|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TITLE OF EACH CLASS

|

|

NAME OF EACH EXCHANGE ON WHICH REGISTERED:

|

|

Common Shares ($1.25 par value)

|

|

New York Stock Exchange

|

|

Securities registered pursuant to Section 12(g) of the Act: None

|

||

|

PART I

|

PAGE

|

|

|

ITEM 1.

|

||

|

ITEM 1A.

|

||

|

ITEM 1B.

|

||

|

ITEM 2.

|

||

|

ITEM 3.

|

||

|

ITEM 4.

|

MINE SAFETY DISCLOSURES — NOT APPLICABLE

|

|

|

PART II

|

||

|

ITEM 5.

|

||

|

ITEM 6.

|

||

|

ITEM 7.

|

||

|

ITEM 7A.

|

||

|

ITEM 8.

|

||

|

ITEM 9.

|

||

|

ITEM 9A.

|

||

|

ITEM 9B.

|

OTHER INFORMATION — NOT APPLICABLE

|

|

|

PART III

|

||

|

ITEM 10.

|

||

|

ITEM 11.

|

||

|

ITEM 12.

|

||

|

ITEM 13.

|

||

|

ITEM 14.

|

||

|

PART IV

|

||

|

ITEM 15.

|

||

|

ITEM 15.

|

||

|

WE CAN TELL YOU MORE

|

|

•

|

the SEC website — www.sec.gov;

|

|

•

|

the SEC’s Public Conference Room, 100 F St. N.E., Washington, D.C., 20549, (800) SEC-0330; and

|

|

•

|

our website (free of charge) — www.weyerhaeuser.com.

|

|

WHO WE ARE

|

|

•

|

Timberlands;

|

|

•

|

Real Estate, Energy and Natural Resources (Real Estate & ENR); and

|

|

•

|

Wood Products.

|

|

•

|

Timberlands — Deliver maximum timber value from every acre we own or manage.

|

|

•

|

Real Estate & ENR — Deliver premiums to timberland value by identifying and monetizing higher and better use lands and capturing the full value of surface and subsurface assets.

|

|

•

|

Wood Products — Manufacture high-quality lumber, structural panels, and engineered wood products, as well as deliver complementary building products for residential, multi-family, industrial and light commercial applications at competitive costs.

|

|

WHAT WE DO

|

|

•

|

grow and harvest trees,

|

|

•

|

maximize the value of every acre we own and

|

|

•

|

manufacture and sell wood products.

|

|

•

|

plants seedlings to reforest harvested areas using the most effective regeneration method for the site and species (natural regeneration is employed and managed in parts of Canada and the northern U.S.);

|

|

•

|

manages our timberlands as the trees grow to maturity;

|

|

•

|

harvests trees to be converted into lumber, wood products, pellets, pulp and paper;

|

|

•

|

manages the health of our forests to sustainably maximize harvest volumes, minimize risks, and protect unique environmental, cultural, historical and recreational value; and

|

|

•

|

offers recreational access.

|

|

PRODUCTS

|

HOW THEY’RE USED

|

|

|

Delivered logs:

• Grade logs

• Fiber logs

|

Grade logs are made into lumber, plywood, veneer and other products used in residential homes, commercial structures, furniture, industrial and decorative applications. Fiber logs are sold to pulp, paper, and oriented strand board mills to make products used for printing, writing, packaging, homebuilding and consumer products, as well as into renewable energy and pellets.

|

|

|

Timber

|

Standing timber is sold to third parties through stumpage sales.

|

|

|

Recreational leases

|

Timberlands are leased or permitted for recreational purposes.

|

|

|

Other products

|

Seed and seedlings grown in the U.S and chips. We previously produced plywood at our mill in Uruguay

(1)

.

|

|

|

(1) Our Uruguayan operations were divested on September 1, 2017. Refer to

Note 4: Discontinued Operations and Other Divestitures

in the

Notes to Consolidated Financial Statements

for further information on this divestiture.

|

||

|

•

|

Thousand board feet (MBF) — used in the West to measure the expected lumber recovery from a tree or log; and

|

|

•

|

Green tons (GT) — used in the South to measure weight; factors used for conversion to product volume can vary by species, size, location and season.

|

|

•

|

2.9 million

acres in the western U.S. (Oregon and Washington);

|

|

•

|

6.9 million

acres in the southern U.S. (Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, Oklahoma, South Carolina, Texas and Virginia); and

|

|

•

|

2.4 million

acres in the northern U.S. (Maine, Michigan, Montana, New Hampshire, Vermont, West Virginia and Wisconsin).

|

|

GEOGRAPHIC AREA

|

MILLIONS OF TONS AT

DECEMBER 31, 2018 |

|

|

TOTAL INVENTORY

(1)

|

||

|

U.S.:

|

||

|

West

|

||

|

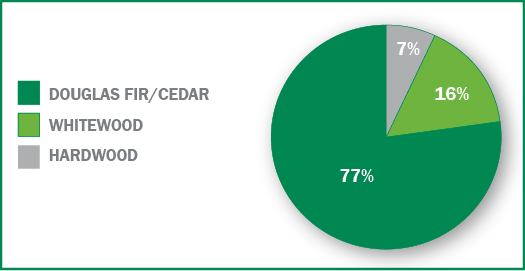

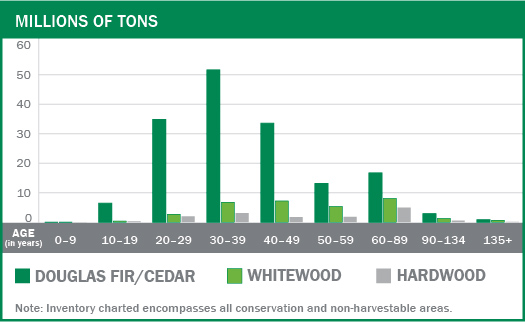

Douglas fir/Cedar

|

160

|

|

|

Whitewood

|

33

|

|

|

Hardwood

|

14

|

|

|

Total West

|

207

|

|

|

South

|

||

|

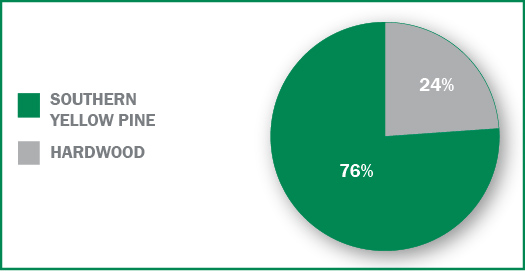

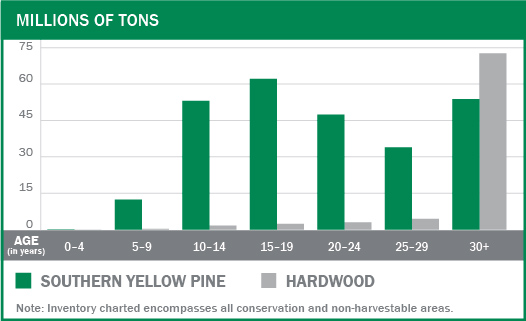

Southern yellow pine

|

263

|

|

|

Hardwood

|

84

|

|

|

Total South

|

347

|

|

|

North

|

||

|

Conifer

|

32

|

|

|

Hardwood

|

40

|

|

|

Total North

|

72

|

|

|

Total Company

|

626

|

|

|

(1) Inventory includes all conservation and non-harvestable areas.

|

||

|

GEOGRAPHIC AREA

|

THOUSANDS OF ACRES AT

DECEMBER 31, 2018 |

|||||

|

|

FEE OWNERSHIP

|

|

LONG-TERM CONTRACTS

|

|

TOTAL

ACRES

(1)

|

|

|

U.S.:

|

||||||

|

West

|

||||||

|

Oregon

|

1,596

|

|

—

|

|

1,596

|

|

|

Washington

|

1,314

|

|

—

|

|

1,314

|

|

|

Total West

|

2,910

|

|

—

|

|

2,910

|

|

|

South

|

||||||

|

Alabama

|

388

|

|

228

|

|

616

|

|

|

Arkansas

|

1,211

|

|

18

|

|

1,229

|

|

|

Florida

|

226

|

|

85

|

|

311

|

|

|

Georgia

|

618

|

|

50

|

|

668

|

|

|

Louisiana

|

1,023

|

|

351

|

|

1,374

|

|

|

Mississippi

|

1,131

|

|

75

|

|

1,206

|

|

|

North Carolina

|

563

|

|

—

|

|

563

|

|

|

Oklahoma

|

494

|

|

—

|

|

494

|

|

|

South Carolina

|

278

|

|

—

|

|

278

|

|

|

Texas

|

29

|

|

2

|

|

31

|

|

|

Virginia

|

123

|

|

—

|

|

123

|

|

|

Total South

|

6,084

|

|

809

|

|

6,893

|

|

|

North

|

||||||

|

Maine

|

838

|

|

—

|

|

838

|

|

|

Michigan

|

556

|

|

—

|

|

556

|

|

|

Montana

|

658

|

|

—

|

|

658

|

|

|

New Hampshire

|

24

|

|

—

|

|

24

|

|

|

Vermont

|

86

|

|

—

|

|

86

|

|

|

West Virginia

|

256

|

|

—

|

|

256

|

|

|

Wisconsin

|

4

|

|

—

|

|

4

|

|

|

Total North

|

2,422

|

|

—

|

|

2,422

|

|

|

Total Company

|

11,416

|

|

809

|

|

12,225

|

|

|

(1) Acres include all conservation and non-harvestable areas.

|

||||||

|

•

|

forestry research and planning systems to optimize log production,

|

|

•

|

customized silviculture prescriptions which increase productivity across our acreage and

|

|

•

|

innovative planting and harvesting techniques on varying Southern terrain.

|

|

•

|

Alberta — 2,914 thousand tons,

|

|

•

|

British Columbia — 547 thousand tons,

|

|

•

|

Ontario — 154 thousand tons and

|

|

•

|

Saskatchewan — 634 thousand tons.

|

|

GEOGRAPHIC AREA

|

THOUSANDS OF ACRES AT

DECEMBER 31, 2018 |

|

|

TOTAL ACRES UNDER LICENSE ARRANGEMENTS

|

||

|

Province:

|

|

|

|

Alberta

|

5,398

|

|

|

British Columbia

|

1,014

|

|

|

Ontario

(1)

|

2,574

|

|

|

Saskatchewan

(1)

|

4,987

|

|

|

Total Canada

|

13,973

|

|

|

(1) License is managed by partnership.

|

||

|

FEE HARVEST VOLUMES IN THOUSANDS OF TONS

(1)

|

||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|

Fee harvest volume – tons:

|

|

|

|

|

|

|

||||

|

West

|

9,571

|

|

10,083

|

|

11,083

|

|

10,563

|

|

10,580

|

|

|

South

|

26,708

|

|

27,149

|

|

26,343

|

|

14,113

|

|

14,276

|

|

|

North

|

2,129

|

|

2,205

|

|

2,044

|

|

—

|

|

—

|

|

|

Uruguay

(2)

|

—

|

|

822

|

|

1,119

|

|

980

|

|

1,091

|

|

|

Other

(3)

|

—

|

|

1,384

|

|

701

|

|

—

|

|

—

|

|

|

Total

|

38,408

|

|

41,643

|

|

41,290

|

|

25,656

|

|

25,947

|

|

|

(1) In February 2016, we merged with Plum Creek Timber Company, Inc. (Plum Creek). Refer to

Note 5: Merger With Plum Creek

in the

Notes to Consolidated Financial Statements

for further information on this merger.

(2) Our Uruguayan operations were divested on September 1, 2017. Refer to

Note 4: Discontinued Operations and Other Divestitures

in the

Notes to Consolidated Financial Statements

for further information on this divestiture.

(3) Other includes volumes managed for the Twin Creeks Venture. Our management agreement for the Twin Creeks Venture began in April 2016 and terminated in December 2017. For additional information see

Note 9: Related Parties

in

Notes to Consolidated Financial Statements

.

|

||||||||||

|

PERCENTAGE OF GRADE AND FIBER

(1)

|

|||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|

|

West

|

Grade

|

90

|

%

|

89

|

%

|

87

|

%

|

87

|

%

|

89

|

%

|

|

Fiber

|

10

|

%

|

11

|

%

|

13

|

%

|

13

|

%

|

11

|

%

|

|

|

South

|

Grade

|

51

|

%

|

52

|

%

|

52

|

%

|

59

|

%

|

59

|

%

|

|

Fiber

|

49

|

%

|

48

|

%

|

48

|

%

|

41

|

%

|

41

|

%

|

|

|

North

|

Grade

|

46

|

%

|

49

|

%

|

47

|

%

|

—

|

%

|

—

|

%

|

|

Fiber

|

54

|

%

|

51

|

%

|

53

|

%

|

—

|

%

|

—

|

%

|

|

|

Uruguay

(2)

|

Grade

|

—

|

%

|

69

|

%

|

66

|

%

|

65

|

%

|

63

|

%

|

|

Fiber

|

—

|

%

|

31

|

%

|

34

|

%

|

35

|

%

|

37

|

%

|

|

|

Other

(3)

|

Grade

|

—

|

%

|

47

|

%

|

45

|

%

|

—

|

%

|

—

|

%

|

|

Fiber

|

—

|

%

|

53

|

%

|

55

|

%

|

—

|

%

|

—

|

%

|

|

|

Total

|

Grade

|

62

|

%

|

63

|

%

|

64

|

%

|

73

|

%

|

73

|

%

|

|

Fiber

|

38

|

%

|

37

|

%

|

36

|

%

|

27

|

%

|

27

|

%

|

|

|

(1) In February 2016, we merged with Plum Creek. Refer to

Note 5: Merger With Plum Creek

in the

Notes to Consolidated Financial Statements

for further information on this merger.

(2) Our Uruguayan operations were divested on September 1, 2017. Refer to

Note 4: Discontinued Operations and Other Divestitures

in the

Notes to Consolidated Financial Statements

for further information on this divestiture.

(3) Other includes volumes managed for the Twin Creeks Venture. Our management agreement for the Twin Creeks Venture began in April 2016 and terminated in December 2017. For additional information see

Note 9: Related Parties

in

Notes to Consolidated Financial Statements

.

|

|||||||||||

|

•

|

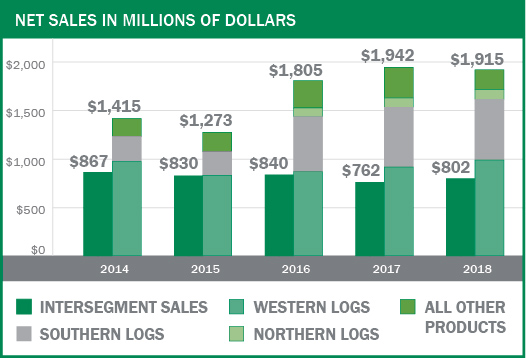

$1.9 billion

in

2018

and

|

|

•

|

$1.9 billion

in

2017

.

|

|

•

|

$802 million

in

2018

and

|

|

•

|

$762 million

in

2017

.

|

|

NET SALES IN MILLIONS OF DOLLARS

(1)

|

|||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

To unaffiliated customers:

|

|

|

|

|

|

||||||||||

|

Delivered Logs:

|

|

|

|

|

|

||||||||||

|

West

|

$

|

987

|

|

$

|

915

|

|

$

|

865

|

|

$

|

830

|

|

$

|

972

|

|

|

South

|

625

|

|

616

|

|

566

|

|

241

|

|

257

|

|

|||||

|

North

|

99

|

|

95

|

|

91

|

|

—

|

|

—

|

|

|||||

|

Other

(2)

|

41

|

|

59

|

|

38

|

|

24

|

|

22

|

|

|||||

|

Total

|

1,752

|

|

1,685

|

|

1,560

|

|

1,095

|

|

1,251

|

|

|||||

|

Stumpage and pay-as-cut timber

|

59

|

|

73

|

|

85

|

|

37

|

|

18

|

|

|||||

|

Uruguay operations

(3)

|

—

|

|

63

|

|

79

|

|

87

|

|

88

|

|

|||||

|

Recreational lease revenue

|

59

|

|

59

|

|

44

|

|

25

|

|

22

|

|

|||||

|

Other products

(4)

|

45

|

|

62

|

|

37

|

|

29

|

|

36

|

|

|||||

|

Subtotal sales to unaffiliated customers

|

1,915

|

|

1,942

|

|

1,805

|

|

1,273

|

|

1,415

|

|

|||||

|

Intersegment sales:

|

|

|

|

|

|

||||||||||

|

United States

|

537

|

|

520

|

|

590

|

|

559

|

|

576

|

|

|||||

|

Canada

|

265

|

|

242

|

|

250

|

|

271

|

|

291

|

|

|||||

|

Subtotal intersegment sales

|

802

|

|

762

|

|

840

|

|

830

|

|

867

|

|

|||||

|

Total

|

$

|

2,717

|

|

$

|

2,704

|

|

$

|

2,645

|

|

$

|

2,103

|

|

$

|

2,282

|

|

|

(1) In February 2016, we merged with Plum Creek. Refer to

Note 5: Merger With Plum Creek

in the

Notes to Consolidated Financial Statements

for further information on this merger.

(2) Other delivered logs include sales to unaffiliated customers in Canada and sales from timberlands managed for the Twin Creeks Venture. Our management agreement for the Twin Creeks Venture began in April 2016 and terminated in December 2017. For additional information see

Note 9: Related Parties

in

Notes to Consolidated Financial Statements

.

(3) Sales from our Uruguay operations include plywood and hardwood lumber. Our Uruguayan operations were divested on September 1, 2017. Refer to

Note 4: Discontinued Operations and Other Divestitures

in the

Notes to Consolidated Financial Statements

for further information on this divestiture.

(4) Other products include sales of seeds and seedlings from our nursery operations, chips and sales from our operations in Brazil (operations sold in 2014).

|

|||||||||||||||

|

•

|

28,250 thousand

tons in

2018

and

|

|

•

|

29,420 thousand

tons in

2017

.

|

|

•

|

domestic grade log sales — lumber usage, primarily for housing starts and repair and remodel activity, the needs of our own mills and the availability of logs from both outside markets and our own timberlands;

|

|

•

|

domestic fiber log sales — demand for chips by pulp, containerboard mills, pellet mills and OSB mills; and

|

|

•

|

export log sales — the level of housing starts in Japan and construction in China.

|

|

SALES VOLUME IN THOUSANDS

(1)

|

||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|

Logs – tons:

|

|

|

|

|

|

|||||

|

West

|

7,858

|

|

8,202

|

|

8,713

|

|

8,212

|

|

8,504

|

|

|

South

|

18,008

|

|

17,895

|

|

15,967

|

|

6,480

|

|

6,941

|

|

|

North

|

1,628

|

|

1,574

|

|

1,500

|

|

—

|

|

—

|

|

|

Uruguay

(2)

|

—

|

|

291

|

|

470

|

|

714

|

|

667

|

|

|

Other

(3)

|

756

|

|

1,458

|

|

943

|

|

551

|

|

474

|

|

|

Total

|

28,250

|

|

29,420

|

|

27,593

|

|

15,957

|

|

16,586

|

|

|

(1) In February 2016, we merged with Plum Creek. Refer to

Note 5: Merger With Plum Creek

in the

Notes to Consolidated Financial Statements

for further information on this merger.

(2) Our Uruguayan operations were divested on September 1, 2017. Refer to

Note 4: Discontinued Operations and Other Divestitures

in the

Notes to Consolidated Financial Statements

for further information on this divestiture.

(3) Other includes our Canadian operations and managed Twin Creeks Venture. Our management agreement for the Twin Creeks Venture began in April 2016 and terminated in December 2017. For additional information see

Note 9: Related Parties

in

Notes to Consolidated Financial Statements

.

|

||||||||||

|

•

|

continuing to capitalize on our scale of operations, silviculture and supply chain expertise and sustainability practices;

|

|

•

|

improving cash flow through operational excellence initiatives including merchandising for value, harvest and transportation efficiencies as well as focused silviculture investments to improve forest productivity;

|

|

•

|

leveraging our export and domestic market access, infrastructure and strong customer relationships;

|

|

•

|

increasing our recreational lease revenue; and

|

|

•

|

continuing to maximize the value of our timberlands portfolio by managing the acres with the highest and best use in mind.

|

|

•

|

rentals and royalties from the exploration, extraction, production and sale of aggregates and industrial minerals, oil and natural gas, coal and wind energy production;

|

|

•

|

rental payments from, or sale of, communication, energy and transportation rights of way; and

|

|

•

|

the occasional sale of mineral assets.

|

|

SOURCES

|

ACTIVITIES

|

||

|

Real Estate

|

Select timberland tracts are sold for recreational, conservation, commercial or residential purposes.

|

||

|

Energy and Natural Resources

|

• Rights are sold to explore and extract construction aggregates (rock, sand and gravel), coal, industrial materials

and oil and natural gas for sale into energy markets.

• Ground leases and easements are granted to wind and solar developers to generate renewable electricity from

our timberlands.

• Rights are granted to access and utilize timberland acreage for communications, pipeline, powerline and

transportation rights of way.

|

||

|

•

|

$306 million

in

2018

and

|

|

•

|

$280 million

in

2017

.

|

|

NET SALES IN MILLIONS OF DOLLARS

|

|||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

Net Sales:

|

|

|

|

|

|

||||||||||

|

Real Estate

|

$

|

229

|

|

$

|

208

|

|

$

|

172

|

|

$

|

75

|

|

$

|

72

|

|

|

Energy and Natural Resources

|

78

|

|

73

|

|

54

|

|

26

|

|

32

|

|

|||||

|

Total

|

$

|

307

|

|

$

|

281

|

|

$

|

226

|

|

$

|

101

|

|

$

|

104

|

|

|

REAL ESTATE SALES STATISTICS

|

|||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

Acres sold

|

131,575

|

|

97,235

|

|

82,687

|

|

27,390

|

|

24,583

|

|

|||||

|

Average price per acre

|

$

|

1,701

|

|

$

|

2,079

|

|

$

|

2,072

|

|

$

|

2,490

|

|

$

|

2,428

|

|

|

•

|

continuing to apply the AVO process to identify opportunities to capture a premium to timber value;

|

|

•

|

maintaining a flexible, low-cost execution model by continuing to leverage strategic relationships with outside real estate brokers;

|

|

•

|

capturing the full value of our oil and natural gas, aggregates and industrial minerals, and wind renewable energy resources; and

|

|

•

|

delivering the most value from every acre.

|

|

•

|

provides high-quality structural lumber, oriented strand board (OSB), engineered wood products and other specialty products to the residential, multi-family, industrial, light commercial and repair and remodel markets;

|

|

•

|

distributes our products as well as complementary building products that we purchase from other manufacturers; and

|

|

•

|

exports our structural lumber and engineered wood products, primarily to Asia.

|

|

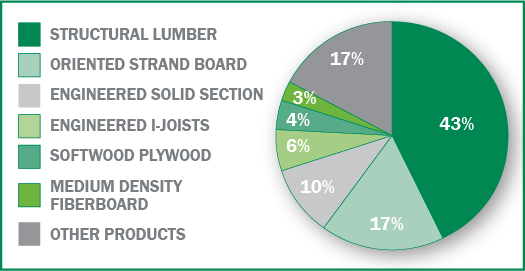

PRODUCTS

|

HOW THEY’RE USED

|

|

Structural lumber

|

Structural framing for new residential, repair and remodel, treated applications, industrial and commercial structures

|

|

Oriented strand board

|

Structural sheathing, subflooring and stair tread for residential, multi-family and commercial structures

|

|

Engineered wood products

• Solid section

• I-joists

• Softwood plywood

• Medium density fiberboard

|

Structural elements for residential, multi-family and commercial structures such as floor and roof joists, headers, beams, subflooring, and sheathing.

Medium density fiberboard products are used for store fixtures, molding, doors, and cabinet components. |

|

Other products

|

Wood chips and other byproducts

|

|

Complementary building products

|

Complementary building products such as cedar, decking, siding, insulation and rebar sold in our distribution facilities

|

|

CAPACITIES IN MILLIONS

|

|||||

|

|

PRODUCTION

CAPACITY

|

|

NUMBER OF

FACILITIES

|

|

FACILITY

LOCATION

|

|

Structural lumber – board feet

|

5,025

|

|

19

|

|

Alabama, Arkansas, Louisiana (2), Mississippi (3), Montana, North Carolina (3), Oklahoma, Oregon (2), Washington (2), Alberta (2), British Columbia

|

|

Oriented strand board – square feet (3/8”)

|

3,035

|

|

6

|

|

Louisiana, Michigan, North Carolina, West Virginia, Alberta, Saskatchewan

|

|

Engineered solid section – cubic feet

(1)

|

43

|

|

6

|

|

Alabama, Louisiana, Oregon, West Virginia, British Columbia, Ontario

|

|

Softwood plywood – square feet (3/8”)

|

610

|

|

3

|

|

Arkansas, Louisiana, Montana

|

|

Medium density fiberboard – square feet (3/4")

|

265

|

|

1

|

|

Montana

|

|

(1) This represents total press capacity. Three facilities also produce I-Joist to meet market demand. In 2018, approximately 25 percent of the total press production was converted into 191 lineal feet of I-Joist.

|

|||||

|

PRODUCTION IN MILLIONS

|

||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|

Structural lumber – board feet

|

4,541

|

|

4,509

|

|

4,516

|

|

4,252

|

|

4,152

|

|

|

Oriented strand board – square feet (3/8”)

|

2,837

|

|

2,995

|

|

2,910

|

|

2,847

|

|

2,749

|

|

|

Engineered solid section – cubic feet

(1)

|

24.3

|

|

25.1

|

|

22.8

|

|

20.9

|

|

20.4

|

|

|

Engineered I-joists – lineal feet

(1)

|

191

|

|

213

|

|

184

|

|

185

|

|

182

|

|

|

Softwood plywood – square feet (3/8”)

(2)

|

404

|

|

370

|

|

396

|

|

248

|

|

252

|

|

|

Medium density fiberboard – square feet (3/4")

|

220

|

|

232

|

|

209

|

|

—

|

|

—

|

|

|

(1) Weyerhaeuser engineered solid section facilities also may produce engineered I-joists.

(2) All Weyerhaeuser plywood facilities also produce veneer.

|

||||||||||

|

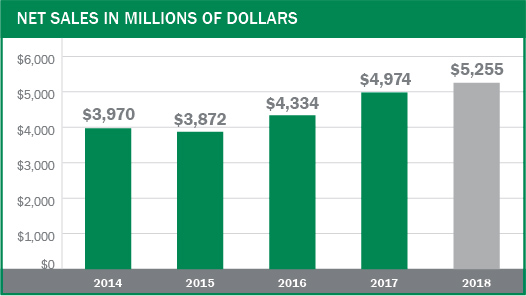

NET SALES IN MILLIONS OF DOLLARS

|

|||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

Structural lumber

|

$

|

2,258

|

|

$

|

2,058

|

|

$

|

1,839

|

|

$

|

1,741

|

|

$

|

1,901

|

|

|

Oriented strand board

|

891

|

|

904

|

|

707

|

|

595

|

|

610

|

|

|||||

|

Engineered solid section

|

521

|

|

500

|

|

450

|

|

428

|

|

402

|

|

|||||

|

Engineered I-joists

|

336

|

|

336

|

|

290

|

|

284

|

|

277

|

|

|||||

|

Softwood plywood

|

200

|

|

176

|

|

174

|

|

129

|

|

143

|

|

|||||

|

Medium density fiberboard

|

177

|

|

183

|

|

158

|

|

—

|

|

—

|

|

|||||

|

Other products produced

(1)

|

288

|

|

276

|

|

201

|

|

189

|

|

176

|

|

|||||

|

Complementary building products

|

584

|

|

541

|

|

515

|

|

506

|

|

461

|

|

|||||

|

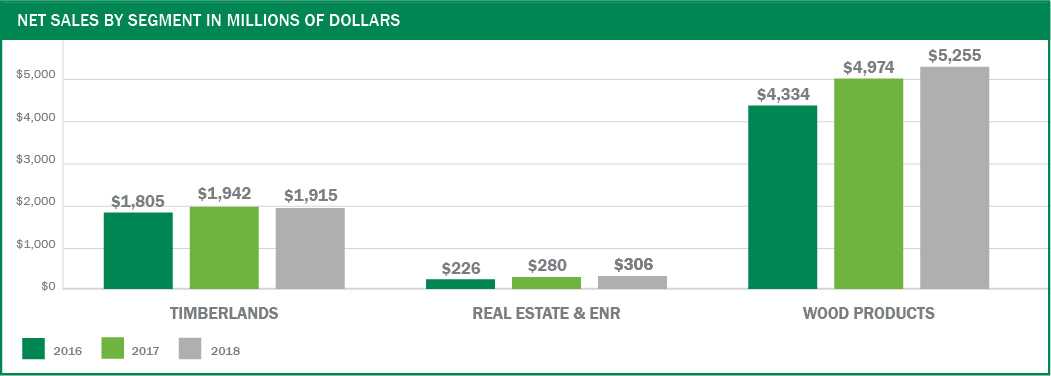

Total

|

$

|

5,255

|

|

$

|

4,974

|

|

$

|

4,334

|

|

$

|

3,872

|

|

$

|

3,970

|

|

|

(1) Includes wood chips and other byproducts.

|

|||||||||||||||

|

SALES VOLUME

(1)

IN MILLIONS

|

||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|

Structural lumber – board feet

|

4,684

|

|

4,658

|

|

4,723

|

|

4,588

|

|

4,463

|

|

|

Oriented strand board – square feet (3/8”)

|

2,827

|

|

2,971

|

|

2,934

|

|

2,972

|

|

2,788

|

|

|

Engineered solid section – cubic feet

|

24.3

|

|

25.1

|

|

23.3

|

|

21.3

|

|

20.0

|

|

|

Engineered I-joists – lineal feet

|

204

|

|

220

|

|

195

|

|

188

|

|

184

|

|

|

Softwood Plywood – square feet (3/8”)

|

459

|

|

453

|

|

481

|

|

381

|

|

395

|

|

|

Medium density fiberboard – square feet (3/4")

|

212

|

|

222

|

|

206

|

|

—

|

|

—

|

|

|

(1) Sales volume includes sales of internally produced products and complementary building products sold primarily through our distribution centers.

|

||||||||||

|

•

|

Demand for wood products used in residential and multi-family construction and the repair and remodel of existing homes affects prices. Residential and multi-family construction is influenced by factors such as population growth and other demographics, availability of labor and lots, the level of employment, consumer confidence, consumer income, availability of financing and interest rate levels, and the supply and pricing of existing homes on the market. Repair and remodel activity is affected by the size and age of existing housing inventory and access to home equity financing and other credit.

|

|

•

|

The supply of commodity building products such as structural lumber, OSB and plywood affects prices. A number of factors can influence supply, including changes in production capacity and utilization rates, weather, raw material supply and availability of transportation.

|

|

•

|

Achieve industry leading controllable manufacturing costs through operational excellence and disciplined capital execution;

|

|

•

|

strong alignment with fiber supply;

|

|

•

|

leverage our brand and reputation as the preferred provider of quality building products; and

|

|

•

|

pursue disciplined, profitable sales growth in target markets.

|

|

EXECUTIVE OFFICERS OF THE REGISTRANT

|

|

NATURAL RESOURCE AND ENVIRONMENTAL MATTERS

|

|

•

|

limits on the size of clearcuts,

|

|

•

|

requirements that some timber be left unharvested to protect water quality and fish and wildlife habitat,

|

|

•

|

regulations regarding construction and maintenance of forest roads,

|

|

•

|

rules requiring reforestation following timber harvest and

|

|

•

|

various related permit programs.

|

|

•

|

forest practices and environmental regulations and

|

|

•

|

license requirements established by contract between us and the relevant province designed to:

|

|

•

|

the northern spotted owl, the marbled murrelet, a number of salmon species, bull trout and steelhead trout in the Pacific Northwest;

|

|

•

|

several freshwater mussel and sturgeon species; and

|

|

•

|

the red-cockaded woodpecker, gopher tortoise, dusky gopher frog, American burying beetle and Northern long-eared bat in the South or Southeast.

|

|

•

|

federal and state requirements to protect habitat for threatened and endangered species;

|

|

•

|

regulatory actions by federal or state agencies to protect these species and their habitat; and

|

|

•

|

citizen suits under the ESA.

|

|

•

|

The federal Species at Risk Act (SARA) requires protective measures for species identified as being at risk and for their critical habitat. Pursuant to SARA, Environment Canada continues to identify and assess species deemed to be at risk and their critical habitat.

|

|

•

|

In October 2012, the Canadian Minister of the Environment released a strategy for the recovery of the boreal population of woodland caribou under the SARA. The population and distribution objectives for boreal caribou across Canada are to (1) maintain the current status of existing, self-sustaining local caribou populations and (2) stabilize and achieve self-sustaining status for non-self-sustaining local caribou populations. Critical habitat for boreal caribou is identified for all boreal caribou ranges, except for northern Saskatchewan’s Boreal Shield range (SK1) where additional information is required for that population. Species assessment and recovery plans are developed in consultation with aboriginal communities and stakeholders.

|

|

•

|

In 2017, the Provinces were required to update the federal government on any progress associated with their draft caribou range plans. These draft plans will be further evaluated in 2019, and any additional information on potential effects to forest harvest operations will be released.

|

|

•

|

conservation organizations,

|

|

•

|

academia,

|

|

•

|

the forest industry and

|

|

•

|

large and small forest landowners.

|

|

•

|

increased our operating costs;

|

|

•

|

resulted in changes in the value of timber and logs from our timberlands;

|

|

•

|

contributed to increases in the prices paid for wood products and wood chips during periods of high demand;

|

|

•

|

sometimes made it more difficult for us to respond to rapid changes in markets, extreme weather or other unexpected circumstances; and

|

|

•

|

potentially encouraged further reductions in the use of, or substitution of other products for, lumber, oriented strand board, engineered wood products and plywood.

|

|

•

|

additional restrictions on the sale or harvest of timber,

|

|

•

|

potential increase in operating costs and

|

|

•

|

effect on timber supply and prices in Canada.

|

|

•

|

air, water and land;

|

|

•

|

solid and hazardous waste management;

|

|

•

|

waste disposal;

|

|

•

|

remediation of contaminated sites; and

|

|

•

|

the chemical content of some of our products.

|

|

•

|

enhance safety,

|

|

•

|

extend the life of a facility,

|

|

•

|

lower costs and improve efficiency,

|

|

•

|

improve reliability,

|

|

•

|

increase capacity,

|

|

•

|

facilitate raw material changes and handling requirements,

|

|

•

|

increase the economic value of assets or products, and

|

|

•

|

comply with regulatory standards.

|

|

•

|

we may have the sole obligation to remediate,

|

|

•

|

we may share that obligation with one or more parties,

|

|

•

|

several parties may have joint and several obligations to remediate and

|

|

•

|

we may have been named as a potentially responsible party for contaminated sites, including those designated as U

.

S

.

Superfund sites.

|

|

•

|

quantity, toxicity and nature of materials at the site; and

|

|

•

|

number and economic viability of the other responsible parties.

|

|

•

|

determine it is probable that such an obligation exists and

|

|

•

|

can reasonably estimate the amount of the obligation.

|

|

•

|

wood products facilities and

|

|

•

|

industrial boilers.

|

|

•

|

hazardous air pollutants that require use of maximum achievable control technology (MACT); and

|

|

•

|

controls and/or monitoring for pollutants that contribute to smog, haze and more recently, greenhouse gases.

|

|

•

|

closely monitor legislative, regulatory and scientific developments pertaining to climate change;

|

|

•

|

adopted in 2006, as part of the company's sustainability program, a goal of reducing greenhouse gas emissions by 40 percent by 2020 compared with our emissions in 2000, assuming a comparable portfolio and regulations;

|

|

•

|

determined to achieve this goal by increasing energy efficiency and using more greenhouse gas-neutral, biomass fuels instead of fossil fuels; and

|

|

•

|

reduced greenhouse gas emissions by approximately 44 percent considering changes in the asset portfolio according to 2017 data, compared to our 2000 baseline.

|

|

•

|

policy proposals by federal or state governments regarding regulation of greenhouse gas emissions,

|

|

•

|

Congressional legislation regulating or taxing greenhouse gas emissions within the next several years and

|

|

•

|

establishment of a multistate or federal greenhouse gas emissions reduction trading system with potentially significant implications for all U.S. businesses.

|

|

•

|

ambient air quality standards for outdoor air quality management across the country;

|

|

•

|

a framework for air zone air management within provinces and territories that targets specific sources of air emissions;

|

|

•

|

regional airsheds that facilitate coordinated action across borders;

|

|

•

|

industrial sector based emission requirements that set a national base level of performance for major industries in Canada; and

|

|

•

|

improved intergovernmental collaboration to reduce emissions from the transportation sector.

|

|

•

|

have greenhouse gas reporting requirements,

|

|

•

|

are working on reduction strategies and

|

|

•

|

together with the Canadian federal government, are considering new or revised emission standards.

|

|

•

|

limits on pollutants that may be discharged to a body of water; or

|

|

•

|

additional requirements, such as best management practices for nonpoint sources, including timberland operations, to reduce the amounts of pollutants.

|

|

FORWARD-LOOKING STATEMENTS

|

|

•

|

the effect of general economic conditions, including employment rates, interest rate levels, housing starts, general availability of financing for home mortgages and the relative strength of the U.S. dollar;

|

|

•

|

market demand for the company's products, including market demand for our timberland properties with higher and better uses, which is related to, among other factors, the strength of the various U.S. business segments and U.S. and international economic conditions;

|

|

•

|

changes in currency exchange rates, particularly the relative value of the U.S. dollar to the Japanese yen, the Chinese yuan, and the Canadian dollar, and the relative value of the euro to the yen;

|

|

•

|

restrictions on international trade and tariffs imposed on imports or exports;

|

|

•

|

the availability and cost of shipping and transportation;

|

|

•

|

economic activity in Asia, especially Japan and China;

|

|

•

|

performance of our manufacturing operations, including maintenance and capital requirements;

|

|

•

|

potential disruptions in our manufacturing operations;

|

|

•

|

the level of competition from domestic and foreign producers;

|

|

•

|

the successful execution of our internal plans and strategic initiatives, including restructuring and cost reduction initiatives;

|

|

•

|

the successful and timely execution and integration of our strategic acquisitions, including our ability to realize expected benefits and synergies, and the successful and timely execution of our strategic divestitures, each of which is subject to a number of risks and conditions beyond our control including, but not limited to, timing and required regulatory approvals;

|

|

•

|

raw material availability and prices;

|

|

•

|

the effect of weather;

|

|

•

|

changes in global or regional climate conditions and governmental response to such changes;

|

|

•

|

the risk of loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters;

|

|

•

|

energy prices;

|

|

•

|

transportation and labor availability and costs;

|

|

•

|

federal tax policies;

|

|

•

|

the effect of forestry, land use, environmental and other governmental regulations;

|

|

•

|

legal proceedings;

|

|

•

|

performance of pension fund investments and related derivatives;

|

|

•

|

the effect of timing of employee retirements and changes in the market price of our common stock on charges for share-based compensation;

|

|

•

|

the accuracy of our estimates of costs and expenses related to contingent liabilities;

|

|

•

|

changes in accounting principles; and

|

|

•

|

other factors described in this report under

Risk Factors

and

Management's Discussion and Analysis of Financial Condition and Results of Operations

.

|

|

RISKS RELATED TO OUR INDUSTRY

|

|

RISKS RELATED TO OUR BUSINESS

|

|

•

|

unscheduled maintenance outages;

|

|

•

|

prolonged power failures;

|

|

•

|

equipment failure;

|

|

•

|

chemical spill or release;

|

|

•

|

explosion of a boiler;

|

|

•

|

fires, floods, windstorms, earthquakes, hurricanes or other severe weather conditions or catastrophes, affecting the production of goods or the supply of raw materials (including fiber);

|

|

•

|

the effect of drought or reduced rainfall on water supply;

|

|

•

|

labor difficulties;

|

|

•

|

disruptions in transportation or transportation infrastructure, including roads, bridges, rail, tunnels, shipping and port facilities;

|

|

•

|

terrorism or threats of terrorism;

|

|

•

|

cyber attack;

|

|

•

|

governmental regulations; and

|

|

•

|

other operational problems.

|

|

RISKS RELATED TO CAPITAL MARKETS

|

|

RISKS RELATED TO LEGAL, REGULATORY AND TAX

|

|

•

|

air emissions,

|

|

•

|

wastewater discharges,

|

|

•

|

harvesting and other silvicultural activities,

|

|

•

|

forestry operations and endangered species habitat protection,

|

|

•

|

surface water management,

|

|

•

|

the storage, usage, management and disposal of hazardous substances and wastes,

|

|

•

|

the cleanup of contaminated sites,

|

|

•

|

landfill operation and closure obligations,

|

|

•

|

building codes, and

|

|

•

|

health and safety matters.

|

|

•

|

We would not be allowed to deduct dividends to shareholders in computing our taxable income.

|

|

•

|

We would be subject to federal and state income tax on our taxable income at applicable corporate rates.

|

|

•

|

We also would be disqualified from treatment as a REIT for the four taxable years following the year during which we lost qualification.

|

|

OTHER RISKS

|

|

•

|

actual or anticipated fluctuations in our operating results or our competitors' operating results;

|

|

•

|

announcements by us or our competitors of new products, capacity changes, significant contracts, acquisitions or strategic investments;

|

|

•

|

our growth rate and our competitors

’

growth rates;

|

|

•

|

general economic conditions;

|

|

•

|

conditions in the financial markets;

|

|

•

|

market interest rates and the relative yields on other financial instruments;

|

|

•

|

general perceptions and expectations regarding housing markets, interest rates, commodity prices, and currencies;

|

|

•

|

changes in stock market analyst recommendations regarding us, our competitors or the forest products industry generally, or lack of analyst coverage of our common stock;

|

|

•

|

sales of our common stock by our executive officers, directors and significant shareholders;

|

|

•

|

sales or repurchases of substantial amounts of common stock;

|

|

•

|

changes in accounting principles; and

|

|

•

|

changes in tax laws and regulations.

|

|

•

|

For details about our Timberlands properties, go to

Our Business/What We Do/Timberlands/Where We Do It

.

|

|

•

|

For details about our Real Estate, Energy and Natural Resources properties, go to

Our Business/What We Do/Real Estate, Energy and Natural Resources/Where We Do It

.

|

|

•

|

For details about our Wood Products properties, go to

Our Business/What We Do/Wood Products/Where We Do It

.

|

|

NUMBER OF

SECURITIES TO BE

ISSUED UPON

EXERCISE OF

OUTSTANDING

OPTIONS,

WARRANTS AND

RIGHTS

|

|

WEIGHTED

AVERAGE EXERCISE

PRICE OF

OUTSTANDING

OPTIONS,

WARRANTS AND

RIGHTS

|

|

NUMBER OF

SECURITIES

REMAINING AVAILABLE

FOR FUTURE ISSUANCE

UNDER EQUITY

COMPENSATION PLANS

(EXCLUDING

SECURITIES TO BE ISSUED UPON EXERCISE)

|

|

||

|

Equity compensation plans approved by security holders

(1)

|

9,180,693

|

|

$

|

19.01

|

|

20,554,887

|

|

|

Equity compensation plans not approved by security holders

|

N/A

|

|

N/A

|

|

N/A

|

|

|

|

Total

|

9,180,693

|

|

$

|

19.01

|

|

20,554,887

|

|

|

(1) Includes 1,592,843 restricted stock units and 1,040,582 performance share units. Because there is no exercise price associated with restricted stock units and performance share units, excluding these stock units the weighted average exercise price calculation would be $26.66.

|

|||||||

|

COMMON SHARE REPURCHASE DURING FOURTH QUARTER 2018

|

TOTAL NUMBER OF SHARES PURCHASED

|

|

AVERAGE PRICE PAID PER SHARE

|

|

TOTAL NUMBER OF SHARES PURCHASED AS PART OF PUBLICLY ANNOUNCED PLANS OR PROGRAMS

|

|

APPROXIMATE DOLLAR VALUE OF SHARES THAT MAY YET BE PURCHASED UNDER THE PLANS OR PROGRAMS

(1)

|

|

||

|

October 1 - October 31

|

394,223

|

|

$

|

26.13

|

|

394,223

|

|

$

|

199,311,977

|

|

|

November 1 - November 30

|

1,475,848

|

|

27.10

|

|

1,475,848

|

|

159,313,972

|

|

||

|

December 1 - December 31

|

954,418

|

|

25.86

|

|

954,418

|

|

134,633,963

|

|

||

|

Total

|

2,824,489

|

|

$

|

26.55

|

|

2,824,489

|

|

$

|

134,633,963

|

|

|

(1) During fourth quarter 2018, we repurchased 2.8 million shares of common stock for $75 million (including transaction fees) under the 2016 Share Repurchase Authorization. The 2016 Share Repurchase Authorization was approved in November 2015 by our Board of Directors and authorized management to repurchase up to $2.5 billion of outstanding shares subsequent to the closing of our merger with Plum Creek. Transaction fees incurred for repurchases are not counted as use of funds authorized for repurchase under the 2016 Share Repurchase Authorization. All common stock purchases under the stock repurchase program were made in open-market transactions.

|

||||||||||

|

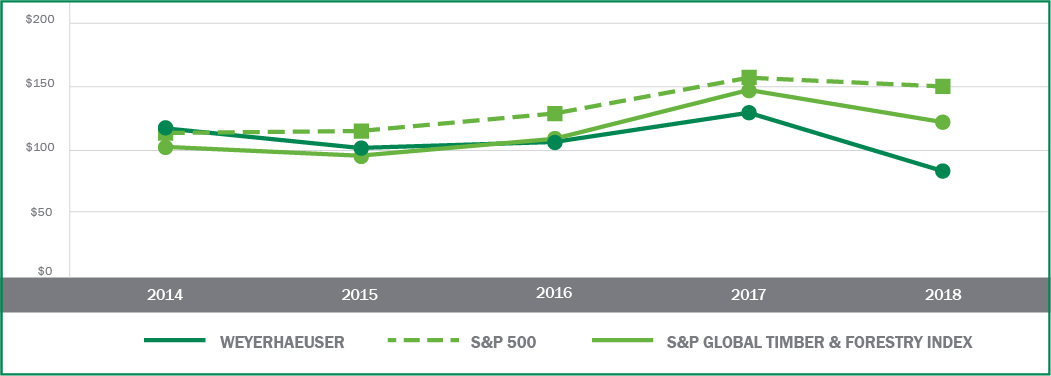

•

|

Assumes $100 invested on

December 31, 2013

, in Weyerhaeuser common stock, the S&P 500 Index and the S&P Global Timber & Forestry Index.

|

|

•

|

Total return assumes dividends received are reinvested at month end.

|

|

•

|

Measurement dates are the last trading day of the calendar year shown.

|

|

PER COMMON SHARE

|

|||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

Diluted earnings from continuing operations attributable to Weyerhaeuser common shareholders

|

$

|

0.99

|

|

$

|

0.77

|

|

$

|

0.55

|

|

$

|

0.71

|

|

$

|

1.02

|

|

|

Diluted earnings from discontinued operations attributable to Weyerhaeuser common shareholders

|

$

|

—

|

|

$

|

—

|

|

$

|

0.84

|

|

$

|

0.18

|

|

$

|

2.16

|

|

|

Diluted net earnings attributable to Weyerhaeuser common shareholders

|

$

|

0.99

|

|

$

|

0.77

|

|

$

|

1.39

|

|

$

|

0.89

|

|

$

|

3.18

|

|

|

Dividends paid

|

$

|

1.32

|

|

$

|

1.25

|

|

$

|

1.24

|

|

$

|

1.20

|

|

$

|

1.02

|

|

|

Weyerhaeuser shareholders’ interest (end of year)

|

$

|

12.12

|

|

$

|

11.78

|

|

$

|

12.26

|

|

$

|

9.54

|

|

$

|

10.11

|

|

|

FINANCIAL POSITION

|

|||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

Total assets

|

$

|

17,249

|

|

$

|

18,059

|

|

$

|

19,243

|

|

$

|

12,470

|

|

$

|

13,247

|

|

|

Total long-term debt, including current portion, and borrowings on line of credit

(1)

|

$

|

6,344

|

|

$

|

5,992

|

|

$

|

6,610

|

|

$

|

4,787

|

|

$

|

4,873

|

|

|

Weyerhaeuser shareholders’ interest

|

$

|

9,046

|

|

$

|

8,899

|

|

$

|

9,180

|

|

$

|

4,869

|

|

$

|

5,304

|

|

|

Percent earned on average year-end Weyerhaeuser shareholders’ interest

|

8.3

|

%

|

6.4

|

%

|

14.3

|

%

|

9.1

|

%

|

29.5

|

%

|

|||||

|

OPERATING RESULTS

|

|||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

Net sales

|

$

|

7,476

|

|

7,196

|

|

6,365

|

|

5,246

|

|

5,489

|

|

||||

|

Earnings from continuing operations

|

748

|

|

582

|

|

415

|

|

411

|

|

616

|

|

|||||

|

Discontinued operations, net of income taxes

|

—

|

|

—

|

|

612

|

|

95

|

|

1,210

|

|

|||||

|

Net earnings

|

748

|

|

582

|

|

1,027

|

|

506

|

|

1,826

|

|

|||||

|

Dividends on preference shares

|

—

|

|

—

|

|

(22

|

)

|

(44

|

)

|

(44

|

)

|

|||||

|

Net earnings attributable to Weyerhaeuser common shareholders

|

$

|

748

|

|

$

|

582

|

|

$

|

1,005

|

|

$

|

462

|

|

$

|

1,782

|

|

|

CASH FLOWS

|

|||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

Net cash from operations

|

$

|

1,112

|

|

$

|

1,201

|

|

$

|

735

|

|

$

|

1,075

|

|

$

|

1,109

|

|

|

Net cash from investing activities

|

(440

|

)

|

367

|

|

2,559

|

|

(487

|

)

|

361

|

|

|||||

|

Net cash from financing activities

|

(1,162

|

)

|

(1,420

|

)

|

(3,630

|

)

|

(1,156

|

)

|

(725

|

)

|

|||||

|

Net change in cash and cash equivalents

|

$

|

(490

|

)

|

$

|

148

|

|

$

|

(336

|

)

|

$

|

(568

|

)

|

$

|

745

|

|

|

STATISTICS (UNAUDITED)

|

|||||||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2015

|

|

2014

|

|

|||||

|

Number of employees

|

9,300

|

|

9,300

|

|

10,400

|

|

12,600

|

|

12,800

|

|

|||||

|

Number of common shareholder accounts at year-end

|

14,525

|

|

15,138

|

|

15,504

|

|

7,700

|

|

8,248

|

|

|||||

|

Number of common shares outstanding at year-end (thousands)

|

746,391

|

|

755,223

|

|

748,528

|

|

510,483

|

|

524,474

|

|

|||||

|

Weighted average common shares outstanding – diluted (thousands)

|

756,827

|

|

756,666

|

|

722,401

|

|

519,618

|

|

560,899

|

|

|||||

|

(1) Does not include nonrecourse debt held by our Variable Interest Entities (VIEs). See

Note 9: Related Parties

in the

Notes to Consolidated Financial Statements

for further information on our VIEs and the related nonrecourse debt.

|

|||||||||||||||

|

WHAT YOU WILL FIND IN THIS MD&A

|

|

•

|

economic and market conditions affecting our operations;

|

|

•

|

financial performance summary;

|

|

•

|

discussion of the softwood lumber agreement;

|

|

•

|

results of our operations — consolidated and by segment;

|

|

•

|

liquidity and capital resources — where we discuss our cash flows;

|

|

•

|

off-balance sheet arrangements;

|

|

•

|

environmental matters, legal proceedings and other contingencies; and

|

|

•

|

accounting matters — where we discuss critical accounting policies and areas requiring judgments and estimates.

|

|

ECONOMIC AND MARKET CONDITIONS AFFECTING OUR OPERATIONS

|

|

FINANCIAL PERFORMANCE SUMMARY

|

|

SOFTWOOD LUMBER AGREEMENT

|

|

RESULTS OF OPERATIONS

|

|

•

|

Sales realizations refer to net selling prices — this includes selling price plus freight minus normal sales deductions;

|

|

•

|

Net contribution to earnings refers to earnings (loss) attributable to Weyerhaeuser shareholders before interest expense and income taxes.

|

|

DOLLAR AMOUNTS IN MILLIONS, EXCEPT PER-SHARE FIGURES

|

|||||||||||||||

|

|

|

|

|

AMOUNT OF CHANGE

|

|||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2018

vs. 2017 |

|

2017

vs. 2016 |

|

|||||

|

Net sales

|

$

|

7,476

|

|

$

|

7,196

|

|

$

|

6,365

|

|

$

|

280

|

|

$

|

831

|

|

|

Costs of sales

|

$

|

5,592

|

|

$

|

5,298

|

|

$

|

4,980

|

|

$

|

294

|

|

$

|

318

|

|

|

Operating income

|

$

|

1,394

|

|

$

|

1,131

|

|

$

|

822

|

|

$

|

263

|

|

$

|

309

|

|

|

Earnings from discontinued operations, net of tax

|

$

|

—

|

|

$

|

—

|

|

$

|

612

|

|

$

|

—

|

|

$

|

(612

|

)

|

|

Net earnings attributable to Weyerhaeuser common shareholders

|

$

|

748

|

|

$

|

582

|

|

$

|

1,005

|

|

$

|

166

|

|

$

|

(423

|

)

|

|

Basic earnings per share attributable to Weyerhaeuser common shareholders

|

$

|

0.99

|

|

$

|

0.77

|

|

$

|

1.40

|

|

$

|

0.22

|

|

$

|

(0.63

|

)

|

|

Diluted earnings per share attributable to Weyerhaeuser common shareholders

|

$

|

0.99

|

|

$

|

0.77

|

|

$

|

1.39

|

|

$

|

0.22

|

|

$

|

(0.62

|

)

|

|

•

|

Wood Products segment net sales to unaffiliated customers increased

$281 million

, primarily attributable to increased sales realizations across all product lines; and

|

|

•

|

Real Estate & ENR segment net sales to unaffiliated customers increased

$26 million

primarily attributable to increased acres sold.

|

|

•

|

$290 million

decrease in charges for product remediation; and

|

|

•

|

$147 million

decrease in charges related to a noncash pretax impairment in 2017, with no similar charges in 2018. This impairment was a result of our agreement to sell our Uruguayan operations, as announced during June 2017 (refer to

Note 18: Charges for Integration and Restructuring, Closures and Asset Impairments

in the

Notes to Consolidated Financial Statements

).

|

|

•

|

$99 million

gain recorded in fourth quarter 2017 that did not occur in 2018 as a result of the sale of land in our Southern timberlands region to Twin Creeks (refer to

Note 9: Related Parties

in the

Notes to Consolidated Financial Statements

for further details);

|

|

•

|

$37 million decrease in environmental remediation insurance recoveries received; and

|

|

•

|

$14 million

decreased consolidated gross margin, as described above.

|

|

•

|

a

$263 million

increase to operating income, as described above;

|

|

•

|

a $75 million decrease in income tax expense; and

|

|

•

|

an $18 million decrease in interest expense, net of capitalized interest.

|

|

•

|

Wood Products net sales to unaffiliated customers increased

$640 million

primarily attributable to increased sales realizations across all product lines, as well as increased sales volumes within our oriented strand board, engineered I-joists, medium density fiberboard, and our engineered solid section product lines. Additionally, upon completion of the sales of our former Cellulose Fibers businesses, chips previously sold to Cellulose Fibers are now sales to unaffiliated customers. Refer to

Note 4: Discontinued Operations and Other Divestitures

in the

Notes to Consolidated Financial Statements

for further details regarding these divestitures.

|

|

•

|

Timberlands net sales to unaffiliated customers increased

$137 million

, which is primarily attributable to increased Southern and Other (includes our Canadian operations and timberlands included in the Twin Creeks Venture) delivered log sales volumes, as well as, an increase in Western log sales prices.

|

|

•

|

Real Estate & ENR net sales to unaffiliated customers increased

$54 million

attributable to an increase in timberlands acres sold in Real Estate and an increase in royalties.

|

|

•

|

an increase to consolidated gross margin of

$513 million

, as described above;

|

|

•

|

an increase in other operating income, net of

$75 million

, which is primarily attributable to:

|

|

–

|

a

$99 million

gain recorded in fourth quarter 2017 as a result of the sale of land in our Southern timberlands region to Twin Creeks (refer to

Note 9: Related Parties

in the

Notes to Consolidated Financial Statements

for further details);

|

|

–

|

a $44 million decrease in gains on disposition of nonstrategic assets, primarily attributable to a $36 million pretax gain recognized in the first quarter of 2016 on the sale of our Federal Way, Washington headquarters campus (refer to

Note 20: Other Operating Costs (Income), Net

in the

Notes to Consolidated Financial Statements

for further information).

|

|

•

|

the addition of

$290 million

in charges (recoveries) for product remediation, net in 2017, as there were no similar charges during 2016. Refer to

Note 19: Charges (Recoveries) for Product Remediation, Net

in the

Notes to Consolidated Financial Statements

for further information.

|

|

•

|

a

$24 million

increase in charges for integration and restructuring, closures and asset impairments, which is primarily attributable to a

$147 million

noncash impairment charge recognized during second quarter 2017 in relation to the divestiture of our Uruguayan operations.

This was partially offset by a

$112 million

decrease in charges related to our merger with Plum Creek. Refer to

Note 18: Charges for Integration and Restructurings, Closures and Asset Impairments

in the

Notes to Consolidated Financial Statements

for further details regarding the impairment as well as the Plum Creek merger related costs.

|

|

DOLLAR AMOUNTS IN MILLIONS

|

|||||||||||||||

|

|

|

|

|

AMOUNT OF CHANGE

|

|||||||||||

|

|

2018

|

|

2017

|

|

2016

|

|

2018

vs. 2017 |

|

2017

vs. 2016 |

|

|||||

|