|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended December 31, 2014

|

||

|

or

|

||

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from __________ to __________

|

||

|

Zoetis Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Delaware

|

46-0696167

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

|

incorporation or organization)

|

||

|

100 Campus Drive, Florham Park, New Jersey

|

07932

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

(973) 822-7000

|

|

(Registrant’s telephone number, including area code)

|

|

Title of each class

|

Name of each exchange on which registered

|

||

|

Common Stock, $0.01 par value per share

|

New York Stock Exchange

|

||

|

Large accelerated filer

x

|

Accelerated filer

¨

|

Non-accelerated filer

¨

|

Smaller reporting company

¨

|

|||

|

Page

|

||||

|

Item 1.

|

||||

|

Item 1A.

|

||||

|

Item 1B.

|

||||

|

Item 2.

|

||||

|

Item 3.

|

||||

|

Item 4.

|

||||

|

Item 5.

|

||||

|

Item 6.

|

||||

|

Item 7.

|

||||

|

Item 7A.

|

||||

|

Item 8.

|

||||

|

Item 9.

|

||||

|

Item 9A.

|

||||

|

Item 9B.

|

||||

|

Item 10.

|

||||

|

Item 11.

|

||||

|

Item 12.

|

||||

|

Item 13.

|

||||

|

Item 14.

|

||||

|

Item 15.

|

||||

|

•

|

economic differences, such as standards of living in developed markets as compared to emerging markets;

|

|

•

|

cultural differences, such as dietary preferences for different animal proteins, pet ownership preferences and pet care standards;

|

|

•

|

epidemiological differences, such as the prevalence of certain bacterial and viral strains and disease dynamics;

|

|

•

|

treatment differences, such as utilization of different types of medicines and vaccines, as well as the pace of adoption of new technologies;

|

|

•

|

environmental differences, such as seasonality, climate and the availability of arable land and fresh water; and

|

|

•

|

regulatory differences, such as standards for product approval and manufacturing.

|

|

•

|

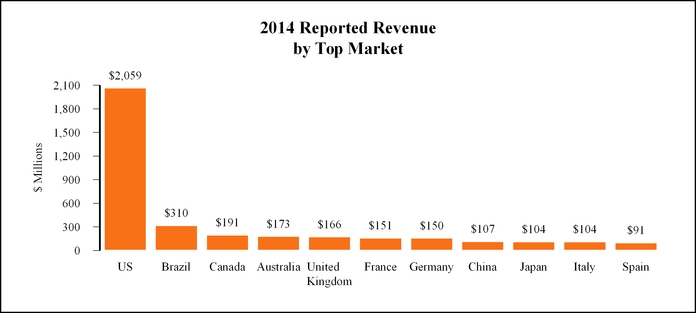

United States

with revenue of $

2,059 million

, or

43%

of total revenue for the year ended

December 31, 2014

.

|

|

•

|

Europe/Africa/Middle East

with revenue of $

1,141 million

, or

24%

of total revenue for the year ended

December 31, 2014

. Key developed markets in this segment include the United Kingdom, France and Germany. Key emerging markets in this segment include South Africa, Russia and Turkey.

|

|

•

|

Canada/Latin America

with revenue of $

815 million

, or

17%

of total revenue for the year ended

December 31, 2014

. The developed market in this segment is Canada. Key emerging markets in this segment include Brazil and Mexico.

|

|

•

|

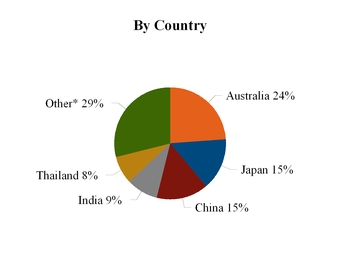

Asia/Pacific

with revenue of $

720 million

, or

15%

of total revenue for the year ended

December 31, 2014

. Key developed markets in this segment include Australia, Japan and New Zealand. Key emerging markets in this segment include China, India and Thailand.

|

|

US

|

Brazil

|

Canada

|

Australia

|

UK

|

France

|

Germany

|

China

|

Japan

|

Italy

|

Spain

|

|

|

Livestock

|

56%

|

84%

|

63%

|

61%

|

55%

|

65%

|

58%

|

84%

|

56%

|

60%

|

79%

|

|

Companion Animal

|

44%

|

16%

|

37%

|

39%

|

45%

|

35%

|

42%

|

16%

|

44%

|

40%

|

21%

|

|

•

|

anti-infectives

: products that prevent, kill or slow the growth of bacteria, fungi or protozoa;

|

|

•

|

vaccines

: biological preparations that help prevent diseases of the respiratory, gastrointestinal and reproductive tracts or induce a specific immune response;

|

|

•

|

parasiticides

: products that prevent or eliminate external and internal parasites such as fleas, ticks and worms;

|

|

•

|

medicated feed additives

: products added to animal feed that provide medicines to livestock; and

|

|

•

|

other pharmaceutical products

: pain and sedation, oncology, antiemetic, allergy and dermatology; and reproductive products.

|

|

•

|

Improvac/Improvest/Vivax, a protein product that works like an immunization, is currently the only product that provides a safe and effective alternative to physical castration to manage unpleasant aromas that can occur when cooking pork; launched in Australia and New Zealand in 2004, in Brazil in 2007, in certain European countries beginning in 2008, and in the United States in 2011;

|

|

•

|

Convenia, the first single-injection anti-infective for common bacterial skin infections in cats and dogs, launched in 2006;

|

|

•

|

Cerenia®, the first and only product on the market to prevent vomiting due to motion sickness in dogs, was first launched in Europe in 2006, followed by the United States in 2007;

|

|

•

|

Palladia, the first drug to be approved by the FDA for treating cancer in dogs, launched in 2009;

|

|

•

|

Inforce

TM

3, the first and only respiratory vaccine for cattle that prevents respiratory disease caused by bovine respiratory syncytial virus (BRSV) while also aiding in the prevention of infectious bovine rhinotracheitis (IBR) and parainfluenza

3

(PI

3

), launched in 2010;

|

|

•

|

Fostera® PCV MH was introduced in November 2013 and developed to help protect pigs from PCVAD and enzootic pneumonia caused by M. hyo. Unlike other combination vaccines that require field mixing, the one-bottle formulation of Fostera PCV MH allows the convenience of a one-dose program or the flexibility of a two-dose program; and

|

|

•

|

Apoquel, the first Janus kinase inhibitor for use in veterinary medicine, was approved for the control of pruritus associated with allergic dermatitis and the control of atopic dermatitis in dogs at least 12 months of age. We launched Apoquel in the United States, United Kingdom, Austria and Germany in January 2014 and expect other market launches to follow.

|

|

Product line / product

|

Description

|

Primary species

|

||

|

Anti-infectives

|

||||

|

Ceftiofur injectable line

|

Broad-spectrum cephalosporin antibiotic active against gram-positive and gram-negative bacteria, including ß-lactamase-producing strains, with some formulations producing a single course of therapy in one injection

|

Cattle, sheep, swine

|

||

|

Draxxin

|

Single-dose low-volume antibiotic for the treatment and prevention of bovine and swine respiratory disease, infectious bovine keratoconjunctivitis and bovine foot rot

|

Cattle, swine

|

||

|

Spectramast

|

Treatment of subclinical or clinical mastitis in dry or lactating dairy cattle, delivered via intramammary infusion; same active ingredient as the ceftiofur line

|

Cattle

|

||

|

Terramycin line

|

Antibiotic for the treatment of susceptible infections

|

Cattle, poultry, sheep, swine

|

||

|

Vaccines

|

||||

|

Bovi-shield

®

line

|

Aids in preventing diseases, including infectious bovine rhinotracheitis (IBR), bovine viral diarrhea (BVD) Types 1 and 2, parainfluenza

3

(PI

3

), bovine respiratory syncytial virus (BRSV), and leptospirosis caused by

Leptospira borgpetersenii

,

L.canicola, L grippotyphosa, L. hardjo,L. icterohaemorrhagiae, and L. pamona

, depending on formulation

|

Cattle

|

||

|

Improvac / Improvest / Vivax

|

Reduces boar taint, as an alternative to surgical castration

|

Swine

|

||

|

Rispoval

®

line

|

Aids in preventing three key viruses involved in cattle pneumonia-BRSV, PI

3

and BVD-as well as other respiratory diseases, depending on formulation

|

Cattle

|

||

|

Suvaxyn

®

PCV / Fostera™ PCV

|

Aids in preventing viremia and helps control lymphoid depletion caused by porcine circovirus

|

Swine

|

||

|

Parasiticides

|

||||

|

Cydectin

|

Injectable or pour-on endectocide to treat and control internal and external cattle parasites, including gastrointestinal roundworms, lungworms, cattle grubs, mites and lice

|

Cattle, sheep

|

||

|

Dectomax

|

Injectable or pour-on endectocide, characterized by extended duration of activity, for the treatment and control of internal and external parasite infections

|

Cattle, swine

|

||

|

Medicated Feed Additives

|

||||

|

Aureomycin

|

Provides livestock producers control, treatment and convenience against a wide range of respiratory, enteric and reproductive diseases

|

Cattle, poultry, sheep, swine

|

||

|

BMD

|

Aids in preventing and controlling enteritis; and increases rate of weight gain and improves feed efficiency in poultry and swine

|

Poultry, swine

|

||

|

Lasalocid line

|

Controls coccidiosis in poultry (Avatec) and cattle (Bovatec) and for increased rate of weight gain and improved feed efficiency in cattle

|

Poultry, cattle

|

||

|

Lincomycin line

|

Controls necrotic enteritis; treatment of dysentery (bloody scours), control of ileitis, treatment/reduction in severity of mycoplasmal pneumonia, increases weight gain in swine

|

Swine, poultry

|

||

|

Other

|

||||

|

Embrex

®

devices

|

Devices for enhancing hatchery operations' efficiency through

in ovo

detection and vaccination

|

Poultry

|

||

|

Lutalyse

|

For estrus control or in the induction of parturition or abortion

|

Cattle, swine

|

||

|

Orbeseal / Teatseal

|

Non-antibiotic intramammary infusion that prevents new intramammary infections in dairy cattle

|

Cattle

|

||

|

Product line / product

|

Description

|

Primary species

|

||

|

Anti-infectives

|

||||

|

Clavamox / Synulox

|

A broad-spectrum antibiotic and the first and only potentiated penicillin approved for use in dogs and cats

|

Cats, dogs

|

||

|

Convenia

|

Anti-infective for the treatment of common bacterial skin infections that provides a course of treatment in a single injection

|

Cats, dogs

|

||

|

Vaccines

|

||||

|

Vanguard

®

L4 (4-way Lepto)

|

Compatible with the Vanguard line and helps protect against leptospirosis caused by

Leptospira canicola

,

L. grippotyphosa

,

L. icterohaemorrhagiae

and

L. pomona

|

Dogs

|

||

|

Vanguard line

|

Aids in preventing canine distemper caused by canine distemper virus, infectious canine hepatitis caused by canine adenovirus type 1, respiratory disease caused by canine adenovirus type 2, canine parainfluenza caused by canine parainfluenza virus and canine parvoviral enteritis caused by canine parvovirus

|

Dogs

|

||

|

Parasiticides

|

||||

|

Revolution / Stronghold

|

An antiparasitic for protection against fleas, heartworm disease and ear mites in cats and dogs; canine sarcoptic mites and American dog tick and roundworms and hookworms for cats

|

Cats, dogs

|

||

|

ProHeart

|

Prevents heartworm infestation; also for treatment of existing larval and adult hookworm infections

|

Dogs

|

||

|

Other

|

||||

|

Cerenia

|

A medication that prevents and treats acute vomiting in dogs, treats acute vomiting in cats and prevents vomiting due to motion sickness in dogs

|

Cats, dogs

|

||

|

Rimadyl

|

For the relief of pain and inflammation associated with osteoarthritis and for the control of postoperative pain associated with soft tissue and orthopedic surgeries

|

Dogs

|

||

|

Anchor Sites

|

Satellite Sites

|

|||||

|

Site

|

Location

|

Site

|

Location

|

|||

|

Catania

|

Italy

|

Campinas

|

Brazil

|

|||

|

Charles City

|

Iowa, U.S.

|

Durham

|

North Carolina, U.S.

|

|||

|

Chicago Heights

|

Illinois, U.S.

|

Eagle Grove

|

Iowa, U.S.

|

|||

|

Guarulhos

(1)

|

Brazil

|

Hsinchu

(4)

|

Taiwan

|

|||

|

Haridwar

|

India

|

Laurinburg

|

North Carolina, U.S.

|

|||

|

Jilin

(2)

|

China

|

Longmont

|

Colorado, U.S.

|

|||

|

Kalamazoo

(3)

|

Michigan, U.S.

|

Medolla

|

Italy

|

|||

|

Lincoln

|

Nebraska, U.S.

|

Salisbury

|

Maryland, U.S.

|

|||

|

Louvain-la-Neuve

|

Belgium

|

San Diego

|

California, U.S.

|

|||

|

Melbourne

|

Australia

|

Shenzhou

|

China

|

|||

|

Olot

|

Spain

|

Van Buren

|

Arkansas, U.S.

|

|||

|

Suzhou

|

China

|

Wellington

|

New Zealand

|

|||

|

Willow Island

|

West Virginia, U.S.

|

White Hall

|

Illinois, U.S.

|

|||

|

Yantai

|

China

|

|||||

|

(1)

|

This site is owned by us and leased back to Pfizer, pursuant to an arrangement by which Pfizer operates the manufacturing operations at the site for a period of time. See

Item 13.

Certain Relationships and Related Transactions, and Director Independence—Relationship with Pfizer—Brazil lease agreements.

|

|

(2)

|

This site is operated by the China joint venture, Jilin Zoetis Guoyuan Animal Health Company, Ltd.

|

|

(3)

|

Prior to the Separation, Pfizer's manufacturing site in Kalamazoo manufactured both human health and animal health products. Since the Separation, we own the portions of this site that predominantly manufacture animal health products and Pfizer owns the portions of this site that predominantly manufacture human health products.

|

|

(4)

|

This site is operated by the Taiwan joint venture, Zoetis Biotech Manufacturing Limited.

|

|

•

|

livestock producers tend to be loyal to medicines and vaccines that have been demonstrated to be efficacious because medicines and vaccines are a small portion of a livestock producer's total production costs and ineffective medicines and vaccines could result in the loss of animals, causing disproportionate harm to such producer's investment;

|

|

•

|

livestock producers value the technical assistance provided through our veterinary operations' support of our products and field force; and

|

|

•

|

the importance of reliable supply.

|

|

•

|

Establish and implement harmonized technical requirements for the registration of veterinary medicinal products in the VICH regions, which meet high quality, safety and efficacy standards and minimize the use of test animals and costs of product development.

|

|

•

|

Provide a basis for wider international harmonization of registration requirements.

|

|

•

|

Monitor and maintain existing VICH guidelines, taking particular note of the ICH work program and, where necessary, update these VICH guidelines.

|

|

•

|

Ensure efficient processes for maintaining and monitoring consistent interpretation of data requirements following the implementation of VICH guidelines.

|

|

•

|

By means of a constructive dialogue between regulatory authorities and industry, provide technical guidance enabling response to significant emerging global issues and science that impact on regulatory requirements within the VICH regions.

|

|

•

|

environmental-related capital expenditures - $1 million; and

|

|

•

|

other environmental-related expenditures - $10 million.

|

|

•

|

our historical combined financial data does not reflect the Separation;

|

|

•

|

our historical combined financial data reflects expense allocations for certain support functions that are provided on a centralized basis within Pfizer, such as expenses for business technology, facilities, legal, finance, human resources, business development, public affairs and procurement, as well as certain manufacturing and supply costs incurred by manufacturing sites that are shared with other Pfizer business units that may be higher or lower than the comparable expenses we would have actually incurred, or will incur, as an independent company;

|

|

•

|

our cost of debt and our capital structure is different from that reflected in our historical combined financial statements;

|

|

•

|

significant increases may occur in our cost structure as a result of our being an independent public company, including costs related to public company reporting, investor relations and compliance with the Sarbanes-Oxley Act of 2002 (Sarbanes-Oxley Act); and

|

|

•

|

loss of economies of scale as a result of our no longer being a part of Pfizer.

|

|

•

|

the failure of us or any of our vendors or suppliers, including logistical service providers, to comply with applicable regulations and quality assurance guidelines;

|

|

•

|

construction delays;

|

|

•

|

equipment malfunctions;

|

|

•

|

shortages of materials;

|

|

•

|

labor problems;

|

|

•

|

natural disasters;

|

|

•

|

power outages;

|

|

•

|

criminal and terrorist activities;

|

|

•

|

changes in manufacturing production sites and limits to manufacturing capacity due to regulatory requirements, changes in types of products produced, shipping distributions or physical limitations; and

|

|

•

|

the outbreak of any highly contagious diseases near our production sites.

|

|

•

|

volatility in the international financial markets;

|

|

•

|

compliance with governmental controls;

|

|

•

|

difficulties enforcing contractual and intellectual property rights;

|

|

•

|

parallel trade in our products (importation of our products from European Union countries where our products are sold at lower prices into European Union countries where the products are sold at higher prices);

|

|

•

|

compliance with a wide variety of laws and regulations, such as the FCPA and similar non-U.S. laws and regulations;

|

|

•

|

compliance with foreign labor laws;

|

|

•

|

burdens to comply with multiple and potentially conflicting foreign laws and regulations, including those relating to environmental, health and safety requirements;

|

|

•

|

changes in laws, regulations, government controls or enforcement practices with respect to our business and the businesses of our customers;

|

|

•

|

political and social instability, including crime, civil disturbance, terrorist activities and armed conflicts;

|

|

•

|

trade restrictions and restrictions on direct investments by foreign entities, including restrictions administered by the OFAC and the European Union, in relation to our products or the products of farmers and other customers (e.g., restrictions on the importation of agricultural products from the European Union to Russia)

;

|

|

•

|

changes in tax laws, challenges brought against our incentive tax rulings, and tariffs;

|

|

•

|

imposition of antidumping and countervailing duties or other trade-related sanctions;

|

|

•

|

costs and difficulties in staffing, managing and monitoring international operations; and

|

|

•

|

longer payment cycles and increased exposure to counterparty risk.

|

|

•

|

pay monetary damages;

|

|

•

|

obtain a license in order to continue manufacturing or marketing the affected products, which may not be available on commercially reasonable terms, or at all; or

|

|

•

|

stop activities, including any commercial activities, relating to the affected products, which could include a recall of the affected products and/or a cessation of sales in the future.

|

|

•

|

making it more difficult for us to satisfy our obligations with respect to our debt;

|

|

•

|

limiting our ability to obtain additional financing to fund future working capital, capital expenditures, business development or other general corporate requirements, including dividends;

|

|

•

|

increasing our vulnerability to general adverse economic and industry conditions;

|

|

•

|

exposing us to the risk of increased interest rates as certain of our borrowings are and may in the future be at variable rates of interest;

|

|

•

|

limiting our flexibility in planning for and reacting to changes in the animal health industry;

|

|

•

|

placing us at a competitive disadvantage to other, less leveraged competitors;

|

|

•

|

impacting our effective tax rate; and

|

|

•

|

increasing our cost of borrowing.

|

|

•

|

improving strategic and operational flexibility, increasing management focus and streamlining decision-making by providing the flexibility to implement our strategic plan and to respond more effectively to different customer needs and the changing economic environment;

|

|

•

|

allowing us to adopt the capital structure, investment policy and dividend policy best suited to our financial profile and business needs, without competing for capital with Pfizer's other businesses;

|

|

•

|

creating an independent equity structure that will facilitate our ability to effect future acquisitions utilizing our common stock; and

|

|

•

|

facilitating incentive compensation arrangements for employees more directly tied to the performance of our business, and enhancing employee hiring and retention by, among other things, improving the alignment of management and employee incentives with performance and growth objectives of our business.

|

|

•

|

Pfizer will retain ownership of, and license to us, the intellectual property that we develop under the R&D agreement. In many circumstances, the intellectual property we license from Pfizer will be non-exclusive as to Pfizer and third parties.

|

|

•

|

We are not assured access to Pfizer's newest programs.

|

|

•

|

Pfizer can prevent us from progressing pre-development compounds and, under certain circumstances, Pfizer may terminate our rights to a development stage compound by paying us the fair market value for such compound.

|

|

•

|

The R&D agreement may be terminated before the expiration of the seven year term in certain circumstances, including if we acquire an interest in, or assets of, a human pharmaceutical business, enter into a definitive agreement relating to, or undergo, a change of control or if Pfizer acquires, or is acquired by, an animal health business.

|

|

•

|

our operating performance and the performance of our competitors;

|

|

•

|

our or our competitors' press releases, other public announcements and filings with the SEC regarding new products or services, enhancements, significant contracts, acquisitions or strategic investments;

|

|

•

|

changes in earnings estimates or recommendations by securities analysts, if any, who cover our common stock;

|

|

•

|

changes in our investor base;

|

|

•

|

failures to meet external expectations or management guidance;

|

|

•

|

fluctuations in our financial results or the financial results of companies perceived to be similar to us;

|

|

•

|

changes in our capital structure or dividend policy, including as a result of the Exchange Offer, future issuances of securities, sales of large blocks of common stock by our stockholders or the incurrence of additional debt;

|

|

•

|

reputational issues;

|

|

•

|

changes in general economic and market conditions in any of the regions in which we conduct our business;

|

|

•

|

the arrival or departure of key personnel;

|

|

•

|

the actions of speculators and financial arbitrageurs (such as hedge funds) during and after the Exchange Offer;

|

|

•

|

changes in applicable laws, rules or regulations and other dynamics; and

|

|

•

|

other developments or changes affecting us, our industry or our competitors.

|

|

•

|

a Board of Directors that is divided into three classes with staggered terms;

|

|

•

|

rules regarding how our stockholders may present proposals or nominate directors for election at stockholder meetings;

|

|

•

|

the right of our Board of Directors to issue preferred stock without stockholder approval; and

|

|

•

|

limitations on the right of stockholders to remove directors.

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

|

High

|

Low

|

|

|

2013

|

||

|

First Quarter (beginning February 1, 2013)

|

$35.42

|

$30.47

|

|

Second Quarter

|

$34.74

|

$29.40

|

|

Third Quarter

|

$32.90

|

$28.81

|

|

Fourth Quarter

|

$33.34

|

$30.76

|

|

2014

|

||

|

First Quarter

|

$32.73

|

$28.77

|

|

Second Quarter

|

$33.05

|

$28.14

|

|

Third Quarter

|

$37.31

|

$31.67

|

|

Fourth Quarter

|

$45.24

|

$34.16

|

|

Issuer Purchases of Equity Securities

|

||||

|

Total Number of Shares Purchased

(a)

|

Average Price Paid Per Share

|

Total Number of Shares Purchased as Part of Publicly Announced Programs

|

Approximate Dollar Value of Shares that May Yet Be Purchased Under Plans or Programs

|

|

|

October 1 - October 31, 2014

|

296

|

$36.45

|

—

|

$500,000,000

|

|

November 1 - November 30, 2014

|

184

|

$38.60

|

—

|

500,000,000

|

|

December 1 - December 31, 2014

|

471

|

$38.28

|

—

|

500,000,000

|

|

Total

|

951

|

$37.77

|

—

|

$500,000,000

|

|

2014

|

2013

|

|

|

First Quarter

|

$0.072

|

$0.065

|

|

Second Quarter

|

$0.072

|

$0.065

|

|

Third Quarter

|

$0.072

|

$0.065

|

|

Fourth Quarter

|

$0.072

|

$0.065

|

|

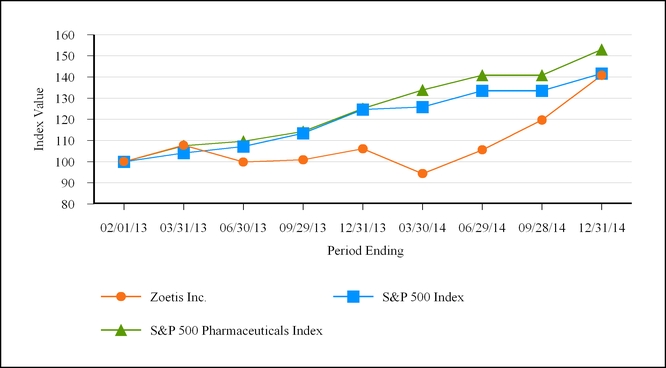

February 1, 2013

|

March 31, 2013

|

June 30, 2013

|

September 29, 2013

|

December 31, 2013

|

March 30, 2014

|

June 29, 2014

|

September 28, 2014

|

December 31, 2014

|

|

|

Zoetis Inc.

|

$100

|

$107.71

|

$99.81

|

$100.87

|

$106.07

|

$94.35

|

$105.56

|

$119.67

|

$140.84

|

|

S&P 500

|

$100

|

$104.11

|

$107.14

|

$113.44

|

$124.61

|

$125.86

|

$133.55

|

$135.72

|

$141.67

|

|

S&P 500 Pharmaceuticals Index

|

$100

|

$107.48

|

$109.67

|

$114.24

|

$125.16

|

$133.85

|

$140.83

|

$145.82

|

$152.97

|

|

Year Ended December 31,

(a)

|

||||||||||||||||||||

|

(MILLIONS, EXCEPT PER SHARE AMOUNTS)

|

2014

|

|

2013

|

|

2012

|

|

2011

|

|

2010

|

|

||||||||||

|

Statement of income data:

|

||||||||||||||||||||

|

Revenue

|

$

|

4,785

|

|

$

|

4,561

|

|

$

|

4,336

|

|

$

|

4,233

|

|

$

|

3,582

|

|

|||||

|

Net income attributable to Zoetis

|

583

|

|

504

|

|

436

|

|

245

|

|

110

|

|

||||||||||

|

Balance sheet data:

|

||||||||||||||||||||

|

Total assets

|

$

|

6,607

|

|

$

|

6,558

|

|

$

|

6,262

|

|

$

|

5,711

|

|

$

|

5,284

|

|

|||||

|

Long-term obligations

(b)

|

3,643

|

|

3,642

|

|

509

|

|

575

|

|

673

|

|

||||||||||

|

Other data (unaudited):

|

||||||||||||||||||||

|

Adjusted net income

(c)

|

$

|

790

|

|

$

|

709

|

|

$

|

539

|

|

$

|

503

|

|

$

|

275

|

|

|||||

|

Earnings per share attributable to Zoetis Inc. stockholders

(d)

:

|

||||||||||||||||||||

|

Basic

|

$

|

1.16

|

|

$

|

1.01

|

|

$

|

0.87

|

|

$

|

0.49

|

|

$

|

0.22

|

|

|||||

|

Diluted

|

$

|

1.16

|

|

$

|

1.01

|

|

$

|

0.87

|

|

$

|

0.49

|

|

$

|

0.22

|

|

|||||

|

Weighted average shares outstanding (in thousands):

|

||||||||||||||||||||

|

Basic

|

501,055

|

|

500,002

|

|

500,000

|

|

500,000

|

|

500,000

|

|

||||||||||

|

Diluted

|

502,025

|

|

500,317

|

|

500,000

|

|

500,000

|

|

500,000

|

|

||||||||||

|

(a)

|

Starting in 2011, includes the King Animal Health (KAH), business acquired as part of Pfizer's acquisition of King Pharmaceuticals, Inc., commencing on the acquisition date of January 31, 2011. See

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations—Comparability of historical results and our relationship with Pfizer—Recent significant acquisitions and government-mandated divestitures

.

|

|

(b)

|

In 2010 through 2012, primarily includes an allocation of Pfizer debt that was issued to partially finance the acquisition of Wyeth (including FDAH) in 2009. The debt has been allocated on a pro-rata basis using the deemed acquisition cost of FDAH as a percentage of the total acquisition cost of Wyeth.

|

|

(c)

|

Adjusted net income (a non-GAAP financial measure) is defined as reported net income attributable to Zoetis excluding purchase accounting adjustments, acquisition-related costs and certain significant items. Management uses adjusted net income, among other factors, to set performance goals and to measure the performance of the overall company, as described in

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations—Adjusted net income

. We believe that investors’ understanding of our performance is enhanced by disclosing this performance measure. Reconciliations of U.S. GAAP reported net income attributable to Zoetis to non-GAAP adjusted net income for the years ended December 31, 2014, 2013 and 2012 are provided in

Item 7.

Management’s Discussion and Analysis of Financial Condition and Results of Operations—Adjusted net income

. The adjusted net income measure is not, and should not be viewed as, a substitute for U.S. GAAP reported net income attributable to Zoetis.

|

|

(d)

|

The weighted average shares outstanding for both basic and diluted earnings per share for the years ended December 31, 2012, 2011 and 2010 was calculated using

500

million shares of common stock outstanding, which was the number of Zoetis Inc. shares outstanding at the time of the IPO, which was completed on February 6, 2013.

|

|

Section

|

Description

|

Page

|

|

Overview of our business

|

A general description of our business and the industry in which we operate. For more information regarding our business and the animal health industry, see

Item 1. Business.

|

|

|

Our operating environment

|

Information regarding the animal health industry and factors that affect our company.

|

|

|

Our growth strategies

|

An explanation of our growth strategies.

|

|

|

Components of revenue and costs and expenses

|

An explanation of the components of our consolidated and combined statements of income.

|

|

|

Comparability of historical results and our relationship with Pfizer

|

Information about the limitations of the predictive value of the consolidated and combined financial statements.

|

|

|

Significant accounting policies and application of critical accounting estimates

|

Accounting policies and estimates that we consider important to understanding our consolidated and combined financial statements.

|

|

|

Analysis of the consolidated and combined statements of income

|

Consists of the following for all periods presented:

|

|

|

•

Revenue

: An analysis of our revenue in total, by operating segment and by species.

|

||

|

•

Costs and expenses

: A discussion about the drivers of our costs and expenses.

|

||

|

•

Operating segment results

: A discussion of our revenue by operating segment and species and items impacting our earnings before income tax.

|

||

|

Adjusted net income

|

A discussion of adjusted net income, an alternative view of performance used by management. Adjusted net income is a non-GAAP financial measure.

|

|

|

Our financial guidance for 2015

|

A discussion of our 2015 financial guidance.

|

|

|

Analysis of the consolidated and combined statements of comprehensive income

|

An analysis of the components of comprehensive income for all periods presented.

|

|

|

Analysis of the consolidated balance sheets

|

A discussion of changes in certain balance sheet accounts for balance sheets presented.

|

|

|

Analysis of the consolidated and combined statements of cash flows

|

An analysis of the drivers of our operating, investing and financing cash flows for all periods presented.

|

|

|

Analysis of financial condition, liquidity and capital resources

|

An analysis of our ability to meet our short-term and long-term financing needs.

|

|

|

New accounting standards

|

Accounting standards that we have recently adopted.

|

|

|

Forward-looking statements and factors that may affect future results

|

A description of the risks and uncertainties that could cause actual results to differ materially from those discussed in forward-looking statements presented in this MD&A and elsewhere in this 2014 Annual Report. Such forward-looking statements are based on management's current expectations about future events, which are inherently susceptible to uncertainty and changes in circumstances.

|

|

|

Years Ended December 31,

|

% Change

|

||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

|

13/12

|

||||||||

|

Revenue

|

$

|

4,785

|

|

$

|

4,561

|

|

$

|

4,336

|

|

5

|

|

5

|

|||||

|

Net income attributable to Zoetis

|

583

|

|

504

|

|

436

|

|

16

|

|

16

|

||||||||

|

Adjusted net income

(a)

|

790

|

|

709

|

|

539

|

|

11

|

|

32

|

||||||||

|

(a)

|

Adjusted net income is a non-GAAP financial measure. See the

Adjusted net income

section of this MD&A for more information.

|

|

•

|

human population growth and increasing standards of living, particularly in many emerging markets;

|

|

•

|

increasing demand for improved nutrition, particularly animal protein;

|

|

•

|

natural resource constraints, such as scarcity of arable land, fresh water and increased competition for cultivated land, resulting in fewer resources that will be available to meet this increased demand for animal protein; and

|

|

•

|

increased focus on food safety.

|

|

•

|

economic development and related increases in disposable income, particularly in many emerging markets;

|

|

•

|

increasing pet ownership; and

|

|

•

|

companion animals living longer, increasing medical treatment of companion animals and advances in companion animal medicines and vaccines.

|

|

•

|

leverage our direct local presence and strong customer relationships

—Through our direct selling commercial model, we can deepen our understanding of our customers’ businesses and can encourage the adoption of more sophisticated animal health products;

|

|

•

|

further penetrate emerging markets

—We seek to maximize our presence where economic development is driving increased demand for animal protein and increased demand for and spending on companion animals;

|

|

•

|

pursue new product research and development and value-added product lifecycle development

to extend our product portfolio

—New product R&D and product lifecycle development enable us to deliver innovative products to address unmet needs and evolve our product lines so they remain relevant for our customers. We seek to leverage our strong direct presence in many regions and cost-effectively develop new products;

|

|

•

|

remain the partner of choice

for access to new products and technologies

—We seek to continue to support cutting-edge research and secure the right to develop and commercialize new products and technologies;

|

|

•

|

continue to provide high-quality products

and improve manufacturing production margins

—We believe our manufacturing and supply chain provides us with a global platform for continued expansion, including in emerging markets, and that our quality and reliability differentiate us from our competitors; and

|

|

•

|

expand into complementary businesses

to become a more complete, trusted partner in providing solutions

—We believe we have the potential to generate incremental and complementary revenue, in the areas of diagnostics, genetics, devices, dairy data management, e-learning and professional consulting, which could also enhance the loyalty of our customer base and may lead to increased product sales.

|

|

•

|

for sales returns, we perform calculations in each market that incorporate the following, as appropriate: local returns policies and practices; returns as a percentage of revenue; an understanding of the reasons for past returns; estimated shelf life by product; an estimate of the amount of time between shipment and return or lag time; and any other factors that could impact the estimate of future returns, product recalls, discontinuation of products or a changing competitive environment; and

|

|

•

|

for revenue incentives, we use our historical experience with similar incentives programs to estimate the impact of such programs on revenue.

|

|

•

|

a significant adverse change in the extent or manner in which an asset is used. For example, restrictions imposed by the regulatory authorities could affect our ability to manufacture or sell a product.

|

|

•

|

a projection or forecast that demonstrates losses or reduced profits associated with an asset. This could result, for example, from the introduction of a competitor’s product that results in a significant loss of market share or the inability to achieve the previously projected revenue growth, or from the lack of acceptance of a product by customers.

|

|

•

|

In 2014, the intangible asset impairment charges reflect (i) approximately $6 million of acquired in-process research and development (IPR&D) assets related to a pharmaceutical product for dogs acquired with the FDAH acquisition in 2009, as a result of the termination of the development program due to a re-assessment of economic viability; and (ii) approximately $1 million related to finite-lived developed technology rights and IPR&D due to negative market conditions and the re-assessment of economic viability.

|

|

•

|

In 2013, the intangible asset impairment charges reflect (i) approximately $2 million of finite-lived developed technology rights due to a re-assessment of economic viability; (ii) approximately $2 million of finite-lived developed technology rights and IPR&D as a result of exiting a combined manufacturing and R&D facility; and (iii) approximately $2 million related to acquired IPR&D as a result of the termination of certain development programs due to a re-assessment of their economic viability.

|

|

•

|

In 2012, the intangible asset impairment charges reflect: (i) approximately $2 million of finite-lived companion animal developed technology rights; (ii) approximately $1 million of finite-lived trademarks related to genetic testing services; and (iii) approximately $2 million of finite-lived patents related to poultry technology. The intangible asset impairment charges for 2012 reflect, among other things, loss of revenue as a result of negative market conditions and, with respect to the poultry technology, a re-assessment of economic viability.

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

|

13/12

|

|

||||||||

|

Revenue

|

$

|

4,785

|

|

$

|

4,561

|

|

$

|

4,336

|

|

5

|

|

5

|

|

|||||

|

Costs and expenses:

|

||||||||||||||||||

|

Cost of sales

(a)

|

1,717

|

|

1,669

|

|

1,563

|

|

3

|

|

7

|

|

||||||||

|

% of revenue

|

36

|

%

|

37

|

%

|

36

|

%

|

||||||||||||

|

Selling, general and administrative expenses

(a)

|

1,643

|

|

1,613

|

|

1,470

|

|

2

|

|

10

|

|

||||||||

|

% of revenue

|

34

|

%

|

35

|

%

|

34

|

%

|

||||||||||||

|

Research and development expenses

(a)

|

396

|

|

399

|

|

409

|

|

(1

|

)

|

(2

|

)

|

||||||||

|

% of revenue

|

8

|

%

|

9

|

%

|

9

|

%

|

||||||||||||

|

Amortization of intangible assets

|

60

|

|

60

|

|

64

|

|

—

|

|

(6

|

)

|

||||||||

|

Restructuring charges and certain acquisition-related costs

|

25

|

|

26

|

|

135

|

|

(4

|

)

|

(81

|

)

|

||||||||

|

Interest expense, net of capitalized interest

|

117

|

|

113

|

|

31

|

|

4

|

|

*

|

|

||||||||

|

Other (income)/deductions—net

|

7

|

|

(9

|

)

|

(46

|

)

|

*

|

|

(80

|

)

|

||||||||

|

Income before provision for taxes on income

|

820

|

|

690

|

|

710

|

|

19

|

|

(3

|

)

|

||||||||

|

% of revenue

|

17

|

%

|

15

|

%

|

16

|

%

|

||||||||||||

|

Provision for taxes on income

|

233

|

|

187

|

|

274

|

|

25

|

|

(32

|

)

|

||||||||

|

Effective tax rate

|

28.4

|

%

|

27.1

|

%

|

38.6

|

%

|

||||||||||||

|

Net income before allocation to noncontrolling interests

|

587

|

|

503

|

|

436

|

|

17

|

|

15

|

|

||||||||

|

Less: Net income attributable to noncontrolling interests

|

4

|

|

(1

|

)

|

—

|

|

*

|

|

*

|

|

||||||||

|

Net income attributable to Zoetis

|

$

|

583

|

|

$

|

504

|

|

$

|

436

|

|

16

|

|

16

|

|

|||||

|

% of revenue

|

12

|

%

|

11

|

%

|

10

|

%

|

||||||||||||

|

(a)

|

Exclusive of amortization of intangible assets, except as disclosed in Notes to Consolidated and Combined Financial Statements—

Note 4. Significant Accounting Policies—Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets

.

|

|

Year Ended December 31,

|

% Change

|

||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

|

13/12

|

||||||||

|

U.S.

|

$

|

2,059

|

|

$

|

1,902

|

|

$

|

1,776

|

|

8

|

|

7

|

|||||

|

EuAfME

|

1,141

|

|

1,115

|

|

1,068

|

|

2

|

|

4

|

||||||||

|

CLAR

|

815

|

|

778

|

|

769

|

|

5

|

|

1

|

||||||||

|

APAC

|

720

|

|

713

|

|

695

|

|

1

|

|

3

|

||||||||

|

Contract Manufacturing

|

50

|

|

53

|

|

28

|

|

(6

|

)

|

89

|

||||||||

|

Total

|

$

|

4,785

|

|

$

|

4,561

|

|

$

|

4,336

|

|

5

|

|

5

|

|||||

|

Year Ended December 31,

|

% Change

|

||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

|

13/12

|

||||||||

|

Livestock

|

$

|

3,103

|

|

$

|

2,916

|

|

$

|

2,795

|

|

6

|

|

4

|

|||||

|

Companion animal

|

1,632

|

|

1,592

|

|

1,513

|

|

3

|

|

5

|

||||||||

|

Contract Manufacturing

|

50

|

|

53

|

|

28

|

|

(6

|

)

|

89

|

||||||||

|

Total

|

$

|

4,785

|

|

$

|

4,561

|

|

$

|

4,336

|

|

5

|

|

5

|

|||||

|

Year Ended December 31,

|

% Change

|

|||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

13/12

|

||||||||

|

Cost of sales

(a)

|

$

|

1,717

|

|

$

|

1,669

|

|

$

|

1,563

|

|

3

|

7

|

|||||

|

% of revenue

|

36

|

%

|

37

|

%

|

36

|

%

|

||||||||||

|

(a)

|

Allocation of corporate enabling functions were: $3 million in 2013 and $1 million in 2012.

|

|

•

|

an increase in sales volume;

|

|

•

|

incremental global manufacturing and supply spending associated with the build-up of our operations in 2013, which is now impacting our 2014 cost of sales; and

|

|

•

|

an increase in inventory obsolescence, scrap and other charges,

|

|

•

|

favorable foreign exchange.

|

|

•

|

revenue growth and product and geographic mix;

|

|

•

|

additional costs of $21 million related to becoming an independent public company, including expense of $2 million due to the accelerated vesting of certain Pfizer equity awards and associated cash payments, as a result of the Separation;

|

|

•

|

a $19 million charge associated with the write-offs of inventory and intercompany accounts that were transferred to us as part of the Separation from Pfizer;

|

|

•

|

higher costs associated with certain manufacturing agreements related to government-mandated divestitures from prior acquisitions; and

|

|

•

|

unfavorable foreign exchange,

|

|

•

|

operational efficiencies; and

|

|

•

|

lower employee benefit costs due to the termination of the defined benefit pension plan for U.S. employees.

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

13/12

|

||||||||

|

Selling, general and administrative expenses

(a)

|

$

|

1,643

|

|

$

|

1,613

|

|

$

|

1,470

|

|

2

|

10

|

|||||

|

% of revenue

|

34

|

%

|

35

|

%

|

34

|

%

|

||||||||||

|

(a)

|

Allocation of corporate enabling functions were: $24 million in 2013 and $254 million in 2012.

|

|

•

|

increased field selling and distribution expenses in certain regions due to higher sales and increased costs associated with delivering our products to customers; and

|

|

•

|

additional costs due to the build-up of our supply chain and logistics organization and enabling functions and related costs post-separation from Pfizer,

|

|

•

|

a reduction in the amount of additional costs related to becoming an independent public company, including the nonrecurrence of additional costs in 2013 due to the accelerated vesting of stock options and associated expenses related to certain Pfizer equity awards as a result of the Separation;

|

|

•

|

favorable foreign exchange; and

|

|

•

|

lower direct marketing spending.

|

|

•

|

additional costs of $177 million related to becoming an independent public company, including expense of $25 million due to the accelerated vesting of certain Pfizer equity awards and associated cash payments, as a result of the Separation;

|

|

•

|

a $5 million charge associated with the write-offs of intercompany accounts that were transferred to us as part of the Separation from Pfizer; and

|

|

•

|

increased distribution expenses due to higher sales and increased temperature-controlled supply chain

costs in certain regions,

|

|

•

|

lower employee benefit costs due to the termination of the defined benefit pension plan for U.S. employees;

|

|

•

|

lower bad debt expense associated with improved accounts receivable collection experience; and

|

|

•

|

favorable foreign exchange.

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

|

13/12

|

|

||||||||

|

Research and development expenses

(a)

|

$

|

396

|

|

$

|

399

|

|

$

|

409

|

|

(1

|

)

|

(2

|

)

|

|||||

|

% of revenue

|

8

|

%

|

9

|

%

|

9

|

%

|

||||||||||||

|

(a)

|

Allocation of corporate enabling functions were $55 million in 2012.

|

|

•

|

the nonrecurrence of additional costs in 2013 due to the accelerated vesting of stock options and associated expenses related to certain Pfizer equity awards as a result of the Separation;

|

|

•

|

savings associated with the closure of two R&D sites; and

|

|

•

|

favorable foreign exchange,

|

|

•

|

higher salary-related expenses.

|

|

•

|

the non-recurrence of depreciation expense incurred in 2012 related to the closing of an R&D facility in the UK; and

|

|

•

|

lower employee benefit costs due to the termination of the defined benefit pension plan for U.S. employees,

|

|

•

|

incremental costs of $7 million related to becoming an independent public company, including expense of $4 million due to the accelerated vesting of certain Pfizer equity awards and associated cash payments, as a result of the Separation; and

|

|

•

|

an increase in the volume of R&D activities.

|

|

Year Ended December 31,

|

% Change

|

||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

13/12

|

|

||||||||

|

Amortization of intangible assets

|

$

|

60

|

|

$

|

60

|

|

$

|

64

|

|

—

|

(6

|

)

|

|||||

|

Year Ended December 31,

|

% Change

|

|||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

|

13/12

|

|

||||||||

|

Restructuring charges and certain acquisition-related costs

(a)

|

$

|

25

|

|

$

|

26

|

|

$

|

135

|

|

(4

|

)

|

(81

|

)

|

|||||

|

(a)

|

Allocation of

Restructuring charges and certain acquisition-related costs

were $57 million in 2012.

|

|

•

|

a decrease in asset impairment charges due to the exiting of one of our manufacturing facilities in 2013; and

|

|

•

|

a decrease in integration costs related to the KAH and FDAH acquisitions,

|

|

•

|

an increase in employee termination costs primarily due to a reversal in 2013 related to a previously established termination reserve that was reversed in the second quarter of 2013 related to our operations in Europe.

|

|

•

|

a $27 million decrease in employee termination costs related to the reversal of a previously established termination reserve related to our operations in Europe;

|

|

•

|

a decrease in integration and restructuring costs related to the KAH and FDAH acquisitions; and

|

|

•

|

the non-recurrence of allocated charges from Pfizer,

|

|

•

|

asset impairment charges of approximately $17 million related to one of our manufacturing facilities in the United States; and

|

|

•

|

employee termination costs of $2 million, exit costs of $4 million, and accelerated depreciation of $5 million as a result of exiting certain manufacturing and research facilities.

|

|

Year Ended December 31,

|

% Change

|

|||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

13/12

|

||||||||

|

Interest expense, net of capitalized interest

|

$

|

117

|

|

$

|

113

|

|

$

|

31

|

|

4

|

*

|

|||||

|

Year Ended December 31,

|

% Change

|

|||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

13/12

|

||||||||

|

Other (income)/deductions—net

|

$

|

7

|

|

$

|

(9

|

)

|

$

|

(46

|

)

|

*

|

*

|

|||||

|

•

|

a charge associated with a commercial settlement and recall in Mexico of $13 million, partially offset by the related insurance recovery of $1 million;

|

|

•

|

higher foreign currency losses of $8 million, primarily driven by costs related to hedging and exposures to certain emerging market currencies, as well as losses related to the depreciation of the Argentine peso in the first quarter of 2014;

|

|

•

|

an impairment charge related to IPR&D assets acquired with the FDAH acquisition in 2009, as a result of the termination of the development program due to a re-assessment of economic viability; and

|

|

•

|

a pension plan settlement charge related to the divestiture of a manufacturing facility,

|

|

•

|

an insurance recovery of litigation related charges.

|

|

•

|

the non-recurrence of income recognized in 2012 from a favorable legal settlement of $14 million and the non-recurrence of a favorable change in estimate for an environmental-related reserve of $7 million in 2012;

|

|

•

|

foreign currency loss of $9 million related to the Venezuela currency devaluation in February 2013; and

|

|

•

|

other foreign currency losses primarily related to Argentina,

|

|

•

|

a net gain on the government-mandated sale of certain product rights in Brazil that were acquired with the FDAH acquisition in 2009; and

|

|

•

|

lower asset impairment charges of identifiable intangible assets of approximately $4 million.

|

|

Year Ended December 31,

|

% Change

|

||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

14/13

|

13/12

|

|

||||||||

|

Provision for taxes on income

|

$

|

233

|

|

$

|

187

|

|

$

|

274

|

|

25

|

(32

|

)

|

|||||

|

Effective tax rate

|

28.4

|

%

|

27.1

|

%

|

38.6

|

%

|

|||||||||||

|

•

|

the change in the jurisdictional mix of earnings, which includes the impact of the location of earnings as well as repatriation costs. The jurisdictional mix of earnings can vary as a result of repatriation decisions and as a result of operating fluctuations in the normal course of business, the impact of non-deductible items and the extent and location of other income and expense items, such as restructuring charges/(benefits), asset impairments and gains and losses on asset divestitures;

|

|

•

|

changes in valuation allowances and resolution of other tax items;

|

|

•

|

the tax cost related to changes in uncertain tax positions, see Notes to Consolidated and Combined Financial Statements—

Note 8D. Tax Matters

—

Tax Contingencies

; and

|

|

•

|

an $8 million discrete tax expense during the first quarter of 2014 related to an intercompany inventory adjustment.

|

|

•

|

the change in the jurisdictional mix of earnings, which includes the impact of the location of earnings as well as repatriation costs. The jurisdictional mix of earnings can vary as a result of repatriation decisions and as a result of operating fluctuations in the normal course of business, the impact of non-deductible items and the extent and location of other income and expense items, such as restructuring charges/(benefits), asset impairments and gains and losses on asset divestitures;

|

|

•

|

incentive tax rulings in Belgium, effective December 1, 2012 through 2017, and Singapore, effective October 29, 2012 through 2016. These incentive tax rulings may be extended for another 5 and 6 years, respectively, if certain requirements are met; and

|

|

•

|

a $2 million discrete income tax benefit during the first quarter of 2013 related to the 2012 U.S. Research and Development Tax Credit which was retroactively extended on January 3, 2013,

|

|

•

|

the tax cost related to changes in uncertain tax positions, see Notes to Consolidated and Combined Financial Statements—

Note 8D. Tax Matters

—

Tax Contingencies

.

|

|

% Change

|

|||||||||||||||||||||||||

|

14/13

|

13/12

|

||||||||||||||||||||||||

|

Related to

|

Related to

|

||||||||||||||||||||||||

|

Year Ended December 31,

|

Foreign

|

|

Foreign

|

|

|||||||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

Total

|

|

Exchange

|

|

Operational

|

|

Total

|

Exchange

|

|

Operational

|

|||||||||

|

U.S.

|

|||||||||||||||||||||||||

|

Livestock

|

$

|

1,163

|

|

$

|

1,034

|

|

$

|

966

|

|

12

|

|

—

|

|

12

|

|

7

|

—

|

|

7

|

||||||

|

Companion animal

|

896

|

|

868

|

|

810

|

|

3

|

|

—

|

|

3

|

|

7

|

—

|

|

7

|

|||||||||

|

2,059

|

|

1,902

|

|

1,776

|

|

8

|

|

—

|

|

8

|

|

7

|

—

|

|

7

|

||||||||||

|

EuAfME

|

|||||||||||||||||||||||||

|

Livestock

|

772

|

|

762

|

|

729

|

|

1

|

|

(1

|

)

|

2

|

|

5

|

1

|

|

4

|

|||||||||

|

Companion animal

|

369

|

|

353

|

|

339

|

|

5

|

|

1

|

|

4

|

|

4

|

1

|

|

3

|

|||||||||

|

1,141

|

|

1,115

|

|

1,068

|

|

2

|

|

—

|

|

2

|

|

4

|

1

|

|

3

|

||||||||||

|

CLAR

|

|||||||||||||||||||||||||

|

Livestock

|

633

|

|

605

|

|

603

|

|

5

|

|

(8

|

)

|

13

|

|

—

|

(6

|

)

|

6

|

|||||||||

|

Companion animal

|

182

|

|

173

|

|

166

|

|

5

|

|

(8

|

)

|

13

|

|

4

|

(5

|

)

|

9

|

|||||||||

|

815

|

|

778

|

|

769

|

|

5

|

|

(8

|

)

|

13

|

|

1

|

(5

|

)

|

6

|

||||||||||

|

APAC

|

|||||||||||||||||||||||||

|

Livestock

|

535

|

|

515

|

|

497

|

|

4

|

|

(4

|

)

|

8

|

|

4

|

(4

|

)

|

8

|

|||||||||

|

Companion animal

|

185

|

|

198

|

|

198

|

|

(7

|

)

|

(5

|

)

|

(2

|

)

|

—

|

(7

|

)

|

7

|

|||||||||

|

720

|

|

713

|

|

695

|

|

1

|

|

(4

|

)

|

5

|

|

3

|

(4

|

)

|

7

|

||||||||||

|

Total

|

|||||||||||||||||||||||||

|

Livestock

|

3,103

|

|

2,916

|

|

2,795

|

|

6

|

|

(3

|

)

|

9

|

|

4

|

(2

|

)

|

6

|

|||||||||

|

Companion animal

|

1,632

|

|

1,592

|

|

1,513

|

|

3

|

|

(1

|

)

|

4

|

|

5

|

(1

|

)

|

6

|

|||||||||

|

Contract manufacturing

|

50

|

|

53

|

|

28

|

|

(6

|

)

|

(1

|

)

|

(5

|

)

|

89

|

3

|

|

86

|

|||||||||

|

$

|

4,785

|

|

$

|

4,561

|

|

$

|

4,336

|

|

5

|

|

(2

|

)

|

7

|

|

5

|

(2

|

)

|

7

|

|||||||

|

% Change

|

|||||||||||||||||||||

|

14/13

|

13/12

|

||||||||||||||||||||

|

Related to

|

Related to

|

||||||||||||||||||||

|

Year Ended December 31,

|

Foreign

|

|

Foreign

|

|

|||||||||||||||||

|

(MILLIONS OF DOLLARS)

|

2014

|

|

2013

|

|

2012

|

|

Total

|

|