|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[

]

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

|

|

|

|

EXCHANGE ACT OF 1934

for the fiscal year ended December 31, 2017

|

|

|

|

|

|

|

|

OR

|

|

|

|

|

|

[ ]

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

|

|

|

|

EXCHANGE ACT OF 1934

|

|

|

North Carolina

|

|

13-3951308

|

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

|

Identification No.)

|

|

|

|

|

|

|

|

1441 Gardiner Lane, Louisville, Kentucky

|

|

40213

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

Registrant’s telephone number, including area code: (502) 874-8300

|

|||

|

Securities registered pursuant to Section 12(b) of the Act

|

|||

|

|

|

|

|

|

|

Title of Each Class

|

|

Name of Each Exchange on Which Registered

|

|

|

Common Stock, no par value

|

|

New York Stock Exchange

|

|

|

|

||

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

||

|

|

None

|

||

|

Item 1.

|

Business.

|

|

•

|

The KFC Division which includes the worldwide operations of the KFC concept

|

|

•

|

The Pizza Hut Division which includes the worldwide operations of the Pizza Hut concept

|

|

•

|

The Taco Bell Division which includes the worldwide operations of the Taco Bell concept

|

|

•

|

KFC was founded in Corbin, Kentucky by Colonel Harland D. Sanders, an early developer of the quick service food business and a pioneer of the restaurant franchise concept. The Colonel perfected his secret blend of 11 herbs and spices for Kentucky Fried Chicken in 1939 and signed up his first franchisee in 1952.

|

|

•

|

KFC operates in 131 countries and territories throughout the world. As of year end 2017, KFC had 21,487 units, 97 percent of which are franchised.

|

|

•

|

KFC restaurants across the world offer fried and non-fried chicken products such as sandwiches, chicken strips, chicken-on-the-bone and other chicken products marketed under a variety of names. KFC restaurants also offer a variety of entrees and side items suited to local preferences and tastes. Restaurant decor throughout the world is characterized by the image of the Colonel.

|

|

•

|

The first Pizza Hut restaurant was opened in 1958 in Wichita, Kansas, and within a year, the first franchise unit was opened. Today, Pizza Hut is the largest restaurant chain in the world specializing in the sale of ready-to-eat pizza products.

|

|

•

|

Pizza Hut operates in 106 countries and territories throughout the world. As of year end 2017, Pizza Hut had 16,748 units, 99 percent of which are franchised.

|

|

•

|

Pizza Hut operates in the delivery, carryout and casual dining segments around the world. Outside of the U.S., Pizza Hut often uses unique branding to differentiate these segments. Additionally, a growing percentage of Pizza Hut's customer orders are being generated digitally.

|

|

•

|

Pizza Hut features a variety of pizzas which are marketed under varying names. Each of these pizzas is offered with a variety of different toppings suited to local preferences and tastes. Many Pizza Huts also offer pasta and chicken wings, including approximately 5,900 stores offering wings under the WingStreet brand in the U.S. Outside the U.S., Pizza Hut casual dining restaurants offer a variety of core menu products other than pizza, which are typically suited to local preferences and tastes. Pizza Hut units feature a distinctive red roof logo on their signage.

|

|

•

|

The first Taco Bell restaurant was opened in 1962 by Glen Bell in Downey, California, and in 1964, the first Taco Bell franchise was sold.

|

|

•

|

Taco Bell operates in 27 countries and territories throughout the world. As of year end 2017, there were 6,849 Taco Bell units, primarily in the U.S., 90 percent of which are franchised.

|

|

•

|

Taco Bell specializes in Mexican-style food products, including various types of tacos, burritos, quesadillas, salads, nachos and other related items. Taco Bell offers breakfast items in its U.S. stores. Taco Bell units feature a distinctive bell logo on their signage.

|

|

Item 1A.

|

Risk Factors.

|

|

•

|

The Americans with Disabilities Act in the U.S. and similar state laws that give civil rights protections to individuals with disabilities in the context of employment, public accommodations and other areas.

|

|

•

|

The U.S. Fair Labor Standards Act, which governs matters such as minimum wages, overtime and other working conditions, as well as family leave mandates and a variety of similar state laws that govern these and other employment law matters.

|

|

•

|

Laws and regulations in government-mandated health care benefits such as the Patient Protection and Affordable Care Act.

|

|

•

|

Laws and regulations relating to nutritional content, nutritional labeling, product safety, product marketing and menu labeling.

|

|

•

|

Laws relating to state and local licensing.

|

|

•

|

Laws relating to the relationship between franchisors and franchisees.

|

|

•

|

Laws and regulations relating to health, sanitation, food, workplace safety, child labor, including laws prohibiting the use of certain “hazardous equipment” by employees younger than the age of 18 years of age, and fire safety and prevention.

|

|

•

|

Laws and regulations relating to union organizing rights and activities.

|

|

•

|

Laws relating to information security, privacy (including the European Union's GDPR, which will become effective in May 2018), cashless payments, and consumer protection.

|

|

•

|

Laws relating to currency conversion or exchange.

|

|

•

|

Laws relating to international trade and sanctions.

|

|

•

|

Tax laws and regulations.

|

|

•

|

Anti-bribery and anti-corruption laws.

|

|

•

|

Environmental laws and regulations.

|

|

•

|

Federal and state immigration laws and regulations in the U.S.

|

|

•

|

increasing our vulnerability to, and reducing our flexibility to plan for and respond to, adverse economic and industry conditions and changes in our business and the competitive environment;

|

|

•

|

requiring the dedication of a substantial portion of our cash flow from operations to the payment of principal of, and interest on, indebtedness, thereby reducing the availability of such cash flow to fund working capital, capital expenditures, acquisitions, dividends, share repurchases or other corporate purposes;

|

|

•

|

increasing our vulnerability to a further downgrade of our credit rating, which could adversely affect our cost of funds, liquidity and access to capital markets;

|

|

•

|

restricting us from making strategic acquisitions or causing us to make non-strategic divestitures;

|

|

•

|

placing us at a disadvantage compared to other less leveraged competitors or competitors with comparable debt at more favorable interest rates;

|

|

•

|

increasing our exposure to the risk of increased interest rates insofar as current and future borrowings are subject to variable rates of interest;

|

|

•

|

making it more difficult for us to repay, refinance or satisfy our obligations with respect to our debt;

|

|

•

|

limiting our ability to borrow additional funds in the future and increasing the cost of any such borrowing;

|

|

•

|

imposing restrictive covenants on our operations, which, if not complied with, could result in an event of default, which in turn, if not cured or waived, could result in the acceleration of the applicable debt, and may result in the acceleration of any other debt to which a cross-acceleration or cross-default provision applies; and

|

|

•

|

increasing our exposure to risks related to fluctuations in foreign currency as we earn profits in a variety of currencies around the world and our debt is denominated in U.S. dollars.

|

|

Item 1B.

|

Unresolved Staff Comments.

|

|

Item 2.

|

Properties.

|

|

•

|

The KFC Division owned land, building or both for 184 units and leased land, building or both for 484 units.

|

|

•

|

The Pizza Hut Division owned land, building or both for 9 units and leased land, building or both for 151 units.

|

|

•

|

The Taco Bell Division owned land, building or both for 387 units and leased land, building or both for 266 units.

|

|

Item 3.

|

Legal Proceedings

.

|

|

Item 4.

|

Mine Safety Disclosures.

|

|

Item 5.

|

Market for the Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

|

2017

|

||||||||||||

|

Quarter

|

High

|

Low

|

Dividends

Declared

|

|||||||||

|

First

|

$

|

68.65

|

|

$

|

63.18

|

|

$

|

0.30

|

|

|||

|

Second

|

74.82

|

|

63.55

|

|

0.30

|

|

||||||

|

Third

|

77.80

|

|

72.65

|

|

—

|

|

||||||

|

Fourth

|

83.47

|

|

73.75

|

|

0.30

|

|

||||||

|

2016 (As Restated)

(a)

|

||||||||||||

|

Quarter

|

High

|

Low

|

Dividends

Declared

|

|||||||||

|

First

|

$

|

82.25

|

|

$

|

65.24

|

|

$

|

0.46

|

|

|||

|

Second

|

85.90

|

|

79.33

|

|

0.46

|

|

||||||

|

Third

|

91.26

|

|

83.04

|

|

0.51

|

|

||||||

|

Fourth (to October 31)

|

90.92

|

|

85.36

|

|

—

|

|

||||||

|

Fourth (from November 1)

|

64.74

|

|

59.70

|

|

0.30

|

|

||||||

|

(a)

|

Stock price information presented for 2016 is now reflective of our current reporting calendar. See Note 2 to the Consolidated Financial Statements in Item 8 of this Form 10-K for discussion of the change in our reporting calendar.

|

|

Fiscal Periods

|

Total number

of shares

purchased

(thousands)

|

Average price

paid per share

|

Total number of shares

purchased as part of

publicly announced plans

or programs

(thousands)

|

Approximate dollar value

of shares that may yet be

purchased under the plans

or programs

(millions)

|

||||||||

|

10/1/17 - 10/31/17

|

2,686

|

$

|

75.47

|

|

2,686

|

$

|

385

|

|

||||

|

11/1/17- 11/30/17

|

3,162

|

$

|

79.68

|

|

3,162

|

$

|

1,633

|

|

||||

|

12/1/17 - 12/31/17

|

1,603

|

$

|

82.95

|

|

1,603

|

$

|

1,500

|

|

||||

|

Total

|

7,451

|

$

|

78.87

|

|

7,451

|

$

|

1,500

|

|

||||

|

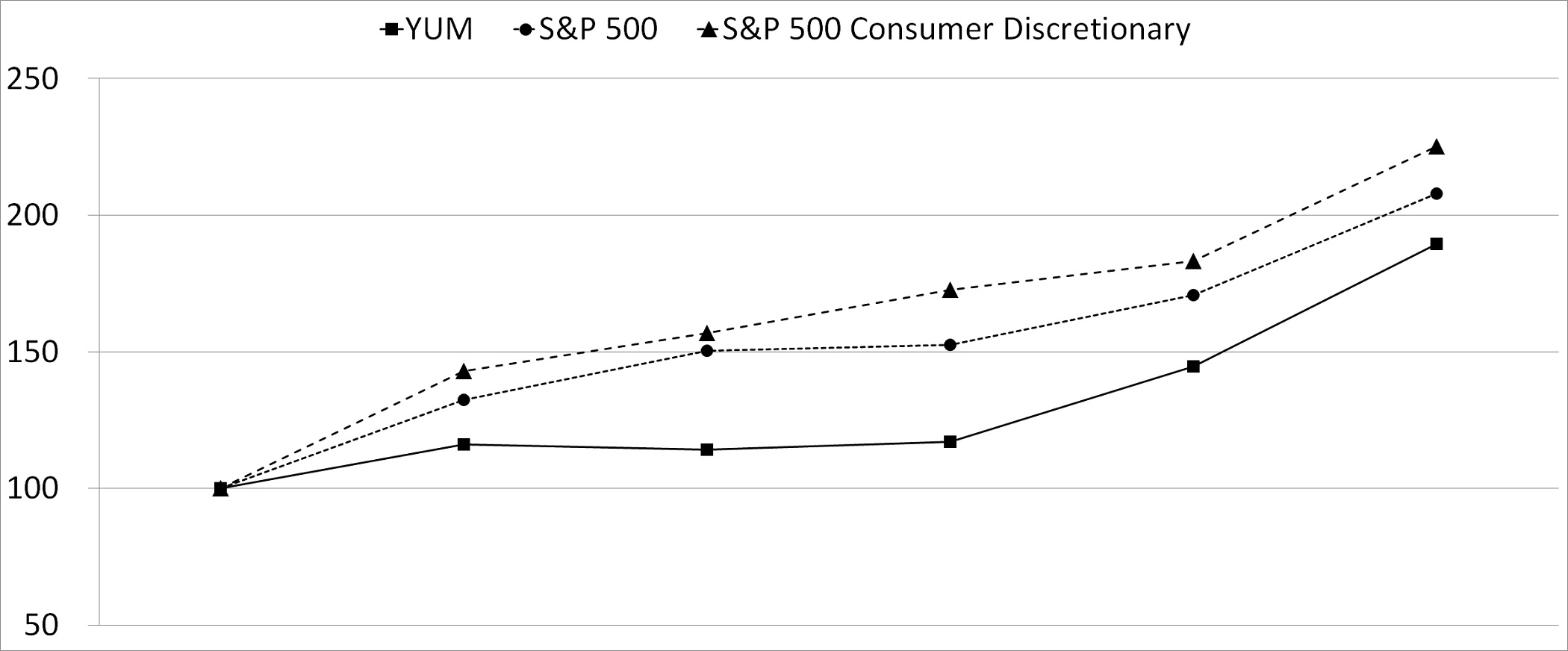

12/31/2012

|

12/31/2013

|

12/31/2014

|

12/31/2015

|

12/30/2016

|

12/29/2017

|

|||||||||||||||||||

|

YUM

|

$

|

100

|

|

$

|

116

|

|

$

|

114

|

|

$

|

117

|

|

$

|

145

|

|

$

|

190

|

|

||||||

|

S&P 500

|

$

|

100

|

|

$

|

132

|

|

$

|

150

|

|

$

|

153

|

|

$

|

171

|

|

$

|

208

|

|

||||||

|

S&P Consumer Discretionary

|

$

|

100

|

|

$

|

143

|

|

$

|

157

|

|

$

|

173

|

|

$

|

183

|

|

$

|

225

|

|

||||||

|

Item 6.

|

Selected Financial Data.

|

|

|

Fiscal Year

|

||||||||||||||||||

|

|

2017

|

2016

(a)(d)

|

2015

(a)

|

2014

(a)

|

2013

(a)

|

||||||||||||||

|

Income Statement Data

|

|||||||||||||||||||

|

Revenues

|

|||||||||||||||||||

|

Company sales

|

$

|

3,572

|

|

$

|

4,189

|

|

$

|

4,336

|

|

$

|

4,503

|

|

$

|

4,384

|

|

||||

|

Franchise and license fees and income

|

2,306

|

|

2,167

|

|

2,082

|

|

2,084

|

|

2,033

|

|

|||||||||

|

Total

|

5,878

|

|

6,356

|

|

6,418

|

|

6,587

|

|

6,417

|

|

|||||||||

|

Refranchising (gain) loss

(b)

|

(1,083

|

)

|

(163

|

)

|

23

|

|

(16

|

)

|

(95

|

)

|

|||||||||

|

Operating Profit

(b)

|

2,761

|

|

1,682

|

|

1,434

|

|

1,517

|

|

1,530

|

|

|||||||||

|

Other pension (income) expense

(b)

|

47

|

|

32

|

|

40

|

|

N/A

|

|

N/A

|

|

|||||||||

|

Interest expense, net

(b)

|

440

|

|

305

|

|

141

|

|

143

|

|

251

|

|

|||||||||

|

Income from continuing operations before income taxes

(b)

|

2,274

|

|

1,345

|

|

1,253

|

|

1,374

|

|

1,279

|

|

|||||||||

|

Income from continuing operations

(b)

|

1,340

|

|

1,018

|

|

926

|

|

1,006

|

|

922

|

|

|||||||||

|

Income from discontinued operations, net of tax

|

N/A

|

|

625

|

|

357

|

|

45

|

|

169

|

|

|||||||||

|

Net Income

(b)

|

1,340

|

|

1,643

|

|

1,283

|

|

1,051

|

|

1,091

|

|

|||||||||

|

Basic earnings per common share from continuing operations

(b)

|

3.86

|

|

2.58

|

|

2.13

|

|

2.27

|

|

2.04

|

|

|||||||||

|

Basic earnings per common share from discontinued operations

|

N/A

|

|

1.59

|

|

0.82

|

|

0.10

|

|

0.37

|

|

|||||||||

|

Basic earnings per common share

(b)

|

3.86

|

|

4.17

|

|

2.95

|

|

2.37

|

|

2.41

|

|

|||||||||

|

Diluted earnings per common share from continuing operations

(b)

|

3.77

|

|

2.54

|

|

2.09

|

|

2.22

|

|

2.00

|

|

|||||||||

|

Diluted earnings per common share from discontinued operations

|

N/A

|

|

1.56

|

|

0.81

|

|

0.10

|

|

0.36

|

|

|||||||||

|

Diluted earnings per common share

(b)

|

3.77

|

|

4.10

|

|

2.90

|

|

2.32

|

|

2.36

|

|

|||||||||

|

Diluted earnings per common share from continuing operations excluding Special Items

(c)

|

2.96

|

|

2.46

|

|

2.31

|

|

2.20

|

|

2.04

|

|

|||||||||

|

Cash Flow Data

|

|||||||||||||||||||

|

Provided by operating activities

|

$

|

1,030

|

|

$

|

1,248

|

|

$

|

1,260

|

|

$

|

1,217

|

|

$

|

1,289

|

|

||||

|

Capital spending

|

318

|

|

427

|

|

442

|

|

508

|

|

481

|

|

|||||||||

|

Proceeds from refranchising of restaurants

|

1,773

|

|

370

|

|

213

|

|

83

|

|

250

|

|

|||||||||

|

Repurchase shares of Common Stock

|

1,960

|

|

5,403

|

|

1,200

|

|

820

|

|

770

|

|

|||||||||

|

Dividends paid on Common Stock

|

416

|

|

744

|

|

730

|

|

669

|

|

615

|

|

|||||||||

|

Balance Sheet Data

|

|||||||||||||||||||

|

Total assets

|

$

|

5,311

|

|

$

|

5,453

|

|

$

|

4,939

|

|

$

|

5,073

|

|

$

|

4,975

|

|

||||

|

Long-term debt

|

9,429

|

|

9,059

|

|

2,988

|

|

3,003

|

|

2,888

|

|

|||||||||

|

Total debt

|

9,804

|

|

9,125

|

|

3,908

|

|

3,268

|

|

2,958

|

|

|||||||||

|

Other Data

|

|||||||||||||||||||

|

Number of stores at year end

|

|||||||||||||||||||

|

Franchise

|

43,603

|

|

40,834

|

|

39,320

|

|

37,959

|

|

36,746

|

|

|||||||||

|

Company

|

1,481

|

|

2,841

|

|

3,163

|

|

3,279

|

|

3,071

|

|

|||||||||

|

System

|

45,084

|

|

43,675

|

|

42,483

|

|

41,238

|

|

39,817

|

|

|||||||||

|

System Sales

(c)

|

|||||||||||||||||||

|

KFC Division system sales

|

24,515

|

|

23,242

|

|

22,628

|

|

23,458

|

|

23,147

|

|

|||||||||

|

Reported growth

|

5

|

%

|

3

|

%

|

(3

|

)%

|

1

|

%

|

(2

|

)%

|

|||||||||

|

Growth in local currency

|

6

|

%

|

7

|

%

|

5

|

%

|

4

|

%

|

—

|

%

|

|||||||||

|

Pizza Hut Division system sales

|

12,034

|

|

12,019

|

|

11,999

|

|

12,106

|

|

11,948

|

|

|||||||||

|

Reported growth

|

—

|

%

|

—

|

%

|

(1

|

)%

|

1

|

%

|

3

|

%

|

|||||||||

|

Growth in local currency

|

1

|

%

|

2

|

%

|

3

|

%

|

2

|

%

|

4

|

%

|

|||||||||

|

Taco Bell Division system sales

|

10,145

|

|

9,660

|

|

9,102

|

|

8,459

|

|

8,107

|

|

|||||||||

|

Reported growth

|

5

|

%

|

6

|

%

|

8

|

%

|

4

|

%

|

4

|

%

|

|||||||||

|

Growth in local currency

|

5

|

%

|

6

|

%

|

8

|

%

|

4

|

%

|

4

|

%

|

|||||||||

|

Shares outstanding at year end

|

332

|

|

355

|

|

420

|

|

434

|

|

443

|

|

|||||||||

|

Cash dividends declared per Common Share

|

$

|

0.90

|

|

$

|

1.73

|

|

$

|

1.74

|

|

$

|

1.56

|

|

$

|

1.41

|

|

||||

|

Market price per share at year end

(e)

|

$

|

81.61

|

|

$

|

63.33

|

|

$

|

73.05

|

|

$

|

73.14

|

|

$

|

73.87

|

|

||||

|

(a)

|

Selected financial data for years 2016 and 2015 has been recast to present the change in our reporting calendar and retroactively adopting a new accounting standard related to the presentation of net periodic pension cost and net periodic postretirement benefit cost (collectively,"Benefit Costs"). See Notes 2 and 5 to the Consolidated Financial Statements in Item 8 of this Form 10-K for discussion related to adopting a new accounting standard on Benefit Costs and the change in our reporting calendar, respectively. 2014 reflects our Balance Sheet and store count data that were recast for purposes of presenting 2015 Consolidated Statement of Cash Flows and unit growth. No other data presented in 2014 or 2013 has been recast.

|

|

(b)

|

Includes amounts deemed as Special Items for some or all years presented. See discussion of our 2017, 2016 and 2015 Special Items in our Management's Discussion and Analysis ("MD&A"). Special Items in 2014 positively impacted Operating Profit by $16 million, primarily due to Refranchising gains. Special Items in 2013 positively impacted Operating Profit by $73 million, primarily due to Refranchising gains, partially offset by $10 million in pension settlement charges and $5 million of expense related to U.S. productivity initiatives and realignment of resources. Additionally, in 2013, we incurred $118 million of premiums paid and other costs related to the extinguishment of debt that were considered Special Items and were recorded in Interest expense, net. Special Items resulted in cumulative net tax benefits of $23 million 2013.

|

|

(c)

|

These non-GAAP measures are discussed in further detail in our MD&A.

|

|

(d)

|

Fiscal years for our U.S. and certain international subsidiaries that operate on a weekly periodic calendar include 52 weeks in 2017, 2015, 2014 and 2013 and 53 weeks in 2016. Refer to Note 2 for additional details related to our fiscal calendar.

|

|

(e)

|

Historical stock prices prior to November 1, 2016, do not reflect any adjustment for the impact of the Separation.

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

|

•

|

The KFC Division which includes our worldwide operations of the KFC concept

|

|

•

|

The Pizza Hut Division which includes our worldwide operations of the Pizza Hut concept

|

|

•

|

The Taco Bell Division which includes our worldwide operations of the Taco Bell concept

|

|

•

|

More Focused. Four growth drivers form the basis of YUM’s strategic plans and repeatable business model to accelerate same-store sales growth and net-new restaurant development at KFC, Pizza Hut and Taco Bell around the world over the long term. The Company is focused on becoming best-in-class in:

|

|

•

|

Building Distinctive, Relevant and Easy Brands

|

|

•

|

Developing Unmatched Franchise Operating Capability

|

|

•

|

Driving Bold Restaurant Development

|

|

•

|

Growing Unrivaled Culture and Talent

|

|

•

|

More Franchised. YUM intends franchise restaurant ownership to be at least 98% by the end of 2018.

|

|

•

|

More Efficient. The Company is revamping its financial profile, improving the efficiency of its organization and cost structure globally, by:

|

|

•

|

Reducing annual capital expenditures to approximately $100 million in 2019;

|

|

•

|

Lowering General and administrative expenses ("G&A") to 1.7% of system sales in 2019; and

|

|

•

|

Maintaining an optimized capital structure of ~5.0x Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) leverage.

|

|

•

|

Same-store sales growth is the estimated percentage change in sales of all restaurants that have been open and in the YUM system for one year or more.

|

|

•

|

Net new units represents new unit openings, offset by store closures.

|

|

•

|

Company restaurant profit ("Restaurant profit") is defined as Company sales less expenses incurred directly by our Company-owned restaurants in generating Company sales. Company restaurant margin as a percentage of sales is defined as Restaurant profit divided by Company sales. Within the Company sales and Restaurant profit sections of this MD&A, Store Portfolio Actions represent the net impact of new unit openings, acquisitions, refranchising and store closures, and Other primarily represents the impact of same-store sales as well as the impact of changes in costs such as inflation/deflation.

|

|

•

|

Operating margin is Operating Profit divided by Total revenues.

|

|

•

|

System sales, System sales excluding the impacts of foreign currency translation ("FX"), and System sales excluding FX and the impact of the 53rd week in 2016. System sales include the results of all restaurants regardless of ownership, including Company-owned and franchise restaurants that operate our Concepts. Sales of franchise restaurants typically generate ongoing franchise and license fees for the Company at a rate of 3% to 6% of sales. Franchise restaurant sales are not included in Company sales on the Consolidated Statements of Income; however, the franchise and license fees are included in the Company’s revenues. We believe System sales growth is useful to investors as a significant indicator of the overall strength of our business as it incorporates all of our revenue drivers, Company and franchise same-store sales as well as net unit growth.

|

|

•

|

Diluted Earnings Per Share from Continuing Operations excluding Special Items (as defined below);

|

|

•

|

Effective Tax Rate excluding Special Items;

|

|

•

|

Core Operating Profit and Core Operating Profit excluding the impact of the 53rd week in 2016. Core Operating Profit excludes Special Items and FX and we use Core Operating Profit for the purposes of evaluating performance internally.

|

|

% Change

|

|||||||||

|

System Sales, Ex FX

|

Same-Store Sales

|

Net New Units

|

GAAP Operating Profit

|

Core Operating Profit

|

|||||

|

KFC Division

|

+6

|

+3

|

+4

|

+13

|

+12

|

||||

|

Pizza Hut Division

|

+1

|

Even

|

+2

|

(7)

|

(6)

|

||||

|

Taco Bell Division

|

+5

|

+4

|

+4

|

+4

|

+4

|

||||

|

Worldwide

|

+4

|

+2

|

+3

|

+64

|

+7

|

||||

|

Results Excluding 53

rd

Week in 2016

(% Change)

|

|||

|

System Sales, Ex FX

|

Core Operating Profit

|

||

|

KFC Division

|

+6

|

+14

|

|

|

Pizza Hut Division

|

+2

|

(5)

|

|

|

Taco Bell Division

|

+7

|

+6

|

|

|

Worldwide

|

+5

|

+9

|

|

|

•

|

During the year, we opened 1,407 net new units for 3% net new unit growth.

|

|

•

|

During the year, we refranchised 1,470 restaurants, including 828 KFC, 389 Pizza Hut and 253 Taco Bell units, for pre-tax proceeds of $1.8 billion. We recorded net refranchising gains of $1.1 billion in Special Items.

|

|

•

|

During the year, we repurchased 26.6 million shares totaling $1.9 billion at an average share price of $72.

|

|

|

Amount

|

% B/(W)

|

|||||||||||||||||||

|

|

2017

|

2016

|

2015

|

2017

|

2016

|

||||||||||||||||

|

Company sales

|

$

|

3,572

|

|

$

|

4,189

|

|

$

|

4,336

|

|

|

(15

|

)

|

|

(3

|

)

|

||||||

|

Franchise and license fees and income

|

2,306

|

|

2,167

|

|

2,082

|

|

|

6

|

|

|

4

|

|

|||||||||

|

Total revenues

|

$

|

5,878

|

|

$

|

6,356

|

|

$

|

6,418

|

|

|

(8

|

)

|

|

(1

|

)

|

||||||

|

Restaurant profit

|

$

|

618

|

|

$

|

700

|

|

$

|

709

|

|

|

(12

|

)

|

|

(1

|

)

|

|

|||||

|

Restaurant margin %

|

17.3

|

%

|

16.7

|

%

|

16.3

|

%

|

0.6

|

|

ppts.

|

0.4

|

|

ppts.

|

|||||||||

|

G&A expenses

|

$

|

999

|

|

$

|

1,129

|

|

$

|

1,058

|

|

12

|

|

(7

|

)

|

||||||||

|

Franchise and license expenses

|

237

|

|

201

|

|

240

|

|

(18

|

)

|

16

|

|

|||||||||||

|

Closures and impairment expenses

|

3

|

|

15

|

|

16

|

|

82

|

|

8

|

|

|||||||||||

|

Refranchising (gain) loss

|

(1,083

|

)

|

(163

|

)

|

23

|

|

NM

|

|

NM

|

|

|||||||||||

|

Other (income) expense

|

7

|

|

3

|

|

20

|

|

(103

|

)

|

83

|

|

|||||||||||

|

Operating Profit

|

$

|

2,761

|

|

$

|

1,682

|

|

$

|

1,434

|

|

|

64

|

|

|

17

|

|

|

|||||

|

Other pension (income) expense

|

47

|

|

32

|

|

40

|

|

(45

|

)

|

18

|

|

|||||||||||

|

Interest expense, net

|

440

|

|

305

|

|

141

|

|

|

(44

|

)

|

|

NM

|

|

|

||||||||

|

Income tax provision

|

934

|

|

327

|

|

327

|

|

|

NM

|

|

—

|

|

|

|||||||||

|

Income from continuing operations

|

1,340

|

|

1,018

|

|

926

|

|

32

|

|

10

|

|

|||||||||||

|

Income from discontinued operations, net of tax

|

N/A

|

|

625

|

|

357

|

|

NM

|

|

75

|

|

|||||||||||

|

Net Income

|

$

|

1,340

|

|

$

|

1,643

|

|

$

|

1,283

|

|

|

(18

|

)

|

|

28

|

|

|

|||||

|

Diluted EPS from continuing operations

(a)

|

$

|

3.77

|

|

$

|

2.54

|

|

$

|

2.09

|

|

48

|

|

22

|

|

||||||||

|

Diluted EPS from discontinued operations

(a)

|

N/A

|

|

$

|

1.56

|

|

$

|

0.81

|

|

NM

|

|

93

|

|

|||||||||

|

Diluted EPS

(a)

|

$

|

3.77

|

|

$

|

4.10

|

|

$

|

2.90

|

|

|

(8

|

)

|

|

42

|

|

|

|||||

|

Effective tax rate - continuing operations

|

41.1%

|

24.3%

|

26.1%

|

|

(16.8

|

)

|

ppts.

|

1.8

|

|

ppts.

|

|||||||||||

|

(a)

|

See Note 3 for the number of shares used in these calculations.

|

|

% Increase (Decrease)

|

||||||||||||||

|

Unit Count

|

2017

|

2016

|

2015

|

2017

|

2016

|

|||||||||

|

Franchise

|

43,603

|

|

40,834

|

|

39,320

|

|

7

|

|

4

|

|

||||

|

Company-owned

|

1,481

|

|

2,841

|

|

3,163

|

|

(48

|

)

|

(10

|

)

|

||||

|

45,084

|

|

43,675

|

|

42,483

|

|

3

|

|

3

|

|

|||||

|

% B/(W)

|

||||||

|

2017

|

2016

|

|||||

|

System Sales Growth, reported

|

4

|

|

3

|

|

||

|

System Sales Growth, excluding FX

|

4

|

|

5

|

|

||

|

System Sales Growth, excluding FX and 53

rd

week

|

5

|

|

4

|

|

||

|

Same-Store Sales Growth

|

2

|

|

1

|

|

||

|

Non-GAAP Items

|

||||||

|

Core Operating Profit Growth

|

7

|

|

11

|

|

||

|

Core Operating Profit Growth, excluding 53

rd

week

|

9

|

|

9

|

|

||

|

Diluted EPS from Continuing Operations, excluding Special Items

|

20

|

|

7

|

|

||

|

KFC Division

|

Pizza Hut Division

|

Taco Bell Division

|

Total

|

||||||||||||

|

Revenues

|

|||||||||||||||

|

Company sales

|

$

|

26

|

|

$

|

5

|

|

$

|

24

|

|

$

|

55

|

|

|||

|

Franchise and license fees and income

|

8

|

|

6

|

|

7

|

|

21

|

|

|||||||

|

Total revenues

|

$

|

34

|

|

$

|

11

|

|

$

|

31

|

|

$

|

76

|

|

|||

|

Operating Profit

|

|||||||||||||||

|

Franchise and license fees and income

|

$

|

8

|

|

$

|

6

|

|

$

|

7

|

|

$

|

21

|

|

|||

|

Restaurant profit

|

6

|

|

1

|

|

7

|

|

14

|

|

|||||||

|

G&A expenses

|

(3

|

)

|

(2

|

)

|

(2

|

)

|

(7

|

)

|

|||||||

|

Operating Profit

|

$

|

11

|

|

$

|

5

|

|

$

|

12

|

|

$

|

28

|

|

|||

|

|

Year

|

|||||||||||

|

Detail of Special Items

|

2017

|

2016

|

2015

|

|||||||||

|

Refranchising gain (loss) (See Note 5)

|

$

|

1,083

|

|

$

|

163

|

|

$

|

(19

|

)

|

|||

|

YUM's Strategic Transformation Initiatives

(See Note 5)

|

(23

|

)

|

(67

|

)

|

—

|

|

||||||

|

Costs associated with Pizza Hut U.S. Transformation Agreement (See Note 5)

|

(31

|

)

|

—

|

|

—

|

|

||||||

|

Costs associated with KFC U.S. Acceleration Agreement (See Note 5)

|

(17

|

)

|

(26

|

)

|

(72

|

)

|

||||||

|

Non-cash charges associated with share-based compensation

(See Note 5)

|

(18

|

)

|

(30

|

)

|

—

|

|

||||||

|

Other Special Items Income (Expense)

|

7

|

|

(5

|

)

|

—

|

|

||||||

|

Special Items Income (Expense) - Operating Profit

|

1,001

|

|

35

|

|

(91

|

)

|

||||||

|

Special Items - Other Pension Income (Expense) (See Note 5)

|

(23

|

)

|

(26

|

)

|

—

|

|

||||||

|

Special Items Income (Expense) from Continuing Operations before Income Taxes

|

978

|

|

9

|

|

(91

|

)

|

||||||

|

Tax Benefit (Expense) on Special Items

(a)

|

(256

|

)

|

24

|

|

(4

|

)

|

||||||

|

Tax (Expense) - U.S. Tax Act

(a)

|

(434

|

)

|

—

|

|

—

|

|

||||||

|

Special Items Income (Expense), net of tax

|

$

|

288

|

|

$

|

33

|

|

$

|

(95

|

)

|

|||

|

Average diluted shares outstanding

|

355

|

|

400

|

|

443

|

|

||||||

|

Special Items diluted EPS

|

$

|

0.81

|

|

$

|

0.08

|

|

$

|

(0.22

|

)

|

|||

|

Reconciliation of GAAP Operating Profit to Core Operating Profit and Core Operating Profit, excluding 53

rd

Week

|

||||||||||||

|

Consolidated

|

||||||||||||

|

GAAP Operating Profit

|

$

|

2,761

|

|

$

|

1,682

|

|

$

|

1,434

|

|

|||

|

Special Items Income (Expense) - Operating Profit

|

1,001

|

|

35

|

|

(91

|

)

|

||||||

|

Foreign Currency Impact on Divisional Operating Profit

(b)

|

—

|

|

(47

|

)

|

N/A

|

|

||||||

|

Core Operating Profit

|

$

|

1,760

|

|

$

|

1,694

|

|

$

|

1,525

|

|

|||

|

Impact of 53

rd

Week

|

N/A

|

|

28

|

|

N/A

|

|

||||||

|

Core Operating Profit, excluding 53

rd

Week

|

$

|

1,760

|

|

$

|

1,666

|

|

$

|

1,525

|

|

|||

|

KFC Division

|

||||||||||||

|

GAAP Operating Profit

|

$

|

981

|

|

$

|

871

|

|

$

|

835

|

|

|||

|

Foreign Currency Impact on Divisional Operating Profit

(b)

|

4

|

|

(41

|

)

|

N/A

|

|

||||||

|

Core Operating Profit

|

977

|

|

912

|

|

835

|

|

||||||

|

Impact of 53

rd

Week

|

N/A

|

|

11

|

|

N/A

|

|

||||||

|

Core Operating Profit, excluding 53

rd

Week

|

$

|

977

|

|

$

|

901

|

|

$

|

835

|

|

|||

|

Pizza Hut Division

|

||||||||||||

|

GAAP Operating Profit

|

$

|

341

|

|

$

|

367

|

|

$

|

351

|

|

|||

|

Foreign Currency Impact on Divisional Operating Profit

(b)

|

(4

|

)

|

(7

|

)

|

N/A

|

|

||||||

|

Core Operating Profit

|

345

|

|

374

|

|

351

|

|

||||||

|

Impact of 53

rd

Week

|

N/A

|

|

5

|

|

N/A

|

|

||||||

|

Core Operating Profit, excluding 53

rd

Week

|

$

|

345

|

|

$

|

369

|

|

$

|

351

|

|

|||

|

Taco Bell Division

|

||||||||||||

|

GAAP Operating Profit

|

$

|

619

|

|

$

|

595

|

|

$

|

546

|

|

|||

|

Foreign Currency Impact on Divisional Operating Profit

(b)

|

—

|

|

1

|

|

N/A

|

|

||||||

|

Core Operating Profit

|

619

|

|

594

|

|

546

|

|

||||||

|

Impact of 53

rd

Week

|

N/A

|

|

12

|

|

N/A

|

|

||||||

|

Core Operating Profit, excluding 53

rd

Week

|

$

|

619

|

|

$

|

582

|

|

$

|

546

|

|

|||

|

Reconciliation of Diluted EPS from Continuing Operations to Diluted EPS from Continuing Operations, excluding Special Items

|

||||||||||||

|

Diluted EPS from Continuing Operations

|

$

|

3.77

|

|

$

|

2.54

|

|

$

|

2.09

|

|

|||

|

Special Items Diluted EPS

|

0.81

|

|

0.08

|

|

(0.22

|

)

|

||||||

|

Diluted EPS from Continuing Operations excluding Special Items

|

$

|

2.96

|

|

$

|

2.46

|

|

$

|

2.31

|

|

|||

|

Reconciliation of GAAP Effective Tax Rate to Effective Tax Rate, excluding Special Items

|

||||||||||||

|

GAAP Effective Tax Rate

|

41.1

|

%

|

24.3

|

%

|

26.1

|

%

|

||||||

|

Impact on Tax Rate as a result of Special Items

(a)

|

22.3

|

%

|

(2.0

|

)%

|

2.1

|

%

|

||||||

|

Effective Tax Rate excluding Special Items

(c)

|

18.8

|

%

|

26.3

|

%

|

24.0

|

%

|

||||||

|

Reconciliation of GAAP Company sales to System sales

|

||||||||||||

|

Consolidated

|

||||||||||||

|

GAAP Company sales

(d)

|

$

|

3,572

|

|

$

|

4,189

|

|

$

|

4,336

|

|

|||

|

Franchise sales

|

43,122

|

|

40,732

|

|

39,393

|

|

||||||

|

System sales

|

46,694

|

|

44,921

|

|

43,729

|

|

||||||

|

Foreign Currency Impact on System sales

(e)

|

(90

|

)

|

(1,123

|

)

|

N/A

|

|

||||||

|

System sales, excluding FX

|

46,784

|

|

46,044

|

|

43,729

|

|

||||||

|

Impact of 53

rd

week

|

N/A

|

|

434

|

|

N/A

|

|

||||||

|

System sales, excluding FX and 53

rd

Week

|

$

|

46,784

|

|

$

|

45,610

|

|

$

|

43,729

|

|

|||

|

KFC Division

|

||||||||||||

|

GAAP Company sales

(d)

|

$

|

1,928

|

|

$

|

2,156

|

|

$

|

2,191

|

|

|||

|

Franchise sales

|

22,587

|

|

21,086

|

|

20,437

|

|

||||||

|

System sales

|

24,515

|

|

23,242

|

|

22,628

|

|

||||||

|

Foreign Currency Impact on System sales

(e)

|

(28

|

)

|

(858

|

)

|

N/A

|

|

||||||

|

System sales, excluding FX

|

24,543

|

|

24,100

|

|

22,628

|

|

||||||

|

Impact of 53

rd

week

|

N/A

|

|

165

|

|

N/A

|

|

||||||

|

System sales, excluding FX and 53

rd

Week

|

$

|

24,543

|

|

$

|

23,935

|

|

$

|

22,628

|

|

|||

|

Pizza Hut Division

|

||||||||||||

|

GAAP Company sales

(d)

|

$

|

285

|

|

$

|

493

|

|

$

|

601

|

|

|||

|

Franchise sales

|

11,749

|

|

11,526

|

|

11,398

|

|

||||||

|

System sales

|

12,034

|

|

12,019

|

|

11,999

|

|

||||||

|

Foreign Currency Impact on System sales

(e)

|

(66

|

)

|

(258

|

)

|

N/A

|

|

||||||

|

System sales, excluding FX

|

12,100

|

|

12,277

|

|

11,999

|

|

||||||

|

Impact of 53

rd

week

|

N/A

|

|

113

|

|

N/A

|

|

||||||

|

System sales, excluding FX and 53

rd

Week

|

$

|

12,100

|

|

$

|

12,164

|

|

$

|

11,999

|

|

|||

|

Taco Bell Division

|

||||||||||||

|

GAAP Company sales

(d)

|

$

|

1,359

|

|

$

|

1,540

|

|

$

|

1,544

|

|

|||

|

Franchise sales

|

8,786

|

|

8,120

|

|

7,558

|

|

||||||

|

System sales

|

10,145

|

|

9,660

|

|

9,102

|

|

||||||

|

Foreign Currency Impact on System sales

(e)

|

4

|

|

$

|

(7

|

)

|

N/A

|

|

|||||

|

System sales, excluding FX

|

10,141

|

|

9,667

|

|

9,102

|

|

||||||

|

Impact of 53

rd

week

|

N/A

|

|

156

|

|

N/A

|

|

||||||

|

System sales, excluding FX and 53

rd

Week

|

$

|

10,141

|

|

$

|

9,511

|

|

$

|

9,102

|

|

|||

|

(a)

|

The tax benefit (expense) was determined based upon the impact of the nature, as well as the jurisdiction of the respective individual components within Special Items. In 2016, our tax rate on Special Items was favorably impacted by the recognition of capital loss carryforwards in anticipation of U.S. refranchising gains. In 2015, our tax rate on Special Items was unfavorably impacted by the non-deductibility of certain losses associated with international refranchising. See Note 18.

|

|

(b)

|

The foreign currency impact on reported Operating Profit is presented in relation only to the immediately preceding year presented. When determining applicable Core Operating Profit Growth percentages, the Core Operating Profit for the current year should be compared to the prior year Operating Profit, prior to adjustment for the prior year FX impact.

|

|

(c)

|

Our 2017 Effective Tax Rate excluding Special Items was lower than prior years due primarily to the inclusion of tax expense on the repatriation of certain foreign earnings in 2017 being included in the one-time Special Items charge referenced in (a) above. The majority of our foreign entities have a tax year-end of November 30. Amounts repatriated from these foreign entities after November 30, 2017, which were significant due to the timing of international refranchising proceeds, were required to be taxed as part of the mandatory deemed repatriation tax in connection with the Tax Act. See Note 18.

|

|

(d)

|

Company Sales represents sales from our Company-operated stores as presented on our Consolidated Statements of Income.

|

|

(e)

|

The foreign currency impact on System sales is presented in relation only to the immediately preceding year presented. When determining applicable System sales growth percentages, the System sales excluding FX for the current year should be compared to the prior year System sales prior to adjustment for the prior year FX impact.

|

|

% B/(W)

|

% B/(W)

|

|||||||||||||||||||||||||||||||||||

|

2017

|

2016

|

|||||||||||||||||||||||||||||||||||

|

2017

|

2016

|

2015

|

Reported

|

Ex FX

|

Ex FX and 53

rd

Week in 2016

|

Reported

|

Ex FX

|

|

Ex FX and 53

rd

Week in 2016

|

|||||||||||||||||||||||||||

|

System Sales

|

$

|

24,515

|

|

$

|

23,242

|

|

$

|

22,628

|

|

5

|

|

6

|

|

6

|

|

3

|

|

7

|

|

|

6

|

|

|

|||||||||||||

|

Same-Store Sales Growth (Decline)

|

3

|

|

N/A

|

|

N/A

|

2

|

|

N/A

|

|

|

N/A

|

|

||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||

|

Company sales

|

$

|

1,928

|

|

$

|

2,156

|

|

$

|

2,191

|

|

(11

|

)

|

(12

|

)

|

(11

|

)

|

(2

|

)

|

4

|

|

|

3

|

|

|

|||||||||||||

|

Franchise and license fees and income

|

1,182

|

|

1,069

|

|

1,031

|

|

11

|

|

10

|

|

11

|

|

4

|

|

7

|

|

|

7

|

|

|

||||||||||||||||

|

Total revenues

|

$

|

3,110

|

|

$

|

3,225

|

|

$

|

3,222

|

|

(4

|

)

|

(4

|

)

|

(3

|

)

|

—

|

|

5

|

|

|

4

|

|

|

|||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||

|

Restaurant profit

|

$

|

289

|

|

$

|

317

|

|

$

|

307

|

|

(9

|

)

|

(10

|

)

|

(8

|

)

|

3

|

|

9

|

|

|

7

|

|

|

|||||||||||||

|

Restaurant margin %

|

15.0

|

%

|

14.7

|

%

|

14.0

|

%

|

0.3

|

|

ppts.

|

0.3

|

|

ppts.

|

0.4

|

|

ppts.

|

0.7

|

|

ppts.

|

0.7

|

|

ppts.

|

|

0.6

|

|

ppts.

|

|||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||

|

G&A expenses

|

$

|

370

|

|

$

|

396

|

|

$

|

395

|

|

7

|

|

7

|

|

7

|

|

—

|

|

(3

|

)

|

|

(3

|

)

|

|

|||||||||||||

|

Operating Profit

|

$

|

981

|

|

$

|

871

|

|

$

|

835

|

|

13

|

|

12

|

|

14

|

|

4

|

|

9

|

|

|

8

|

|

|

|||||||||||||

|

% Increase (Decrease)

|

||||||||||||||||

|

Unit Count

|

2017

|

2016

|

2015

|

2017

|

2016

|

|||||||||||

|

Franchise

|

20,819

|

|

19,236

|

|

18,473

|

|

8

|

4

|

|

|||||||

|

Company-owned

|

668

|

|

1,407

|

|

1,513

|

|

(53

|

)

|

(7

|

)

|

||||||

|

21,487

|

|

20,643

|

|

19,986

|

|

4

|

3

|

|

||||||||

|

2016

|

New Builds

|

Closures

|

Refranchised

|

Acquired

|

Other

|

2017

|

|||||||||||||||

|

Franchise

|

19,236

|

|

1,169

|

|

(414

|

)

|

828

|

|

—

|

|

—

|

|

20,819

|

|

|||||||

|

Company-owned

|

1,407

|

|

102

|

|

(13

|

)

|

(828

|

)

|

—

|

|

—

|

|

668

|

|

|||||||

|

Total

|

20,643

|

|

1,271

|

|

(427

|

)

|

—

|

|

—

|

|

—

|

|

21,487

|

|

|||||||

|

2015

|

New Builds

|

Closures

|

Refranchised

|

Acquired

|

Other

|

2016

|

|||||||||||||||

|

Franchise

|

18,473

|

|

994

|

|

(412

|

)

|

180

|

|

—

|

|

1

|

|

19,236

|

|

|||||||

|

Company-owned

|

1,513

|

|

114

|

|

(39

|

)

|

(180

|

)

|

—

|

|

(1

|

)

|

1,407

|

|

|||||||

|

Total

|

19,986

|

|

1,108

|

|

(451

|

)

|

—

|

|

—

|

|

—

|

|

20,643

|

|

|||||||

|

2017 vs. 2016

|

|||||||||||||||||||||||

|

Income / (Expense)

|

2016

|

Store Portfolio Actions

|

Other

|

FX

|

53

rd

Week

|

2017

|

|||||||||||||||||

|

Company sales

|

$

|

2,156

|

|

$

|

(286

|

)

|

$

|

61

|

|

$

|

23

|

|

$

|

(26

|

)

|

$

|

1,928

|

|

|||||

|

Cost of sales

|

(733

|

)

|

93

|

|

(22

|

)

|

(11

|

)

|

9

|

|

(664

|

)

|

|||||||||||

|

Cost of labor

|

(507

|

)

|

69

|

|

(16

|

)

|

(3

|

)

|

6

|

|

(451

|

)

|

|||||||||||

|

Occupancy and other

|

(599

|

)

|

82

|

|

(7

|

)

|

(5

|

)

|

5

|

|

(524

|

)

|

|||||||||||

|

Company restaurant expenses

|

$

|

(1,839

|

)

|

$

|

244

|

|

$

|

(45

|

)

|

$

|

(19

|

)

|

$

|

20

|

|

$

|

(1,639

|

)

|

|||||

|

Restaurant profit

|

$

|

317

|

|

$

|

(42

|

)

|

$

|

16

|

|

$

|

4

|

|

$

|

(6

|

)

|

$

|

289

|

|

|||||

|

2016 vs. 2015

|

|||||||||||||||||||||||

|

Income / (Expense)

|

2015

|

Store Portfolio Actions

|

Other

|

FX

|

53

rd

Week

|

2016

|

|||||||||||||||||

|

Company sales

|

$

|

2,191

|

|

$

|

24

|

|

$

|

39

|

|

$

|

(124

|

)

|

$

|

26

|

|

$

|

2,156

|

|

|||||

|

Cost of sales

|

(751

|

)

|

(10

|

)

|

(7

|

)

|

44

|

|

(9

|

)

|

(733

|

)

|

|||||||||||

|

Cost of labor

|

(511

|

)

|

(3

|

)

|

(14

|

)

|

27

|

|

(6

|

)

|

(507

|

)

|

|||||||||||

|

Occupancy and other

|

(622

|

)

|

3

|

|

(10

|

)

|

35

|

|

(5

|

)

|

(599

|

)

|

|||||||||||

|

Company restaurant expenses

|

$

|

(1,884

|

)

|

$

|

(10

|

)

|

$

|

(31

|

)

|

$

|

106

|

|

$

|

(20

|

)

|

$

|

(1,839

|

)

|

|||||

|

Restaurant profit

|

$

|

307

|

|

$

|

14

|

|

$

|

8

|

|

$

|

(18

|

)

|

$

|

6

|

|

$

|

317

|

|

|||||

|

% B/(W)

|

% B/(W)

|

|||||||||||||||||||||||||||||||||||

|

2017

|

2016

|

|||||||||||||||||||||||||||||||||||

|

2017

|

2016

|

2015

|

Reported

|

Ex FX

|

Ex FX and 53

rd

Week in 2016

|

Reported

|

Ex FX

|

Ex FX and 53

rd

Week in 2016

|

||||||||||||||||||||||||||||

|

System Sales

|

$

|

12,034

|

|

$

|

12,019

|

|

$

|

11,999

|

|

—

|

|

1

|

|

2

|

|

—

|

|

2

|

|

1

|

|

|||||||||||||||

|

Same-Store Sales Growth (Decline)

|

Even

|

N/A

|

|

N/A

|

(2

|

)

|

N/A

|

|

N/A

|

|||||||||||||||||||||||||||

|

Company sales

|

$

|

285

|

|

$

|

493

|

|

$

|

601

|

|

(42

|

)

|

(42

|

)

|

(41

|

)

|

(18

|

)

|

(16

|

)

|

(17

|

)

|

|||||||||||||||

|

Franchise and license fees and income

|

608

|

|

615

|

|

604

|

|

(1

|

)

|

(1

|

)

|

—

|

|

2

|

|

4

|

|

3

|

|

||||||||||||||||||

|

Total revenues

|

$

|

893

|

|

$

|

1,108

|

|

$

|

1,205

|

|

(19

|

)

|

(19

|

)

|

(18

|

)

|

(8

|

)

|

(6

|

)

|

(7

|

)

|

|||||||||||||||

|

Restaurant profit

|

$

|

14

|

|

$

|

41

|

|

$

|

58

|

|

(63

|

)

|

(63

|

)

|

(62

|

)

|

(31

|

)

|

(31

|

)

|

(31

|

)

|

|||||||||||||||

|

Restaurant margin %

|

5.3

|

%

|

8.3

|

%

|

9.8

|

%

|

(3.0

|

)

|

ppts.

|

(3.0

|

)

|

ppts.

|

(2.9

|

)

|

ppts.

|

(1.5)

|

|

ppts.

|

(1.7)

|

|

ppts.

|

(1.7

|

)

|

ppts.

|

||||||||||||

|

G&A expenses

|

$

|

211

|

|

$

|

242

|

|

$

|

262

|

|

13

|

|

13

|

|

12

|

|

7

|

|

6

|

|

6

|

|

|||||||||||||||

|

Operating Profit

|

$

|

341

|

|

$

|

367

|

|

$

|

351

|

|

(7

|

)

|

(6

|

)

|

(5

|

)

|

4

|

|

6

|

|

5

|

|

|||||||||||||||

|

% Increase (Decrease)

|

||||||||||||||||

|

Unit Count

|

2017

|

2016

|

2015

|

2017

|

2016

|

|||||||||||

|

Franchise

|

16,588

|

|

15,871

|

|

15,334

|

|

5

|

4

|

|

|||||||

|

Company-owned

|

160

|

|

549

|

|

750

|

|

(71

|

)

|

(27

|

)

|

||||||

|

16,748

|

|

16,420

|

|

16,084

|

|

2

|

2

|

|

||||||||

|

2016

|

New Builds

|

Closures

|

Refranchised

|

Acquired

|

Other

|

2017

|

|||||||||||||||

|

Franchise

|

15,871

|

|

1,035

|

|

(708

|

)

|

389

|

|

—

|

|

1

|

|

16,588

|

|

|||||||

|

Company-owned

|

549

|

|

12

|

|

(12

|

)

|

(389

|

)

|

—

|

|

—

|

|

160

|

|

|||||||

|

Total

|

16,420

|

|

1,047

|

|

(720

|

)

|

—

|

|

—

|

|

1

|

|

16,748

|

|

|||||||

|

2015

|

New Builds

|

Closures

|

Refranchised

|

Acquired

|

Other

|

2016

|

|||||||||||||||

|

Franchise

|

15,334

|

|

885

|

|

(554

|

)

|

206

|

|

—

|

|

—

|

|

15,871

|

|

|||||||

|

Company-owned

|

750

|

|

40

|

|

(35

|

)

|

(206

|

)

|

—

|

|

—

|

|

549

|

|

|||||||

|

Total

|

16,084

|

|

925

|

|

(589

|

)

|

—

|

|

—

|

|

—

|

|

16,420

|

|

|||||||

|

2017 vs. 2016

|

|||||||||||||||||||||||

|

Income / (Expense)

|

2016

|

Store Portfolio Actions

|

Other

|

FX

|

53

rd

Week

|

2017

|

|||||||||||||||||

|

Company sales

|

$

|

493

|

|

$

|

(193

|

)

|

$

|

(9

|

)

|

$

|

(1

|

)

|

$

|

(5

|

)

|

$

|

285

|

|

|||||

|

Cost of sales

|

(137

|

)

|

56

|

|

(4

|

)

|

—

|

|

2

|

|

(83

|

)

|

|||||||||||

|

Cost of labor

|

(156

|

)

|

61

|

|

(1

|

)

|

1

|

|

1

|

|

(94

|

)

|

|||||||||||

|

Occupancy and other

|

(159

|

)

|

61

|

|

3

|

|

—

|

|

1

|

|

(94

|

)

|

|||||||||||

|

Company restaurant expenses

|

$

|