|

||||||||||

|

Adjustment for (gains) losses on disposal of premises and

equipment, net

|

109

|

|

25

|

|

4

|

|

6

|

|

(1,069

|

)

|

||||||||||

|

Adjusted income

|

$

|

70,843

|

|

$

|

71,081

|

|

$

|

67,661

|

|

$

|

64,920

|

|

$

|

60,354

|

|

|||||

|

Noninterest expense

|

$

|

34,992

|

|

$

|

32,267

|

|

$

|

31,148

|

|

$

|

30,068

|

|

$

|

32,002

|

|

|||||

|

Less: Other real estate owned expenses

|

—

|

|

—

|

|

—

|

|

(10

|

)

|

(1,865

|

)

|

||||||||||

|

Adjustment for write-down of premises

|

(333

|

)

|

—

|

|

—

|

|

—

|

|

—

|

|

||||||||||

|

Adjusted expense

|

$

|

34,659

|

|

$

|

32,267

|

|

$

|

31,148

|

|

$

|

30,058

|

|

$

|

30,137

|

|

|||||

|

Efficiency ratio on an adjusted and FTE basis (non-GAAP)

(2)

|

48.92

|

%

|

45.39

|

%

|

46.03

|

%

|

46.30

|

%

|

49.93

|

%

|

||||||||||

|

•

|

ROA was

1.31 percent

compared to

1.18 percent

in

2017

.

|

|

•

|

ROE was

15.68 percent

compared to

13.29 percent

in

2017

.

|

|

•

|

Efficiency ratio was

48.92 percent

compared to

45.39 percent

in

2017

.

|

|

•

|

Texas ratio was

0.93 percent

compared to

0.32 percent

in

2017

.

|

|

•

|

The loan portfolio grew 14.0 percent during

2018

.

|

|

•

|

Deposits increased by 4.6 percent during

2018

.

|

|

|

Years ended December 31

|

|||||||||||||

|

Noninterest income:

|

2018

|

2017

|

Change

|

Change %

|

||||||||||

|

Service charges on deposit accounts

|

$

|

2,541

|

|

$

|

2,632

|

|

$

|

(91

|

)

|

(3.46

|

)%

|

|||

|

Debit card usage fees

|

1,681

|

|

1,754

|

|

(73

|

)

|

(4.16

|

)%

|

||||||

|

Trust services

|

1,921

|

|

1,705

|

|

216

|

|

12.67

|

%

|

||||||

|

Increase in cash value of bank-owned life insurance

|

631

|

|

652

|

|

(21

|

)

|

(3.22

|

)%

|

||||||

|

Gain from bank-owned life insurance

|

—

|

|

307

|

|

(307

|

)

|

(100.00

|

)%

|

||||||

|

Realized investment securities gains (losses), net

|

(263

|

)

|

326

|

|

(589

|

)

|

(180.67

|

)%

|

||||||

|

Other income:

|

|

|

|

|

|

|

|

|

||||||

|

Loan fees

|

87

|

|

74

|

|

13

|

|

17.57

|

%

|

||||||

|

Letter of credit fees

|

76

|

|

73

|

|

3

|

|

4.11

|

%

|

||||||

|

Credit card fees

|

236

|

|

250

|

|

(14

|

)

|

(5.60

|

)%

|

||||||

|

Gain on sale of other assets

|

—

|

|

88

|

|

(88

|

)

|

(100.00

|

)%

|

||||||

|

Discount on purchased income tax credits

|

22

|

|

153

|

|

(131

|

)

|

(85.62

|

)%

|

||||||

|

Guarantee fees

|

254

|

|

—

|

|

254

|

|

N/A

|

|

||||||

|

All other

|

566

|

|

634

|

|

(68

|

)

|

(10.73

|

)%

|

||||||

|

Total other income

|

1,241

|

|

1,272

|

|

(31

|

)

|

(2.44

|

)%

|

||||||

|

Total noninterest income

|

$

|

7,752

|

|

$

|

8,648

|

|

$

|

(896

|

)

|

(10.36

|

)%

|

|||

|

|

Years ended December 31

|

|||||||||||||

|

Noninterest expense:

|

2018

|

2017

|

Change

|

Change %

|

|

|||||||||

|

Salaries and employee benefits

|

$

|

18,791

|

|

$

|

17,633

|

|

$

|

1,158

|

|

6.57

|

%

|

|||

|

Occupancy

|

4,996

|

|

4,406

|

|

590

|

|

13.39

|

%

|

||||||

|

Data processing

|

2,682

|

|

2,677

|

|

5

|

|

0.19

|

%

|

||||||

|

FDIC insurance

|

685

|

|

677

|

|

8

|

|

1.18

|

%

|

||||||

|

Professional fees

|

840

|

|

1,075

|

|

(235

|

)

|

(21.86

|

)%

|

||||||

|

Director fees

|

1,014

|

|

950

|

|

64

|

|

6.74

|

%

|

||||||

|

Write-down of premises

|

333

|

|

—

|

|

333

|

|

N/A

|

|

||||||

|

Other expenses:

|

|

|

|

|

|

|

||||||||

|

Marketing

|

195

|

|

224

|

|

(29

|

)

|

(12.95

|

)%

|

||||||

|

Business development

|

824

|

|

779

|

|

45

|

|

5.78

|

%

|

||||||

|

Insurance expense

|

361

|

|

355

|

|

6

|

|

1.69

|

%

|

||||||

|

Subscriptions

|

341

|

|

297

|

|

44

|

|

14.81

|

%

|

||||||

|

Trust

|

400

|

|

432

|

|

(32

|

)

|

(7.41

|

)%

|

||||||

|

Consulting fees

|

256

|

|

297

|

|

(41

|

)

|

(13.80

|

)%

|

||||||

|

Postage and courier

|

289

|

|

303

|

|

(14

|

)

|

(4.62

|

)%

|

||||||

|

Supplies

|

241

|

|

267

|

|

(26

|

)

|

(9.74

|

)%

|

||||||

|

Low income housing projects amortization

|

541

|

|

435

|

|

106

|

|

24.37

|

%

|

||||||

|

New market tax credit project amortization

|

647

|

|

—

|

|

647

|

|

N/A

|

|

||||||

|

All other

|

1,556

|

|

1,460

|

|

96

|

|

6.58

|

%

|

||||||

|

Total other

|

5,651

|

|

4,849

|

|

802

|

|

16.54

|

%

|

||||||

|

Total noninterest expense

|

$

|

34,992

|

|

$

|

32,267

|

|

$

|

2,725

|

|

8.45

|

%

|

|||

|

•

|

ROA was

1.18%

percent compared to

1.27%

percent in

2016

.

|

|

•

|

ROE was

13.29%

percent compared to

14.35%

percent in

2016

.

|

|

•

|

Efficiency ratio was

45.39%

percent compared to

46.03%

percent in

2016

.

|

|

•

|

Texas ratio was

0.32%

percent compared to

0.56%

percent in

2016

.

|

|

•

|

The loan portfolio grew 7.9 percent during

2017

.

|

|

•

|

Deposits increased by 17.1 percent during

2017

.

|

|

|

Years ended December 31

|

|||||||||||||

|

Noninterest income:

|

2017

|

2016

|

Change

|

Change %

|

||||||||||

|

Service charges on deposit accounts

|

$

|

2,632

|

|

$

|

2,461

|

|

$

|

171

|

|

6.95

|

%

|

|||

|

Debit card usage fees

|

1,754

|

|

1,825

|

|

(71

|

)

|

(3.89

|

)%

|

||||||

|

Trust services

|

1,705

|

|

1,310

|

|

395

|

|

30.15

|

%

|

||||||

|

Increase in cash value of bank-owned life insurance

|

652

|

|

647

|

|

5

|

|

0.77

|

%

|

||||||

|

Gain from bank-owned life insurance

|

307

|

|

443

|

|

(136

|

)

|

(30.70

|

)%

|

||||||

|

Realized investment securities gains, net

|

326

|

|

66

|

|

260

|

|

393.94

|

%

|

||||||

|

Other income:

|

|

|

|

|

|

|

|

|

||||||

|

Loan fees

|

74

|

|

110

|

|

(36

|

)

|

(32.73

|

)%

|

||||||

|

Letter of credit fees

|

73

|

|

96

|

|

(23

|

)

|

(23.96

|

)%

|

||||||

|

Credit card fees

|

250

|

|

261

|

|

(11

|

)

|

(4.21

|

)%

|

||||||

|

Gain on sale of other assets

|

88

|

|

—

|

|

88

|

|

N/A

|

|

||||||

|

Discount on purchased income tax credits

|

153

|

|

94

|

|

59

|

|

62.77

|

%

|

||||||

|

All other

|

634

|

|

669

|

|

(35

|

)

|

(5.23

|

)%

|

||||||

|

Total other income

|

1,272

|

|

1,230

|

|

42

|

|

3.41

|

%

|

||||||

|

Total noninterest income

|

$

|

8,648

|

|

$

|

7,982

|

|

$

|

666

|

|

8.34

|

%

|

|||

|

|

Years ended December 31

|

|||||||||||||

|

Noninterest expense:

|

2017

|

2016

|

Change

|

Change %

|

|

|||||||||

|

Salaries and employee benefits

|

$

|

17,633

|

|

$

|

16,731

|

|

$

|

902

|

|

5.39

|

%

|

|||

|

Occupancy

|

4,406

|

|

4,033

|

|

373

|

|

9.25

|

%

|

||||||

|

Data processing

|

2,677

|

|

2,510

|

|

167

|

|

6.65

|

%

|

||||||

|

FDIC insurance

|

677

|

|

937

|

|

(260

|

)

|

(27.75

|

)%

|

||||||

|

Professional fees

|

1,075

|

|

774

|

|

301

|

|

38.89

|

%

|

||||||

|

Director fees

|

950

|

|

888

|

|

62

|

|

6.98

|

%

|

||||||

|

Other expenses:

|

|

|

|

|

|

|

||||||||

|

Marketing

|

224

|

|

231

|

|

(7

|

)

|

(3.03

|

)%

|

||||||

|

Business development

|

779

|

|

701

|

|

78

|

|

11.13

|

%

|

||||||

|

Insurance expense

|

355

|

|

348

|

|

7

|

|

2.01

|

%

|

||||||

|

Investment advisory fees

|

110

|

|

442

|

|

(332

|

)

|

(75.11

|

)%

|

||||||

|

Subscriptions

|

297

|

|

177

|

|

120

|

|

67.80

|

%

|

||||||

|

Trust

|

432

|

|

415

|

|

17

|

|

4.10

|

%

|

||||||

|

Consulting fees

|

297

|

|

302

|

|

(5

|

)

|

(1.66

|

)%

|

||||||

|

Postage and courier

|

303

|

|

321

|

|

(18

|

)

|

(5.61

|

)%

|

||||||

|

Supplies

|

267

|

|

310

|

|

(43

|

)

|

(13.87

|

)%

|

||||||

|

Low income housing projects amortization

|

435

|

|

418

|

|

17

|

|

4.07

|

%

|

||||||

|

All other

|

1,350

|

|

1,610

|

|

(260

|

)

|

(16.15

|

)%

|

||||||

|

Total other

|

4,849

|

|

5,275

|

|

(426

|

)

|

(8.08

|

)%

|

||||||

|

Total noninterest expense

|

$

|

32,267

|

|

$

|

31,148

|

|

$

|

1,119

|

|

3.59

|

%

|

|||

|

2018

|

2017

|

2016

|

||||||||||||||||||||||||||||||

|

|

Average

Balance

|

Revenue/

Expense

|

Yield/

Rate |

Average

Balance

|

Revenue/

Expense

|

Yield/

Rate |

Average

Balance

|

Revenue/

Expense

|

Yield/

Rate |

|||||||||||||||||||||||

|

Assets

|

||||||||||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||||||||||

|

Loans:

(1) (2)

|

||||||||||||||||||||||||||||||||

|

Commercial

|

$

|

321,395

|

|

$

|

15,315

|

|

4.77

|

%

|

$

|

327,673

|

|

$

|

14,279

|

|

4.36

|

%

|

$

|

354,790

|

|

$

|

14,854

|

|

4.19

|

%

|

||||||||

|

Real estate

(3)

|

1,225,665

|

|

55,757

|

|

4.55

|

%

|

1,108,062

|

|

49,481

|

|

4.47

|

%

|

972,571

|

|

43,193

|

|

4.44

|

%

|

||||||||||||||

|

Consumer and other

|

6,613

|

|

282

|

|

4.26

|

%

|

8,150

|

|

330

|

|

4.05

|

%

|

8,795

|

|

348

|

|

3.95

|

%

|

||||||||||||||

|

Total loans

|

1,553,673

|

|

71,354

|

|

4.59

|

%

|

1,443,885

|

|

64,090

|

|

4.44

|

%

|

1,336,156

|

|

58,395

|

|

4.37

|

%

|

||||||||||||||

|

Investment securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Taxable

|

322,795

|

|

8,124

|

|

2.52

|

%

|

248,698

|

|

5,501

|

|

2.21

|

%

|

236,770

|

|

4,201

|

|

1.77

|

%

|

||||||||||||||

|

Tax-exempt

(3)

|

173,449

|

|

5,489

|

|

3.16

|

%

|

143,612

|

|

5,789

|

|

4.03

|

%

|

118,622

|

|

4,913

|

|

4.14

|

%

|

||||||||||||||

|

Total investment securities

|

496,244

|

|

13,613

|

|

2.74

|

%

|

392,310

|

|

11,290

|

|

2.88

|

%

|

355,392

|

|

9,114

|

|

2.56

|

%

|

||||||||||||||

|

Federal funds sold

|

25,455

|

|

487

|

|

1.91

|

%

|

27,596

|

|

331

|

|

1.20

|

%

|

20,064

|

|

108

|

|

0.54

|

%

|

||||||||||||||

|

Total interest-earning assets

(3)

|

2,075,372

|

|

85,454

|

|

4.12

|

%

|

1,863,791

|

|

75,711

|

|

4.06

|

%

|

1,711,612

|

|

67,617

|

|

3.95

|

%

|

||||||||||||||

|

Noninterest-earning assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Cash and due from banks

|

33,934

|

|

|

|

|

|

34,477

|

|

|

|

|

|

44,875

|

|

|

|

|

|

||||||||||||||

|

Premises and equipment, net

|

22,271

|

|

|

|

|

|

23,088

|

|

|

|

|

|

18,843

|

|

|

|

|

|

||||||||||||||

|

Other, less allowance for

|

||||||||||||||||||||||||||||||||

|

loan losses

|

37,822

|

|

|

|

|

|

32,886

|

|

|

|

|

|

30,920

|

|

|

|

|

|

||||||||||||||

|

Total noninterest-earning assets

|

94,027

|

|

|

|

|

|

90,451

|

|

|

|

|

|

94,638

|

|

|

|

|

|

||||||||||||||

|

Total assets

|

$

|

2,169,399

|

|

|

|

|

|

$

|

1,954,242

|

|

|

|

|

|

$

|

1,806,250

|

|

|

|

|

|

|||||||||||

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Interest-bearing liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Deposits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

Savings, interest-bearing

|

||||||||||||||||||||||||||||||||

|

demand and money markets

|

$

|

1,266,534

|

|

14,369

|

|

1.13

|

%

|

$

|

1,067,164

|

|

6,166

|

|

0.58

|

%

|

$

|

917,774

|

|

2,610

|

|

0.28

|

%

|

|||||||||||

|

Time

|

184,386

|

|

2,695

|

|

1.46

|

%

|

147,232

|

|

1,456

|

|

0.99

|

%

|

110,407

|

|

781

|

|

0.71

|

%

|

||||||||||||||

|

Total deposits

|

1,450,920

|

|

17,064

|

|

1.18

|

%

|

1,214,396

|

|

7,622

|

|

0.63

|

%

|

1,028,181

|

|

3,391

|

|

0.33

|

%

|

||||||||||||||

|

Other borrowed funds

|

127,836

|

|

5,671

|

|

4.44

|

%

|

146,577

|

|

5,355

|

|

3.65

|

%

|

136,535

|

|

4,485

|

|

3.28

|

%

|

||||||||||||||

|

Total interest-bearing liabilities

|

1,578,756

|

|

22,735

|

|

1.44

|

%

|

1,360,973

|

|

12,977

|

|

0.95

|

%

|

1,164,716

|

|

7,876

|

|

0.68

|

%

|

||||||||||||||

|

Noninterest-bearing liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

Demand deposits

|

401,778

|

|

|

|

412,078

|

|

|

|

|

|

473,380

|

|

|

|

|

|

||||||||||||||||

|

Other liabilities

|

7,108

|

|

|

|

7,623

|

|

|

|

|

|

7,734

|

|

|

|

|

|

||||||||||||||||

|

Stockholders’ equity

|

181,757

|

|

|

|

|

|

173,568

|

|

|

|

|

|

160,420

|

|

|

|

|

|

||||||||||||||

|

Total liabilities and

|

||||||||||||||||||||||||||||||||

|

stockholders’ equity

|

$

|

2,169,399

|

|

|

|

|

|

$

|

1,954,242

|

|

|

|

|

|

$

|

1,806,250

|

|

|

|

|

|

|||||||||||

|

Net interest income

(4)

/net interest spread

(3)

|

$

|

62,719

|

|

2.68

|

%

|

$

|

62,734

|

|

3.11

|

%

|

|

|

$

|

59,741

|

|

3.27

|

%

|

|||||||||||||||

|

Net interest margin

(3) (4)

|

|

|

|

|

3.02

|

%

|

|

|

|

|

3.37

|

%

|

|

|

|

|

3.49

|

%

|

||||||||||||||

|

(1)

|

Average loan balances include nonaccrual loans. Interest income recognized on nonaccrual loans has been included.

|

|

(2)

|

Interest income on loans includes amortization of loan fees and costs and prepayment penalties collected, which are not material.

|

|

(3)

|

Tax-exempt income has been adjusted to a tax-equivalent basis using a federal income tax rate of 21 percent in 2018 and 35 percent in 2017 and 2016 and is adjusted to reflect the effect of the nondeductible interest expense associated with owning tax-exempt investment securities and loans.

|

|

(4)

|

Net interest income (FTE) and net interest margin (FTE) are non-GAAP financial measures. For further information, refer to the section “Non-GAAP Financial Measures” of this Item.

|

|

|

2018 Compared to 2017

|

2017 Compared to 2016

|

|||||||||||||||||||||

|

|

Volume

|

Rate

|

Total

|

Volume

|

Rate

|

Total

|

|||||||||||||||||

|

Interest Income

|

|||||||||||||||||||||||

|

Loans:

(1)

|

|||||||||||||||||||||||

|

Commercial

|

$

|

(278

|

)

|

$

|

1,314

|

|

$

|

1,036

|

|

$

|

(1,166

|

)

|

$

|

591

|

|

$

|

(575

|

)

|

|||||

|

Real estate

(2)

|

5,335

|

|

941

|

|

6,276

|

|

6,049

|

|

239

|

|

6,288

|

|

|||||||||||

|

Consumer and other

|

(65

|

)

|

17

|

|

(48

|

)

|

(26

|

)

|

8

|

|

(18

|

)

|

|||||||||||

|

Total loans (including fees)

|

4,992

|

|

2,272

|

|

7,264

|

|

4,857

|

|

838

|

|

5,695

|

|

|||||||||||

|

Investment securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Taxable

|

1,793

|

|

830

|

|

2,623

|

|

220

|

|

1,080

|

|

1,300

|

|

|||||||||||

|

Tax-exempt

(2)

|

1,076

|

|

(1,376

|

)

|

(300

|

)

|

1,010

|

|

(134

|

)

|

876

|

|

|||||||||||

|

Total investment securities

|

2,869

|

|

(546

|

)

|

2,323

|

|

1,230

|

|

946

|

|

2,176

|

|

|||||||||||

|

Federal funds sold

|

(27

|

)

|

183

|

|

156

|

|

52

|

|

171

|

|

223

|

|

|||||||||||

|

Total interest income

(2)

|

7,834

|

|

1,909

|

|

9,743

|

|

6,139

|

|

1,955

|

|

8,094

|

|

|||||||||||

|

Interest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Deposits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Savings, interest-bearing

|

|||||||||||||||||||||||

|

demand and money market

|

1,332

|

|

6,871

|

|

8,203

|

|

485

|

|

3,071

|

|

3,556

|

|

|||||||||||

|

Time

|

428

|

|

811

|

|

1,239

|

|

308

|

|

367

|

|

675

|

|

|||||||||||

|

Total deposits

|

1,760

|

|

7,682

|

|

9,442

|

|

793

|

|

3,438

|

|

4,231

|

|

|||||||||||

|

Other borrowed funds

|

(740

|

)

|

1,056

|

|

316

|

|

345

|

|

525

|

|

870

|

|

|||||||||||

|

Total interest expense

|

1,020

|

|

8,738

|

|

9,758

|

|

1,138

|

|

3,963

|

|

5,101

|

|

|||||||||||

|

Net interest income

(2) (3)

|

$

|

6,814

|

|

$

|

(6,829

|

)

|

$

|

(15

|

)

|

$

|

5,001

|

|

$

|

(2,008

|

)

|

$

|

2,993

|

|

|||||

|

(1)

|

Average balances of nonaccrual loans were included for computational purposes.

|

|

(2)

|

Tax-exempt income has been converted to a tax-equivalent basis using a federal income tax rate of 21 percent in 2018 and 35 percent in 2017 and 2016 and is adjusted for the effect of the nondeductible interest expense associated with owning tax-exempt investment securities and loans.

|

|

(3)

|

Net interest income (FTE) is a non-GAAP financial measure. For further information, refer to the section “Non-GAAP Financial Measures” of this Item.

|

|

|

As of December 31

|

||||||||||

|

|

2018

|

2017

|

2016

|

||||||||

|

Securities available for sale, at fair value:

|

|||||||||||

|

U.S. government agencies and corporations

|

$

|

—

|

|

$

|

—

|

|

$

|

2,593

|

|

||

|

State and political subdivisions

|

149,156

|

|

146,313

|

|

64,336

|

|

|||||

|

Collateralized mortgage obligations

|

157,004

|

|

159,932

|

|

101,950

|

|

|||||

|

Mortgage-backed securities

|

63,378

|

|

60,429

|

|

80,158

|

|

|||||

|

Asset-backed securities

|

31,903

|

|

45,195

|

|

—

|

|

|||||

|

Trust preferred security

|

1,900

|

|

2,006

|

|

1,250

|

|

|||||

|

Corporate notes

|

50,417

|

|

30,344

|

|

10,350

|

|

|||||

|

Total securities available for sale

|

$

|

453,758

|

|

$

|

444,219

|

|

$

|

260,637

|

|

||

|

Securities held to maturity, at amortized cost:

|

|||||||||||

|

State and political subdivisions

|

$

|

—

|

|

$

|

45,527

|

|

$

|

48,386

|

|

||

|

Investments as of December 31, 2018

|

Within one

year

|

After one year

but within five

years

|

After five years

but within ten

years

|

After ten years

|

Total

|

|||||||||||||||

|

State and political subdivisions

|

$

|

—

|

|

$

|

1,350

|

|

$

|

31,441

|

|

$

|

116,365

|

|

$

|

149,156

|

|

|||||

|

Collateralized mortgage obligations

|

—

|

|

6,207

|

|

14,546

|

|

136,251

|

|

157,004

|

|

||||||||||

|

Mortgage-backed securities

|

—

|

|

—

|

|

22,917

|

|

40,461

|

|

63,378

|

|

||||||||||

|

Asset-backed securities

|

—

|

|

—

|

|

—

|

|

31,903

|

|

31,903

|

|

||||||||||

|

Trust preferred security

|

—

|

|

—

|

|

—

|

|

1,900

|

|

1,900

|

|

||||||||||

|

Corporate notes

|

—

|

|

1,987

|

|

48,430

|

|

—

|

|

50,417

|

|

||||||||||

|

Total

|

$

|

—

|

|

$

|

9,544

|

|

$

|

117,334

|

|

$

|

326,880

|

|

$

|

453,758

|

|

|||||

|

Weighted average yield:

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

State and political subdivisions

(1)

|

—

|

%

|

2.43

|

%

|

2.66

|

%

|

3.22

|

%

|

||||||||||||

|

Collateralized mortgage obligations

|

—

|

|

2.61

|

%

|

2.52

|

%

|

2.55

|

%

|

||||||||||||

|

Mortgage-backed securities

|

—

|

|

—

|

|

2.58

|

%

|

2.99

|

%

|

||||||||||||

|

Asset-backed securities

|

—

|

|

—

|

|

—

|

|

3.28

|

%

|

||||||||||||

|

Trust preferred security

|

—

|

|

—

|

|

—

|

|

5.75

|

%

|

||||||||||||

|

Corporate notes

|

—

|

|

4.19

|

%

|

4.27

|

%

|

—

|

|

||||||||||||

|

Total

|

—

|

%

|

2.91

|

%

|

3.30

|

%

|

2.94

|

%

|

||||||||||||

|

(1)

|

Yields on tax-exempt obligations have been computed on a tax-equivalent basis using a federal income tax rate of 21 percent and are adjusted to reflect the effect of the nondeductible interest expense associated with owning tax-exempt investment securities.

|

|

|

As of December 31

|

||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||

|

Commercial

|

$

|

358,763

|

|

$

|

347,482

|

|

$

|

334,014

|

|

$

|

349,051

|

|

$

|

316,908

|

|

||||

|

Real estate:

|

|

|

|

|

|

|

|

|

|||||||||||

|

Construction, land and land development

|

245,810

|

|

207,451

|

|

205,610

|

|

174,602

|

|

154,490

|

|

|||||||||

|

1-4 family residential first mortgages

|

49,052

|

|

51,044

|

|

47,184

|

|

51,370

|

|

53,497

|

|

|||||||||

|

Home equity

|

14,469

|

|

13,811

|

|

18,057

|

|

21,749

|

|

24,500

|

|

|||||||||

|

Commercial

|

1,050,025

|

|

886,114

|

|

788,000

|

|

644,176

|

|

625,938

|

|

|||||||||

|

Consumer and other

|

6,211

|

|

6,363

|

|

8,355

|

|

6,801

|

|

9,318

|

|

|||||||||

|

Total loans

|

1,724,330

|

|

1,512,265

|

|

1,401,220

|

|

1,247,749

|

|

1,184,651

|

|

|||||||||

|

Deferred loan fees, net

|

(2,500

|

)

|

(1,765

|

)

|

(1,350

|

)

|

(1,061

|

)

|

(606

|

)

|

|||||||||

|

Total loans, net of deferred fees

|

$

|

1,721,830

|

|

$

|

1,510,500

|

|

$

|

1,399,870

|

|

$

|

1,246,688

|

|

$

|

1,184,045

|

|

||||

|

As of December 31, 2018

|

||||||||||

|

Non-owner occupied commercial real estate

|

Balance

|

% of CRE Portfolio

|

Weighted Average LTV

|

|||||||

|

Multifamily

|

$

|

213,475

|

|

19.8

|

%

|

72

|

%

|

|||

|

Medical

|

188,710

|

|

17.5

|

%

|

66

|

%

|

||||

|

Warehouse

|

120,560

|

|

11.2

|

%

|

73

|

%

|

||||

|

Hotel

|

123,318

|

|

11.4

|

%

|

71

|

%

|

||||

|

Mixed use

|

116,857

|

|

10.8

|

%

|

67

|

%

|

||||

|

Offices

|

108,294

|

|

10.0

|

%

|

74

|

%

|

||||

|

Land for development

|

75,307

|

|

7.0

|

%

|

65

|

%

|

||||

|

All other

|

132,928

|

|

12.3

|

%

|

not available

|

|

||||

|

Total

|

$

|

1,079,449

|

|

100.0

|

%

|

|||||

|

As of December 31, 2018

|

|||||||||||||||||||||||||||

|

|

Risk Rating

|

||||||||||||||||||||||||||

|

|

Total

|

1-3

|

4

|

5

|

6

|

7

|

8

|

||||||||||||||||||||

|

Multifamily

|

$

|

213,475

|

|

$

|

30,788

|

|

$

|

168,202

|

|

$

|

3,625

|

|

$

|

10,860

|

|

$

|

—

|

|

$

|

—

|

|

||||||

|

Medical

|

188,710

|

|

116,803

|

|

50,676

|

|

21,231

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Warehouse

|

120,560

|

|

55,111

|

|

58,756

|

|

6,593

|

|

—

|

|

—

|

|

100

|

|

|||||||||||||

|

Hotel

|

123,318

|

|

45,019

|

|

78,299

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Mixed use

|

116,857

|

|

37,322

|

|

60,566

|

|

18,969

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Offices

|

108,294

|

|

11,420

|

|

89,515

|

|

7,359

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

Land for development

|

75,307

|

|

8,892

|

|

56,762

|

|

9,653

|

|

—

|

|

—

|

|

—

|

|

|||||||||||||

|

All other

|

132,928

|

|

64,643

|

|

64,983

|

|

2,210

|

|

1,092

|

|

—

|

|

—

|

|

|||||||||||||

|

Total

|

$

|

1,079,449

|

|

$

|

369,998

|

|

$

|

627,759

|

|

$

|

69,640

|

|

$

|

11,952

|

|

$

|

—

|

|

$

|

100

|

|

||||||

|

Loans as of December 31, 2018

|

Within one

year

|

After one but

within five

years

|

After five

years

|

Total

|

||||||||||||

|

Commercial

|

$

|

127,300

|

|

$

|

155,893

|

|

$

|

75,570

|

|

$

|

358,763

|

|

||||

|

Real estate:

|

|

|

||||||||||||||

|

Construction, land and land development

|

101,978

|

|

109,317

|

|

34,515

|

|

245,810

|

|

||||||||

|

1-4 family residential first mortgages

|

6,364

|

|

38,025

|

|

4,663

|

|

49,052

|

|

||||||||

|

Home equity

|

5,005

|

|

9,435

|

|

29

|

|

14,469

|

|

||||||||

|

Commercial

|

86,596

|

|

472,168

|

|

491,261

|

|

1,050,025

|

|

||||||||

|

Consumer and other

|

1,980

|

|

4,231

|

|

—

|

|

6,211

|

|

||||||||

|

Total loans

|

$

|

329,223

|

|

$

|

789,069

|

|

$

|

606,038

|

|

$

|

1,724,330

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

After one but

within five

years

|

After five

years

|

|

|

|||||||||||

|

Loan maturities after one year with:

|

|

|

|

|

|

|

||||||||||

|

Fixed rates

|

$

|

650,945

|

|

$

|

375,877

|

|

|

|

||||||||

|

Variable rates

|

138,124

|

|

230,161

|

|

|

|

||||||||||

|

|

$

|

789,069

|

|

$

|

606,038

|

|

|

|

||||||||

|

|

Years Ended December 31

|

||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||

|

Nonaccrual loans

|

$

|

1,928

|

|

$

|

622

|

|

$

|

1,022

|

|

$

|

1,381

|

|

$

|

1,561

|

|

||||

|

Loans past due 90 days and still accruing interest

|

—

|

|

—

|

|

—

|

|

—

|

|

—

|

|

|||||||||

|

Troubled debt restructured loans

(1)

|

—

|

|

—

|

|

—

|

|

80

|

|

376

|

|

|||||||||

|

Total nonperforming loans

|

1,928

|

|

622

|

|

1,022

|

|

1,461

|

|

1,937

|

|

|||||||||

|

Other real estate owned

|

—

|

|

—

|

|

—

|

|

—

|

|

2,235

|

|

|||||||||

|

Total nonperforming assets

|

$

|

1,928

|

|

$

|

622

|

|

$

|

1,022

|

|

$

|

1,461

|

|

$

|

4,172

|

|

||||

|

Nonperforming loans to total loans

|

0.11

|

%

|

0.04

|

%

|

0.07

|

%

|

0.12

|

%

|

0.16

|

%

|

|||||||||

|

Nonperforming assets to total assets

|

0.08

|

%

|

0.03

|

%

|

0.06

|

%

|

0.08

|

%

|

0.26

|

%

|

|||||||||

|

(1)

|

While TDR loans are commonly reported by the industry as nonperforming, those not classified in the nonaccrual category are accruing interest due to payment performance. TDR loans on nonaccrual status, if any, are included in the nonaccrual category.

|

|

|

Analysis of the Allowance for Loan Losses for the Years Ended December 31

|

||||||||||||||||||

|

|

2018

|

2017

|

2016

|

2015

|

2014

|

||||||||||||||

|

Balance at beginning of period

|

$

|

16,430

|

|

$

|

16,112

|

|

$

|

14,967

|

|

$

|

13,607

|

|

$

|

13,791

|

|

||||

|

Charge-offs:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Commercial

|

(208

|

)

|

(199

|

)

|

(125

|

)

|

(408

|

)

|

(836

|

)

|

|||||||||

|

Real estate:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Construction, land and land development

|

—

|

|

—

|

|

(141

|

)

|

—

|

|

—

|

|

|||||||||

|

1-4 family residential first mortgages

|

—

|

|

—

|

|

(93

|

)

|

(23

|

)

|

(131

|

)

|

|||||||||

|

Home equity

|

(24

|

)

|

(176

|

)

|

—

|

|

(2

|

)

|

(138

|

)

|

|||||||||

|

Commercial

|

—

|

|

—

|

|

—

|

|

—

|

|

(112

|

)

|

|||||||||

|

Consumer and other

|

(3

|

)

|

—

|

|

(47

|

)

|

(6

|

)

|

—

|

|

|||||||||

|

Total charge-offs

|

(235

|

)

|

(375

|

)

|

(406

|

)

|

(439

|

)

|

(1,217

|

)

|

|||||||||

|

Recoveries:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Commercial

|

673

|

|

232

|

|

218

|

|

579

|

|

116

|

|

|||||||||

|

Real estate:

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Construction, land and land development

|

—

|

|

398

|

|

217

|

|

250

|

|

8

|

|

|||||||||

|

1-4 family residential first mortgages

|

18

|

|

15

|

|

59

|

|

7

|

|

45

|

|

|||||||||

|

Home equity

|

24

|

|

28

|

|

36

|

|

87

|

|

99

|

|

|||||||||

|

Commercial

|

13

|

|

13

|

|

13

|

|

12

|

|

11

|

|

|||||||||

|

Consumer and other

|

16

|

|

7

|

|

8

|

|

14

|

|

4

|

|